ANA PALACIO

WASHINGTON, DC – There was a time when everyone was talking about a group of fast-growing emerging economies with huge potential. But the BRICS – Brazil, Russia, India, China, and South Africa – struggled to transform themselves from a promising asset class into a unified real-world diplomatic and financial player. Is this finally changing?

The story of the BRICS begins with a November 2001 paper by Jim O’Neill, then the head of global economic research at Goldman Sachs Asset Management, called “The World Needs Better Economic BRICs” (the original grouping did not include South Africa). At a time when the world was dealing with the fallout of the dot-com bust and the September 11, 2001, terrorist attacks, O’Neill highlighted the BRICs’ vast potential, noting that their GDP growth was likely to accelerate considerably in the ensuing decades.

At the time, China and India were experiencing rapid economic growth, and Russia, aided by booming commodity prices, was recovering from the post-Soviet meltdown of the 1990s. Growth in the BRICs was outpacing that of the advanced economies so significantly that O’Neill predicted in 2003 that their collective GDP could overtake the then-Group of 6 largest developed economies by 2040.

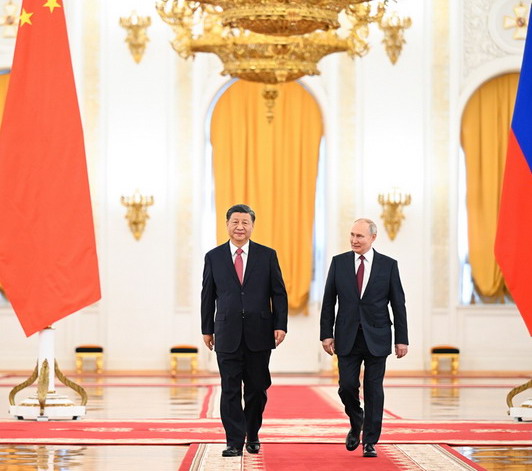

While the world expected the BRICs to thrive economically, few expected them to form a united grouping. After all, they represent a mix of unsteady democracies and outright autocracies, each with its own distinctive economic structure. And two of them – China and India – have long been locked in a border dispute, with no sign of resolution.

But the BRICS saw their economic alignment as an opportunity to expand their global influence by creating an alternative to West-led international institutions. And, for a while, they seemed to be making progress.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/WHOFFG5AMZH7FHQ6EE7YPXZ7F4.jpg)