Yukon Huangand Jacob Feldgoise

Most observers welcomed the recent virtual meeting between US President Joe Biden and Chinese President Xi Jinping, even as some politically sensitive issues remain unresolved. On the trade war, not much has changed under Biden.

Biden’s Buy America initiatives, his commitment to “invest in middle class competitiveness”, and an updated trade strategy highlighting unfair trade practices that hurt US manufacturing firms reinforce the sentiments inherent in former US president Donald Trump’s phase one agreement.

Even as the US and China differ on many economic policies, both sides share the misleading perception that promoting manufacturing is key to job creation, innovation and security. Their respective leaders have not recognised that the path to more constructive reengagement on trade lies in knowledge-intensive services.

America’s obsession with manufacturing is driven by the politics associated with the decline in manufacturing jobs – a major concern among middle-class voters. But in China, the focus on manufacturing is driven by the leadership’s vision of China becoming a global technological power. Yet over the past year, Beijing has reined in many entrepreneurial firms.

These actions call into question China’s support for innovation. The premise is that an innovative economy depends more on “hard-tech” manufacturing, such as AI-enabled robotics and electric vehicles, than on “soft-tech” services such as e-commerce and video platforms.

Policymakers in both the US and China have neglected the lessons of economic history. In the aftermath of World War II, economic power was largely defined by the manufacturing prowess of the US and a recovering Europe led by Germany. As the West prospered, however, its economies gradually transitioned to knowledge-intensive services. China and many other emerging market economies are following a similar path.

Politically what matters most is not any actual decline in manufacturing production but the evaporation of traditionally well-paid manufacturing jobs. In fact, there has been a steady increase, not a decline, in US manufacturing production over the past century. Employment levels have been relatively stable over most of this period, but in recent decades, automation and technological progress sharply reduced the need for workers.

