Alla Hurska

Executive Summary:

- China has become Russia’s primary economic partner in helping the Kremlin circumvent Western sanctions, with bilateral trade turnover reaching $225 billion in 2023.

- Beijing’s supply of dual-use components and critical electronic equipment enhances Moscow’s defense production capabilities.

- Chinese banks play a key role in supporting the Russian banking system through increased investments in yuan.

In 2023, Russia’s trade turnover with China reached $225 billion, representing a 22-percent surge from 2022 and a 60-percent increase from 2021 (Iep.ru, December 25, 2023). The volume of Chinese exports to Russia via Central Asia has also seen a notable increase, further strengthening Beijing’s role as the main trading ally and supplier to Russia’s war economy (Twitter.com/RobinBrooksIIF, January 14). As a result, China has become the Kremlin’s principal partner, with Beijing holding a dominant position (see EDM, January 22). The impact of Western sanctions has significantly isolated Russia from the global community, resulting in a growing dependence on China for its economic needs.

China has refrained from officially supporting anti-Russian sanctions. Beijing, nevertheless, maintains policies that may result in the imposition of secondary sanctions, particularly on its banking institutions. The Chinese government’s position deters many major state-owned corporations from partnering with Russia for fear of falling victim to sanctions. This approach, however, does not hinder private enterprises, including drone manufacturers, from actively participating in trade with Moscow (Tsn.ua, August 21, 2023).

Beijing claims that it has not supplied Russia with Chinese components for weapons production or any items associated with military equipment (BBC News Russian, October 21, 2023). The reality is that numerous goods and components extensively used in warfare possess dual-use applications and therefore can be provided under the guise of “civilian” products. For example, first-person view drones, manufactured on a large scale by Russia, exclusively incorporate “civilian” parts. Russia is still able to import significant quantities of such goods, including microprocessors, printed circuit boards, and various electronics and radio engineering components crucial for defense production. Moscow achieves this through direct Chinese channels and other intermediaries such as the Central Asian states or United Arab Emirates (Sanctions.nazk.gov.ua, accessed January 15). Consequently, China has monopolized the Russian electronics market, consistently supplying critical components. Beijing’s assistance has granted Russia a technological edge on the Ukrainian battlefield (Texty.org.ua, January 3).

China continues to supply the Kremlin with advanced computer numerical control (CNC) machines that are crucial for Russia’s military-industrial complex. Since the start of Moscow’s expanded invasion on February 24, 2022, China has increased the supply of CNC machines to Russia tenfold. This equipment facilitates the rapid production of intricate components and durable materials to enhance Russia’s defense production capabilities. According to Russian customs declarations, Chinese shipments of CNC machines in July 2023 amounted to $68 million, a substantial increase compared to the $6.5 million recorded in February 2022 (24tv.ua, January 3). A recent study by the Kyiv School of Economics (KSE) Institute Sanctions Team reveals that, although China is a global leader in low- and medium-precision CNC machine manufacturing, certain components of Chinese CNC machines are still sourced from Western countries and their allies. Thus, some Chinese CNC machines exported to Russia may bear Western brands but are in fact manufactured in China (Kse.ua, January 2024).

Between January and October 2023, 20.9 percent of battlefield goods and 27.2 percent of critical components imported by Russia were manufactured in countries belonging to the export controls coalition (Kse.ua, January 2024). These countries include a number of EU member states, Japan, South Korea, Taiwan, and the United States. Their figures, however, are overshadowed by China, which single handedly contributes to 63.1 percent of Russia’s battlefield goods and 58.7 percent of its critical components production. A significant portion of Russian imports, comprising 26.8 percent ($2.02 billion) of battlefield goods from January to October, was generated in third countries on behalf of entities from countries that are a part of the sanctions coalition. Approximately two-thirds of these products are manufactured in China.

Coalition countries have a significantly reduced role in final sales to Moscow, as most Russian imports are primarily facilitated through third-country entities. A closer examination of the supply chain, however, reveals a crucial insight: most major suppliers are based in China and Hong Kong (Kse.ua, January 2024). Various spare parts, including those manufactured by companies from the United States, Japan, and Switzerland and delivered to Russia through China and Hong Kong, were discovered in Su-24 tactical bombers; Kalibr and Kinzhal missiles; Forpost, Orlan, Shahed-136, and Cube drones; the on-board “Baguette” computer; and the R-330BMW jamming station (The Insider, January 10). This suggests that Russia faces challenges in locating alternative suppliers for these goods and raising domestic production rates, underscoring the potency of sanctions.

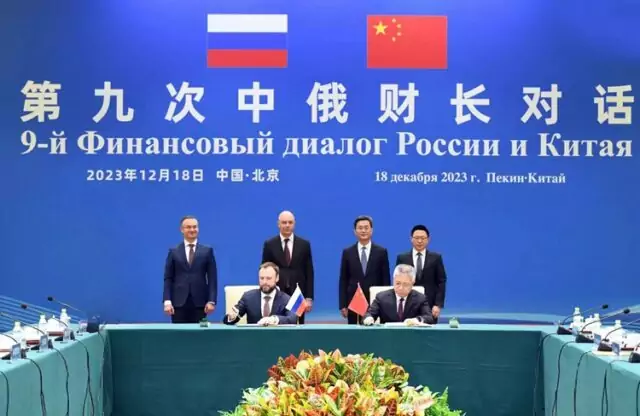

Chinese banks have emerged as the primary creditors for the Russian banking system, following the imposition of Western sanctions. According to KSE, over the initial 14 months of the war in Ukraine, the Industrial and Commercial Bank of China, Bank of China, China Construction Bank, and Agricultural Bank of China all increased their investments in Russia from $2.1 billion to $9.7 billion (Kse.ua, January 2024). As a result, the share of yuan in Russian export payments has risen to 16 percent. Andriy Onoprienko, deputy director for development at KSE, notes that loans from Chinese banks to Russian financial and credit organizations, largely replacing US dollars and euros with yuan, indicate that sanctions are having their intended impact. Chinese banks still lag significantly behind Austria’s Raiffeisen Bank International, the largest Western bank operating in Russia. Over the course of the war, Raiffeisen Bank has increased its assets in Russia by over 40 percent, from $20.5 billion to $29.2 billion (Dw.com, September 4).

Beijing also aids the Russian economy in procuring hydrocarbons from Moscow. These supplies make up more than 70 percent of Russian exports to China (The Moscow Times, January 1). Beijing, however, remains cautious about its dependence on the Russian energy market. China’s reliance on industrial goods from other countries significantly exceeds its dependence on Russian raw materials (Iep.ru, December 25, 2023). That careful approach has decisively given Beijing the upper hand in its relationship with Moscow.

China has emerged as a crucial lifeline for Russia’s sanctioned economy. Chinese support has enabled the Kremlin to effectively circumvent Western sanctions and sustain its war against Ukraine. Beijing’s increased share of the Russian market underscores the Kremlin’s dependence for critical components in arms manufacturing shifting from the West to China. Russia’s one-sided reliance on China raises the potential for Ukrainian partners to utilize secondary sanctions to limit bilateral trade, especially if such measures are implemented against individual companies. That approach, in turn, would significantly curtail Russia’s ability to wage its “long war” against Ukraine.

No comments:

Post a Comment