Tonantzin Carmona, Mark Muro, Sifan Liu

As recently as last year, it seemed that everyone was talking about cryptocurrencies—from celebrities and athletes to news anchors and investors. Even elected officials were getting in on the action, as local governments turned to cryptocurrencies as a solution to job growth, income inequality, and more.

But today, the crypto hype cycle is over (although bitcoin has seen gains in recent days). After a major crash in the crypto industry, entrepreneurs and venture capitalists have moved on to generative artificial intelligence (AI) tools, such as those that power ChatGPT and other systems.

Which raises the questions: What’s the status of the crypto craze as the new AI systems dominate the headlines? Where has crypto-related job and startup growth recovered after the recent crash, and where hasn’t it? And what lessons can state and local officials take away to prepare themselves for the next big tech opportunity?

To consider these questions, this piece employs new data to examine the levels and locations of crypto activity in the U.S. Overall commercial activity is tracked through an analysis of job postings in the crypto and blockchain industry. Entrepreneurial dynamism is measured with data on startups in the field. From there, the discussion weighs these signals with an eye toward assessing the most advisable next policy moves for state and local lawmakers.

Crypto trends have been tumultuous in recent years

Even in comparison to the industry’s unstable longer-term past, crypto trends during the last few years have been tumultuous. During the peak of the most recent hype cycle, a number of state and local government leaders embraced cryptocurrencies. These officials jockeyed for crypto jobs by introducing bills or launching public relations stunts, such as announcing they would take their paychecks in crypto or promoting city-branded cryptocurrencies. In other cases, they explored ways to allow residents to pay for government services using cryptocurrencies or for their governments to mine bitcoin.

By the end of 2022, however, the spectacular downfall of Sam Bankman-Fried and his crypto exchange FTX prompted a catastrophic tidal wave, sending crypto values plummeting. Several crypto companies filed for bankruptcy, and many retail investors lost their life savings, with investors of color being hit particularly hard. The collapse led many local leaders to abandon their earlier “gold-rush” efforts, while regulators and other officials stepped in and have shifted the focus to protecting consumers.

In short, overall commercial and entrepreneurial activity has undergone a wild and variable ride, with sharply heterogeneous impacts across places. We can chart the industry’s volatility by looking at job postings requiring crypto and blockchain skills (a measure of overall hiring and employment activity) as well as the number of crypto and blockchain startups.1

