Elizabeth Wishnick

Everyone knows it’s a bad idea to spill water on a cell phone, but did you know that it takes more than 3,000 gallons of water to produce one? Water is needed for mining the metal, making the glue and plastic for assembly and packaging, and then diluting the wastewater used throughout the process. This amount is 10 times the average per capita daily water consumption in China.

Semiconductors, the tiny circuits known as chips that power all of our electronic devices — including your phone — are particularly thirsty. Each 30 cm integrated circuit board that holds the chips in your phone requires at least 2,000 gallons of H2O to produce. This is because each chip needs to be rinsed with ultrapure water (UPW) — water so pure that is considered an industrial solvent — to remove debris (ions, particles, silica, etc.) from the manufacturing process and prevent the chips from becoming contaminated. It takes 1,400-1,600 gallons of tap water to make 1,000 gallons of UPW.

Semiconductors are now a key focal point of China-U.S. geopolitical competition. If data is the new oil and artificial intelligence (AI) is the new electricity, then it make sense to view semiconductors as a global resource generating risks in the same way as any other resources. We also need to keep in mind the water resources that are required to manufacture them.

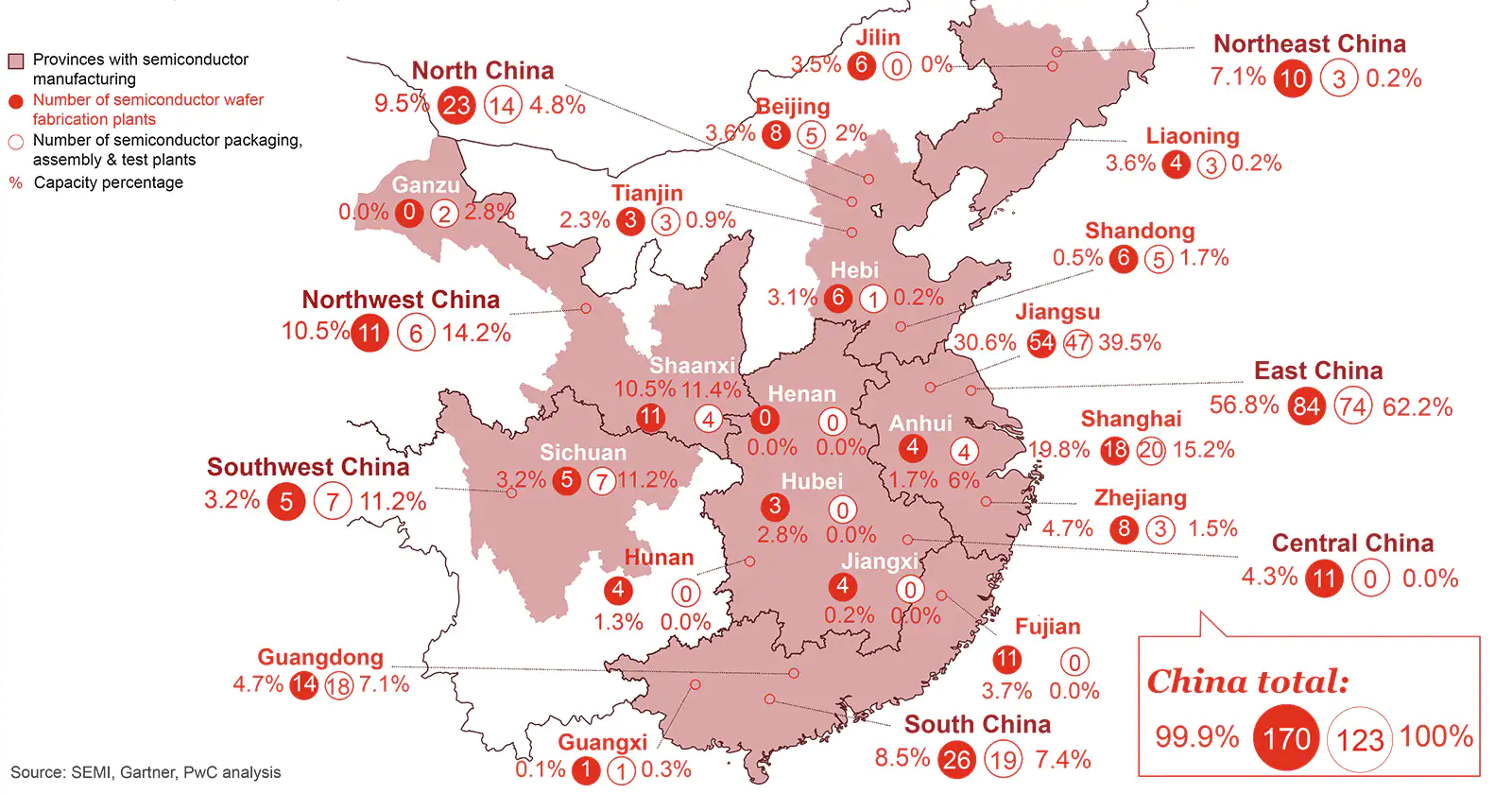

While China only accounts for 7.6 percent of semiconductor sales, its planned massive investment in the sector ($150 billion from 2014 to 2030) has raised concern about a “Sputnik moment“ over China’s determination to achieve technological greatness. Despite this surge in funding, water availability represents an important constraint, as semiconductor production requires considerable water resources which China lacks, especially in areas where chip manufacturing is concentrated.

China’s Risk

The water requirements of semiconductor production thus far have not been raised as a key concern in China, which has been focused on developing domestic technologies to reduce reliance on global supply chains. Even before China-U.S. trade tensions heightened during the Trump administration, China’s 2025 initiative, announced in 2015, outlined steps to develop a domestic semiconductor capability sufficient to meet 70 percent of domestic production needs. While a relative latecomer to the sector, a July 