Agatha Kratz, Janka Oertel

These firms are able to undercut European companies both in the EU and around the world, including in sectors key to Europe’s future economy and security, from energy to telecommunications.

The EU urgently needs to incorporate the concept and reality of this ‘protected home market advantage’ into its thinking on China.

Europe can defend its own industries by adopting an integrated policy approach, working with like-minded partners around the world, and even prising open closed parts of China’s domestic market.

The EU should also look to enhance its single market – both as a defensive measure and a way to improve its strategic sovereignty.

Introduction

At the tail end of 2020, the European Commission and the Chinese government announced the conclusion in principle of a Comprehensive Agreement on Investment (CAI). When sharing news of the deal, Brussels took pains to underline the commitments it had obtained from Beijing to open up more of China’s market and industries to European firms. Sectors due to open up included healthcare, ‘new energy vehicles’, and financial and cloud computing services. For years, European businesses had been complaining about China’s protection of a range of sectors that are partially or fully closed to foreign competition. Their complaint was that a lack of reciprocal openness in trade and investment relations has meant that European companies have missed out on opportunities in the huge and fast-growing Chinese market. Firms had pinned their hopes on an ambitious investment agreement to open the Chinese market further.

These concerns are valid – but they miss part of the picture. A protected Chinese home market has important consequences beyond revenues foregone. It is also an opportunity for Chinese firms to leverage the vast size of China’s market to build scale, amass profit, and improve productivity, technical capabilities, and product design and quality – all with limited or no pressure from foreign competition. This then enables some of these firms to enter foreign markets on a strong financial footing and to sell tried-and-tested, more tailored products at highly competitive or below-market prices. And it facilitates further international expansion and pursuit of global market share, at the expense of European firms.

Cultivating a large, protected home market as a beachhead for international expansion is hardly a new idea – it was the development model of many industrialised economies in the nineteenth and twentieth centuries, from Germany to Japan. Many of these practices were eventually rolled back due to external pressure, and because of their mixed track-record of producing truly competitive national champions in the long term.

But, for Western countries and businesses, waiting for China to ‘normalise’ its behaviour and open up its economy is a risky choice. Firstly, the size of China’s market – the largest globally for a wide range of goods and services – means that such practices have the potential to do significant permanent damage to European firms. Just over a decade ago, Chinese solar panel manufacturers decimated the German photovoltaic industry by offering their products at extremely low prices. Most of that price advantage derived not from state support but from significant economies of scale that these manufacturers secured as part of a large, protected home market. China’s scale is not a problem in itself. But, combined with restrictions on foreign participation, it can do lasting damage to foreign firms and markets.

Secondly, while many of China’s local industries are open to foreign competition, and not all sectors display higher efficiency as they grow in size or scale, market protections in China tend to be stronger and more prevalent in strategic high-tech industries – many of whose efficiency does increase with scale. The large and protected Chinese home market could, therefore, have particularly severe consequences for a string of sectors that are key to Europe’s future, from green technologies to connectivity equipment, to digital industries. In any case, China’s latest policy announcements, including its recently published 14th Five Year Plan, make clear that Beijing intends to continue protecting and promoting local firms in strategic sectors, curbing hopes for short- or even medium-term normalisation.

Thus, it is time for the European Union to integrate an understanding of China’s ‘protected home market advantage’ – the advantages that derive from the combination of a large and restricted home market – into how it defends and promotes European industrial competitiveness and economic prosperity. Despite the implications of this advantage, it is not yet fully embedded into the European Commission’s work on how Chinese market distortions affect the European market. It does not formally fall within the scope of last year’s Commission white paper on foreign subsidies, for example, despite the fact that the distortions arising from this advantage have much the same effects. Nor is it resolved by the CAI, which secures formal openings in some sectors but leaves many either closed or partially closed and includes myriad exceptions. In any case, the agreement’s effectiveness depends on whether China is ultimately willing to implement its commitments to a level playing field. And, of course, given recent EU-China tensions, the agreement may not even be ratified.

This paper introduces and describes the advantages Chinese firms derive from the combination of a large and protected home market in strategic sectors. It seeks to contribute to European policymakers’ thinking about how China’s market distortions affect EU firms and consumers. It does so, firstly, by providing a short overview of the key features of China’s protected home market advantage. It then points to how this advantage plays out in three industries in China. Finally, it lays out the ways that the EU might respond to this challenge. The paper aims to raise awareness of the issue as European decision-makers consider one of the major challenges of our time – how to manage Europe’s economic engagement with China in the twenty-first century.

China’s protected home market advantage

Increased competition is an important characteristic of China’s reform era, which began in the 1980s. China’s economy has not only marketised prices, economic resource allocation, and business practices, but has also significantly opened up to foreign trade and investment. In the past decade, however, such efforts have slowed. Beijing has facilitated inward investment procedures, allowed foreign firms and brands to gain a major foothold in areas ranging from luxury goods to pharmaceutical products, and continued to open up new sectors such as financial services to foreign capital. But, in a variety of industries, the Chinese market remains partially or fully closed to foreign players.

Beijing still formally prohibits foreign activities in sectors that range from film production and social media to printing and publishing. It also uses trade barriers or joint venture requirements to condition market access in sectors such as general aviation and telecommunications services. Importantly, it continues to block foreign competition in specific industries through informal barriers such as deliberately favouring domestic players in public procurement, ensuring slow or selective delivery of licences and permits, or by imposing domestic standards that make it costly for foreign players to enter a market. Altogether, formal and informal restrictions on foreign activities make China a significantly more restricted market than the EU or the United States. This is particularly true for high-tech sectors that China’s industrial policy designates as priority areas, in which Chinese firms have established monopolies – at the expense of their foreign competitors.