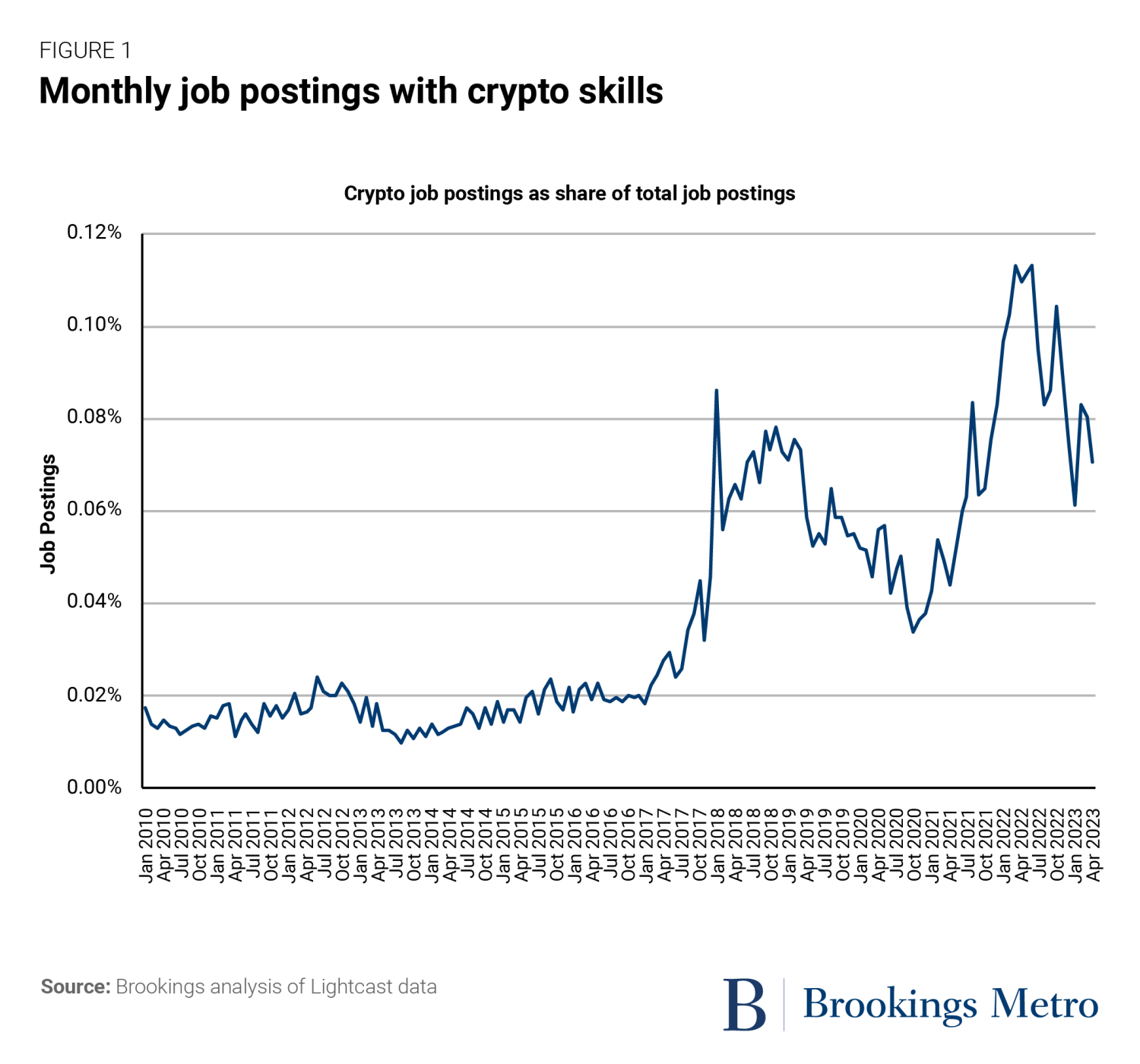

During the period of growing crypto popularity in the mid-2010s, industry job postings saw an overall upward trend. However, much like the prices of cryptocurrencies themselves, this trend was not without volatility. As bitcoin values fluctuated, so did job postings, with the most dramatic surge taking place in 2021 and early 2022.

Then came massive declines during the second half of 2022, which aligns closely with the failure of crypto projects such as TerraUSD, Three Arrows Capital, Celsius, and Voyager, followed by the FTX collapse later in the year. The decline was dramatic, but it bears noting that the number of crypto industry job postings was extremely small even at the peak: less than 0.15% of all postings, with the current level lingering at less than 0.08%.