2021 study by the Semiconductor Industry Association notes that China is catching up fast thanks to government funding, subsidies, and tax benefits for the sector. The newly released 14th Five Year Plan (2021-2025) identified semiconductors as one of the top priority “frontier technologies,” which the Chinese State Council outlined a whole-of-government approach to develop.

Nevertheless, even with $150 billion committed under the 2014 National Integrated Circuit Plan, China faces significant technological hurdles to produce the high-end chips needed for mobile phones, laptops, and other high-tech goods. Experts foresee mixed success for China — its companies will lag in certain areas such as cutting-edge foundry process technology and materials while achieving competitiveness in outsourced assembly and testing (OSAT) and chip design.

Global Risks

Until Taiwan’s 2021 drought highlighted the centrality of water availability for global semiconductor supply chains, the global risks in China’s semiconductor policy focused on national security consequences, Chinese efforts to set global technical standards, China’s role in global supply chains, and the impact of cross-strait tensions on the sector.

National Security: The United States sees national security risks in China’s emergence as a key player in the semiconductor sector. These risks stem from the potential for Chinese tech companies to share information with Chinese government authorities or to contribute to the growth of Chinese military power, as semiconductor technology has many dual-use applications. This is the rationale for the measures the Trump administration took to prevent China’s telecom giant, Huawei, suspected of hosting Chinese government spyware, from purchasing U.S. chips. The U.S. Commerce Department then limited China’s Semiconductor Manufacturing International Corporation (SMIC) — which the U.S. accused of supporting the Chinese military — from purchasing U.S. software and components. While expanding these restraints on Chinese semiconductor firms, the Biden administration has focused on boosting U.S. domestic capabilities. On June 8, 2021, the U.S. Senate passed the U.S. Innovation and Competition Act, allocating $50 billion in emergency funding for domestic semiconductor development, which Biden termed crucial for the U.S. to maintain its leading edge in the “competition for the 21st century.”

