David Uren

China’s system of bankrolling its state companies may be entrenching great inefficiency in its economy but has delivered it unchallenged dominance in the critical minerals required for advanced technologies.

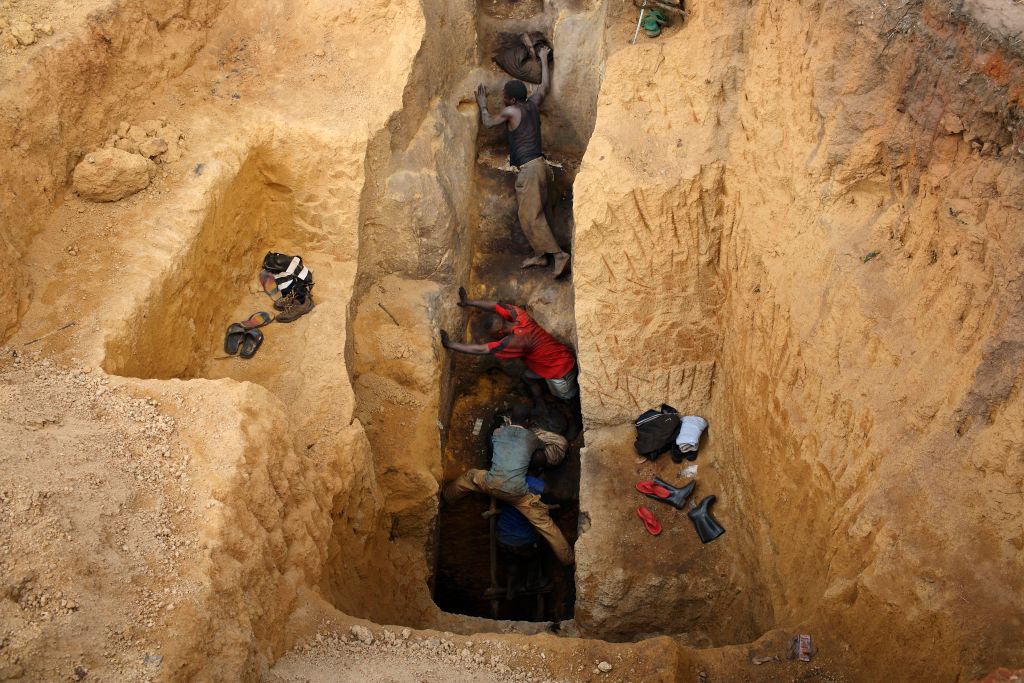

Separate investigations by the New York Times and Bloomberg released in recent weeks have shown how Chinese mining companies, backed by state-owned banks, seized control of the Democratic Republic of the Congo’s most prized cobalt deposits. In 2016, China Molybdenum bought out the holdings of US mining group Freeport-McMoran using very similar means to those used by the Nixon administration to gain control of the DRC’s mineral resources in the 1960s.

Despite an avowed concern to end the US dependence on China for supplies of critical minerals, both the Obama and Trump administrations stood aside, allowing Freeport to hand control of the world’s largest cobalt mine to China Molybdenum with the sale of its nickel and cobalt operations in the DRC. The Chinese were assisted in their purchase by President Joe Biden’s son Hunter.

Cobalt is a very hard metal with a high melting point and magnetic properties. Its uses include jet turbines, rocket engines and permanent magnets, but its biggest application is in the cathodes for lithium batteries.

The New York Times article captures the story of China’s rise and the US’s fall as the dominant external power in Africa. It is a rise that underlines the futility of hopes that Australia’s abundant reserves of critical minerals might somehow relieve US dependence on Chinese supplies.

The Nixon administration understood the importance of putting its foot on the DRC’s rich mineral resources lest they come under the control of the Soviet Union. Richard Nixon hosted the president of the nation (then known as Zaire), Mobutu Sese Seko, at a White House dinner and a private deal handing the concession over rich nickel and cobalt reserves to a New York diamond merchant was concluded during a late night boat ride on the Potomac.