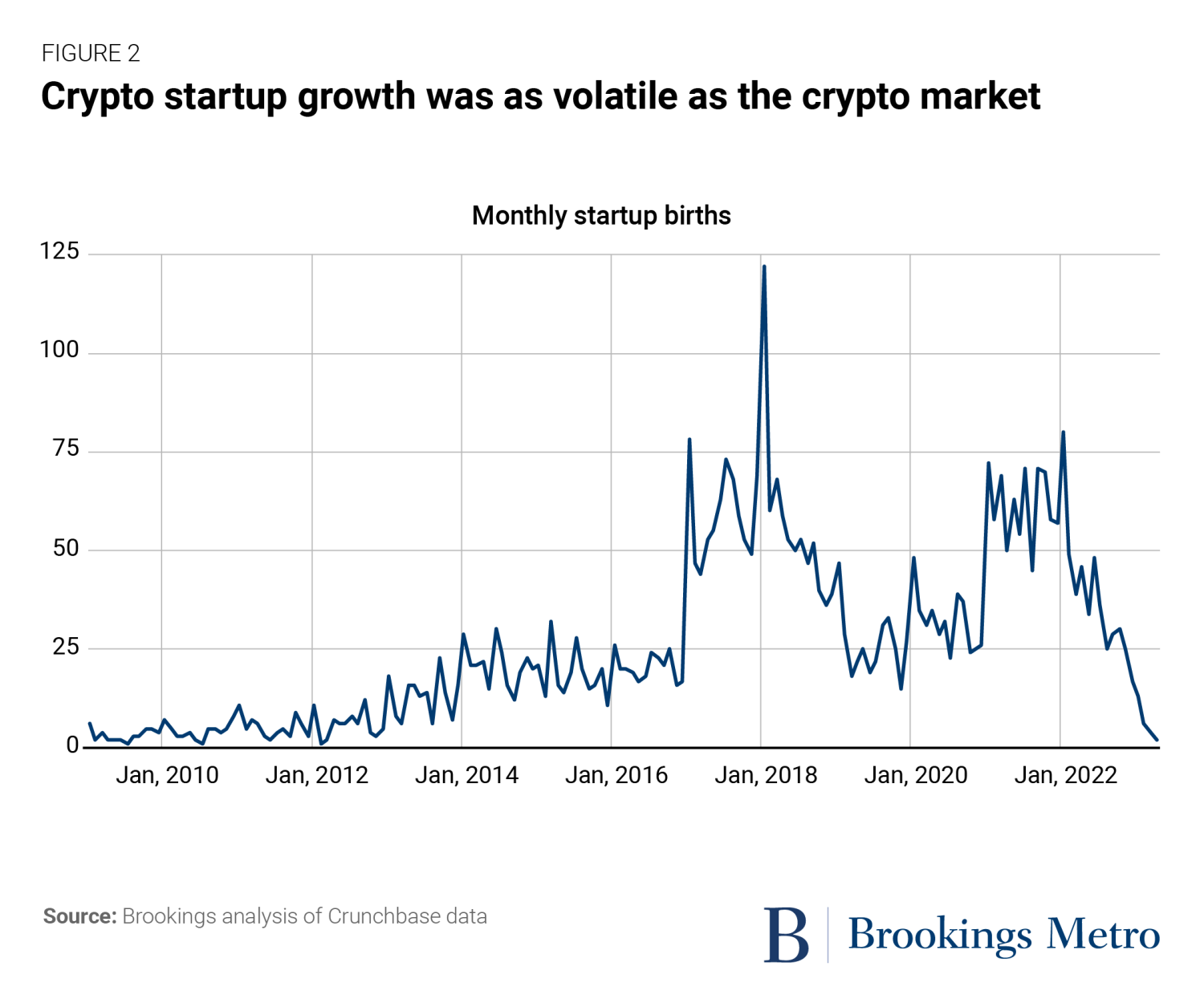

Entrepreneurial activity in the crypto space has also been volatile, as startup growth and declines tracked closely with bitcoin values. For example, the number of crypto startups rose until January 2018, then plummeted—closely mirroring the plunge in bitcoin and cryptocurrency values at that time.

The number of crypto startups slowly began to rise again during the pandemic, followed by a decline starting in January 2022—again, closely mirroring a gradual decline in bitcoin prices between January 2022 and May 2022 before a more dramatic decline due to the failure of a variety of crypto projects (as mentioned above) and the FTX debacle.

