Dr. Stefan Meister, Dr. David Jalilvand

The experience of more than a decade of tough sanctions against Iran could help when it comes to avoiding past mistakes and making the sanctions against Russia more effective without diminishing support for them in Western societies. Although Iran is very different from Russia in terms of its size and its political, economic, and military role in the world, similar patterns nonetheless exist. We believe that sanctions are only effective if they are embedded in an integrated political approach and scalable: in the sense that they can be scaled down if the country takes a cooperative approach and scaled up in the event of any further escalation. Irrespective of this, sanctions can only be one tool among many and should be combined with other forms of pressure and incentives in order to actually influence the actions of the sanctioned country. At the same time, it is important to distinguish between the short-term effects, on the one hand, and the medium- to long-term impact, on the other. In the short term, the effects are often limited, which makes it unlikely that the sanctioned country will back down. In the long term, the economic damage can be considerable, but the sanctioned country may also adapt. For this reason, the different cost-benefit calculations for both sides must be taken into account, as this will influence the actual impact. Meanwhile, completely isolating a country and its society usually leads to the entrenchment of existing authoritarian structures.

Sanctions Against Iran and Russia

Iran was subjected to comprehensive sanctions as part of the dispute over its nuclear program. Multilateral sanctions in the framework of the United Nations from the end of the 2000s targeted the Iranian arms industry, in particular. The sanctions imposed unilaterally by the European Union and by the United States, however, went much further. From 2012, they targeted the energy and financial sectors, the petrochemical industry, and the country’s central bank, with the aim of denying the leadership in Tehran foreign exchange earnings. Foreign assets were also frozen and trade in gold and precious metals was prohibited. In addition, Iran was excluded from the banking communications system SWIFT. In 2013, the United States imposed sanctions on international trade in the Iranian rial, and on the automotive sector and the shipping and ship-building industries.

After sanctions were temporarily lifted when the nuclear deal was reached, in May 2018 the administration under then US President Donald Trump not only reactivated the previous administration’s unilateral sanctions, but expanded them significantly. Sectoral sanctions were now also imposed on the Iranian construction industry, mining, the IT industry, the metals and minerals sectors, the textile industry, and manufacturing. The unilateral US sanctions are extraterritorial: Economic actors from third countries, for example from Europe or Asia, risk harsh penalties in the United States if they fail to comply.

In Russia, banks, companies, and individuals had already been subject to sanctions since 2014, in the context of the annexation of Crimea and the war in Donbas. The aim was to influence the Russian leadership’s political actions and its cost-benefit calculation. The sanctions were primarily intended to affect those in positions of political responsibility and to avoid negative repercussions for the Russian population. The Ukrainian side and some EU member states criticized the fact that these sanctions, given their limited scope, had too little impact on the Russian economy, elite, and population; the sanctions resulted in less than a two-percent reduction in Russian GDP, and Russia soon adapted.

