Wang Zheng

This year marks the 10th anniversary of the launch of China’s Belt and Road Initiative (BRI). Proposed by President Xi Jinping in 2013, the BRI has become China’s flagship foreign policy to realise the Chinese vision of a “global community of shared future.”[1] At the third BRI Forum in Beijing in October 2023, President Xi announced that China has signed BRI-related memoranda with over 150 countries and 30 international organisations and established more than 20 multilateral platforms to facilitate the development of the BRI projects worldwide.[2] The BRI’s coverage has also expanded from traditional physical infrastructure to health, clean energy, digital economy, and people-to-people exchanges.[3]

Among the BRI’s new development trends, the Digital Silk Road (DSR) has become a key pillar of the initiative, especially against the backdrop of the intensifying U.S.-China technological rivalry. Given the geographic proximity and close economic ties between China and Southeast Asia, regional states have been major recipients of China’s DSR investments in recent years. However, systematic DSR development analysis in Southeast Asia is still rare. To fill this gap, this report evaluates the DSR’s progress in Southeast Asia between 2017 and 2023 and analyses the major challenges China faces in pushing the DSR forward in the region, with data collected from various sources including Chinese government reports and state media releases, the IISS’s China Connects dataset, the Submarine Cable Almanac, and the websites of Huawei and ZTE.

THE DSR: WHAT’S IN A NAME?

The DSR, initially launched as the digital aspect of the BRI in 2015, was officiated by President Xi at the BRI Forum in 2017.[4] Later, at the fourth World Internet Conference in 2017, China, Laos, Saudi Arabia, Serbia, Turkey, Thailand, and the United Arab Emirates jointly signed the BRI Digital Economy International Cooperation Initiative, marking a new chapter of the DSR’s development.[5] The DSR was promoted as a stand-alone initiative at the second BRI Forum in 2019 and has since become a critical part of China’s foreign policy agenda.[6] Amid the global COVID-19 pandemic, the DSR’s vital role was further enhanced since it allowed China to transcend the physical barriers of national boundaries and maintain the steady growth of the BRI projects overseas without suffering significant losses of investments.[7] According to the White Paper on the BRI released recently, by the end of 2022, China had inked 17 DSR-specific cooperation agreements and 30 e-commerce memorandums globally and signed the Memorandum of Understanding on Strengthening Investment Cooperation in the Digital Economy with 18 countries and regions.[8]

Overall, the DSR’s status elevation in China’s global strategy is primarily shaped by two factors. The push factor is the rapid growth of China’s digital economy in recent years, driving its tech companies to explore overseas markets. According to the BRI Digital Trade Development Index Report 2022 released by Huaxin Institute, a state-affiliated think tank, the scale of China’s digital economy has reached 45.5 trillion yuan (US$6.37 trillion) by 2022, accounting for 49.8 per cent of China’s GDP, with a year-on-year increase rate of 16.2 per cent.[9] The pull factor is China’s perception of a “digital gap” in developing countries that impedes the growth of the digital economy in these countries. China recognises that underdeveloped digital infrastructure in many developing countries has hindered them from participating in the global wave of digital transformation.[10] Thus, the DSR represents China’s systematic efforts to fill the “digital gap” by building and upgrading recipient countries’ digital infrastructure.

The concept of the DSR is somewhat ambiguous due to the lack of an official definition. A major consensus among China scholars is to treat the DSR as an “umbrella branding effort and a narrative for Beijing to promote its global vision across a range of technology areas and projects.”[11] Thus, the DSR involves normative components beyond the export of digital infrastructure. One example is the “China Solution” to global cyber governance that Beijing has actively promoted recently.[12] The core component of the solution is “cyber sovereignty”, which means that “all countries have their rights to choose their own path of network development and governance model and to equally participate in international governance in cyberspace.”[13] The “China Solution” triggers Western concerns over the export of “digital authoritarianism” through big data and surveillance technologies.[14] However, research shows that “the demand for these technologies and how they are used depend more on local political conditions than Chinese grand strategy.”[15] In addition, China has also made headways in global technological standard-setting through international and regional standard-setting organisations and overseas digital infrastructure investments,[16] owing to its advantages in advanced technologies such as 5G and AI.

