Emily de La Bruyère, Nathan Picarsic

Source LinkIntroduction

The People’s Republic of China, led by the Chinese Communist Party (CCP), has emerged as America’s primary strategic competitor. Both parties in Washington now recognize this reality. Leveraging growing economic, technological, and military means, the CCP is expanding China’s power and influence internationally – including by revising international norms and institutions.

Beijing’s strategy of military-civil fusion (MCF) (军民融合) plays a core role in this global campaign. MCF entails the fusion of military, civilian, and commercial investments, actors, and positioning to increase China’s comprehensive national power.1 The strategy is tailored for the globalized commercial ecosystem: MCF leverages the international integration of Chinese military companies – both private and state-owned – in order to acquire resources and leverage.

Since 2020, the U.S. Department of Defense (DoD) has identified 44 Chinese companies that operate in the United States and have ties to the People’s Liberation Army (PLA). (See Appendix B for a full list.) They include traditional Chinese defense contractors as well as companies that specialize in information technology (IT), engage in commercial business, and operate in legacy industrial domains. Most are state-owned enterprises. All are state-supported. Every one of the 44 companies deploys internationally in accordance with Beijing’s global “Go Out”2 offensive to acquire strategically important technology. They also develop infrastructure and supply chains through which China projects coercive power.

The 44 companies identified by DoD include entities purchasing aerospace firms in Michigan and Alabama, developing real estate in California, selling subway cars to the Massachusetts Bay Transit Authority, and establishing research and development (R&D) centers in Silicon Valley.

The DoD list fulfills two-decades-old congressional tasking. Section 1237 of the National Defense Authorization Act (NDAA) for Fiscal Year (FY) 1999, as amended, directed DoD to document “Communist Chinese military companies” that are “operating directly or indirectly in the United States or any of its territories and possessions.”3 The FY1999 statute required DoD to make its determinations by March 1, 2001.4 But, for two decades, there was no public progress. The FY1999 NDAA congressional mandate resurfaced in 2020 alongside increased attention in Washington on MCF and on China’s competitive threat more broadly.

At present, the DoD list of Chinese military-tied companies is just that: a list. It provides neither information about the identified companies nor the rationale for their inclusion. DoD has not disclosed its methodology. Nor does the list indicate the material consequences for identified entities or whether an entity’s subsidiaries or joint ventures are also implicated.

This report documents connections between the companies on DoD’s list and the Chinese military and military-industrial establishment. The report focuses on three key, overlapping groups: state-owned backbone military-industrial enterprises, companies building global infrastructure and standards, and elements of China’s military-academic complex. These entities reflect core components of China’s MCF program.

However, as this report demonstrates, the companies that DoD has listed thus far represent just the tip of the iceberg. This report points to additional Chinese military-linked companies that operate in the United States but have escaped scrutiny as examples of gaps in the DoD documentation effort. To an extent, such gaps reflect the need to continue expanding the DoD list – as well as to do so according to a broader scope and set of definitions. But gaps are also endemic to the exercise. There will always be more companies that meet qualifying criteria. Simply adding new companies to the existing DoD list will not solve the problem.

Rather than trying to identify every Chinese military-tied company, DoD should adopt a clear prioritization framework to target the companies that matter most. This report outlines a proposed framework that accounts for companies’ roles within the MCF system (for example, do they collect or apply technology?), their capital intensity, the degree of U.S. exposure or vulnerability to them (for example, do they control an industry chain on which the United States depends?), and the technologies or capabilities they develop (for example, do they operate in a domain critical for future U.S. power projection?).

Finally, the report also argues that DoD’s documentation effort should be paired with an operationalization effort: Washington needs mechanisms to encourage government and private-sector action that both defends against and competes with Chinese military companies. Executive Order 13959 offers an example of a mechanism that limits the ability of military-tied Chinese companies to operate in the global financial and commercial system. The United States also needs tools for proactive, offensive competition.

Since the adoption of the 2017 National Security Strategy, the U.S. government has sought to address the asymmetric and non-traditional threats posed by Beijing in an era of renewed great power competition. Documentation of Chinese military companies is a part of that effort. Now, refining the documentation and monitoring process, as well as operationalizing its results, offers an immediate, tractable opportunity to counter the CCP’s global offensive.

The FY1999 NDAA, as amended, directed DoD to document “Communist Chinese military companies” that are “operating directly or indirectly in the United States or any of its territories and possessions.” The original statute required DoD to make its determinations by March 1, 2001.5 But, for two decades, there was no public notice. DoD published its first tranche of identified companies in June 2020 and another four tranches thereafter. To date, DoD has identified 44 companies. (See Appendix B.)

The DoD lists were published without methodological explanation. There was no acknowledgement of the 20-year delay – or the sudden end of that delay. However, DoD likely issued the lists in response to bipartisan congressional pressure: In September 2019, Senator Tom Cotton (R-AR), then-Senate Minority Leader Chuck Schumer (D-NY), and Representatives Mike Gallagher (R-WI) and Ruben Gallego (D-AZ) cited Section 1237 of the FY1999 NDAA in a letter to then-Secretary of Defense Mark Esper. Urging DoD to combat China’s MCF strategy, the bipartisan group of lawmakers pressed Esper to update and publicly release the list required by the FY1999 NDAA. “The Administration should reexamine all the statutory authorities at its disposal to confront the CCP’s strategy of Military-Civilian Fusion,” the group wrote, “including powers that have lain dormant for years.”6

MCF is a national-level Chinese strategy with a corresponding institutional apparatus, designed to fuse military and civilian actors, resources, and positioning for the sake of overarching national power. The term “military-civil fusion” emerged in the late 1990s under Hu Jintao, then-vice chairman of the CCP’s Central Military Commission. But it was by no means a new concept: Hu drew on longstanding CCP theory that dates back to Mao Zedong and the founding of the People’s Republic of China, then labeled “military-civil combination” (军民结合).7 At the end of 2007, the 17th Chinese People’s Congress formally called for developing a strategy of “military-civil fusion with Chinese characteristics” in order to “adapt to the technological revolution and military change with Chinese characteristics.”8 In 2015, current CCP General Secretary Xi Jinping elevated MCF to national-level strategy.