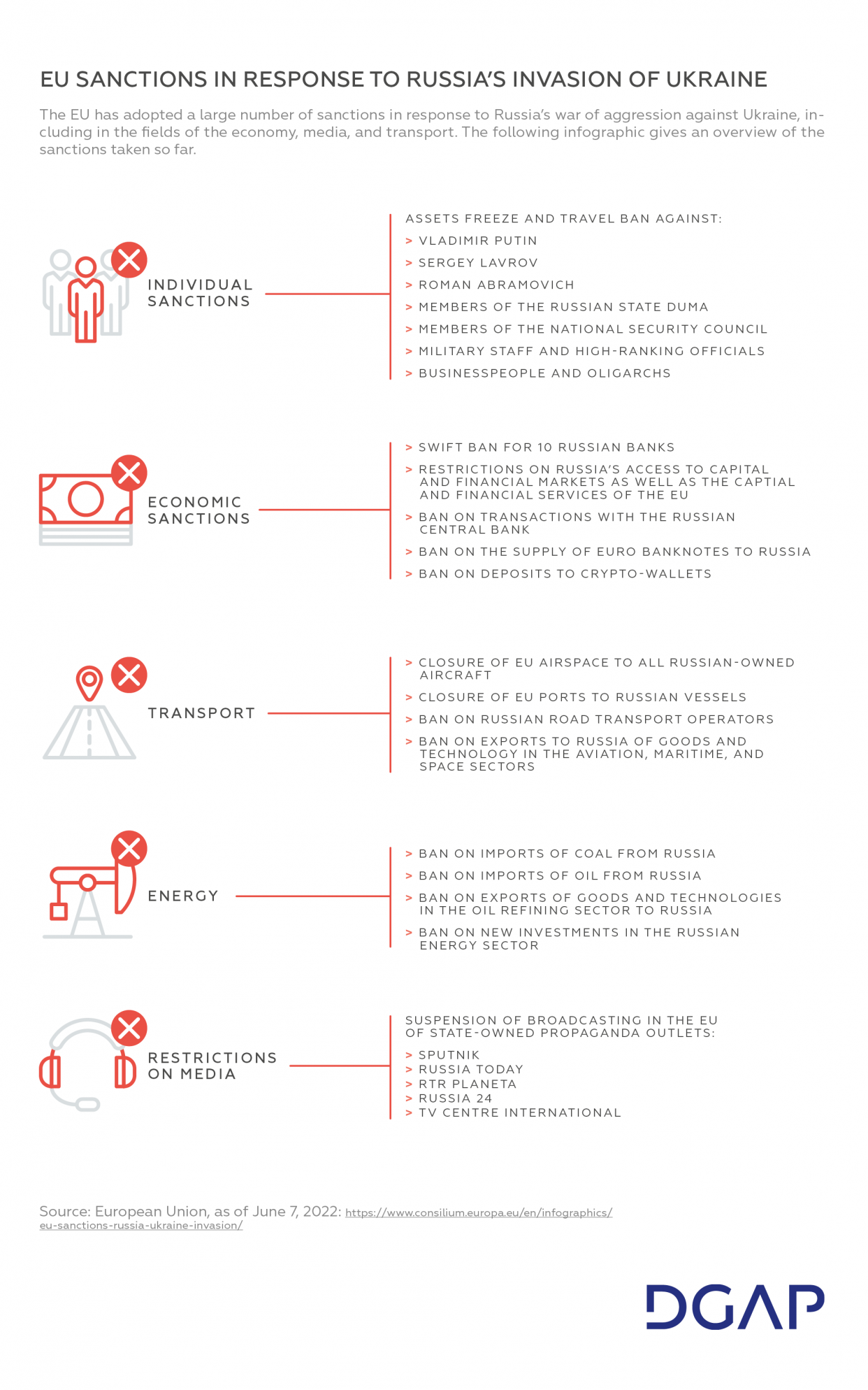

The EU and US sanctions imposed in response to Russia’s current war in Ukraine, however, are on another level entirely and are modelled on the sanctions against Iran. They not only aim to massively reduce the Russian state’s revenues to wage this war, but also to impact economic actors and the Russian population so that they in turn will put pressure on the political leadership.

Individual sanctions have now been imposed on more than a thousand decision-makers in key political and economic positions and in the security apparatus, including President Vladimir Putin and Foreign Minister Sergey Lavrov. Foreign assets have been frozen and sanctioned individuals face restrictions on their freedom to travel. Members of the Duma and the Federation Council are also subject to these kinds of sanctions. Almost 50 percent of the Russian central bank’s foreign exchange reserves have been frozen, and Western banks have been banned from undertaking transactions with it. This makes it difficult to service debt, despite Russia having sufficient foreign exchange reserves. Key Russian banks have been removed from the SWIFT system in the course of several waves of sanctions, making international transactions more difficult for Russian companies. Russian airlines have been banned from European and US airspace; their aircraft are no longer being maintained and they cannot obtain parts. In addition, Russian energy and arms companies have been sanctioned; among other things, they can no longer receive loans from Western banks. Key technologies for aviation, shipping, and raw material extraction and processing are subject to an export ban that goes far beyond the dual-use sanctions imposed in 2014. The EU has agreed to ban imports of Russian oil and petroleum products, but with transitional periods for countries that are particularly affected and exemptions for pipeline deliveries.

When Imposing Sanctions on Decision-Makers, Offers Should Always Be Extended to the Wider Society

In autocratic political systems where elections and parliaments nominally exist, sanctions can further weaken pluralistic stakeholders and institutions. At the same time, they primarily strengthen those with an interest in autarky and isolation, especially security actors. Sanctions directly promote a further securitization of the economy, which enables the security apparatus to expand its grip on power. Not only do sanctions lead to a rise in relevant (economic) policy decisions being taken at the top of the political systems in question; the use of clandestine methods to circumvent sanctions also boosts the importance of the security apparatus.