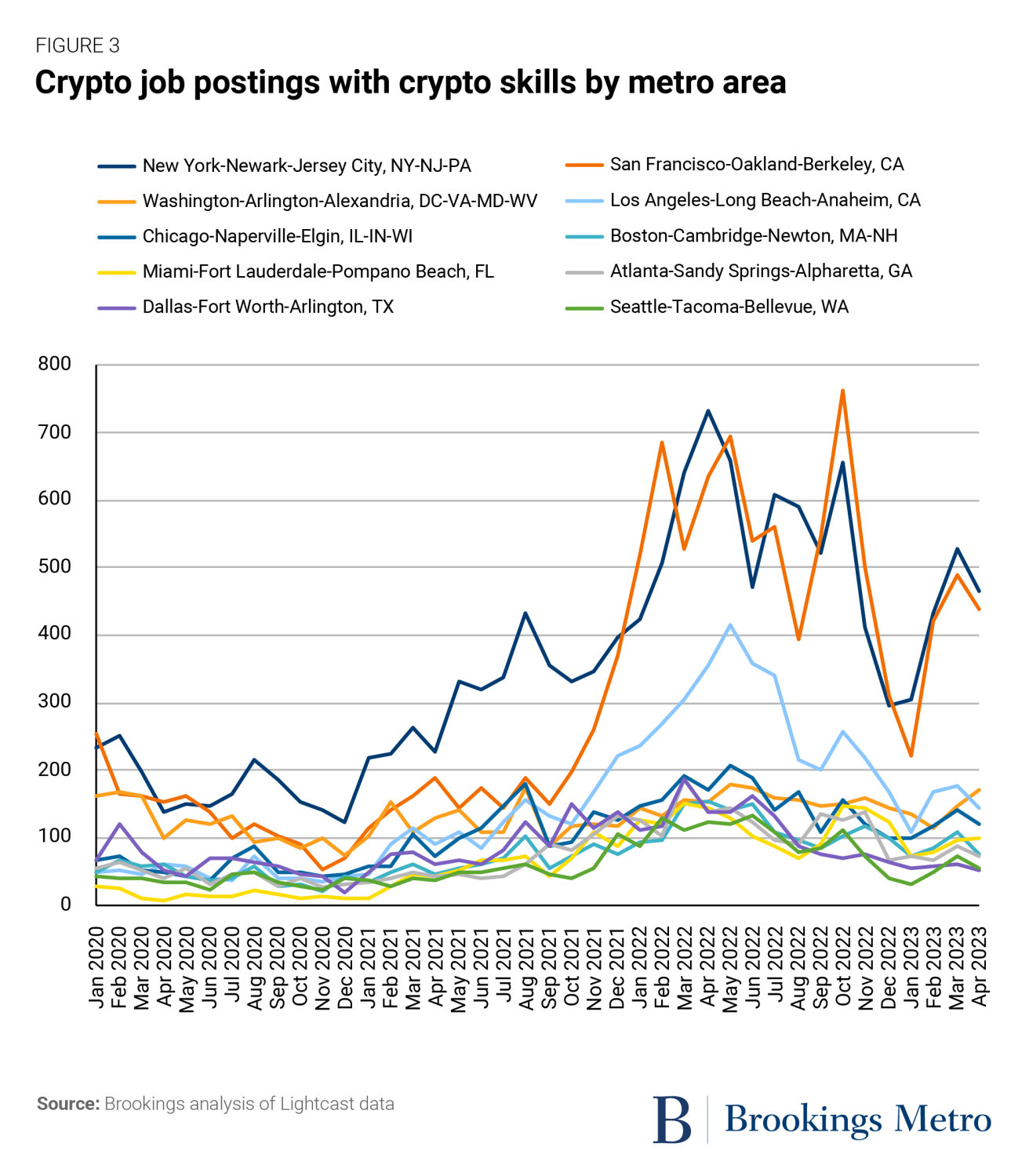

These trends have not manifested themselves uniformly across metro areas. To the contrary: While crypto consumer activity and disruption was widely distributed, a few pre-existing tech and finance hubs saw heavy concentrations of commercial and entrepreneurial activities, several of which were also some of the few places to see at least partial rebounds of crypto-related job postings (and likely employment).