MCF entails the two-way transfer of technology, resources, and information between military and civilian entities. The MCF strategy also uses international commercial and civilian, as well as military, positioning for coercive ends. At the broadest level, MCF is intended to strengthen all elements of China’s national power by fusing economic, military, and social governance.

MCF provides China with a diverse array of levers for influence and coercion. Dominance in certain supply chains might be used to compel a state or company to cave to Beijing’s geopolitical agenda.9 Investments in international media, social media, and cross-border data flows might allow Beijing to disseminate propaganda and control international narratives.10 Infrastructure construction abroad might allow China to influence production and transportation of, and therefore markets for, critical raw materials.11 And construction of virtual networks and systems – such as space satellite, telecommunications, and logistics systems – might allow Beijing to collect, influence, and direct global data.12 In other words, Beijing does not simply share inputs to power between civilian and military entities. Beijing also fuses outputs. Beijing uses both military and civilian players and positioning to project a new kind of national power and shape the global order in the CCP’s favor.

The 44 companies DoD identified reflect different modes and mechanisms of China’s MCF strategy. The listed companies include the key state-owned enterprises supporting China’s military industry; companies acquiring military-relevant technology from abroad; entities facilitating the transfer of technology between military and civilian; and companies developing virtual and physical infrastructure that can be used to project power internationally. These companies illustrate the MCF threats and actors against which the United States and its allies and partners must defend. However, these 44 companies are merely a starting point. Countless other Chinese entities support China’s military and MCF system internationally. These entities operate through sweeping, often opaque, systems of subsidiaries and partnerships not currently covered by the DoD list or U.S. law.

Identified Companies

This section provides examples of ties between companies on the DoD list and the Chinese military, military-industrial, and MCF establishments. This section explores three avenues of connection: state-owned backbone military-industrial enterprises, companies building global infrastructure and standards, and elements of China’s military-academic complex. These avenues reflect core elements of China’s MCF program. They are neither mutually exclusive nor rigidly defined.

BACKBONE MILITARY-INDUSTRIAL GROUPS

The DoD list includes China’s 10 state-owned military-industrial groups. These conglomerates oversee a sprawling network of connected subsidiaries and industrial partnerships.13 Owned by the State-owned Assets Supervision and Administration Commission of the State Council, these companies constitute the backbone of China’s national defense industry.14 They are the obvious place to start in identifying companies working with the PLA. As major industrial conglomerates, all of these companies operate, to one degree or another, in the United States. They span the nuclear, aviation, aerospace, shipbuilding, weapons, and electronic information industries.

These 10 entities, as one MCF industry association puts it, represent “the backbone of national security, undertake national defense research and production tasks, and provide various weapons and equipment for the development of the national armed forces.”15 China North Industries Group’s products range from amphibious assault weapons to air and missile defense technology; China South Industries’ products range from light weapons to armored vehicles. China Aerospace Science and Technology Corporation (CASC) and China Aerospace Science and Industry Corporation cover space technology, strategic nuclear missiles, and conventional missile systems. Aviation Industry Corporation of China (AVIC) and Aero Engine Corporation of China develop military aircraft, while China Shipbuilding Industry Corporation and China State Shipbuilding Corporation produce military vessels. China National Nuclear Corporation researches and develops nuclear weapons.16 China Electronics Technology Group Corporation (CETC) and China Electronics Corporation (CEC) research and develop reconnaissance and early warning, electronic jamming, intelligence analysis, and other military information technologies.17

These companies maintain and operate a host of subsidiaries. The DoD list explicitly designates three of those subsidiaries. The first, China Academy of Launch Vehicle Technology (CALT), is a subsidiary of CASC.18 CALT makes China’s Long March space-launch rockets and is responsible for the launch missions of major national space activities, including Beidou’s satellite network, manned space program, and lunar exploration projects. CALT’s website notes that all of its work maintains the spirit of “the in-depth development strategy of military-civil fusion.”19

The second subsidiary, China SpaceSat, is publicly listed on the Shanghai Stock Exchange and is also majority-owned by CASC.20 China SpaceSat specializes in the development and application of small satellites. As the company puts it, “China SpaceSat has now developed into a space-earth integrated design, development, integration, and operation company, focusing on the two main businesses of aerospace manufacturing and satellite applications.”21 U.S.-based investment funds, including the BlackRock ISF-iShares Emerging Markets Index Fund and Vanguard Investment Series PlC – Emerging Markets Stock Index, invest in China SpaceSat.22

The third subsidiary of the backbone military-industrial companies identified on the DoD list is Hikvision. CETC is the controlling shareholder of Hikvision, a video surveillance equipment supplier.23 2020 media coverage found that Hikvision had received almost $300 million in U.S. government contracts.24 Reporting in 2019 documented the pervasive presence of Hikvision security cameras in U.S. government buildings.25

China’s 10 military-industrial groups serve as coordinators of China’s MCF program domestically and internationally. They help facilitate the exchange of technology, capital, and infrastructure between China’s military and civilian sectors. For example, nine of the 10 groups are investors in China’s National Military-Civil Fusion Industry Investment Fund.26

AVIC provides an example of the institutional support that China’s military-industrial groups provide for MCF. One of China’s two state-owned aviation military-industrial groups, AVIC develops and manufactures fighter planes, bombers, transport aircraft, reconnaissance planes, helicopters, and unmanned aerial vehicles (UAVs) as well as missiles and other airborne systems. Within China, AVIC also plays a central coordinating role in the MCF apparatus. Through industrial parks, dedicated investment funds, and direct individual investments, AVIC provides capital and infrastructure to other MCF businesses, often in partnership with other leading Chinese military, technology, and financial players.