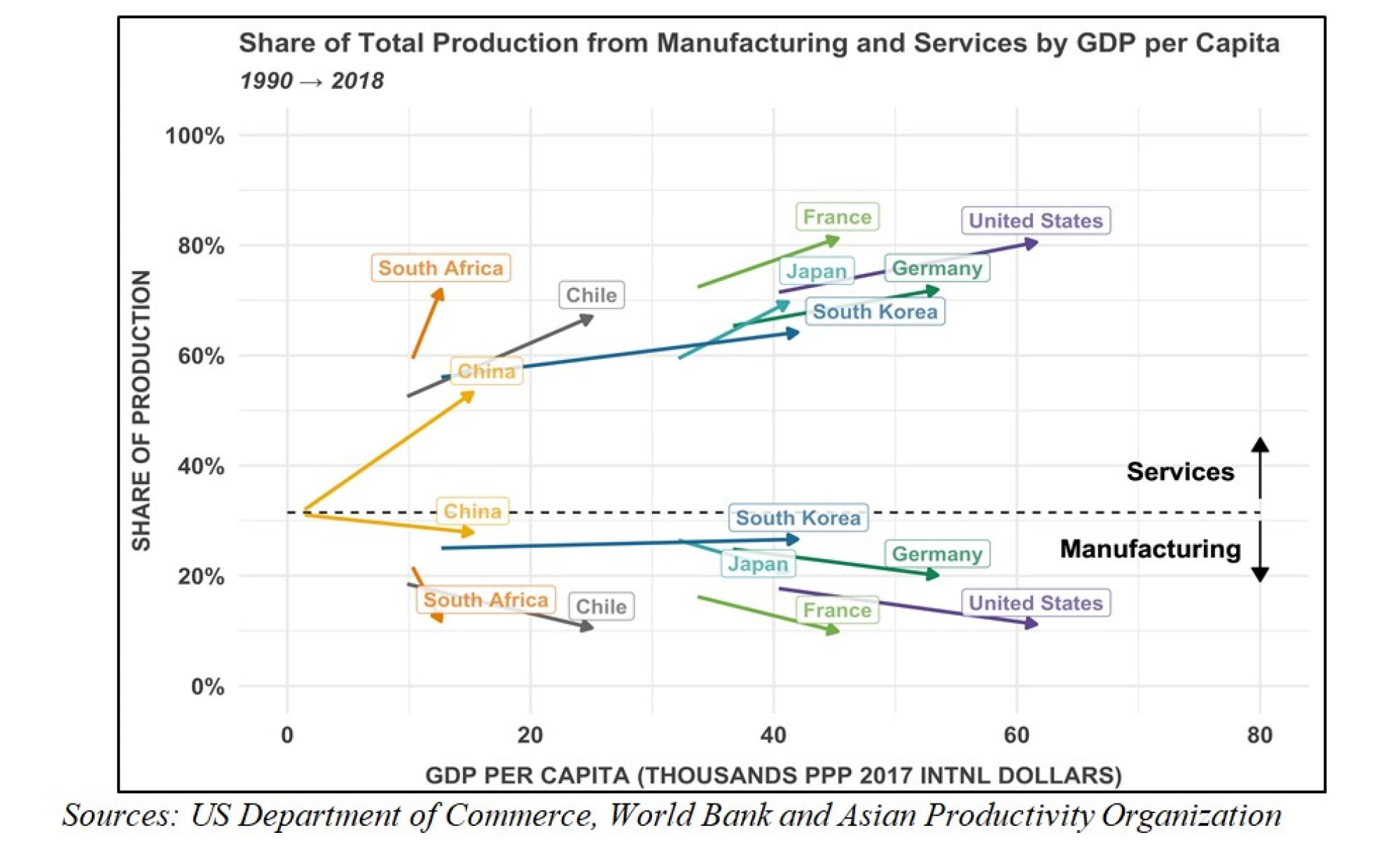

With few exceptions, all economies have experienced a decline in their share of manufacturing and an increase in services relative to total production as per capita gross domestic product increased over the past three decades.

The rapid shift to services supports the creation and sharing of technology, both at home and with other countries. As reported by the US National Science Foundation in 2016, knowledge and technology intensive (KTI) services (ranging from education and health to IT and financial services) accounted for 24 per cent of global GDP, while KTI manufacturing accounted for 7 per cent. The US economy’s success in terms of growth and innovation has been driven by KTI services that accounted for 32 per cent of GDP while KTI manufacturing stood at only 6 per cent.

Pew surveys report that most Americans are aware that manufacturing jobs have evaporated over time, with many blaming trade deficits with China. The number of manufacturing jobs peaked in 1978 and has been falling ever since. As a share of non-farm employment, manufacturing jobs fell from a high of 38 per cent around World War II to 8 per cent by 2019.

But most Americans do not realise that the job decline began decades before China’s rise, or that manufacturing output has nevertheless been increasing steadily even though its share of GDP has been shrinking.

The decrease in manufacturing as a share of GDP stems from deep-rooted structural factors. Technological improvements are driving down the prices of manufactured goods more rapidly than services. Also, as economies develop, companies shift from manufacturing to more profitable services.

Apple’s market prominence comes from its skill in design and marketing services, leaving the actual manufacturing of products to the Taiwanese company Foxconn. Moreover, as incomes rise, households spend more on services relative to manufactured products.

The path of deindustrialisation is now the norm for high-income economies. Yet America’s political establishment continues to focus on small wins in hi-tech manufacturing instead of recognising the critical role of knowledge-intensive services in driving economic growth.

Line workers work on the chassis of full-size General Motors pickup trucks at an assembly plant in Flint, Michigan, on June 12, 2019. There has been a steady increase, not a decline, in US manufacturing production over the past century. Photo: AFP

Decades ago, China was much more restrictive than other major economies, according to the Organisation for Economic Cooperation and Development’s foreign investment restrictiveness index. Today, China has opened up foreign investment in manufacturing to levels comparable to other advanced economies. But for KTI services, China is still much more restrictive.

China fears that its service providers would not be competitive in global, open markets and that national security could be jeopardised. But Chinese companies have matured and would benefit from robust foreign competition while security can be managed.

Fighting protectionism in services is more challenging than in manufacturing where governments typically rely on subsidies and tariffs. Liberalising services requires reworking complex regulations and establishing globally compatible standards. This is difficult to negotiate across borders especially if there are concerns about data ownership and security.

Both the US and China need to be involved in forging global guidelines if a broadly acceptable framework is to be developed. For China, greater competition with the US would accelerate knowledge transfer and help Chinese firms upgrade skills.

For American hi-tech companies, the Chinese market generates the large profits needed to invest in R&D to maintain an innovative edge. Economic competition puts pressure on both sides to become more productive.

The phase one agreement with China may be good politics, but the logic is questionable. If the US and China want to address the issues that will affect future prosperity, strengthening collaboration in high-value services offers an alternative path.

No comments:

Post a Comment