Joseph Webster

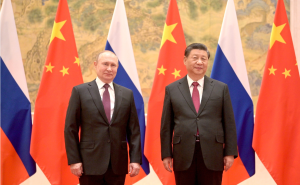

Xi Jinping and Vladimir Putin exchanged a warm phone call on Friday, providing a fitting bookend to a year that saw China and Russia strengthen relations across the board. Still, Moscow is becoming weaker both absolutely and relatively, tilting the relationship ever more in Beijing’s favor and creating uncertainty about future interactions. The two sides will very likely continue to expand military and political ties in 2023, although a mutual trust gap could emerge in future years.

Russia’s Disastrous Invasion of Ukraine Made It Even More Dependent on China

Russia, with an economy a tenth the size of China’s, is firmly the junior partner in the relationship. Events this year have underscored Russia’s dependency. In late January, Western diplomatic sources claimed to Bloomberg that Xi asked Putin to delay any escalation in Ukraine until after the conclusion of the 2022 Beijing Olympics. If true, this claim would have extraordinary implications for Putin’s perceptions of the role of China, the conduct of Russian foreign policy, and, potentially, the outcome of the war itself. As many analysts noted at the time, any escalatory delay would strengthen Kyiv’s hand by giving it more time to receive arms and aid shipments.

The claims of the Western diplomat appear to have been vindicated by events. Russia and Belarus announced “Allied Resolve 2022” joint exercises, which ended on February 20, the day of the closing ceremony of the 2022 Beijing Olympics, in a likely signal to Beijing. Moreover, Putin initiated the invasion on February 24, four days after the Olympics – as soon as possible but distant enough for plausible deniability, perhaps.

The invasion’s delay may have proved consequential. In the early days of the war, Russian forces narrowly failed to establish an “air bridge” to Kyiv at the Battle of Antonov Airport. Did the escalatory delay, apparently imposed by Beijing or implemented by Moscow to satisfy its partner, determine the course of the war?

We’ll never know the counterfactual, but Russia’s war efforts appear to have been shaped, to a large and potentially decisive degree, by its relationship with China. Delaying the invasion in accordance with Beijing’s explicit or unspoken preference may have imposed severe costs on the Russian war effort and potentially even undermined it.

Russia’s dependency on China was pronounced before the invasion and will likely worsen. In 2021, Russian exports to China accounted for 4.4 percent of Russian GDP; this year the figure could easily exceed 5 percent, as Russian GDP falls and trade with the West contracts. Russia is shut out of Western technology markets and has little-to-no capacity to innovate on its own. Some surveys suggest more than 30 percent of Russian IT professionals have fled the country; the former CEO of Yandex, arguably Russia’s most successful tech company, now lives in Israel. Unwilling to import technology from the West, and unable to innovate on its own, Russia will be forced to turn to China for semiconductors, 5G, and more. China’s increasingly dominant economic and technological influence in Russia will continue to constrain Moscow’s freedom of maneuver.

How much dependency Russia can tolerate? With Russian comprehensive national power extremely likely to attenuate, Moscow must continue to accept Beijing’s priorities over its own.

China-Russia Military Ties Are Expanding Rapidly and Significantly

While China may have encumbered Russia’s invasion of Ukraine, the two sides made unprecedented strides in bilateral military operations this year. In late November, Chinese and Russian forces conducted a joint bomber patrol and landed at each other’s airfields, in an (apparent) first for the two sides in the post-Cold War era. In May, China and Russia conducted joint bomber patrols that coincided with the Quad summit.

The most important military-to-military interactions may have been in the naval domain, however. During Russia’s Vostok 2018 military exercises, Russian naval forces were accompanied by an apparently uninvited Chinese Dongdiao-class auxiliary general intelligence (AGI) vessel. Four years later, during September’s 2022 Vostok exercises, however, Chinese ships were formal participants. Vostok 2022 also was the first time the People’s Liberation Army sent three military branches to any single Russian drill, according to the Global Times.

The two sides continue to eschew any formal military alliance and are unlikely to commit to one anytime soon, especially while Russia is engaged in a military conflict in Ukraine. Nevertheless, the two sides are enhancing military cooperation, complicating planning for the Quad and U.S. allies, especially Japan.

