Laura He

China is beset by severe economic problems. Growth has stalled, youth unemployment is at a record high, the housing market is collapsing, and companies are struggling with recurring supply chain headaches.

The world's second biggest economy is grappling with the impact of severe drought and its vast real estate sector is suffering the consequences of running up too much debt. But the situation is being made much worse by Bejing's adherence to a rigid zero-Covid policy, and there's no sign that's going to change this year.

Within the past two weeks, eight megacities have gone into full or partial lockdowns. Together these vital centers of manufacturing and transport are home to 127 million people.

Nationwide, at least 74 cities had been closed off since late August, affecting more than 313 million residents, according to CNN calculations based on government statistics. Goldman Sachs last week estimated that cities impacted by lockdowns account for 35% of China's gross domestic product (GDP).

"Beijing appears willing to absorb the economic and social costs that stem from its zero-Covid policy because the alternative — widespread infections along with corresponding hospitalizations and deaths — represents an even greater threat to the government's legitimacy," said Craig Singleton, senior China fellow at the Foundation for Defense of Democracies, a DC-based think tank.

"Major policy shifts before the party congress appear unlikely, although we could see a softening in certain policies in early 2023 after Xi Jinping's political future has been assured," Singleton said.

"Even then, the Party is running short on both time and available policy levers to address many of the most pressing systemic threats to China's economy," he added.

The economy will continue to worsen in the next few months, said Raymond Yeung, chief Greater China economist for ANZ Research. He added that local governments will be "more inclined to prioritizing zero-Covid and snuffing out the virus outbreaks" as the party congress approaches.

Tightening of Covid restrictions will hit consumption and investment during China's "Golden September, Silver October," traditionally the peak season for home sales.

In the meantime, a sharp slowdown in the global economy doesn't bode well for China's growth either, Yeung said, as weakening demand from the US and European markets will weigh on China's exports.

He now expects Chinese GDP to grow by just 3% this year, missing Beijing's official target of 5.5% by a wide margin. Other analysts are even more bearish. Nomura cut its forecast to 2.7% this week.

No exit until early 2023?

More than two years into the pandemic, Beijing is sticking to its extreme approach to the virus with forced quarantines, mass mandatory testing, and snap lockdowns.

The policy was deemed successful in the early stage of the pandemic. China managed to keep the virus at bay in 2020 and 2021 and stave off the large number of deaths many other countries suffered, while building a quick recovery following a record contraction in GDP. At a ceremony in 2020, Xi proclaimed that China's success in containing the virus was proof of the Communist Party's "superiority" over Western democracy.

But the premature declaration of victory has come back to haunt him, as the highly transmissible Omicron variant makes the zero-Covid policy less effective.

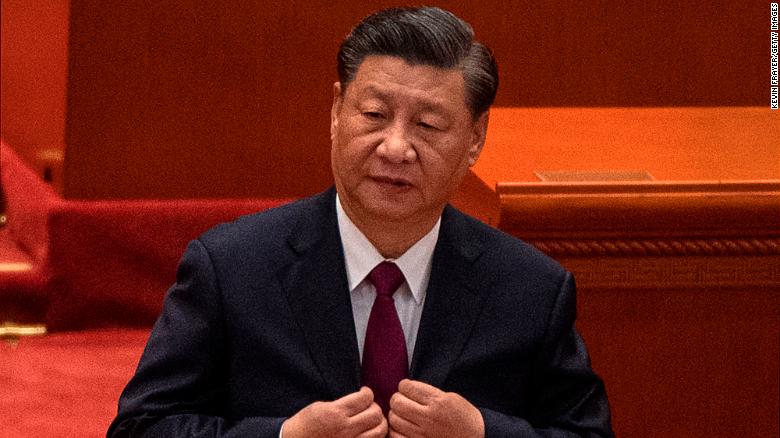

However, giving up on zero-Covid doesn't seem like an option for Xi, who has repeatedly put greater emphasis on defeating the virus than rescuing the economy this year.

In a trip to Wuhan in June, he said China must maintain its zero-Covid policy "even though it might hurt the economy." At a leadership meeting in July, he reaffirmed that approach and urged officials to look at the relationship between virus prevention and economic growth "from a political point of view."

"Beijing has sought to cast its zero-Covid policies as evidence of the Party's strength, and therefore, by extension, Xi Jinping's leadership," Singleton said.

Any change in approach may not come until next year, and even then it's most likely to be very gradual, said Zhiwei Zhang, president and chief economist for Pinpoint Asset Management.

"It will be a long process," he said, adding that Hong Kong — where quarantine and testing rules for visitors have recently been relaxed — could be "an important leading indicator for what will happen in the mainland."

Another dismal quarter

While Beijing seems unwavering on its zero-Covid strategy, the government has rolled out a flurry of stimulus measures to boost the flagging economy, including a one trillion yuan ($146 billion) package unveiled last month to improve infrastructure and ease power shortages.

The government is trying to achieve "the best possible outcome" for economic growth and jobs while sticking to zero-Covid, but it's "very hard to balance the twin goals," said Yeung from ANZ.

Recent data suggest the Chinese economy could be headed for another dismal performance in the third quarter. GDP expanded by only 0.4% in the second quarter from a year earlier, slowing sharply from growth of 4.8% in the first quarter.

Official and private sector surveys released last week showed China's manufacturing industry contracting in August for the first time in three months, while growth in services slowed.

"The picture is not pretty, as China continues to battle the broadest wave of Covid infections thus far," Nomura analysts said in a research report on Tuesday.

Jobs and property issues

China's job market has deteriorated in the past few months. Most recent data showed that the unemployment rate among 16 to 24 year-olds hit an all-time high of 19.9% in July, the fourth consecutive month it had broken records.

That means China now has about 21 million jobless youth in cities and towns. Rural unemployment isn't included in official figures.

"The most worrying issue is jobs," said ANZ's Yeung, adding that youth unemployment could climb to 20% or higher.

Other economists say more job losses are likely this year as social distancing measures hurt the catering and retail industries, which in turn piles pressure on manufacturers.

The deepening property market downturn is another major drag. The sector, which accounts for as much as 30% of China's GDP, has been crippled by a government campaign since 2020 to rein in reckless borrowing and curb speculative trading. Property prices have been falling, as have sales of new homes.

While there could be a relaxation of zero-Covid rules in 2023, housing policy may not look very different after the party congress.

No comments:

Post a Comment