Internationally, AVIC invests in foreign sources of technology and develops global infrastructure. As AVIC Chairman Lin Zuoming explained at the CCP’s 18th National Congress in 2012, “AVIC has been accelerating its pace of Going Global in recent years and has acquired a number of foreign companies.”27 Overseas deals that AVIC and its subsidiaries have executed over the past decade bear out that statement. In 2011, AVIC International acquired Alabama-based Continental Motors (now Continental Aerospace Technologies), an aircraft engine manufacturer, through AVIC’s subsidiary Technify Motor.28 Also in 2011, AVIC’s automotive subsidiary AVIC Auto acquired a controlling share in Michigan-based Nexteer Automotive, a steering and drivetrain maker. At the time of acquisition, Nexteer ranked third in the world in sales of driveshaft components and fourth for steering systems.29

That same year, AVIC subsidiary Chinese Aviation Industry General Aircraft bought Minnesota’s Cirrus Aircraft.30 This was the first time a Chinese company had purchased a U.S. aircraft maker. In 2013, AVIC’s Continental Motors bought Southern Avionics, a small Texas-based company specializing in avionics services.31 In 2015, the same AVIC subsidiary acquired Florida-based United Turbine and UT Aeroparts,32 both focused on the aircraft turbine market. Also in 2015, AVIC International Holding acquired California-based aerospace parts maker Align Aerospace, and AVIC Auto joined with U.S.-Chinese investment firm BHR in purchasing Henniges, Michigan’s leader in anti-vibration technology.33 AVIC also operates real estate projects in the United States, including a string of hotels in California, Georgia, and Michigan.34 Some of AVIC’s subsidaries even received Paycheck Protection Program funding from U.S. COVID-19 relief efforts in 2020.35

At a more structural level, AVIC has proposed the concept of an “Air Silk Road.” The project is an aviation industry-specific offshoot of China’s One Belt One Road (OBOR) initiative, focusing on “the three major areas of aviation infrastructure construction, aviation network construction, and aviation project trade.” The Air Silk Road’s goal is to shape the aviation industry and systems within and among target countries as well as to propel the “going out” of China’s aviation supply chains.36

INTERNATIONAL INFRASTRUCTURE PLAYERS

Beijing’s global project hinges on developing international infrastructure and standards through which to project power. The DoD list covers many major infrastructure companies, state-owned and private, spanning both traditional industries (such as rail, construction, and energy) and emerging ones (such as cloud computing, telecommunications, and space). In some cases, the infrastructure these companies build is for direct military use. In others, it serves integrated military and civilian ends. And in still other cases, the infrastructure is purely civilian but establishes positions that encourage dependence on China and enhance Chinese influence or geopolitical leverage, in accordance with the MCF strategy.

MILITARY INFRASTRUCTURE

China Communications Construction Co. (CCCC) is a state-owned engineering and construction company identified by DoD in August 2020 as linked to China’s military. According to its website, CCCC is the world’s largest dredging company, port machinery manufacturer, marine equipment design company, and offshore oil rig design company.37 CCCC developed the advanced dredgers for, and carried out the construction of, artificial islands in the South China Sea.38 In March 2019, CCCC signed a strategic cooperation framework with China’s Eastern Theater Navy in the field of military facility construction. They agreed to cooperate on engineering technology, construction management, and personnel training for “mutual benefit to advance the war zone.”39

CCCC’s business spans more than 150 countries.40 Its Singapore-based subsidiary, CCCG Overseas Real Estate, is currently developing the Grand Plaza (also known as The Grand) in Los Angeles, a $1 billion mixed-use real estate development project that began construction in 2019.41 The project is a public-private partnership with the Los Angeles Grand Avenue Authority, among others.42 Representatives from the Los Angeles municipal government and the Chinese Consulate in Los Angeles attended the project’s signing ceremony.43

COMMERCIAL INFRASTRUCTURE

State-owned CRRC is the world’s largest manufacturer (by revenue) of rolling stock, or railway products and services. CRRC exports to more than 105 countries and maintains R&D centers globally, including in the United States.44 CRRC is a dedicated MCF player and ranks among the most heavily subsidized companies in China.45 The company’s 2018 annual report vows to “implement the military-civil fusion development strategy and expand the application of technology and products.”46 CRRC documents also profess commitments to OBOR, Made in China 2025, and “Go Out.”47 In May 2017, CRRC joined with CASC – one of the 10 core state-owned military-industrial companies – and other government and state-owned entities to launch an investment fund dedicated to MCF technologies ranging from high-speed rail to power grid equipment to aerospace.48

What role does a rolling stock company play in MCF? Much rail technology is dual-use. It also supports national – including military – logistical capacity. One of MCF’s priorities is leveraging civilian infrastructure, construction, and logistics for military purposes. According to this logic, rail infrastructure, whether located in China or abroad, should support the PLA’s requirements.49

Moreover, CRRC’s international rail projects could allow China to acquire coercive leverage through commercial positioning. For example, Boston has sourced rail cars for its Red Line and Orange Line subways from CRRC.50 Boston’s transportation system could become dependent on CRRC for parts, servicing, equipment, and technology.51 Such dependence is particularly concerning, as Beijing frames transportation networks as components of national security.52 Transportation networks also provide indirect leverage via influence over the goods transported. For example, in Africa, China develops transportation networks alongside its investments in strategic mineral reserves and their processing. These transportation networks help shore up vertically integrated control over resource extraction, production, and trade.53

Expansion of China’s rail and other heavy-industry players also provides industrial capacity that bolsters China’s commercial and military prospects. Technology and support from, as well as sales to, the military allow China’s large construction and manufacturing companies to develop their products and lower costs, thereby out-muscling their international competitors. Think of this as not only technological transfer from military to civilian but also capacity transfer: Military procurement of CRRC’s rail products or China State Shipbuilding Corporation’s ships permits those entities to operate at greater capacity. Greater capacity allows the companies to lower costs and increase production scale. As a result, the companies can both underprice competitors and, during times of increasing demand or decreasing supply, fill market gaps to capture market share. China’s relatively insulatated domestic markets, along with state support for core domestic actors such as CRRC, allow the Chinese economic system to underwrite the acquisition and development of dual-use and military-relevant technology.