In Iran, the Revolutionary Guards, in particular, have emerged as winners from the crisis. They play a key role in foreign trade, the concealment of oil exports, and the smuggling of imported goods. Ultimately, they were also able to further strengthen their position in the domestic economy by taking over projects left behind by international companies. In parallel with this, the Guards expanded their political power and, together with political partners from the ranks of the hardliners, weakened the elected institutions of the Islamic Republic.

In the meantime, the Iranian middle class, in particular, suffered as a result of the sanctions, with direct negative repercussions for civil society. The weakening of comparatively moderate forces in the political system enabled the hardliners to take even more ruthless action against civil-society stakeholders and protesters. Economic hardship has also had an adverse impact on civil society. The poverty rate has doubled over the past decade, and many people now simply lack the resources for civil-society engagement – because, for example, they are now forced to take on second jobs or materials have become unaffordable. The sanctions also meant that essential medicines could no longer be imported or became unaffordable for much of the population, and people lost their lives as a result.

From the start of Vladimir Putin’s third term of office as president in 2012 and the imposition of sanctions in 2014, there has been a trend toward the securitization of all areas of the Russian state and society. This includes a systematic crackdown on independent media outlets, the opposition, and civil-society organizations, as well as foreign sources of funding. The 2014 sanctions made private companies more dependent on public financing, while at the same time the military and intelligence services received more public resources. This was justified with the aim of achieving economic policy sovereignty and independence from Western technology and, especially since 2014, reducing the country’s vulnerability to Western sanctions. The limitation of Russia’s foreign debt to below 20 percent of GDP, the build-up of foreign exchange reserves worth 550 billion euros by the outbreak of the war, and a conservative spending policy in the context of the COVID-19 pandemic also served to make Russia less vulnerable to foreign influence. The war has further exacerbated the regime’s tight grip on society and the Russian information sphere.

The degree to which sanctions promote an increase in repression is unclear. Even in the absence of Western sanctions, authoritarian regimes impose restrictions on their societies. Nonetheless, what is lacking in the current approach to Russia, as in the case of Iran, is for the West to extend medium- to long-term offers to Russian society, to provide alternatives to what is offered by the autocratic regime. The intense pressure caused by sanctions, the interruption of cultural and scientific relations, and the restriction of travel options also take opportunities for dialogue away from the section of Russian society that is opposed to the war. Offering alternative development options over the medium to long term is an approach that should be utilized alongside the sanctions. This could have an impact, especially if the economic situation deteriorates.

Sanctions Can Only Bring About a Change of Course in Combination With Other Tools

Comprehensive sanctions regimes are typically imposed in response to events of strategic importance (Iran’s nuclear program, Russia’s invasion of Ukraine). Sanctioned countries weigh up the costs and benefits, but take a much broader view of the benefits than just the economic perspective, focusing on political goals, such as retaining power.

Today, Iran’s political leadership still vehemently denies wanting to develop a nuclear bomb. Yet there is much to suggest that those in power would at least like to achieve a nuclear weapons capability. This, together with a highly developed missile program and allied militias, could enable Iran, given that it is clearly outmatched when it comes to conventional forces, to establish an asymmetric deterrent to potential enemies at the regional level and strengthen its own position of power. Much of the political leadership in Tehran regards this as more important than economic prosperity. In addition, many in Iran’s political class are convinced that the United States is focused on regime change, not the nuclear deal. In any event, the nuclear program has become a matter of national prestige. Iran still refuses to relinquish its nuclear program, despite the massive economic damage inflicted by the sanctions.

In the eyes of the Russian leadership, Russia is fighting in Ukraine for a vital sphere of influence and waging a proxy war against the United States. Although it is not always possible to distinguish between what Russia genuinely perceives as a threat and what is propaganda, the Kremlin has continued to lose influence over Ukraine since 2014, and Russia’s escalation dominance has been diminished by the modernization of the Ukrainian army with Western support. For historical, geopolitical, and power-political reasons, Putin wants to bring Ukraine back under Russian control and even denies the country’s right to exist. Economic interests are being subordinated to these overarching objectives, and it is safe to assume that the economic costs are of secondary importance to the regime. This is another reason why it makes sense to combine the economic sanctions with effective military assistance for Ukraine, as a Russian military failure in Ukraine would also place President Putin under political pressure. Only a combination of military failures and high economic pressure can permanently weaken Putin’s regime. At the same time, the West needs to extend offers to the section of the elite and society that does not wish to live in an isolated, technologically backward, authoritarian state. The lack of alternatives, due to non-targeted sanctions that are hard to lift in practice, as in the case of Iran, ultimately leads to apathy and adaptation. This reduces the internal pressure on the regime for a change of policy.

