Luke Patey

It’s a c-suite mantra: to be competitive globally, companies must be competitive in China. But with a rising global market share, robust supply chain, & cutting-edge tech, Ericsson shows that life post-China might not be so bad.

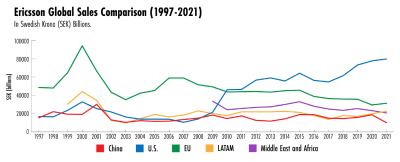

In a cover story for The Wire China, Luke Patey examines the competitiveness of Ericsson in the global race for leadership in fifth-generation mobile networks. Since Sweden’s ban on China’s tech champion Huawei last year, Ericsson has lost half its market share in China. But not since 2001 has its China revenues represented over 10% of Ericsson’s total.

Telecom markets a fraction of the size, including Latin America, have long generated more revenues. Today, decoupling between China and the West brings both new risks and benefits: What is lost in China, can be gained elsewhere. Over the past decade, Ericsson generated 3 to 5 times more revenues in the United States than China. The US, not China, is Ericsson's boom market.

Source: Author’s calculations based on available data from Ericsson annual reports

Source: Author’s calculations based on available data from Ericsson annual reportsFor production, Ericsson was also quick to adjust to geopolitical pressures from the US-China rivalry: moving from just-in-time to just-in-case with new manufacturing in the USA, Estonia, India, & Malaysia to develop dual-sourcing.

Finally, when it comes to learning new technologies & know-how, it’s not ideal to have a small presence in China. But Ericsson is active in more countries than any of its rivals. Its experience is that diversity, not uniformity, drives innovation.

Ericsson’s experience in China may not be repeated across all industries, but it is instructive to multinationals facing the dual challenge of China’s market restrictions and intensifying geopolitical pressures. Just as Huawei grew into a global telecom leader with limited access to the United States, Patey’s findings suggest European telecoms can prosper without significant stakes in China.

No comments:

Post a Comment