FUSED MILITARY AND CIVILIAN INFRASTRUCTURE

At the 2018 National Informatization Work Conference, Xi declared, “[C]yber-information military-civil fusion is the key field and frontier field of military-civil fusion, and it is also the most dynamic and high-potential field of military-civil fusion.”54 Accordingly, the DoD list covers some of China’s key players in international IT systems, which Beijing uses to serve integrated military and civilian ends.

Take, for example, China’s space infrastructure – particularly Beidou, China’s satellite navigation system and alternative to GPS. Beidou serves the spectrum of military and civilian purposes, including military aircraft, smart-city construction, carshare systems, deep-space activities, and commercial aerospace.55 The Beidou system’s development and operation appear to be covertly directed by China’s military apparatus.56

Chinese sources frequently frame Beidou as an archetype of MCF. In 2012, the vice chairman of the Central Military Commission, China’s top military body, described Beidou as a “milestone” for the military and the nation.57 China National Defense News calls Beidou a “model of military-civil fusion.” In September 2017, Gao Weiguang, assistant director of the China Satellite Navigation Engineering Center, said, “Beidou serves the construction of national defense as well as economic and social development… China deeply integrates the Beidou system into the Belt and Road strategy, military-civil fusion, and information development.”58

CASC, one of China’s 10 state-owned military-industrial groups, played a critical role in the construction and development of the Beidou system, including through CASC’s China SpaceSat and CALT subsidiaries.59 As CASC’s website puts it, the company “is responsible for the development of the launch vehicles and most of the satellites for China’s Beidou Navigation Program.”60 CETC also supports Beidou’s technological and industrial development, primarily through its 54th Research Institute – described at the 2020 China Satellite Navigation Conference as “engaged in technology research and development, manufacturing, and system integration in cutting-edge fields such as military communications, satellite navigation and positioning, aerospace measurement and control, intelligence reconnaissance and command, communications and information countermeasures, and integrated applications of aerospace electronic information systems.”61 In November 2020, CETC won the “Beidou Satellite Navigation Application Promotion Contribution Award,” issued by the China Satellite Navigation Management Office and the China Satellite Navigation Conference Organizing Committee.62

Beidou’s relationships extend well beyond China’s state-owned military-industrial companies. Take Semiconductor Manufacturing International Corporation (SMIC), also named on the DoD list and the largest semiconductor foundry company in China. Headquartered in Shanghai and incorporated in the Cayman Islands, SMIC is partially state-owned and publicly listed on the Shanghai and Hong Kong stock exchanges. SMIC appears to be a Beidou supplier, building domestic capabilities that add value to the Beidou ecosystem.63

Other IT infrastructures and champions also play key roles in China’s global MCF ambitions.64 China Telecommunications Corporation (China Telecom) describes MCF as one of its primary applications. China Telecom is a state-owned telecommunications company on the DoD list alongside China United Network Communications Group Co., Ltd. and China Mobile Communications Group, also state-owned, and Huawei.65 China Telecom’s government-enterprise operation is divided into 11 divisions, including an MCF industry division.66 In a concrete manifestation of its military ties, China Telecom signed a strategic cooperation agreement with China’s Eastern Theater Command in 2017 for the construction of battlefield information infrastructure, military emergency communications, application and transformation of new-generation IT, and the training of informatization professionals.67

MILITARY-ACADEMIC COMPLEX

Technologies developed by information infrastructure champions on the DoD list often appear on China’s national- and provincial-level MCF public-service platforms. These platforms are hubs designed to encourage sharing of technology and other resources among military and civilian entities.68

This points to another way entities can support China’s military and MCF programs: the provision of research, development, and engineering. Discussions of MCF in China emphasize the value of dual-use technologies and the efficiencies derived from breaking down barriers between military and civilian technology development as well as technological applications.69 Several companies on the DoD list participate in this process, transferring technology from the commercial space to China’s military and security apparatus.70

In June 2020, the DoD identified Inspur, a Chinese company focused on cloud computing and big data, as tied to the PLA. Inspur has a strategic cooperation agreement with the 36th Institute of CETC, one of China’s 10 core military-industrial groups, “to jointly build a new dream in the field of national defense and informatization” through technology partnerships in control, intelligent equipment, and other data-related areas. A press release notes that “through cooperation in comprehensive research, technology demonstration, product development, [and] manufacturing … the two parties will achieve complementary advantages.”71 Inspur operates a U.S.-based subsidiary, Inspur Systems, based in Milpitas, California. The subsidiary has an R&D center in Fremont, California, and facilities in Seattle, Washington, and Newark, California.72

Sugon, a leading Chinese computing company, offers a similar example. In 2016, Sugon signed a strategic cooperation agreement with the Chinese Institute of Command and Control to promote “the application of command and control technology in national defense construction and national security.”73 Xinhua observed that “Sugon cloud computing technology helps the PLA joint combat command system.”74 Currently listed on the Shanghai Stock Exchange, Sugon was established through support from the Chinese Academy of Sciences,75 which remains Sugon’s largest shareholder.76 Sugon’s 2019 annual report lists 19 subsidiaries. They include Sugon U.S. Systems, Inc., a California-based subsidiary that appears to have been dissolved. The subsidiary list also includes Zhongke Ruiguang Software Technology Company, a joint venture with California-based VMW focused on cloud computing, big data, and other fields.77

