Last month, Sweden announced that its State-owned mining company LKAB has discovered 1 million tonnes of rare earth oxides in the far north region of the country. This is Europe’s biggest deposit of rare earth elements found so far and is potentially significant to its future plans for energy transition and self-sufficiency in critical minerals.

The press release by the Swedish authorities stressed the need for independence from China and Russia from where Europe imports most of its rare earth minerals today. The actual mining and production from the new-found deposits are likely to take another 10-15 years.

This was followed by a study from Norway which found substantial mineral resource deposits on the seabed of its extended continental shelf, which will require deep-sea mining for exploitation in the future.

In this Issue Brief, we discuss the nature and use of rare earth elements, their geopolitical significance, India’s strategic and commercial interests in the minerals, and possible future courses of action.

What are Rare Earth Elements?

Rare earth elements is a collective term for 17 elements, namely, scandium, yttrium, and lanthanides (a further set of 15 elements). The elements are usually found as compounds of rare earth minerals.

They are used in the manufacture of strategic and commercial goods having applications in defence, electric vehicles, clean energy, chemicals, and electronics industries, among others. They are particularly necessary for manufacturing batteries and magnets, both of which are critical for the transition towards clean energy in countries’ efforts to fight climate change.

Rare earth deposits are abundantly found, but not often in commercially viable quantities, thus making their supply all the more critical.

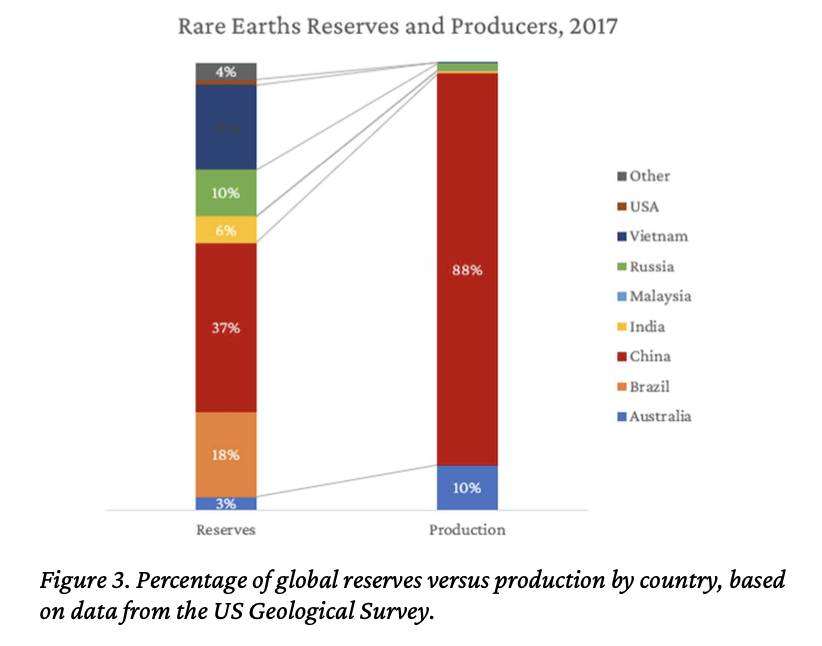

China has the largest reserves of rare earth deposits and is the biggest producer and exporter of rare earth elements, accounting for around 90% of the total production. India has around 6% of the world’s reserves, found mostly in monazite sands, but the actual production stands at a paltry 1% of global production. India is a net importer of rare earth minerals.

Importance of Rare Earth Minerals

In the present geopolitical context, rare earth elements have attained greater significance for three important reasons:

Countries seek to avoid overdependence on China for imports of strategic minerals since China may use this for economic and diplomatic coercion.

Global supply chain disruptions caused by the pandemic, military conflicts, trade wars, and geopolitical tensions in recent years have prompted countries to re-shore strategic manufacturing and build supply chains with ‘trusted’ partner countries.

Given their use in strategic sectors like defence weapons, electronics systems, and clean energy, countries having deposits seek to attain a degree of self-sufficiency in rare earth elements production and processing.

Therefore, India must focus on expanding its production of rare earth minerals and building upstream and downstream processing capacity. This in turn will boost local manufacturing in the renewables and electronics industries, if domestically produced rare earth elements are available at competitive prices. India can also build an export market in the rare earth sector.

Where is India Placed vis-a-vis Rare Earths?

IREL (India) Limited, a central government enterprise, has an effective monopoly over rare earth minerals production in the country since exploration and mining of monazite sands are reserved for government enterprises under the Atomic Mineral Concession Rules (2016). IREL’s primary remit involves mining beach sands for thorium used in nuclear power reactors, and not other rare earth elements per se, although it has expanded production of the latter in recent years.

Rajasthan unveiled a draft Rare Earth Elements Policy, 202,1 after preliminary findings of rare earth minerals in felsite rocks in the Barmer district of the state. Gujarat Mineral Development Corporation is also undertaking studies for setting up a rare earth mineral processing facility in the state. Indian industry bodies have urged the Union Government to set up an Indian Rare Earths Mission, on the lines of the Indian Semiconductor Mission.

What Should India Focus On?

In Takshashila Discussion Document - A Rare Earths Strategy for India, we present a framework for assessing India’s rare earth needs, based on their strategic and commercial potential, availability for Indian industries, and timelines for extraction and processing:

Light rare earth elements (shaded in light grey) in general have high commercial potential and availability in India. Therefore, India must prioritise their extraction, processing, and building a high-value supply chain around them in the medium term.

For the heavy rare earth elements (shaded in dark grey), India’s options include establishing secure supply chains with trusted partner countries like the U.S. and Australia which produce these elements and investing in mining and production capacity in countries like Vietnam which have significant deposits.

Immediate Reforms for the Rare Earths Sector in India

India must not only secure its national interests in the rare earth sector but also take advantage of the current geopolitical and trade situation to become a major player globally. This will require liberalising the mining of rare earth, increasing extraction, production, and processing capacity, and building a high-value supply chain including in the renewables and electronics sector.

To do so, we suggest the establishment of the Department of Rare Earths (DRE) under the Ministry of Petroleum and Natural Gas. The DRE can oversee India's rare earth policy and facilitate investment and R&D in the sector.

In the alternative, the mandate of the Department of Atomic Energy (DAE) can be re-prioritised to achieve similar outcomes. DAE can build on the expertise it has built up through the likes of IREL over the years.

We outline three approaches for boosting India’s rare earth sector, and the final strategy can be a combination of the below:

Introducing more players in production and processing will create higher-value supply chains due to competition and innovation.

While IREL can continue its monopoly over radioactive minerals from a nuclear security perspective, exploration and mining of rare earth must be opened to other government and private establishments.

The Minerals Security Partnership between the U.S., U.K., European Union, Australia, Japan, and others is an initiative to secure critical minerals supply chains, and increase investment, and information sharing in the sector.

The Quad also offers a platform for building consensus and cooperation around critical and strategic minerals.

India and the Indian industry must look to collaborate in such initiatives, as investors, suppliers and consumers. India can also look to build rare earth reserves as part of such international groupings.

This Issue Brief has been compiled by Shrikrishna Upadhayaya, with inputs from Pranay Kotasthane.

No comments:

Post a Comment