Nixon agreed to give Mobutu three C-130 Hercules transports, one of which was loaded with US$60,000 of Coca Cola at Mobutu’s insistence. Another was used by president as his personal aircraft, with the pilot’s seats upholstered in leopard skin.

The deal ran sour, partly due to anti-government rebels shutting down the mine’s rail link to the coast, and the mine was abandoned for around 20 years. But it was revived in the late 1990s under the control of Freeport, which may be familiar to Australian readers as the joint owner with Rio Tinto of the giant Grassberg gold and copper mine in West Papua.

Amid continuing civil war in the DRC, it took until 2007 before the project got going. Mindful of contemporary ‘social licence’ concerns, Freeport invested heavily in local infrastructure, building schools and covered marketplaces, digging wells, establishing an anti-malaria project and creating botanical gardens to preserve plants threatened by its mine.

But in 2012, Freeport made a US$20 billion investment in the oil industry, which left it in financial trouble when the oil price collapsed in 2015. Its DRC assets were on the market, and China Molybdenum happily paid US$2.65 billion for them in 2016.

A Freeport legal executive alerted an Obama administration national security adviser, General James Jones, about the imminent sale but was told, ‘There’s no one that’s going to be interested in that.’ The deal was facilitated by a US private equity firm in which Hunter Biden was a director.

When Freeport last year pinned a ‘for sale’ sign on its last remaining asset in the DRC, believed to be the world’s richest undeveloped cobalt deposit, China Molybdenum was again ready with US$550 million. The New York Times reports there was again no discussion of the sale within the Trump administration.

Former Chinese president Hu Jintao paved the way for Chinese mineral interests in the DRC in 2005 by hosting a reception for its new 33-year-old president, Joseph Kabila, at the Great Hall of the People in Beijing. This was followed by a US$6 billion agreement under which China would fund hospitals, railways, roads, schools and electricity networks.

The leak of a trove of more than 3 million documents from a Gabon-based bank, BGFI, which was run by Kabila’s brother, shows how Chinese interests ensured that US$55 million was channelled to the personal interests of Kabila and his family as part of a massive bribery scheme.

Chinese interests now own 15 of the 17 cobalt operations in the DRC. The five biggest Chinese mining companies with cobalt and copper interests in the country can draw on lines of credit with Chinese state banks totalling an extraordinary US$124 billion.

As New York Times reporter Mike Forsythe commented on Twitter, ‘Chinese mining companies in the DRC operated in an entirely different financial reality … When it comes to the new energy revolution, China is in the pole position and this state-backed financing plays a role.’

Contrast this with Australia, where Austrade is marketing the country as a ‘reliable and responsible cobalt source’. Cobalt is often found in association with nickel, of which Australia is a major producer. Australia is the third biggest cobalt producer, but its 4% of global production is dwarfed by the DRC’s 71%.

Austrade’s pitch highlights the top six cobalt prospects in Australia, with the leading contenders requiring around $1 billion to develop their prospects. Most are valued at less than $100 million, reflecting their speculative status.

The government has made clear that Chinese investment in Australia’s critical minerals isn’t welcome, but the chance of significant funding coming from elsewhere is slight, no matter how responsible our mining operations may be, given the market dominance that China has now achieved.

China is meanwhile continuing to build its profile in Africa. Direct Chinese investment in Africa has surpassed that of the US every year since 2014, while Beijing backs its economic interests with its own brand of soft diplomacy.

Chinese President Xi Jinping was beamed by video link into the triennial Forum on China–Africa Cooperation held in Senegal last week. As well as offering 1 billion doses of Covid-19 vaccine, he declared an ‘everlasting spirit of China–Africa friendship and cooperation … which features sincere friendship and equality, win–win for mutual benefit and common development, fairness and justice, and progress with the times and openness and inclusiveness’.

No comments:

Post a Comment