It is worth noting that while the DSR emerged as a part of the BRI, it differs from the BRI in that state-owned companies are major BRI stakeholders whereas the DSR’s main stakeholders are private tech companies such as Huawei, Tencent, Alibaba, and ZTE, which often gain policy support to expand their overseas business.[17] Moreover, Chinese tech companies’ entry into overseas markets has long predated the DSR’s emergence.[18] Thus, the geopolitical impulse behind the DSR should not be exaggerated as it signifies more of a continuation and expansion of China’s ongoing strategy to broaden the global market for its tech companies and reinforce China’s technological global leadership.[19] This nuanced perspective contrasts with the portrayal often made by Western observers, who depict the DSR as China’s concerted state-led efforts to reshape the global digital order.[20]

INSTITUTIONALISING DSR COOPERATION IN SOUTHEAST ASIA

Southeast Asian countries have long been the major recipients of Chinese tech companies’ investments branded under the DSR banner. To facilitate the DSR’s development in the region, China has sought to institutionalise the DSR through various channels, including establishing DSR-specific mechanisms and institutions, organising DSR-related events, and providing technology-training sessions. These efforts are mainly led by local governments, universities and private companies. The central government in Beijing plays a supportive role by providing inter-governmental frameworks on various aspects of digital economy cooperation, especially through ASEAN-China mechanisms.

Thus far, China has established multiple mechanisms and institutions to facilitate regional DSR investments. Key mechanisms in this regard include the ASEAN-China Initiative on Enhancing Cooperation on E-Commerce (2023),[21] Action Plan on Implementing the ASEAN-China Partnership on Digital Economy Cooperation (2021-2025) (2022),[22] China-ASEAN Digital Economy Partnership Initiative (2020),[23] ASEAN-China Cyber Dialogue Mechanism (2020 and 2022)[24] and ASEAN-China Smart City Cooperation Initiative (2019).[25] Besides, China is negotiating with ASEAN countries to upgrade the ASEAN-China Free Trade Agreement (ACFTA 3.0), which will focus on three emerging domains: digital economy, green economy, and supply chain industries.[26]

As for institutions, a key example is the China-ASEAN Information Harbor (CAIH) established by China’s Guangxi autonomous region in 2016 to transform Guangxi into a “digital hub” connecting China and ASEAN.[27] More recently, multiple companies and NGOs from China and ASEAN jointly launched the ASEAN-oriented “Digital Silk Road” Think Tank Alliance in September 2022 to enhance ASEAN-China cooperation on digital transformation.[28] In April 2023, the Malaysia-based venture capital firm Kairous Capital announced the launch of the Malaysian-China Digital Cooperation Council, which aims to “facilitate long-term cross-border collaboration between Malaysian and Chinese companies in the areas of technology and innovation.” [29]

Additionally, China has organised multiple seminars and forums to support the DSR’s development in Southeast Asia. In June 2020, Zhejiang University hosted the “Digital Silk Road” Online Seminar attended by government officials, scholars, and business elites from 16 countries, including Indonesia, Singapore, Malaysia and Thailand.[30] In November 2020, the CAIH co-hosted the China-ASEAN Information Harbor Forum themed “Digital Silk Road, The Road Ahead,” which aimed to “build a mutually beneficial and win-win cooperation platform and promote the ASEAN-China digital economy industry cooperation.”[31] In December 2022, China Daily and the ASEAN-China Center co-hosted a seminar themed “Digital Economy Ties, A New Chapter in Smart City,” where representatives from China and ASEAN exchanged views on promoting cooperation on digital economy and smart cities.[32]

Western scholars have recently attributed Chinese tech companies’ success in Indonesia to their localisation strategies, which include providing cybersecurity training sessions to local government officials, professionals and college students.[33] For instance, in 2021, Huawei launched a five-year digital literacy training course for 100,000 government officials and a digital talent training programme for over 30 universities in Indonesia.[34] More broadly, through its “Seeds for the Future” programme initiated in 2011, Huawei has trained over 3,000 university students from more than 108 countries (including Southeast Asian ones).[35]

TRACKING THE DSR’S PROGRESS IN SOUTHEAST ASIA (2017-2023)

This section tracks the DSR’s progress in Southeast Asia from 2017 to 2023. It first provides an overview of the DSR’s development in Southeast Asia as of 2020 with data from the China Connects dataset. Then, it analyses the DSR’s progress in building digital infrastructure and platforms in the region since 2020, using data from the websites of Huawei and ZTE, the Submarine Cable Almanac, and relevant media releases.

