Josh Horwitz

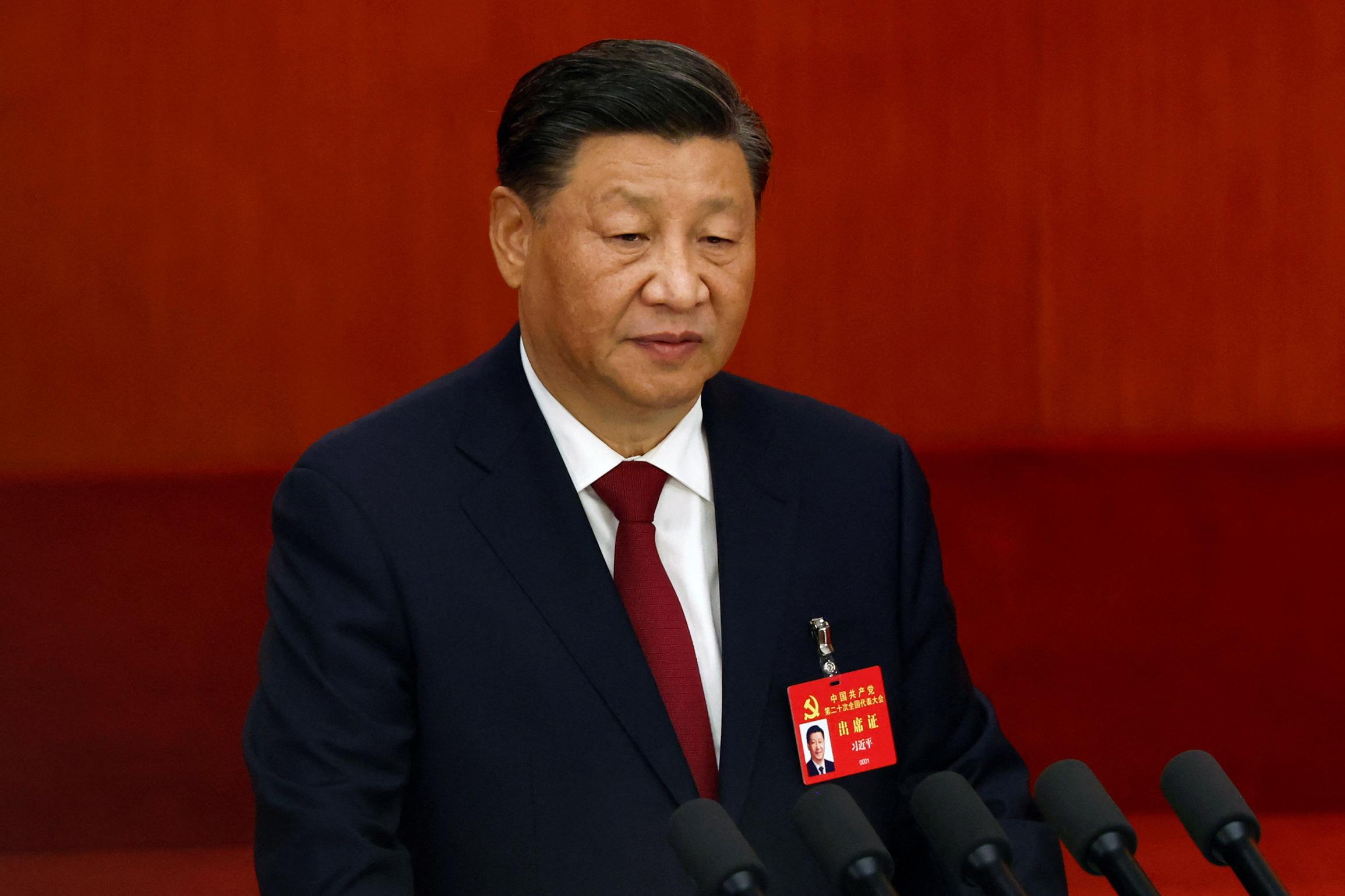

SHANGHAI, Oct 17 (Reuters) - President Xi Jinping's call for China to "win the battle" in core technologies could signal an overhaul in Beijing's approach to advancing its tech industry, with more state-led spending and intervention to counter U.S. pressures, analysts say.

Achieving self-reliance in technology featured prominently in Xi's full work report to kick off the once-every-five-years Communist Party Congress, with four mentions versus none in 2017. The term "technology" was referred to 40 times, up from 17 times in the report from the 2017 congress.

While the report did not mention any other countries or specific sectors for that goal, it comes days after Washington imposed sweeping new regulations aimed at undermining China's efforts to develop its own chip industry.

HSBC analysts said their takeaway was that increased spending in China, particular in STEM (science, technology, engineering and maths) fields, and policy support was likely.

Iris Pang, chief economist for Greater China at ING, said Xi's remarks addressed "the urgent need for talent and promoting self-sufficiency in technological advancement".

"We believe that this echoes to the U.S.'s CHIPS Act," Pang said, referring to the U.S. regulations. "As such research spending on semiconductor technology should increase. Typically, policies are released after such important events in China."

On Monday, shares in Chinese information technology companies (.CSIINT) rose more than 1%, while semiconductor stocks (.CSIH30184) rose 0.7%.

In his speech, Xi listed a slew of industries where he described China as having achieved breakthroughs over the past decade, including large aircraft, space flight, satellite navigation - all of which rely on copious state support.

No mention was made of semiconductors, an area where China has funnelled billions of dollars in government funds but was also seen to have been given more lee-way in using market-led approaches versus other sectors.

Venture capital (VC) has been allowed to invest in Chinese chip companies, with such firms receiving over $30 billion in VC cash between 2020-2021, according to Chinese investment research firm CVInfo. State-backed chip companies are also free to buy and sell goods and supplies according to market demand, in competition with foreign products.

But while the support has propelled the rise of potential giants like Semiconductor Manufacturing International Corp (0981.HK) and Yangtze Memory Technologies Co Ltd, no domestic Chinese chip company has gained global dominance at the most advanced level, and the sector remains heavily reliant on foreign technology.

The sector has also seen some expensive failures.

In 2017, the local government in Wuhan and investors in Beijing placed tens of billions of yuan in Wuhan Hongxin Semiconductor Manufacturing, a chip fab that promised to produce 30,000 wafers per month, only to see it shutter in 2021 due to financial issues.

In the run up to the congress, a number of people affiliated with China's national chip fund, which has raised 342.7 billion yuan ($47.6 billion) so far, were placed under investigation for corruption, raising speculation over the entity's future.

Tianfeng Securities analysts Song Xuetao and Zhang Wei on Monday noted that Xi in his speech called for China to "build a completely new national-led system", for technology, a step away from how he urged in 2017 to build a system for technology innovation that was "enterprise-based" and "market-based".

No comments:

Post a Comment