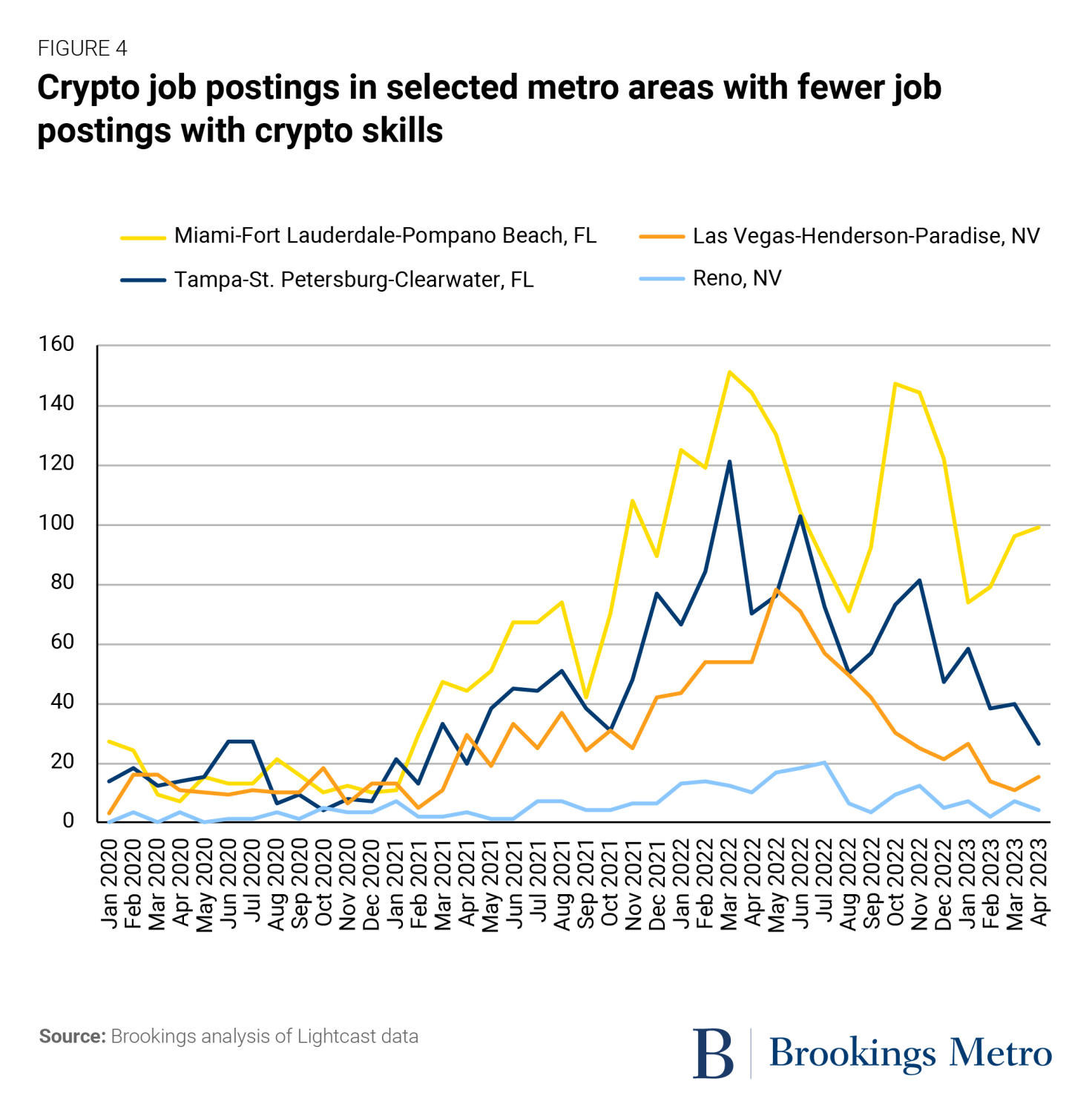

In this regard, between January 2020 and April 2023, a very small number of metro areas dominated aggregate crypto activity in the U.S. For example, the places with the most prominent crypto presence included the New York, San Francisco, and Los Angeles metro areas—all of which already were large tech or finance hubs to begin with. In most other places, by contrast, the number of crypto-related job postings plummeted shortly after bitcoin prices fell in 2022, around the time of the TerraUSD stablecoin implosion. Few places saw crypto rebounds after this crash, with the exception of the New York, San Francisco, and Los Angeles metro areas, as well as the Miami and Tampa, Fla. metro areas, which attracted high numbers of remote workers during the pandemic.

Still, the number of crypto-related job postings in those Florida metro areas—both the increased activity and rebounds—remained significantly smaller than that of New York and San Francisco. What’s more, even the metro areas with pre-existing tech or finance hubs saw job postings decline again after the FTX collapse in November 2022, as bitcoin prices dropped and the volatile crypto market was shaken once more.

Crypto is concentrating in ‘superstar’ cities while leaving other places behind

As local leaders strive to attract economic growth to their regions, the volatility associated with cryptocurrency business activity—and its geographical patterns—raises important considerations.

Despite some state and local governments’ efforts to attract crypto activity, few of the associated startups and jobs have been stable or sustainable. While the big, established markets mentioned above saw job activity largely recover after crypto market crashes, the most recent accountings suggest that in most cases, crypto-related business booms left behind few long-term job or startup gains. Instead, in many cases, what they did create were troubling pollution and energy costs, failed business projects, major consumer and investor losses, and an outbreak of fraud that local law enforcement struggled to curb.

