Jon B. Alterman

Source Link

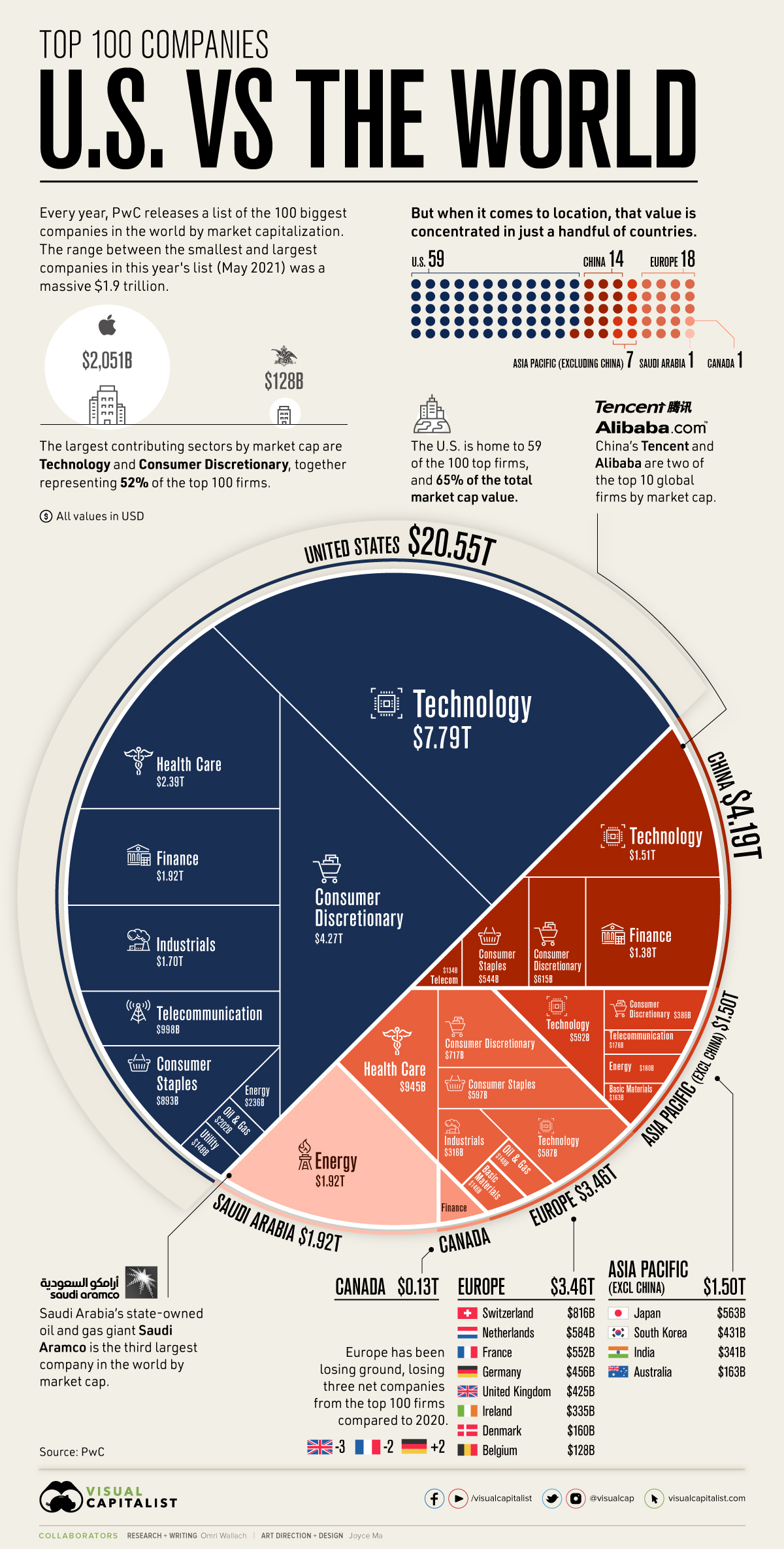

To hear some people describe it, the global energy transition is nigh. Widespread awareness of climate change has galvanized consumers and governments alike to get serious about abandoning hydrocarbons. The financial world has read the new sentiment and pivoted away from oil and gas. Investors are now pouring billions into renewables, and China sees renewable energy as a national security imperative. Soon, oil production will outstrip demand, and as prices fall, producers will produce even more to make up for lower volumes, suppressing prices still further. Oil prices are going to drop off a cliff.

An alternative view is that the energy transition will take decades, and the built infrastructure to consume hydrocarbons ensures a robust market for many years. While electric cars get attention, approximately 90 percent of new car sales are still gas-fueled, and charging infrastructure is still billions of dollars and decades away. Existing homes have gas furnaces and gas stoves, and they last decades. Virtually all of the world’s jet fuel is petroleum based, and the world is becoming ever more reliant on plastics, which are derived from oil. That is to say nothing of the developing world, where most of the world’s population lives, and which often operates on smaller economic margins than wealthier nations. These countries’ consumption is rising sharply as incomes increase, and they are likely to rely on existing equipment and technology for longer. While the wealthy can spend thousands on green products, for much of the world’s population, oil and gas will remain the affordable and available fuels.