In a broader example of technology sharing between China’s military and civilian systems, since 2015, the year Beijing elevated MCF to national-level strategy, the Chinese Institute of Command and Control has held an annual “Military-Civil Fusion Technology and Equipment Expo” in Beijing.78 The event is attended by tens of thousands of representatives from the government, military, armed police, public security, transportation, civil air defense, aerospace, aviation, weapons, ships, and electrical technology fields.79 Huawei, Inspur, and Sugon80 – to name a few companies – are regular participants.81 So are core state-owned military-industrial companies and their subsidiaries (such as Hikvision).82

Remaining Gaps

The FY1999 NDAA tasking directs DoD to identify Chinese military companies that operate in the United States. These companies do not only support the PLA industrially and technologically. They also conduct business in the United States and, in some cases, leverage that business to obtain dual-use and other military-relevant resources. Some build infrastructure in the United States, as in the cases of CRRC and the Boston subway, CCCC and the Los Angeles Grand Plaza, and AVIC and its real estate operations nationwide. Some have headquarters or operate R&D centers in the United States, such as Huawei in Santa Clara83 and Inspur and China Mobile in Milpitas, California.84 Many occupy positions in U.S. supply chains and connect to U.S. information systems.

The DoD list is a critical resource. It begins to reveal the opaque nature of Chinese entities doing business globally – and the national security risks they present. However, this list should not be considered exhaustive. The 44 companies identified are by no means the only PLA-tied Chinese companies operating in the United States. Many centrally state-owned military-industrial companies, builders of global infrastructure for Chinese power projection, and pillars of Beijing’s military-academic complex are not on the list. Those 44 companies also operate through subsidiaries, joint ventures, and investment vehicles that are difficult to identify and may evade the scrutiny sparked by the DoD list.

This section details additional companies not on the list that meet qualifying conditions. These companies are presented as examples of gaps, not remedies for them. It would be insufficient simply to expand the existing DoD list to include these companies. Rather, the current documentation effort should be updated to account for the reality that there will always be more companies that meet qualifying criteria, especially as Beijing is adept at repackaging old players. Rather than trying to collect them all, the DoD effort should adopt a clear prioritization framework to focus on the military-tied companies that matter most, based on their role within the MCF system, the technologies or capabilities they develop, and their ties to U.S. resources or vulnerabiliites.

CENTRALLY STATE-OWNED MILITARY-INDUSTRIAL COMPANIES

The DoD list identifies the 10 primary centrally state-owned military-industrial companies. Those are not the only military-industrial players among China’s centrally state-owned enterprises. For example, China Poly Group Corporation (CPGC) is involved in art and antique auctioning, textile manufacturing, international trade, fishing, and real estate. It also works in defense and explosive manufacturing.85 The company owns the world’s third-largest art auction house.86 CPGC also exports arms internationally, with past customers including Myanmar and Zimbabwe, reportedly in exchange for Chinese access to raw materials.87

Most of CPGC’s arms sales take place through its subsidiary Poly Technologies. Poly Technologies is a leading exporter of missile equipment, military-related electronic equipment, police and anti-riot equipment, military logistics supplies, and firearms.88 Its products include a laser defense system to counter UAVs;89 UAVs that can perform reconnaissance and missile strike missions;90 and armored vehicles.91 The U.S. Department of State sanctioned Poly Technologies in 2013 for its violation of the Iran, North Korea, and Syria Nonproliferation Act.92

CPGC is also an institutional supporter of China’s domestic MCF apparatus. It operates several MCF research centers and investment funds.93 Its real estate-related subsidiaries construct buildings and infrastructure in MCF industrial bases and zones across China.94 CPGC’s website advertises that the company is “combining national policies and [CPGC’s] own advantages to promote military-civil fusion and innovative development.”95 CPGC also coordinates with PLA-affiliated institutions, including China’s National Defense University96 and the China Academy of Engineering Physics, which leads China’s research on nuclear directed-energy weapons and has been subject to U.S. export controls since 1997.97

CPGC operates and invests around the world as well. In the United States, CPGC operates real estate projects in Los Angeles and San Francisco, has hosted cultural events with U.S. theaters in California, and reports having run partnerships with Yale, Columbia, the Lincoln Center, and the Met.98 CPGC’s mining subsidiary has signed procurement agreements with JP Morgan Chase.99 In the 1990s, the U.S. Department of Justice investigated CPGC for allegedly smuggling small arms into the United States, including automatic weapons.100

ADDITIONAL INFRASTRUCTURE PLAYERS

While the DoD list identifies key companies that support the Beidou system, these are only the tip of the iceberg. Beijing BDStar, the company responsible for developing Beidou’s 22nm chip technology, stands out.101 Established in 2000, Beijing BDStar was the first public company in China’s satellite navigation industry. As the company’s website puts it, “Beijing BDStar was born as a result of Beidou and was registered and established on the eve of the launch of China’s first Beidou satellite. For 20 years, BDStar has grown with Beidou and has promoted and witnessed the development of China’s satellite navigation and related industries.”102

With industrial priorities in satellite navigation, microwave ceramic devices, and automotive engineering services, BDStar describes its R&D system as, among other things, a “military-civil fusion research and development platform.”103 BDStar has at least 11 subsidiaries, including Unicore Communications, a satellite positioning company with offices in Beijing, Shanghai, and Silicon Valley;104 Chongqing-headquartered BDStar Intelligent & Connected Vehicle, which has an R&D center in Silicon Valley;105 and In-tech GmbH, a Germany-based automotive and smart mobility company with offices in the United States, Mexico, the Czech Republic, the United Kingdom, and Romania.106

