SEAN O'DRISCOLL

It seems a long way from the misery of Gaza's shattered buildings. Situated a short walk from the Golden Horn, an estuary of the Bosphorus in bustling Istanbul, AG Plaza boasts terraces, pools and commercial space, and is designed to attract tech companies that want to benefit from the city's Commerce University campus.

Yet the two places are indeed linked. The glistening project in Turkey's cultural capital was built by a company controlled by what the U.S. Treasury Department describes as "Hamas elements."

The AG Plaza in Istanbul is just one example of how, according to the U.S. Treasury Department, It reveals extensive new links between companies and individuals that the U.S. says are funding Hamas operations.

Hamas is running a network of construction companies worth hundreds of millions of dollars, a Newsweek investigation has found.

By examining business records and cross-referencing them with the sanctions lists, Newsweek's investigation shows how Hamas is using some of its key personnel to set up such companies around the Middle East and elsewhere to run its financial empire—often in places where, one expert said, it may find tacit approval for such operations. They include businesses in the United Arab Emirates, Turkey, Algeria, Saudi Arabia and Sudan, and may even reveal how the group is expanding into Western Europe.

It also illustrates that while the unprecedented aerial and ground assault on Gaza, which Israel says is necessary to ensure Hamas' destruction, may paralyze the militant group there, it seems unlikely to stop the flow of funds from abroad.

This task—cutting off Hamas funding at source—appears to have become an urgent priority for the Biden administration, which on January 5 announced it is offering a reward of up to $10 million for information that could dismantle the group's economic foundations.

The Rewards for Justice Program aims to disrupt the broader network that sustains Hamas, including targeting any source of revenue, major donors, financial facilitators and financial institutions that facilitate transactions for the group.

The program also focuses on businesses or investments owned or controlled by Hamas or its financiers, as well as front companies engaged in procuring dual-use technology and criminal schemes that financially benefit the organization.

The program reflects the difficulty of targeting such funding. Hamas' web of interconnected companies, which has also enriched senior Hamas figures to a degree unimaginable for the ordinary people of Gaza, is remarkable in its size and complexity.

Newsweek found that one Yemeni business administrator is the joint owner of Hamas' UAE property company, which owned an office block worth $150 million; is the co-founder of a Hamas-linked, publicly traded Turkish construction company; owns 20 percent of a Hamas front company in Saudi Arabia; and is on the board of another Hamas-linked Sudanese company. Separately, company records show an accountant from the West Bank is central to four major construction and real estate companies in three countries: Turkey, Sudan and Saudi Arabia.

The network appears to be growing. A wealthy Sudanese businessman who had close ties to Osama bin Laden, the late Al-Qaeda leader, and who is described by the U.S. Treasury Department as a "Hamas financier," set up a Hamas-linked company in Spain last December, corporate filings show.

In a press release on May 24, 2022, the U.S. Treasury Department estimated that the Hamas-linked construction empire was worth $500 million in total and said that a publicly traded Turkish company—the same company that developed the AG Plaza in Istanbul—was 75 percent-owned by Hamas-connected members in 2018. It alleged that the same company planned to secret away $15 million in shares for senior Hamas figures that same year.

Members of Al-Qassam Brigades, the armed wing of the Palestinian Hamas movement, march in Gaza City on May 22, 2021.

The U.S. placed companies and executives on its Hamas sanctions list in 2022 and during three rounds of sanctions imposed on Hamas after the October 7 attack on Israel. That attack killed around 1,200 people, and militants took some 250 others hostage, the Associated Press reported. As of January 9, 2024, Israel's air, ground and sea assault in Gaza had killed more than 22,400 people, two-thirds of them women and children, the AP said, citing the Hamas-run Gaza Health Ministry. The offensive has devastated large parts of the Gaza Strip, displaced nearly 85 percent of its population of 2.3 million, and left a quarter of its residents facing starvation, according to the United Nations.

"In addition to the funds Hamas receives from Iran, its global portfolio of investments generates vast sums of revenue through its assets, estimated to be worth hundreds of millions of dollars, with companies operating in Sudan, Algeria, Türkiye, the United Arab Emirates, and other countries," the U.S. Treasury said in a statement when it updated its Hamas sanctions list on October 18, 2023.

"The companies in Hamas' portfolio have operated under the guise of legitimate businesses and their representatives have attempted to conceal Hamas' control over their assets.