DSR’s Progress in Southeast Asia (2017-2020)

Constructed by the International Institute for Strategic Studies (IISS), the China Connects dataset contains a list of the DSR projects across 173 countries up to December 2020, which fall under the following categories: 5G, academic programs, data center, e-commerce, e-governance, fibre optic network technology, fintech, people-to-people exchange programmes, satellite technology, security information system, smart city, submarine and overland fibre optic cables, telecom, and transfer of knowledge/technology.[36] This section extracts data for all Southeast Asian countries, including 176 projects, to analyse the DSR’s progress in the region by 2020.

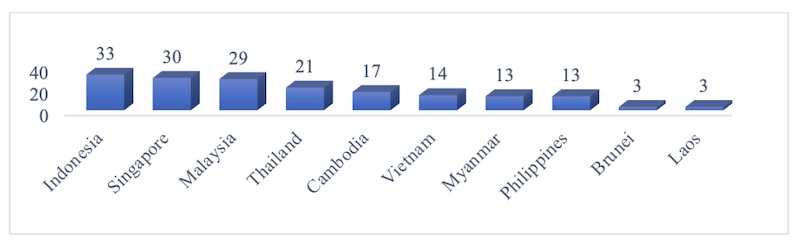

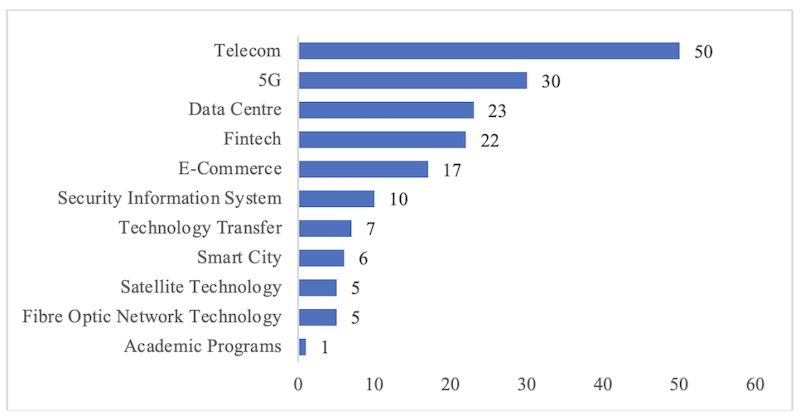

The analysis indicates that all Southeast Asian countries received China’s DSR investments between 2017 and 2020. Figure 1 shows the geographical distribution of the DSR projects in the region. Indonesia, Singapore and Malaysia remain the top three destinations of China’s DSR investments in Southeast Asia, collectively securing 52.3 per cent of all DSR projects. China’s DSR investments in Laos and Brunei are comparably marginal. Figure 2 shows the distribution of the DSR projects by type. It indicates that China’s DSR investments in Southeast Asia are clustered in five areas: Telecom, 5G, Data Centre, Fintech, and E-commerce.