Sanctions Affect Both Sides – and Must Therefore Be Sustainable in the Long Term

Countries that impose sanctions usually suffer economic losses themselves, not least due to the decline in foreign trade with the sanctioned country. The country subject to sanctions is therefore likely to try to drive up the price of sanctions and make them as unappealing as possible in both economic and geostrategic terms. It can do so by taking measures aimed directly against the sanctioning countries, but it can also use indirect means, for example by taking action against allies. Iran, for example, is trying to create a nexus between the sanctions, nuclear non-proliferation, and regional security. The leadership in Tehran has violated a series of key restrictions from the nuclear deal and, together with allied militias, has repeatedly carried out attacks on oil tankers in the waters of the United Arab Emirates, on oil fields in Saudi Arabia, and on US troops in Iraq.

In the current conflict, Russia has imposed countersanctions, for example by restricting entry to the country for people from the United States and the EU, and has threatened to nationalize the property of Western companies. To protect its own economy, it has banned exports of around 200 products, including wood, agricultural products, and technical equipment. Bulgaria, Denmark, Finland, the Netherlands, and Poland, among other countries, are no longer receiving gas supplies as they have not complied with the demand to pay in rubles. On the whole, energy-related sanctions are having a severe impact on both sides, although Russia is generally more dependent on export earnings than Western countries are on imports – with one important exception: natural gas. It would be difficult to replace this with liquefied natural gas (LNG) on the global market at such short notice and in the required quantities. This would particularly affect Germany, Italy, and Austria. While Germany still obtained 55 percent of its gas from Russia in 2021, it reduced this to 35 percent following the attack on Ukraine. The quantity is to be lowered further, to 10 percent, by the summer of 2024, primarily by purchasing LNG. Comprehensive sanctions on certain raw materials lead to significant price rises on the global markets. A planned embargo on oil imports would have an economic impact on Slovakia, the Czech Republic, and Hungary, in particular, and was hugely watered down in a compromise due to a Hungarian veto.

In summary, it can be said that countries must, in the long term, shape the social and economic costs of the sanctions they impose in such a way that they can live with the impacts and maintain public support for the sanctions. Ultimately, a fundamental strategy is needed in relation to authoritarian states, in order to reduce dependencies as a preventive step, including (but not only) in the field of energy supplies.

That Sanctions Can Also Hurt Uninvolved Third Parties Needs to Be Taken Into Consideration

If sanctioned countries are particularly relevant in certain areas, sanctions can also have an impact on the global economy. This is the case if, for example, supply chains become more complex because it is necessary to avoid sanctioned countries or if transaction costs rise due to the use of alternative payment methods. Prices can also rise because of a reduction in the supply of services (e.g., logistics services) and raw materials (e.g., grain) in connection with sanctions. Sanctioned countries may also deliberately delay or halt deliveries in order to put pressure on the sanctioning countries.

In the case of the sanctions against Iran, these effects are comparatively moderate. The sanctioning of Iran by the EU and the United States in 2012 and the re-imposition of sanctions by the United States in 2018 led to a short-term increase in volatility on the crude oil markets in each case, together with a slight rise in prices. The sanctions against Iran also derailed infrastructure projects, such as the upgrading of the Iranian port of Chabahar, which India wanted to develop into a trade route to Afghanistan and Central Asia that avoided Pakistan.

Russia’s aggression against Ukraine is having a huge impact on what was already a tight supply situation on the global food markets, as Ukraine, which accounts for 11.5 percent of global wheat production, and Russia are both important suppliers of grain and other food commodities. This particularly affects poor countries that cannot pay higher prices, and it can lead to hunger and new migration flows. At the same time, transport and food prices are rising worldwide, including as a result of high energy and fuel prices. While the direct effects of Western sanctions are limited in this area, the impact of the devastation caused by the war and the interruption of supply chains is also being felt. For example, fields in Ukraine cannot be tilled due to the lack of fuel for agriculture and the lack of workers. In response to the sanctions and the West’s support for Ukraine, Russia has restricted grain exports in order to secure its own supply. It has also blocked several ships in the Black Sea that were meant to export grain, with the aim of weakening Ukraine economically and putting pressure on global markets. This blackmail threatens the Global South’s support for the Western sanctions against Russia.