Xi Jinping’s Idiosyncratic Decision Making and Russia Relations

Besides sanctions compliance, the most important economic story in bilateral economic relations was China’s public health regime. Beijing insisted on maintaining zero-COVID long after the world had reopened, constraining its energy demand (and Russian energy export earnings). Beijing’s economy remained in partial lockdown in 2022 despite ample access to effective vaccines and an extremely transmissible variant that required mobility restrictions and periodic quarantines, including a brutal Shanghai lockdown.

Xi’s insistence on maintaining lockdowns did not keep the virus at bay, however, while Beijing’s failure to vaccinate China’s elderly population will lead to hundreds of thousands of unnecessary deaths. Lockdown without vaccination only prolonged China’s economic, social, and financial costs without easing its ultimate death toll. While the Chinese Communist Party (CCP) promotes a narrative about the excellence of its personnel, CCP leaders, including Xi Jinping, may not be all that competent – or are at least not very concerned with economic growth.

Indeed, one of the most surprising aspects of China-Russia relations in 2022 has been Beijing’s relaxed reaction to the invasion’s costs. In January 2022, prior to the war but after Omicron’s emergence, the International Monetary Fund (IMF) predicted world annual economic growth of 4.4 percent; it now projects 2022 annual GDP growth will total just 3.2 percent, with much of the downturn occurring in Europe and North America, two of China’s largest export markets. The war has buffeted the Chinese economy to a significant but unknowable extent: An initial Barclays estimate suggested a global energy shock would cause China’s GDP to fall by 0.3-0.5 percent. Perhaps most importantly, Beijing’s “pro-Russia neutrality” has alarmed the West, leading the United States, Europe, Japan, and other economies to impose greater restrictions on technology transfers to the PRC, limiting China’s long term growth prospects.

Despite the costs, Beijing has shown little genuine enthusiasm to encourage Putin to come to the negotiating table, much less mediate a ceasefire. Beijing carefully managed the domestic informational environment after the invasion, avoiding any criticism of Russian forces. Chinese diplomats have also worked to amplify the Kremlin’s false narrative that the United States triggered the invasion. More concretely, while Chinese companies have largely complied with sanctions and avoided rushing to fill the void left by Western energy corporations, they are still consuming Russian energy exports and expanding exports to Russia, cushioning the blow to Russian consumers.

China’s pro-Russia neutrality emanates from the very top. Ukrainian President Volodymyr Zelenskyy has yet to receive a call from his Chinese counterpart after the invasion, although Xi and Putin have spoken at least three times on the telephone and met once in-person after February 24. Most damningly, Xi hosted Dmitri Medvedev, the former moderate Russian president turned uber hawk as the deputy chairman of the Russian Security Council, just as Zelenskyy made his own surprise visit to Washington. Xi’s decision to host Medvedev was highly symbolic and suggests that Beijing, far from seeking an end to the war, may be considering how it can support Moscow without damaging its own interests.

While Both Sides Are Growing Closer, Long-Term Constraints Remain

Beijing and Moscow’s convergence is real. Both sides chafe at the restrictions imposed by the Washington and Brussels-led international order, albeit to varying degrees and in different ways; fear that the West is behind so-called “color revolutions” and pro-democracy movements; and share overlapping economic interests. Still, the relationship is fragile.

If China continues to become more powerful, it will rely less on Russian political support and military technology. Indeed, the FSB publicized the arrest (and potential execution) of a Chinese asset in July 2022. Russian counterintelligence authorities also publicized the summer 2020 arrest of a Russian scientist working on submarine detection technology. In both cases, the release of information in these highly sensitive cases very likely received approval from Russia’s power vertical. Even Vladimir Putin may be uneasy with Beijing’s growing power and influence within Russia.

With China’s economic and military capabilities likely to rise relative to Moscow’s in the years to come, the relationship is becoming ever more imbalanced. Moreover, if China is able to phase out imports of Russian commodities such as oil, gas, and coal, it will have even less need for an unreliable, weak partner. Moscow and Beijing are set to draw closer in 2023, but the relationship’s sustainability remains an open question.

No comments:

Post a Comment