Standards: The U.S. has been pressuring allies and partners not to use Huawei technology. In part this speaks to concerns that national security might be compromised, but also at stake is Huawei’s growing effort to set global technical standards for 5G technologies. This reflects a high-level 15-year Chinese government effort, China Standards 2035, to enable Chinese firms to have a seat at the table when standards for the next generation of technologies, including digital identity tools, are set. U.S. and European firms have led this process thus far for the market share it provides, as well to respond to commercial needs. In its December 2020 annual report, the U.S. Security and Economic Review Commission details how China’s bid to shape global technical standards reflects a Chinese government-sponsored industrial policy to privilege Chinese firms in external markets while restricting access domestically and supporting authoritarian norms. A March 2021 Council on Foreign Relations report found that China has been leveraging development aid through the Belt and Road Initiative (BRI) to press partner countries to use Huawei and other Chinese technologies and follow China’s technical standards.

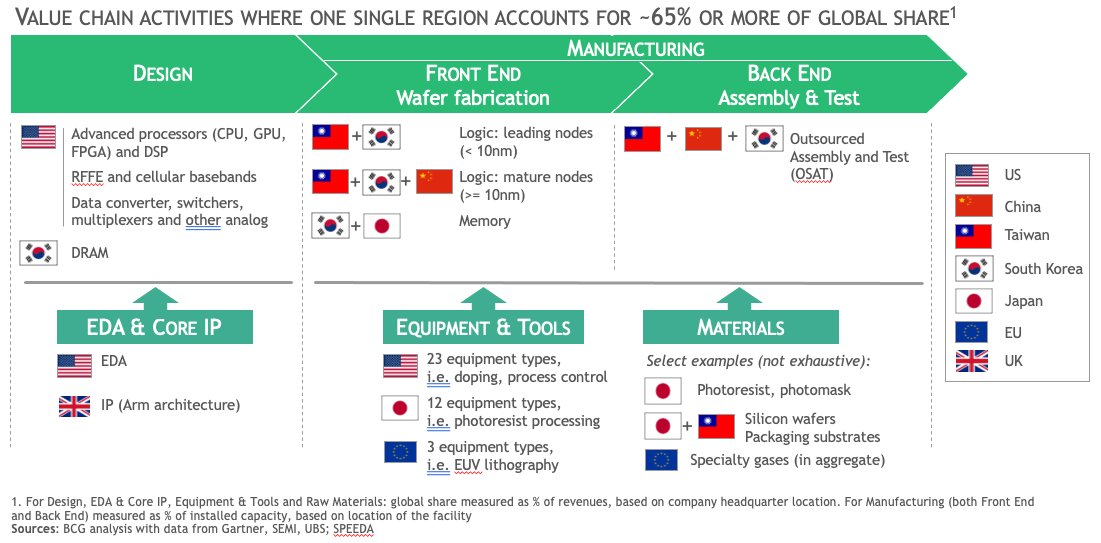

Supply Chains: There are economic risks involved in disrupting the globalized supply chains in the semiconductor industry. As the chart below indicates, firms from multiple countries and several world regions participate in the design and production process.

Source: eetimes.com

For this reason, the Trump administration’s moves against Chinese firms contributed to a shortage of semiconductors and the products that require them such as automobiles, as international firms scrambled to replace SMIC as a supplier. An April 2021 study by the Semiconductor Industry Association concluded that it would cost $1 trillion to create fully self-sufficient local supply chains, which could increase the cost of semiconductors by as much as 65 percent. Some industry experts suggest a more cautious approach to address the most significant vulnerabilities in the supply chain, such as the decline in the share of U.S. manufacturing from 37 percent in 1990 to 12 percent today, while others propose a more comprehensive effort to fill U.S. gaps throughout the production process, including innovation, equipment and packaging.

Taiwan: Taiwan faces multiple pressures due to its central role in the manufacturing of the world’s most advanced semiconductors. In 2020, Taiwan Semiconductor Manufacturing Company (TSMC) accounted for 55.6 percent of the global semiconductor foundry market and produced 92 percent of the world’s cutting-edge chips. In response to new U.S. rules on Huawei, TSMC suspended new orders to the company, its second largest customer after Apple, accounting for as much as 20 percent of its annual revenue. TSMC also agreed to build a plant in Arizona.