BDStar is just one of many additional companies that support the Beidou ecosystem. Haige Communications offers another example. Listed on the Shenzhen Stock Exchange – but with the Guangzhou State-owned Assets Supervision and Administration Commission as its controlling shareholder – the company supports Beidou’s military navigation services.107 It provides wireless communications and navigation technologies, equipment, and services for the Chinese military and armed police.108 The U.S. Department of Commerce added Haige to its Entity List in August 2020 for supporting Beijing’s island construction and militarization in the South China Sea.109

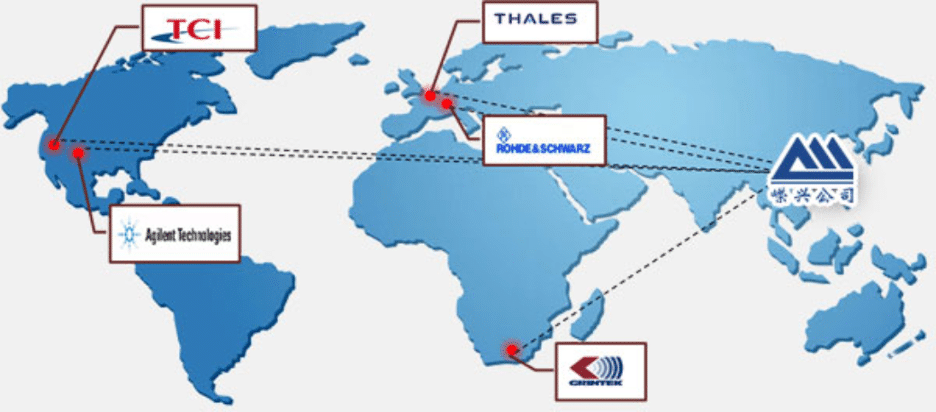

Haige’s annual report lists 25 subsidiaries, including Shenzhen Rongxing Industrial Development Co.110 Shenzhen Rongxing focuses on radio software development and system integration. According to the company’s website, it aims to be “a trusted and respected MCF developer in the field of electromagnetic spectrum.”111 Shenzhen Rongxing has contributed technical support to Sino-Russian joint military exercises as well as to the G-20 summit in Hangzhou in 2016.112 The company advertised itself in 2013 as “the only enterprise in the industry that can realize the integration and networking of the underlying systems for companies such as Germany’s R&S, France’s Thales, and America’s TCI.”113 Shenzhen Rongxing’s website boasts of Shenzhen Rongxing’s “good cooperative relations” with TCI, Agilent, and NARDA in the United States, as well as with France’s Thales, Japan’s AOR, and Germany’s R&S and GEW.114

Shenzhen Rongxing’s Integration System Footprint115

The range of Haige’s operations underlines the scope of the Beidou network and the applications developed by the MCF players supporting it. Another Haige subsidiary is Guangdong South Coast Technology Service Co., Ltd. (South Coast), which uses satellite positioning technology and terminal development to build and support integrated maritime information services. It provides ship positioning supervision systems for China’s customs, inspection and quarantine, border inspection, maritime affairs, border and coastal defense (for example, Guangdong Frontier Defense Corps), and port office entities as well as for foreign shipping companies.116 South Coast also supports China’s development of a cross-border e-commerce platform.117

These are only two companies in the larger Beidou network. And Beidou itself is just one infrastructure system. Similar gaps exist in documentation of actors in other critical MCF infrastructure sectors, such as nuclear energy and “new infrastructure.”118

ADDITIONAL MILITARY-ACADEMIC COMPLEX ENTITIES

MCF is institutionalized. Organizing nodes and coordinating mechanisms shape the activities of countless companies in China, the United States, and internationally. This is particularly obvious when it comes to the military-academic complex. China’s R&D system is relatively centralized. Much of China’s cutting-edge research takes place under the auspices of, or in partnership with, state-led academic institutions that themselves have domestic and international partnerships across the academic and commercial landscape. As organizing forces for the development and sharing of military-relevant technology, these institutions should be included in DoD’s documentation of China’s military and MCF apparatus as well as its offshoots in the United States. Targeting these organizing nodes would allow the United States to move from hunting hydra heads to mounting a systemic defense.

Some of these state academic institutions are already known bad actors. The China Academy of Engineering Physics (CAEP), subordinate to the Ministry of Industry and Information Technology, is the dominant research institution behind China’s nuclear weapons program and also researches directed-energy weapons.119 This is no secret: CAEP is on the U.S. Entity List.120 The DoD list does include Panda Electronics Group, a state-owned electronics group that as the Australian Strategic Policy Institute has documented, reports an address in CAEP’s Institute of Applied Physics and Computational Mathematics, indicating a possible link.121 However, the DoD list does not include CAEP itself.

CAEP is not a company, but it does operate corporate arms and invest capital. For example, CAEP owns Sichuan Jiuyuan Investment Holding Group Co., Ltd.,122 which itself owns or holds a stake in dozens of other entities. Those entities include Lier Chemical, which exports to the United States and reports partnerships with Dow Chemical;123 Sichuan Jiuyuan Yinhai Software Co., Ltd., which invests alongside Tianjin Global Magnetic Card, a licensed Mastercard manufacturer;124 and Beijing Xin’an Fortune Venture Capital, which has invested in U.S. and Chinese technology companies. The DoD documentation effort should prioritize companies engaged in partnerships with, receiving capital from, or allocating capital alongside, CAEP.