"This investment network is directed by the highest levels of Hamas leadership and has allowed Hamas senior officials to live in luxury while ordinary Palestinians in Gaza struggle in harsh living and economic conditions."

The Israeli government also says that construction companies are a vital part of the Hamas finance model and has mirrored the U.S. sanctions list. In an online statement on October 29, the Israeli embassy in the U.S. said that Moussa Abu Marzouk, deputy chair of the Hamas Political Bureau, was worth $3 billion, while senior leaders Khaled Mashal and Ismail Haniyeh were each worth about $4 billion.

The reason that Hamas has turned to property is clear, experts say. Stephen Reimer, a senior research fellow at the U.K.'s Royal United Services Institute, told Newsweek that "building and then selling real estate is a handy way for Hamas to obfuscate its funds."

Reimer, an expert in terrorism financing at RUSI's Center for Financial Crime & Security Studies, said that "financial crime regulation of the construction, property development and real estate industries is fairly weak globally," meaning that Hamas-connected developers "can put funds into building apartments and then selling units to buyers, who would have no way of knowing the provenance of the funds that went into building their home."

In other words, ordinary homeowners are unaware that their purchases have helped to fuel the growth of a militant organization responsible for the worst massacre of Jews since the Holocaust.

Turkey

On the surface, Hisham Younis Yahya Qafisheh's resume makes him an unlikely plutocrat, let alone militant "element." Born on September 1, 1956, in Hebron in what was then Jordan and which would later become the West Bank, he graduated in accounting from King Abdulaziz University, in Jeddah, Saudi Arabia, in 1978. He started his business life as an accountant in the branch of a French company in Saudi Arabia and worked as a finance manager at the Dar Al Eiman hotel company in Jeddah between 1987 and 2005. Arabic is his native language, and he speaks English.

Yet this CV, included in documents that the Turkish company Trend GYO submitted to the Turkish Department of Finance in 2018 as part of its public offering requirements, does not highlight two crucial parts of his life story.

First, the Ticaret Sicil Gazetesi trade registry publication in Turkey printed a notice on March 25, 2021, which corrected Qafisheh's personal data. He had assumed a new Turkish name and obtained Turkish citizenship. This could help him to avoid scrutiny and travel more easily.

Second, according to a U.S. Treasury statement when it placed Qafisheh on its sanction list the following year, he served as deputy head of Hamas' investment office and has played an important role in "transferring funds on behalf of various companies linked to Hamas' investment portfolio." It had been investigating his involvement in Hamas-linked companies in three countries.

"Qafisheh was involved in managing the operations or held key roles in several companies controlled by Hamas," the Treasury Department added.

One of those is the fashionable-sounding Trend GYO, which advertises plush, middle-class apartment blocks and business plazas in its Turkish brochures and website. The company has also set up a Trend REIT, or real estate investment trust, for investors who want to buy into its property developments.

Turkish business records reviewed by Newsweek show that, as of September 2023, Trend is 55 percent publicly traded, meaning it raises money from the public and investors.

According to its own records, Trend GYO has completed 12 major projects throughout Turkey, including AG Plaza at Istanbul Commerce University, one of its most recently completed and largest projects, and a series of apartment blocks in the city of Bursa in northern Turkey that include the Anda Park Sultanbeyli, Anda Park Ertuğrul, Anda Park Özlüce, Anda Park Balat-1, Anda Park Balat-2 and Anda Park Millet projects.

In total, the company says it has built over 500,500 square feet of business and residences over the past 16 years.

Among Trend GYO's six upmarket residential blocks in Bursa is "Trend Boulevard," which the company is encouraging investors to buy into through its investment trust. The 34-unit apartment complex Andapark Ertuğrul offers "the key to a peaceful life with its modern architecture and a green field" in "the most modern district of Bursa," the advertising states. Behind this glossy façade lies a truth that it does not want to advertise.

"As of 2018, Hamas elements held about 75 percent of the issued capital at Turkey-based company Trend GYO. Additionally, Hamas planned to privately issue more than $15 million of Trend GYO's shares to senior officials in the investment portfolio," the U.S. Treasury Department said when it placed Trend GYO on its sanctions list in May 2022.

Corporate governance filings reviewed by Newsweek show that Qafisheh, the accountant who now has Turkish citizenship, had 13 percent of the shares; a billionaire Yemense businessman and politician, Hamid Abdullah Hussein Al-Ahmar, had 17 percent; and the company's deputy chairman, Yemeni national Sahel Mabrouk O. Mangoush, had 30 percent.