The China-U.S. trade tensions come at a time when China, which considers Taiwan a renegade province, has increased military pressure against the self-governing democracy. This has raised questions about access to semiconductor supplies as yet another motive for the Chinese government to resort to force to compel Taiwan’s reunification with the mainland. TSMC Chairman Mark Liu argues that, to the contrary, Taiwan’s semiconductor prowess is just too valuable and may be actually serve as a deterrent.

Analysts also point out that military coercion would not enable China to achieve its goal to build its own semiconductor capability and would alienate the foreign experts and companies needed to do so. TSMC’s announcement that it would invest $2.8 billion in a Nanjing semiconductor plant (for producing chips that are two generations behind the most advanced) actually led to criticism in the PRC that the investment would derail the development of China’s semiconductor industry.

We have seen pressure by China to recruit Taiwan’s IT personnel and increased cyberattacks against the sector. Taiwan cybersecurity experts claim a Chinese state-sponsored hacker group has been infiltrating several semiconductor firms for years in hope of stealing intellectual property. The Taiwan government has been increasingly concerned about Beijing’s efforts to poach IT talent and recently banned local headhunters from posting IT jobs in China. Taiwan also intends to restrict the travel of IT professionals to China.

On top of all these concerns, in the spring of 2021 a severe drought in usually rainy subtropical Taiwan — its worst in 56 years — threatened the production of the world’s semiconductors. The drought delayed production and contributed to the chip shortage. Semiconductor producers were forced to ration water and have it shipped in by truck. Due to concerns about climate change reducing rainfall in the future, TSMC is building a new plant that would be capable of reusing industrial water, while other producers are digging their own wells.

Above all, the 2021 drought in Taiwan called attention to the importance of water for the production of semiconductors.

Water Risk

Securing a sufficient quantity of semiconductors and developing a domestic production capability are not China’s only challenges. Ensuring that there is sufficient water to produce the semiconductors may be even more daunting. ChinaWaterRisk calculates that a factory producing 40,000 circuit boards, which hold the semiconductors, would need 4.8 million gallons of water a day, enough to supply a city of 60,000.

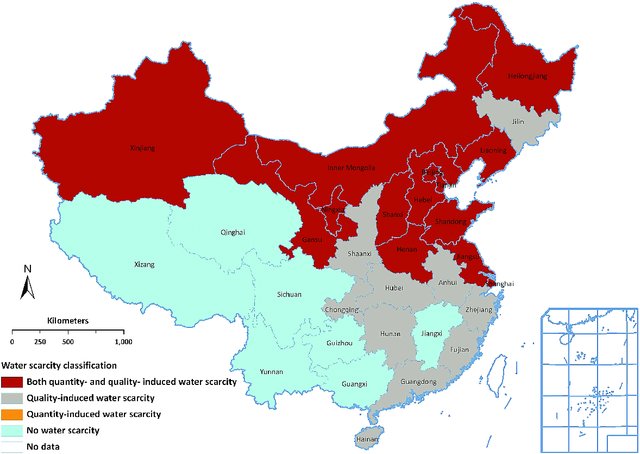

At a time of unprecedented flooding in central China, it is worth remembering that as a whole China is relatively water insecure — although the country is home to 20 percent of the world’s population, China only has 7 percent of global water resources. Water is also unevenly distributed. The north of China, where much of the semiconductor industry in located, has only one-fifth of the country’s water resources.

Source: Earth’s Future

If you compare these two maps, you see there is a mismatch between areas below with the most semiconductor production (China’s north and northwest) and water availability, which the map above shows in the southwest of the country.

Even in conditions of water scarcity, water usage in China’s semiconductor industry is problematic. A 2017 study of water usage in the semiconductor industry found that China used more water than other key producers (Japan, South Korea, Taiwan, and the U.S.) both in the rinsing process and the use of water in generating the electricity needed for production. In comparison with the U.S., China used triple the amount of water. In fact, China’s semiconductor industry absorbed 27 percent of total industry water use.

Alarmism about China’s semiconductor aspirations needs to factor in the water resources required to fulfill them, which the country lacks. As we saw with Taiwan’s 2021 drought, water shortages can derail production even when top talent and cutting edge technologies are available.

No comments:

Post a Comment