Given that, local and state leaders hoping to build regional economies should carefully weigh whether the crypto industry as currently structured merits their investments of time, resources, and taxpayer funds. At the same time, leaders may also want to consider whether there are other advanced or emerging industries they might want to pursue in order to stimulate economic growth.

To the first point: The significant crypto surge and relatively sustained activity witnessed in New York, San Francisco, and Los Angeles underscore the “superstar” nature of how disruptive technologies (especially digital ones) cluster in the largest markets, while frequently leaving other places behind. Even as many local leaders sought to attract crypto businesses to create or grow technology hubs in their regions, the evidence presented here suggests that the metro areas that emerged as the most significant and resilient crypto centers had already developed solid regional advantages in tech or finance before seeing sizable crypto growth. In contrast, most other metro areas struggled with crypto labor market and startup declines after the spring 2022 market crash, and did not significantly recoup those losses. In short, the digital rich prevailed and most others went sideways.

Those dynamics raise a cautionary note for regional leaders: What seems to have mattered more than explicit efforts to lure crypto companies was the existence of a tech hub in the first place.

Also worth noting: The existence of a large-scale local tech ecosystem seems to count for more than a light touch on regulation. The relatively vibrant New York metro area, for example, happens to be one of the few places with significant crypto regulations in place. Despite crypto enthusiasts’ claims to the contrary, regulation in New York does not seem to be impeding crypto-related job growth, as it continues to be one of the few areas with ongoing job postings activity. Meanwhile, “crypto-friendly” environments have not seen quicker rebounds.

How local leaders can prepare for the next big tech opportunity

In terms of thinking about future economic development, the crypto gold rush may be over, but the past few years can still provide local leaders with lessons on how to capitalize on other emerging technologies, especially in light of the current interest in generative AI.

One place for leaders to begin their thinking is surely with a pragmatic baseline examination of any future targeted technology and its use cases. It bears noting that even as regions invested in cryptocurrencies and related technologies, there were prominent reports of investment scams, numerous questions about the main use cases and financial inclusion narratives, and much controversy associated with crypto institutions. Numerous economists and business leaders flagged crypto as a bubble fairly early on; greater due diligence by local economic developers would have helped.

At the same time, authoritative lists of consensus “key technologies”—such as the Pentagon’s Defense Critical Technology Areas—have been available for years and provide vetted inventories of promising technologies suitable for high-potential economic development strategies. The recent CHIPS and Science Act named 10 of these “critical technology areas” (including AI, quantum information science, immersive technologies, advanced energy, and biotech) as potential themes for regional economic development awards from the Economic Development Administration and National Science Foundation. This means that projects focused on such well-vetted technologies are explicitly prioritized in those agencies’ major competitions, which are backed by hundreds of millions of dollars. These and other government-sponsored competitions may make for superior opportunities.

So, as local leaders move beyond the crypto debacle, they should ask themselves hard questions about the future emerging technology opportunities they come upon:Would this industry be part of an existing technology concentration in our region?

Have we grounded our strategy on rigorous, empirical evidence that takes into account the best knowledge about the industry in question, as well as the specific needs of our region and workforce?

Is the technology or industry we seek to attract speculative, or is it based on well-documented productive activity and potential?

Are we attracting an industry that is going to create stable, sustainable jobs?

Regional leaders would also do well to embrace an even broader reorientation of their economic development approach that looks beyond just business attraction activities—even for “hot” individual technologies. This calls for a deeper focus on the starting point and broader vitality of their local “innovation ecosystem”—the interconnected set of institutions (universities, workforce organizations, corporations, governments, startups, and investors) whose interplay in the region will help all kinds of entrepreneurs and enterprises succeed. Hence the special value of the “ecosystem” approach: An ecosystem perspective enables a region to benefit not just from individual entrepreneurs and technology opportunities, but from the region’s broader economic ferment.

Local leaders are under immense pressure to innovate, adapt to new technologies, and spur economic growth. The collapse of the crypto bubble in most, if not all, places ought to nudge local leaders toward other strategies for regional economic development. It should also be taken as a useful caution: Not all emerging technologies are promising, no matter how much they are hyped. Local leaders should do their due diligence to ensure emerging technologies are both proven and suitable for their economic development goals.

No comments:

Post a Comment