Qafisheh is the most significant and is instrumental in both running Hamas-linked construction companies in the Middle East and transferring their funds to Hamas, the U.S. Treasury Department says.

According to the U.S. Treasury Department, among those helping to disguise Hamas involvement in Trend GYO is Musa Dudin, a former suicide-bomb coordinator with close links to the Hamas leadership in Gaza. Dudin was jailed for life but was released in 2011 as part of an Israeli exchange of 1,027 Palestinian prisoners for the kidnapped Israeli soldier Gilad Shalit.

The U.S. Treasury Department said that Dudin was trying to cover up Hamas involvement in the company by transferring shares to other people.

"Musa Muhammad Salim Dudin is a West Bank-based member of Hamas' Political Bureau and Investment Office official and is responsible for negotiations to free Hamas members in prison. Dudin has publicly represented and spoken on behalf of the terrorist organization," it said in a press release to announce its sanctions against Dudin and other Trend GYO-linked officials on October 18, 2023.

It said that "Dudin attempted to obfuscate Trend GYO's continued affiliation with Hamas by transferring ownership to other parties. Dudin has also worked directly with designated Hamas senior leader Yahya Ibrahim Hassan Sinwar. Additionally, Dudin has previously received tens of thousands of dollars from Political Bureau Deputy Chief Salih Al-Aruri. Dudin has used these funds to purchase a variety of weapons for Hamas that were subsequently used in deadly terrorist attacks that resulted in the deaths of Israeli soldiers." The U.S. placed Sinwar on its sanctions list on August 27, 2015, and Al-Arouri on September 10, 2015. Al-Arouri was assassinated in an alleged drone attack in Beirut on January 2.

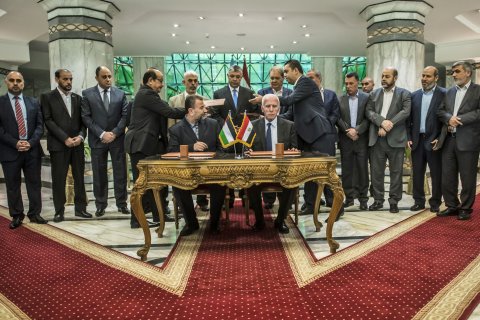

Hamas's new deputy leader Salah al-Aruri (seated L) and Fatah's Azzam al-Ahmad (seated R) sign a reconciliation deal in Cairo on October 12, 2017, as the two rival Palestinian movements ended their decade-long split following negotiations overseen by Egypt. Under the agreement, the West Bank-based Palestinian Authority is to resume full control of the Hamas-controlled Gaza Strip by December 1, 2017, according to a statement from Egypt's government.

In May 2022, Trend GYO was placed on the U.S. sanctions list by the Treasury Department, which listed the company "as part of Hamas' investment portfolio" and "a key component of Hamas' global asset holdings which had previously been estimated to be worth over $500 million."

Although the then chairman, Hamid Al-Ahmar, is not on the U.S. sanctions list, Trend GYO's public offering documents in 2018 state that he is chair of Al-Quds International Foundation, a Lebanese organization that is on the U.S. sanctions list as a Hamas front. Al-Ahmar has frequently spoken about his support for Hamas.

There is evidence of major changes in share ownership from Trend's filings with the Turkish Department of Finance. Trend's latest corporate accounts, filed for September 30, 2023, and reviewed by Newsweek, show that 55.4 percent of the company is publicly owned, compared with 45.74 percent at the end of 2022. The largest private shareholder is Alaeddin Senguler, with 22.19 percent of the company; followed by Arwa Saleh M. Mangoush with 12.07 percent; and Gulsah Yigidoglu with 10.34 percent. All three were placed on the sanctions list in November for "having materially assisted, sponsored, or provided financial, material, or technological support" to Hamas.

One of the three, Arwa Mangoush, a 37-year-old Saudi national, was born in Jeddah and is a female relative of Trend's co-founder Saleh Mangoush, who transferred all his shares to her.

According to Trend GYO public offering documents at the Turkish Department of Finance, Saleh Mangoush was born on November 28, 1957, in Hadhramaut in eastern Yemen. Like Qafisheh, he studied at King Abdulaziz University in Jeddah, Saudi Arabia, having graduated from the Faculty of Business Administration in 1983. He started work life as a cashier at Al Ahli bank in Saudi Arabia in 1979, moving up to be the general manager's special secretary, a position he kept until 2004. His native language is Arabic and he speaks English fluently, the document states.