Figure 1: Distribution of DSR Projects in Southeast Asia by Country

Figure 2: Distribution of DSR Projects in Southeast Asia by Type

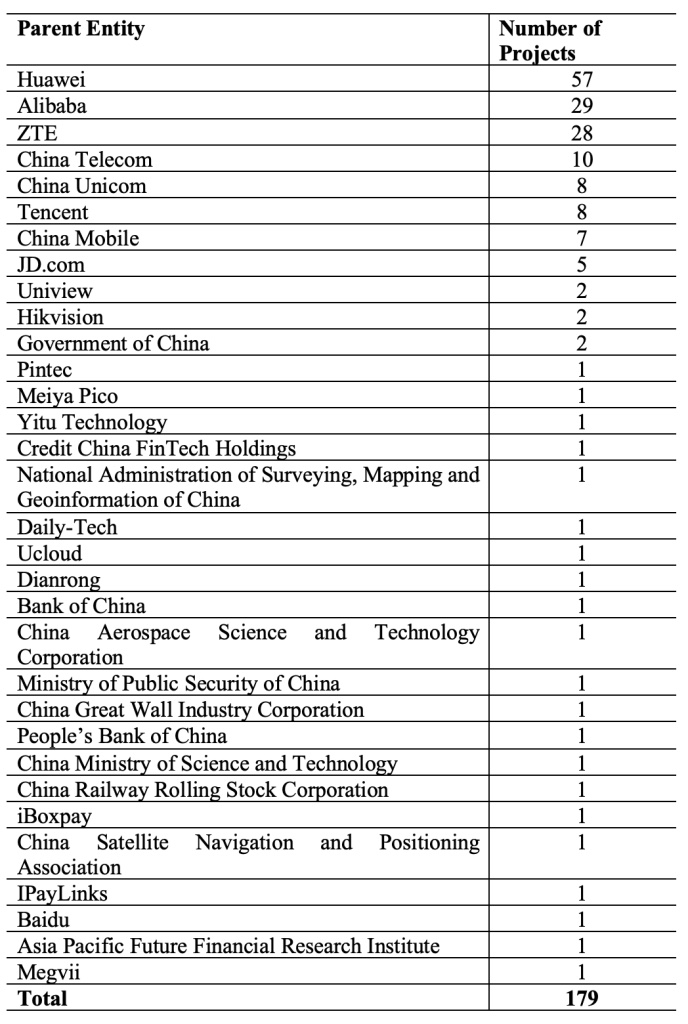

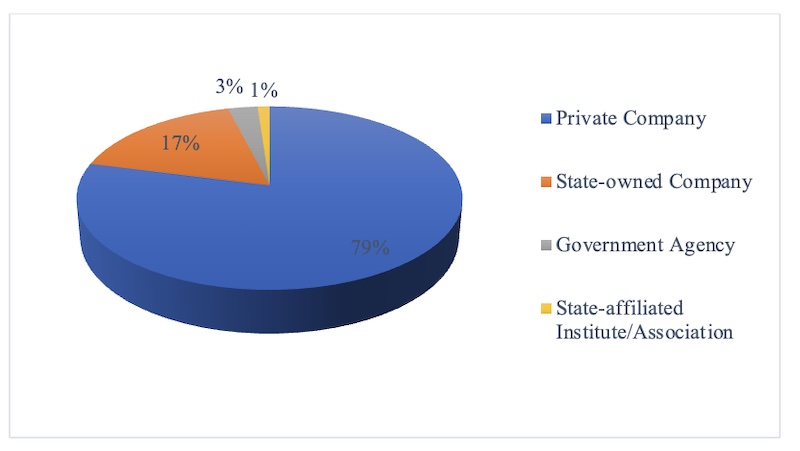

Table 1 shows the parent entities of China’s DSR projects in Southeast Asia by 2020, which can be classified into four categories: private company, state-owned company, government agency, and state-affiliated institute/association. As shown in Table 1, Huawei, Alibaba, and ZTE are the major entities spearheading China’s DSR projects in the region. Figure 3 shows the distribution of these entities by type: private companies (79%), state-owned companies (17%), government agencies (3%), and state-affiliated institute/associations (1%). The prevalent participation of Chinese private companies in the DSR stands in contrast to the predominant role of Chinese state-owned companies in the BRI in general.

Table 1: Parent Entities of China’s DSR Projects in Southeast Asia

Figure 3: Parent Entities of China’s DSR Projects in Southeast Asia by Type

Recent Development of the DSR in Southeast Asia (2020-2023)

