MINXIN PEI

ATHENS – The new leadership team selected by Chinese President Xi Jinping at the 20th National Congress of the Communist Party of China failed to impress financial markets at home and abroad. In the week following the announcement of Xi’s new team, Hong Kong’s stock market declined by 8.3%, and the Shanghai Composite Index, China’s largest stock exchange, dropped 4%, despite the Chinese government’s intervention to prop up prices. US-listed Chinese stocks plunged by 15%.

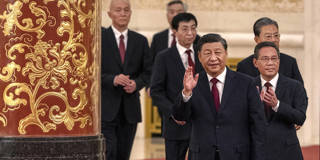

Investors have good reason to worry. Though financial markets had already priced in Xi’s third term, investors had hoped that he would appoint a team of more moderate, experienced officials capable of putting pragmatism above politics. Instead, Xi packed the Politburo and its Standing Committee with loyal allies and protégés.

China’s next premier will be Li Qiang, who was Xi’s chief of staff (2004-07), before later serving as governor of Zhejiang province (2013-16), and CPC Secretary of Shanghai (2017-22). Li is widely credited with convincing Tesla to build its largest overseas factory in Shanghai – an achievement that has bolstered his business-friendly reputation. But, unlike every other premier since 1988, Li has no national-level administrative experience.

Ding Xuexiang, the next executive vice premier of the State Council, has even less leadership experience under his belt, having spent the last ten years as Xi’s principal aide. In investors’ view, these officials lack the knowhow and independence to mount an effective response to the profound economic challenges China faces.

Xi stands to benefit from these low expectations, with any minor success appearing significant and burnishing his government’s credibility. Here, perhaps the lowest-hanging fruit is the zero-COVID policy, which has devastated the economy and contributed to an urban youth unemployment rate of nearly 20%.

At the Party Congress, Xi had little choice but to tout the policy as a major success, despite the devastation it has wrought. But with the meeting out of the way, and Xi starting his third term, the incentive to end the zero-COVID policy is strong. The boost to growth and employment – and to Li and Ding’s reputations – would be immediate.

Xi’s new economic team would also benefit from easing regulatory pressure on China’s technology sector. Since the Chinese government began tightening the regulatory screws, private tech companies such as Alibaba and Tencent have suffered, and foreign investors have fled China in droves. Goldman Sachs estimated last year that the crackdown had wiped out roughly $3 trillion of the Chinese tech sector’s value.

Given that the tech crackdown is widely viewed as excessive and counterproductive, any letup by the government would send positive signals to investors about the future of China’s tech sector, the new leadership team’s pragmatism, and the prospects for a return to robust economic growth.

But China’s new leaders can make the greatest impression on investors if they can prove that they can handle the country’s toughest economic challenge: an imploding real-estate sector. Property sales are likely to drop by as much as 30% this year. Several large developers, such as Evergrande and Shimao, have defaulted on their debt. With funding cut off, many building projects remain unfinished, leading some angry home-buyers to stop making mortgage payments.

This crisis will be the true test of the new economic team’s capabilities. Can they find a solution to widespread developer insolvency? Can they prevent the mass bankruptcy of local government financing vehicles, which took out massive bank loans using land as collateral? Can they find ways to ensure that new projects are not left unfinished? And can they stave off a housing-price collapse, as real-estate investment stops generating returns for the wealthy?

Even partial success here would bring a massive payoff. The real-estate sector powered China’s economy for two decades, contributing 17-29% of China’s GDP growth. Its revival could thus put the country back onto a positive growth path.

It is far from clear that Xi’s new team is capable of devising effective solutions to the real-estate crisis; after all, their predecessors were not, despite being far more experienced. But even if they are, there is good reason to doubt that Xi will allow a change in policy. Simply put, whether the doomsayers are proved right or wrong depends – like virtually everything else in China nowadays – on the man at the top.

No comments:

Post a Comment