The Chinese Academy of Sciences (CAS) is larger and wider-ranging than CAEP. CAS is China’s national academy for the natural sciences. It focuses on chemistry, IT, earth sciences, life and medical sciences, mathematics and physics, and technological sciences. CAS conducts and organizes national R&D projects, collaborates with other domestic and international players, and invests in commercial actors. It also fully espouses MCF. CAS’ technological achievements regularly appear at the Chinese Institute of Command and Control’s Military-Civil Fusion Technology and Equipment Expo.125

In March 2018, CAS held a meeting for the “Chinese Academy of Sciences’ in-depth advancement of the development of military-civil fusion project.” As a report from the meeting noted, its purpose was “to build a research platform for the Chinese Academy of Sciences’ military-civil fusion development strategy, unite multiple forces, exchange and learn, and form a long-term mechanism for military-civil fusion development strategy research.” CAS also operates dedicated MCF institutions, including an MCF big data research center126 and an MCF development center at its university.127 CAS’ model rests on foreign cooperation, including with U.S. researchers, on topics ranging from high-energy physics to materials science.128

As with CAEP, CAS is not a company. But it does operate corporate and investment arms. Those arms include CAS Holdings, which owns more than 30 holding companies.129 And, as previously noted, CAS is the largest shareholder of Sugon, a company on the DoD list.

Enormous and diverse, CAS sits at the center of China’s R&D ecosystem, with operations in civilian as well as military and dual-use domains. As with CAEP, the DoD documentation effort could focus on CAS in prioritizing and structuring documentation of military-civil technology transfer in the Chinese system. Doing so would allow DoD efforts to focus on organizing forces, such as CAS, rather than on their offshoots, such as Sugon.

CAS and CAEP are just two examples. There are other analogues, such as universities that house military or dual-use research benefitting the PLA, as well as government-led research projects with explicit military or MCF mandates.

A New Model: A Prioritization Framework

If U.S. efforts are to match the scope of Beijing’s MCF strategy, they will need updated tasking. Key elements of that updated tasking should include:

Providing a clear definition of a Chinese military or MCF company. Language in the FY2021 NDAA offers a foundation for such a definition, but more is needed.

Expanding the scope of documentation efforts to capture entities that may not operate on U.S. territory but nevertheless impact the United States or U.S. actors.

Incorporating a prioritization framework into the DoD documentation program to allocate resources and attention strategically.

CLEAR DEFINITIONS

The FY1999 NDAA tasking was prescient. It was also crafted at a time when China was less influential, less integrated into the U.S. and global systems, and operating at a smaller scale. A U.S. response to China’s weaponization of cooperation demands a clear definition of Chinese military and MCF entities that focuses on the organizing elements of Beijing’s military and MCF systems. This definition should also offer guidelines for following MCF resource allocations, platforms, vehicles, and partnerships operating in the United States and globally.130

The FY2021 NDAA offered the start of such a framework. Section 1260H calls for “[p]ublic reporting of Chinese military companies operating in the United States” and lays out an annual reporting process for the secretary of defense.131 The NDAA language defines Chinese military companies as those owned by the “People’s Liberation Army or any other organization subordinate to the Central Military Commission of the Chinese Communist Party” and/or serving as a “military-civil fusion contributor.” The NDAA language provides detailed indicators for defining a “military-civil fusion contributor,” including connections to:

Military-relevant streams of Chinese government funding;

Institutional relationships commonly associated with MCF (such as connections to the Ministry of Industry and Information Technology); and

Operational features of the MCF system in China (for example, operations located within an enterprise zone whose mandate and funding focus on MCF).

However, the FY2021 NDAA language still has gaps. Additional indicators are needed for identifying military and MCF companies. For example, the FY2021 NDAA guidance does not account for all non-government funding and investment streams linked to China’s military and MCF program. Private investment funds approved by Chinese central or provincial asset administration authorities to invest with an MCF mandate or thesis do not meet the NDAA criteria. Nor do the holding companies or investment vehicles backed by CAEP or CAS. Yet the portfolio companies into which those companies and vehicles invest, both in China and abroad, meet the spirit of the law’s intent. The FY2021 NDAA guidance also overlooks spin-off MCF actors, which generate revenue for the MCF apparatus by commercializing technology transferred from the military to private actors.132

EXPANDED SCOPE

The FY1999 NDAA limits the scope of DoD’s documentation effort to companies “operating directly or indirectly in the United States.” This limitation should be expanded – or reconceived. A company without a presence in the United States might still control a critical node in a value chain on which the United States depends. A company without physical operations in the United States might still provide technology services or capital to the United States, acquiring influence and information in exchange. Moreover, a company without operations in the United States might still acquire U.S. technology and data (for example, through joint ventures or research cooperation). And a company without operations in the United States might also receive U.S. capital, not only benefiting directly from that capital but also acquiring influence over U.S. economic interests. For example, if a U.S. pension fund were invested in an index fund that invests in Sugon, U.S. pensions would depend on the performance of a Chinese military company.

Software and data are critical components of national prosperity, security, and power. Cross-border capital and supply chains have created complex systems of interdependence and become levers of strategic influence. Conceptions of what it means to operate in or with the United States should reflect this reality.

CLEAR PRIORITIZATION

Even as it expands DoD’s documentation effort, Washington should understand that gaps are inevitable. There will always be companies overlooked. There are simply too many companies tied to China’s military program. There will always be more. Moreover, attempting to list every last company could hinder the concrete action that must follow the documentation process.

The current documentation effort should be expanded, but with a clear prioritization framework in place to target the entities that matter most, based both on U.S. priorities and on each entity’s role within the Chinese system. Congress or DoD should offer a rubric to help the department prioritize between different technologies, sectors, and types of actors.

That rubric should factor in, first, every entity’s role within the MCF system and contribution to China’s offensive capabilities. Some MCF actors primarily collect technologies or resources. Others apply those technologies or resources to operational ends. A Chinese company or investor partnering with a U.S. player in satellite technology would be an example of the former. Companies operationalizing the Beidou ecosystem, such as Beijing BDStar, are examples of the latter. Both types are critical components of the MCF system. If the United States had unlimited time and resources or were further ahead in the competition with China, both would be worthy targets. But the appliers provide the highest value-added and most directly threaten U.S. interests. DoD’s effort should prioritize them.

