Christopher Tang

China has been struggling to balance curbing the spread of the coronavirus with stimulating its weakening economy. The country ended its zero-Covid policy in early December and, by mid-January, had reported nearly 60,000 fatalities linked to the virus.

The full toll of this abrupt change in health policy on human lives will not be known for some time. But economic growth is the silver lining that can create a better future for China and beyond.

Clouds continued to loom over China after three years of isolation due to quarantine, mass testing and Covid-19 lockdowns. The zero-Covid policy successfully reduced the spread of the early strains of the virus, but significantly bogged down the economy.

The youth unemployment rate exceeded 19.9 per cent last July, the highest rate since Beijing started publishing the index in January 2018. In December, China’s exports contracted 9.9 per cent year on year, the worst figures since February 2020. Gross domestic product grew 3 per cent in 2022, well below the government’s target of “around 5.5 per cent”.

Some might argue that the Chinese government should have lifted its zero-Covid policy gradually so the country was better prepared. However, it is also plausible that curbing the spread of the virus is untenable because it has mutated.

Instead of prolonging the agony, it may have been more effective to open everything at one go to stimulate the economy in the hope that a catastrophic loss of human life could be avoided if the Omicron variant is indeed less deadly.

Once herd immunity is achieved, China’s economic engine can reboot by leveraging three competitive advantages.

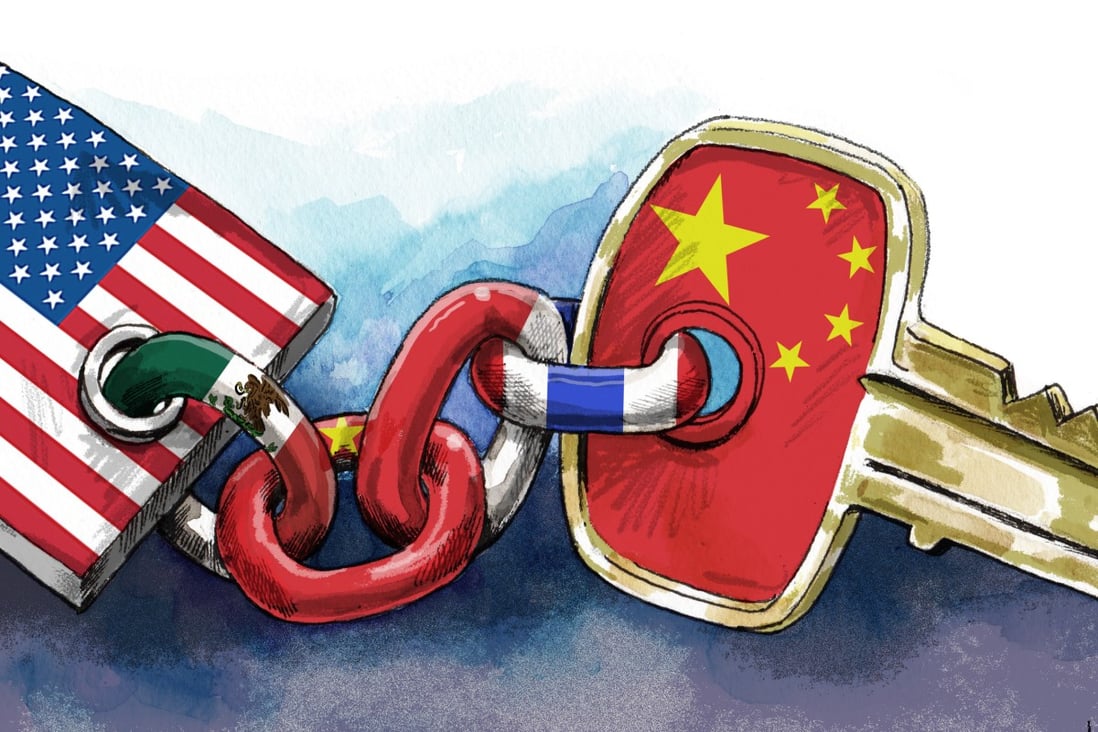

First, China remains the world’s largest producer of several critical products – from electric vehicle batteries and solar panels to certain electronic components used in computers and appliances. On the surface, the United States is less directly dependent on Chinese goods by importing less from China and more from Southeast Asian nations such as Vietnam, Indonesia and Thailand, as well as Mexico.

Beneath the surface, the US continues to depend on China indirectly as it becomes the key supplier of electronic parts and semi-finished products to countries such as Vietnam and Mexico. In 2021, Vietnam imported goods worth US$110 billion from China, but most of these imports are parts to be assembled into finished goods intended for export to the US.

Mexico imported over US$79 billion of goods from China between January and August 2022, representing a 28 per cent increase compared to the same period in 2021. Most of the imports were parts and semi-finished products to be assembled into cars and home appliances intended for export to the US.

Huge solar farm at Mexico City market being built with 32,000 panels from China

Second, China’s dominance in rare earth elements such as cerium and europium, and its self-sufficiency in neon gas, can secure its hi-tech production. Rare earth elements are essential for producing components in hi- tech devices, including smartphones, radars and missiles. As of 2022, China accounted for 63 per cent of the world’s rare earth mining, 85 per cent of rare earth processing and 92 per cent of rare earth magnet production.

China also produced 30 per cent – and Ukraine 40 per cent – of the world’s supply of neon gas used in semiconductor production. Neon gas is not rare – it is a by-product of steel manufacturing – but the war in Ukraine and the decline of the American steel industry has created a shortage that is disrupting chip manufacturing.

To compete with China in the hi-tech sector, US President Joe Biden signed a bill last August to provide US$52.7 billion in subsidies to boost American semiconductor production and research. However, limited supply of rare earth materials and neon gas will hinder production of electronic products and semiconductors in the US. Given China’s ample supply of these critical elements, decoupling completely from China is unlikely in the foreseeable future.

Soil containing rare earth elements is transported for export at a port in Lianyungang, Jiangsu province, China, on October 31, 2010. Photo: Reuters

Third, China’s leadership role in establishing the Regional Comprehensive Economic Partnership in 2020 sets the stage for the country to expand its trade with 15 members ranging from Australia to Indonesia. Effectively, the RCEP is the world’s largest trading bloc, accounting for about 30 per cent of global gross domestic product, larger than both the US-Mexico-Canada Agreement and the European Union.

Under the RCEP, tariffs among the members that ratified the partnership dropped to zero on more than 65 per cent of goods imported. Zero tariffs on 90 per cent of goods are expected in 20 years. China can leverage the free-trade agreement with Southeast Asian nations to increase trade within Asia.

Intraregional trade grew more than 31 per cent in the first three quarters of 2021, and trade within Asia made up 58.5 per cent of the region’s total trade in 2020, its highest share in three decades.

More importantly, since the US first placed 25 per cent tariffs on a range of Chinese goods in July 2018, China’s total trade with the US has declined. However, between July 2018 and November 2022, China’s total trade with these RCEP members, such as Indonesia, Malaysia and Vietnam, grew 71 per cent.

This growth is driven by the need for these Asian countries to import more parts for producing goods to be exported to the US. In addition, free-trade agreements ensure products imported from China are cheaper, making them even more appealing to price-conscious consumers in these Asian countries.

The scale and scope of the impact of China’s sudden end to its zero-Covid policy on human lives cannot be underestimated. But the urgent need to stimulate China’s economy cannot be trivialised either.

Let’s hope China can resume its economic growth without catastrophic human loss.

No comments:

Post a Comment