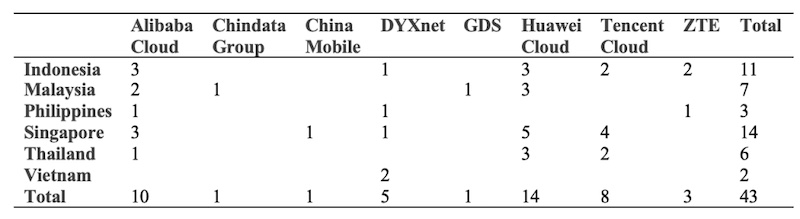

This section provides an update on the progress of China’s DSR investments in Southeast Asia in 5G, fibre optic cables, and cross-border e-commerce between 2020 and 2023. Huawei and ZTE have made decent strides in expanding their business in Southeast Asia’s fast-growing 5G market since 2020. Huawei’s key achievements include 1) building ASEAN’s first 5G smart hospital in Thailand;[37] 2) providing Smart Railway Solutions for the China-Laos Railway;[38] 3) signing multiple MoUs with local telecommunication service providers in Indonesia;[39] 4) launching its first “3AZ” data centre in Indonesia;[40] and 5) planning to build a cybersecurity centre in Malaysia.[41] Similarly, ZTE has signed multiple 5G-related MoUs with local 5G service providers in Malaysia[42] and Indonesia[43]and launched a new data centre in Indonesia.[44] In addition, China Mobile, the world’s largest telecommunication service provider, and GDS, China’s leading data centre operator, have also set foot in Southeast Asia’s 5G market.[45] Table 2 shows the distribution of 43 data centres built by Chinese tech companies in Southeast Asia based on latest available data. It indicates that most data centres are hosted by Singapore (32.5%), Indonesia (25.6%), Malaysia (16.3%), and Thailand (14.0%).

Table 2: Distribution of Data Centres Built by Chinese Tech Companies in Southeast Asia

(Data Source: Official websites of DYXnet, GDS, Huawei Cloud, ZTE, Alibaba Cloud, and Tencent Cloud and news reports from sciencechina.com, caixingglobal.com, thetechcapital.com, South China Morning Post, sina.com, and chinadevelopment.com)