According to Turkish journalist Abdullah Bozkurt, who has investigated Trend GYO for the Swedish news website the Nordic Monitor, the company is both hiding money for Hamas and generating income for its operations.

"The reviews I have conducted so far definitely indicate both. The company develops real estate which is a very lucrative market to make money in Turkey. Its shares are partly traded in the stock exchange so it raises money from the public and investors as well," he said.

For Nicholas Ryder, a law professor and terrorism financing expert at Cardiff University in the U.K., Hamas' use of property companies fits a pattern.

"Property companies could prove to be a useful funding mechanism because the global property market has proven to be a safe investment for both terrorist groups and organized criminal gangs. Additionally, the property sector, via mortgage fraud, has also been used to finance acts of terrorism and there have been several related terrorist financing convictions in America," he told Newsweek.

Newsweek sought email and phone comment from Trend GYO on November 21 and December 1 and email comment from Saleh Mangoush and Hisham Qafisheh on December 18.

Trend GYO has previously denied supporting Hamas or any other organization, saying it is "impossible for it do so." It said it was established with foreign capital and is a profit-oriented institution subject to regular audit by Turkey's Capital Markets Board that acts in accordance with the principle of transparency.

United Arab Emirates

UAE business records reveal that Saleh Mangoush, Trend's co-founder, set up Itqan Real Estate JSC, in Sharjah, the country's third most-populous city, in 2004. The company is listed as being involved in construction and design. It owned UAE office blocks worth hundreds of millions of dollars.

2022 corporate records reviewed by Newsweek show that Saudi national Mangoush, who is listed as "general manager," owns 49 percent of the company. This is consistent with UAE rules that, until recently, stipulated that all companies must be 51 percent owned by UAE citizens, who receive a monthly payment and may have no connection to the day-to-day running of a company. Itqan was "among several commercial companies controlled by Hamas' covert investment portfolio," according to the U.S. Treasury sanctions list statement in May 2022.

"In mid-2019, Hamas investment portfolio managers considered selling one of Itqan's highest-value assets, valued at $150 million," it added. That asset is believed to be a UAE office block the company purchased, although the details are not listed by the U.S. Treasury Department.

However, while Itqan was a major concern on the Sharjah property market for years, there may have been a crackdown. After Itqan was listed on the U.S. sanctions list, it was listed as "inactive" on company records. Newsweek attempted phone and email contact with Itqan Real Estate JSC on November 21 and December 18. The Itqan phone number no longer appears to be working and the emails bounced. Its website also appears to have been removed.

The UAE government, which called the October 7 attack on Israel a "serious and grave escalation" to the Israeli-Palestinian conflict, has taken a much tougher view of Hamas than the Turkish government. The UAE launched a major crackdown on the Muslim Brotherhood after the 2011 Arab Spring and placed 94 alleged members of a Muslim Brotherhood-linked group on trial in 2013.

People hold signs and photos of hostages as they take part in a rally calling for the release of all hostages held in the Gaza Strip on January 6, 2024 in Tel Aviv, Israel. More than 100 Israeli hostages captured on Oct. 7 remain held in Gaza by Hamas and other militant groups, according to Israeli authorities.

Saudi Arabia

According to the Trend GYO public offering documents, Saleh Mangoush, founder of both Trend in Turkey and Itqan in the UAE, is also founder of Anda Company.

Mangoush said in the 2018 Trend public offering documents that he owns 20 percent of Anda Company and is its general manager. He also lists several other Saudi companies he founded, including one with interests in gold and jewelry, hotel management, packaging, car spare parts and contracting.

The U.S. Treasury Department said that Anda is "among Hamas' larger investments in real estate and construction." Anda was placed on the U.S. sanctions list in May 2022. It also said that Anda Company was managed by Mangoush's fellow Trend GYO board member, the accountant Hisham Qafisheh. Newsweek sought email comment from Anda Company and Saleh Mangoush on November 22 and December 18.

Sudan

Sudan-based multimillionaire and Hamas financier Abdelbasit Hamza Elhassan Mohamed Khair "has longstanding ties to terrorism financing, including historic ties to al-Qaida and Osama bin Laden-linked companies in Sudan," according to a statement from the U.S. Treasury Department when it placed Khair on its sanctions list on October 18, 2023. He is the CEO and owner of Sudan-based company Zawaya Group, which was also placed on the U.S. sanctions list on October 18.