Second, this rubric should prioritize areas in which the United States must compete to secure its future power and prosperity. Satellite and sensing systems and global logistics networks offer prime examples. These systems gather commercial and military-relevant information. They increasingly shape global movement. Both battlefield operations and commercial exchange depend on them. Beijing competes for these global information systems, their international technical standards, and their industry chains.133 If the United States is to maintain informational advantages – and the ability to project power globally – it will have to prioritize these as a competitive domain.

Third, this rubric should account for the degree of U.S. vulnerability to a given Chinese entity, taking into account entire value chains. For instance, the rubric should consider the degree to which China’s MCF players enhance Chinese control over markets or industry chains in a way that threatens the autonomy of U.S. or allied value chains. To take a concrete case as an example, DoD should prioritize Chinese actors involved in refining and smelting critical rare earth elements and related magnet production that support U.S. weapons systems.134

To its credit, DoD has designated entities engaged in semiconductor technology and production (such as SMIC, Gowin Semiconductor Corporation, and Advanced Micro-Fabrication Equipment, Inc.). Beijing prioritizes the semiconductor industry. China’s control over nodes in the value chain threatens U.S. economic and national security. DoD’s semiconductor-related designations therefore represent an encouraging first stab at addressing U.S. vulnerabilities. But this first stab is inadequate. DoD action ought to address the broader value chain, including silicon processing, chip design, and production. Moreover, DoD documentation efforts should apply the same lens to other areas of Chinese priority and leverage, such as rare earth elements, machine tools, and UAVs.

OPERATIONALIZING THE DOCUMENTATION EFFORT

No matter how refined the documentation process might be, it means little without operationalization. The DoD list has no teeth on its own. It provides information the government and private sector can use to take action. The expanded DoD documentation effort should be paired with interagency action that encourages government and private-sector players to act on DoD’s findings. For example, companies should review their partnerships and supply chains for possible connections to the Chinese military.

Such action should be both defensive and offensive. In 2020, the Trump administration issued Executive Order 13959, prohibiting investment in identified Chinese military companies. While a valuable step in operationalizing DoD’s findings, that order was also purely defensive. The United States will not be able to combat MCF simply by blocking Chinese military companies.135 The United States must also incentivize positive alternatives to Chinese MCF players and efforts. For example, where China has secured control over core nodes in industry value chains, Washington should encourage investment in and development of alternatives.

DoD, with support from the rest of the federal government, should establish a robust analytical program to monitor the scope and functions of MCF and deliver regular updates, both in classified fora and publicly. These updates would inform U.S. and allied private-sector actors of the risks of doing business with Chinese military-tied companies. These updates would also serve as a foundation to support strategic action by U.S. government authorities. Strategic messaging around this information should frequently and explicitly recall the authorities of the International Emergency Economic Powers Act (IEEPA) associated with the original FY1999 NDAA tasking for the DoD list. IEEPA authorities could empower more proactive operationalization of U.S. government restriction and seizure of Chinese assets linked to MCF ambitions.

The task of monitoring Chinese military companies should be prioritized on par with investment-screening and export-control functions managed by the interagency Committee on Foreign Investment in the United States and the Commerce Department’s Bureau of Industry and Security, respectively. Monitoring should also be coordinated with those efforts, either through existing interagency mechanisms, such as the National Security Council, or through a novel bureaucratic construct focused on the techno-economic competition with China. Each of those entities will have gaps in defending against and disrupting Beijing’s MCF apparatus. Coordination would help close those gaps.

Executive Order 13959 should be implemented in that spirit. U.S. regulators and capital market actors should enforce the order’s prohibitions. Given the scope of integration that Chinese military companies enjoy in global capital markets, those prohibitions should also be expanded to prevent all types of U.S. capital and persons from supporting Chinese military companies, including via private market equity and debt. Clear and consistent U.S. messaging, including from DoD and Congress, should underscore the reputational and operational risks of collaborating with the Chinese military. U.S. investors – institutional and individual – should be well-informed about actors that may propel the CCP’s military capabilities and ambitions or authoritarian control. And U.S. federal funding programs should, from the point of design and commitment of funds, vet against risks of indirectly supporting Chinese military companies and perpetuating the control of supply chains by MCF actors.

Finally, these defensive measures – restricting the capitalization and freedom of maneuver of Chinese military companies – should be paired with the prioritization, promotion, and protecton of alternative ecosystems. DoD’s Trusted Capital program offers an example of how the U.S. government can help create a marketplace for public-private interactions that support the U.S. industrial base. And funding mechanisms for non-traditional innovation-base participants, such as the mechanisms offered by the Defense Innovation Unit and the U.S. Air Force’s AF Ventures and AFWERX, show that U.S. federal funding can be both competitively framed and reach the best and brightest in dual-use technology. As the U.S. government and private sector look to invest in the wake of COVID-19, those investments should be framed in a competitive context and aim to activate multilateral interest in trusted supply lines throughout the defense industrial base.

Conclusion

In the FY1999 NDAA, legislators provided a vital tool for defense against what was then a little-recognized threat. However, that tool sat untapped for two decades. During that time, Beijing integrated globally. It established positions of asymmetric dependence and, with them, coercive influence. The CCP developed its MCF program and elevated it to a national-level strategy. The threat environment evolved to make the 1999 tool simultaneously more valuable and antiquated.

America has recognized the CCP threat. After two decades, DoD has acted on the FY1999 NDAA tasking to deliver a list of 44 Chinese military-tied companies operating in the United States. This list creates momentum. However, the effort requires updated guidance. The FY2021 NDAA offered the beginnings of an updated framework. That framework must now be expanded and complemented with a prioritization logic. It must also be paired with implemantion steps that spark meaningful action on the part of the federal government and the private sector.

No comments:

Post a Comment