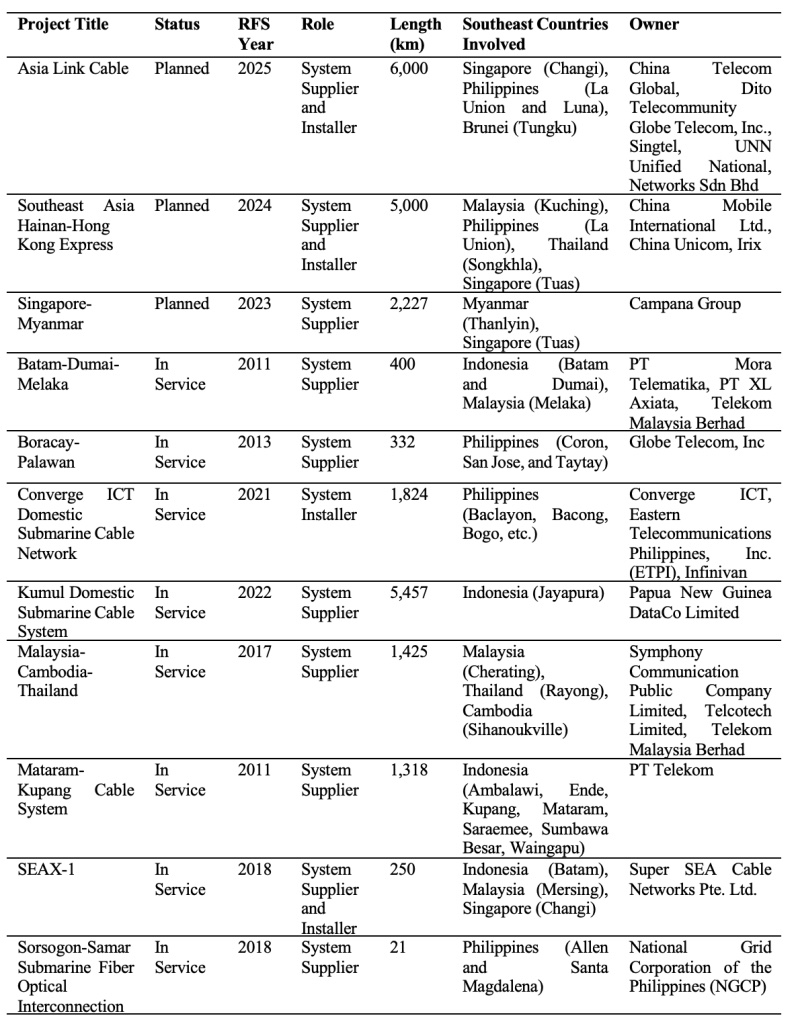

Fibre optic cables play a crucial role in ensuring the smooth transfer of telecommunication signals; thus, Chinese tech companies such as HMN Tech and China Unicom have invested vastly in building cross-land and submarine cables globally. China reportedly has constructed 34 land cables and multiple submarine cables with neighbouring countries.[46] In May 2022, the SEA-H2X Submarine Cable, a project initiated by China Unicom, started construction and is expected to operate in 2024. China Unicom also invested in the Asia Direct Cable (ADC), which began construction in 2020. Once completed, these cables will help integrate Southeast Asian countries into the Asia-Pacific cable network.[47] HMN Tech, formerly owned by Huawei, has also been actively involved in submarine cable construction in Southeast Asia. Table 2 lists selected HMN-involved submarine cable projects in Southeast Asia, which are either at the planned stage or in service now, including domestic and cross-border submarine cable projects within or through the region. HMN’s role in these projects also varies – as system supplier, system installer, or both.

Table 3: Selected HMN-Involved Submarine Cable Projects in Southeast Asia

(Data source: Compiled from Submarine Cable Almanac May 2023[48])

Aside from building digital infrastructure, Chinese companies have stepped up their efforts to engage in Southeast Asia’s e-commerce market. In July 2023, Alibaba, China’s largest e-commerce company, invested US$845 million into Lazada, a Singapore-based online retailer firm.[49] TikTok, a short-video app owned by ByteDance, announced its plan to invest in its online shopping app TikTok Shop in Indonesia.[50] However, TikTok faced a major setback after the Indonesian government banned sales on social media platforms.[51] To secure its business in Indonesia, Tiktok recently revealed that it will invest US$1.5 billion to acquire Tokopedia, Indonesia’s largest e-commerce owned by PT GoTo Gojek Tokopedia.[52] Temu, a Chinese shopping app owned by PDD, entered the Philippines’ digital market in August 2023.[53]

CONCLUSION

Notwithstanding the DSR investments’ progress in Southeast Asia, China faces multiple challenges in pushing the DSR forward. Domestically, China must reconcile the growing tensions between the state and private tech companies, which stem from Beijing’s tightening restrictions over the private tech sector[54] and private tech companies’ quest for profits while complying with and taking advantage of state policies. Such inconsistencies are more pronounced in the context of the DSR, given its involvement in the cross-border flow of capital and technology.[55] For Southeast Asian countries hosting Chinese tech companies, their concerns may be aggravated when Chinese companies “support, assist and cooperate with the state intelligence work” in compliance with China’s National Intelligence Law,[56] which could involve the transfer of critical data back to China and potentially undermine the cybersecurity of host countries. While Beijing has recently lifted some of the restrictions to revive the tech sector, the practical effects of such policy support remain to be seen.[57]

Regionally, China needs to recognise the agency Southeast Asian countries exercise in navigating its DSR engagements. In practice, Southeast Asian countries have adopted different approaches to handle China’s increasing digital engagements in the region,[58] and such decisions are shaped more by domestic economic and security concerns than external geopolitical factors.[59] Indonesia’s recent legal pushback against social media’s interference with e-commerce is a good example. This means that when China’s digital presence is perceived as a major threat rather than a powerful supplement to local economic growth, regional states have the levers to restrict China’s digital engagements through legal and political channels.

Internationally, the DSR’s future in Southeast Asia will be determined by China’s ability to secure dominant positions in frontier technologies such as 5G and AI, and growing shares in the region’s digital market amid the intensifying U.S.-China tech rivalry. Despite China’s increasing representation in certain international standard-setting bodies including the 3rd Generation Partnership Project (5G)[60] and ISO/IEC JTC 1/SC 41(AI),[61] Western countries still generally dominate the standardisation of frontier technologies.[62] Moreover, Chinese tech companies must continue to compete with their U.S. counterparts, whose collective market share accounts for roughly 70% of the region’s digital market.[63] The DSR’s prospects in Southeast Asia is further complicated by the US’ escalating blockage of key technologies to China[64] in the face of Huawei’s recent chip breakthrough.[65] The growing US-China strategic competition heightens the risks of tech-bifurcation and the dilemmas Southeast Asian countries face in their strategic technological choices.

No comments:

Post a Comment