According to the U.S. Treasury Department, Kahir also owns the Western-sounding Larrycom Investment Company, a Sudanese firm in which Hamza is a top executive. Zawaya Group and Larrycom were also put on the U.S. sanctions list on October 18.

Qafisheh, the former chair of Trend GYO, is also heavily involved in the Sudan operations. In Trend GYO's 2018 public offering documents, Qafisheh states that he began investing in Sudan in 2000 and, from 2010 onwards, has been on the board of two of Khair's Khartoum companies: Agrogate Holding, an infrastructure and mining company, and Al Ruwad Real Estate Company, both of which were placed on the sanctions list in November 2023.

In his submission, Qafisheh told the Turkish Department of Finance that Ruwad started real estate investments in Turkey in 2006, using a partnership. The document said that, through Ruwad, Qafisheh took part in "the feasibility and construction of many residences, offices and commercial buildings in Turkey." In 2014, he became the chairman and remained in that position in 2018, the document said.

Through its sanctions list statement, the U.S. Treasury Department confirmed Qafisheh's claim that he is on the board of Agrogate Holding and Chairman of Ruwad.

Qafisheh "interviewed and hired candidates for Agrogate leadership and had a direct line of communication to the company board of directors," according to the statement. Agrogate has been a major player in the Sudanese construction business for over a decade. In 2009, Zawaya Group was awarded a Build, Operate, and Transfer (BOT) contract for the Dongola Argeen Highway Project, a 40-year plan to build a 223-mile highway connecting Sudan and Egypt, at an estimated cost of $500 million. Zawaya Group established Agrogate Holding to carry out the project.

Ruwad was established in 2010 by merging several Hamas companies based in Sudan, the U.S. Treasury Department said. Qafisheh "made hiring and firing decisions at Al Rowad and was also involved in the company's financial dealings," it said.

Newsweek sought email comment from Larrycom; Zawaya Group; Agrogate Holding; and Ruwad on November 18 and December 1.

Spain

Spain is at the center of what may be a bold development in the Hamas financing strategy. Osama bin Laden's friend, Abdelbasit Khair, is the CEO of Spanish company Zawaya Group for Development Investment Sociedad Limitada, which was placed on the U.S. sanctions list on October 18. There is evidence that Hamas' decision to move to western European companies is a new development, possibly enabling it to avoid detection in the Middle East.

Spanish company records reviewed by Newsweek show that the Spanish Zawaya Group was established in Valencia, Spain, on December 19, 2022. The company's financial reports are not yet available. Newsweek sought email comment from Zawaya Group on December 1 and December 15.

Algeria

The U.S. also links Hamas to Sidar Company, which was established in Algeria in 1998, according to company records reviewed by Newsweek. The company works in construction and is headquartered in Algiers. "Sidar Company, Anda Company, and Agrogate Holding were among Hamas' larger investments in real estate and construction. Hamas Investment Office leadership actively managed Sidar Company, a real estate development company," the U.S. Treasury Department said.

Perhaps reflecting the covert nature of the company's finances, Sidar's financial records do not appear to match the U.S. claim that it was among Hamas' larger real estate and construction investments. Company records show it is listed as having four employees with 2022 revenue of 106,414,226 Algerian dinar, equivalent to $790,504. Newsweek sought email comment from Sidar Company, and from two of its company managers, on December 1 and December 15.

'Tacit Support'

Despite the complex nature of the Hamas-linked businesses, the roots of the network lie in support for the organization globally, or support for the Palestinian cause in general. Timothy Wittig, author of Understanding Terrorist Finance and a fellow at Oxford University, told Newsweek that Hamas has sought out countries where it knows its property companies will have support in the business community.

He said it was common in terrorism financing for "sympathetic businesspeople and political and community leaders to align efforts to provide mutually beneficial financial support to 'the cause.'"

"This has long been true for the Islamist movement and Muslim Brotherhood, where there is an appealing quid pro quo offering blacklisted groups a financial lifeline and their business partners a privileged position in peripheral yet lucrative markets," he said.

Wittig said that Hamas' financial success in some countries "may be an indicator of tacit and indirect state support."

"It's a way to financially support Hamas without doing so directly—which would have more international political costs due to the sanctions," he said. "By allowing Hamas to do business in your country, governments can have their cake and eat it too."

No comments:

Post a Comment