Sanctions Must Be Reviewed in Terms of Their Short-, Medium-, and Long-Term Impact and Adjusted Accordingly

Normally, the impact of sanctions is only fully felt after some time has passed. Winding up business relations takes a certain amount of time, and sanctioned countries can initially offset the loss of trade and foreign exchange earnings. The full force of sanctions typically only hits them after several months. If the situation continues, the sanctioned countries make structural changes to their production and trade relations, and as a result sanctions gradually lose their effectiveness.

For example, sanctions plunged the Iranian economy into a severe recession. In response, the leadership in Tehran sought to upgrade the energy sector’s value chain, to further diversify the economy, and ultimately to reorganize the country’s trade, shifting away from crude oil exports by ship to distant countries and toward the export of processed goods by land to neighboring countries. As a result of these efforts, Iran’s gross domestic product has returned to growth since mid-2020, around two years after the United States pulled out of the nuclear deal. While this growth is much too low to offset the losses caused by the sanctions or to meet the population’s economic expectations, it is nonetheless changing how the country’s leaders view the sanctions. The extent to which the economy is growing despite the sanctions makes the concessions that Iran is being asked to make seem more onerous. Those in power in Tehran accept the losses caused by the sanctions as the cost of adaptation.

A glance at Russia also allows conclusions to be drawn about the impact of sanctions. After the first sanctions were imposed, there was a drastic short-term fall in the value of the Russian ruble, the Russian stock exchange was temporarily closed, and many Russians converted money into Western currencies. Yet after the initial shock, the Russian economy has stabilized again, after the central bank raised interest rates to above 20 percent and introduced strict capital controls. This, together with the vast income from the continuing sale of raw materials (62 billion euros in the first two months of the war alone), has enabled Russia to stabilize its budget and the ruble and to cushion the direct economic consequences. In the medium term, the isolation of the Russian economy and particularly the sanctions on (high) tech, with strong effects on nearly any national machinery and technological production, will set back the Russian economy and make it impossible to manufacture certain products for mechanical engineering, car manufacturing, and defense. In the long term, it can be assumed that the Russian economy will adapt, at a lower level. The nationalization of certain companies and the continued operation of a number of Western firms are signs of this. Even if these developments will lead to massive losses of income and prosperity, there are currently many indications that the Russian leadership will accept this and the society will have to adapt.

Conclusions and Recommendations

Over the past decade, sanctions have become a key tool of US and European foreign and security policy. Although Russia has not (yet) been subject to as tough sanctions as Iran, there are signs of what has already become clear in Iran: Sanctions do not necessarily lead to a fundamental, sustained change of course by the sanctioned country, as it usually weighs up the costs and benefits differently to the countries imposing sanctions, in these cases the Western countries.

This in no way means that sanctions should be rejected as a form of pressure. On the contrary: Sanctions can be a powerful instrument to bring about changes of policy and strengthen the negotiating position of those imposing them. To achieve this, however, they must be imposed in a targeted and sustainable manner, and combined with other measures.

This means the following for the sanctions policy against Russia:Economic sanctions alone will not (in the short term) lead to Russia changing its policy toward Ukraine. Only by combining sanctions with other instruments, such as supplying weapons to Ukraine and strengthening its ability to defend itself in the long term, is it possible to influence the course of the war and the Russian leadership’s room for maneuver in the medium to long term.

Sanctions policy must pursue clear goals and cannot simply be intended as an abstract punishment. To this end, the sanctions must be scalable: In order to actually bring about a change in policy, there must be a credible prospect that sanctions can be lifted.

Only sanctions that can be sustained for a relatively long period should be imposed. In the case of Russia, unlike Iran, the economic costs for a number of sanctioning countries are immense and alternatives can only be found in the medium term. If punitive measures are introduced too quickly, including on the basis of the (erroneous) assumption that the country in question will back down, the massive economic consequences can lead to social tensions and a crisis of legitimacy in the sanctioning countries.

Russia’s society must not be isolated completely. Instead, links should be maintained with pro-democracy forces in the country that are critical of the regime, for example via academic and civil-society dialogue. Completely isolating Russia in economic terms with regard to certain technologies and the financial system would also deprive Western countries of ways to exert influence.

The global collateral damage of the war in Ukraine (e.g., the rise in grain and food prices, energy and transport costs) and the sanctions (e.g., the rise in oil and gas prices) must be taken into account, and action should be taken to cushion the impacts as much as possible, in order to avoid losing the support of uninvolved third countries around the world. The same applies to factors such as migration or instability in other parts of the world, which must also be taken into consideration.

No comments:

Post a Comment