How a protected home market benefits Chinese firms

Naturally, keeping certain sectors of the Chinese economy closed to outside companies prevents European and other foreign firms from securing potential revenues and profits in those markets. It is also potentially harmful to European businesses because it provides a vast yet protected base for Chinese firms to grow unimpeded by the pressure of foreign competition – and, in turn, to enter foreign markets from a position of strength.

Limited domestic competition can, of course, stifle Chinese players’ competitive edge in the long run. But, in the short term, firms operating in a protected home market can secure greater revenues and generate more profits than they likely would under open market conditions. Thanks to these profits, and in the knowledge that they can serve their home market on a preferential basis, these companies can invest more in innovation and research and development (R&D). They can also grow in scale and technical proficiency, and test out and improve their products. A strong home consumer base also helps them avoid external demand shocks and increase their credibility and consumer service efficiency. These are advantages when they venture into international markets, giving them greater financial flexibility to secure increased market share by: setting lower prices; making more flexible or tailored offerings; creating higher-quality, more innovative, and more popular products; and generating greater credibility.

In the case of China, the advantages that derive from a protected home market are further augmented by the size of that market. This creates opportunities for significant internal and external economies of scale. Because China is the largest market globally for many goods and services, protected domestic firms can build greater production capacity than their counterparts elsewhere. In certain sectors, larger production volumes facilitate repeated production cycles that encourage production standardisation and automation, avoid waste, and help raise productivity. Larger Chinese firms might also be able to procure inputs at lower prices or finance themselves more cheaply. These ‘internal’ economies of scale allow them to push per unit production costs down significantly – for some firms, well below those of their European rivals.[1] To be clear, it is not the size of China’s domestic market by itself that creates distortions, but its combination with market barriers.

Chinese firms active in this vast and protected home market will also disproportionately benefit from ‘external’ economies of scale available in China – namely, advantages secured by having access to a large, vibrant, and interlinked home market, industrial network, and workforce. China’s dense industry clusters provide local firms with direct access to networks of specialised suppliers, labour, and demand, as well as extensive knowledge spillovers across firms, and between firms and local academic or research institutions. Chinese firms also benefit from high-quality infrastructure and proximity to population centres, which can facilitate hiring, procurement, or logistics activities.[2] Where the Chinese market is open to European firms, these advantages are shared; where the market is closed to foreign competition, they only accrue to Chinese players.

Advantages derived from a large and protected home market

Greater revenues and global market share than under open market conditions

Greater profits that can be reinvested in R&D or international market penetration

Greater product credibility and fit, thanks to extensive home market trials

Greater company credibility and resilience, thanks to sizeable and predictable home market revenues

Lower production costs and sale prices, thanks to internal economies of scale

These advantages are further inflated in China for another reason. In certain sectors or for certain companies, one must also factor in the abundant support that the Chinese state provides to domestic firms, further enhancing their competitive advantage. Such support comes in diverse forms and scale but can include direct subsidies (especially in priority sectors for China’s industrial policy, such as shipbuilding);[3] access to abundant, readily available, and sometimes below-market-rate financing; a tolerance for short-term losses for certain Chinese companies;[4] subsidised input prices, including R&D costs; and a loose application of competition policy. Together, these factors can grant Chinese firms a significant advantage over their foreign peers.

Sectors in which a home market advantage is likely to emerge

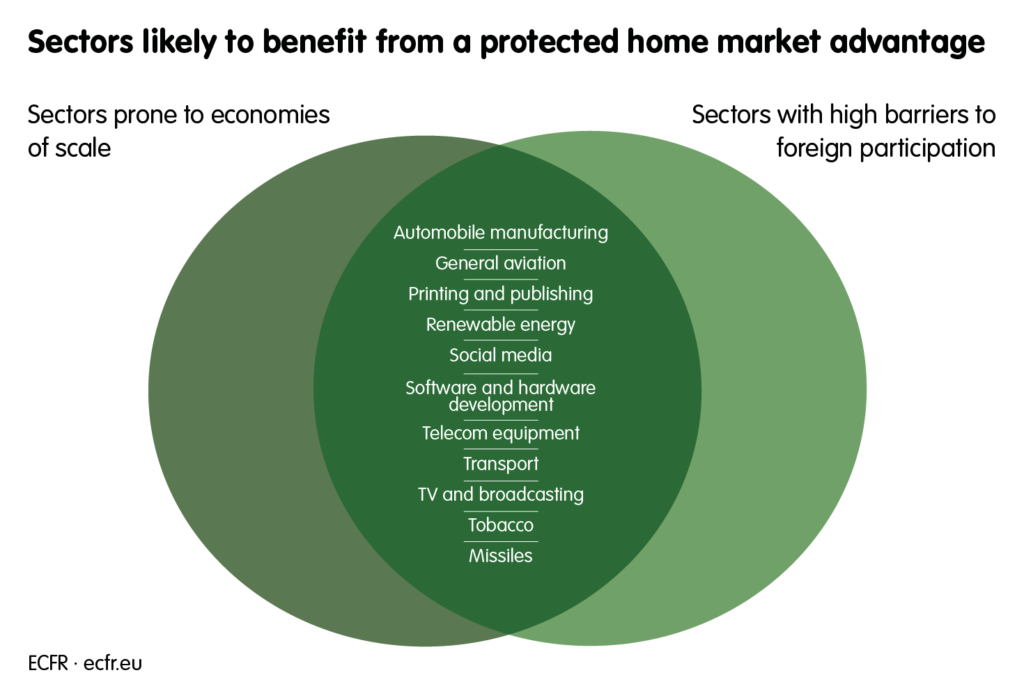

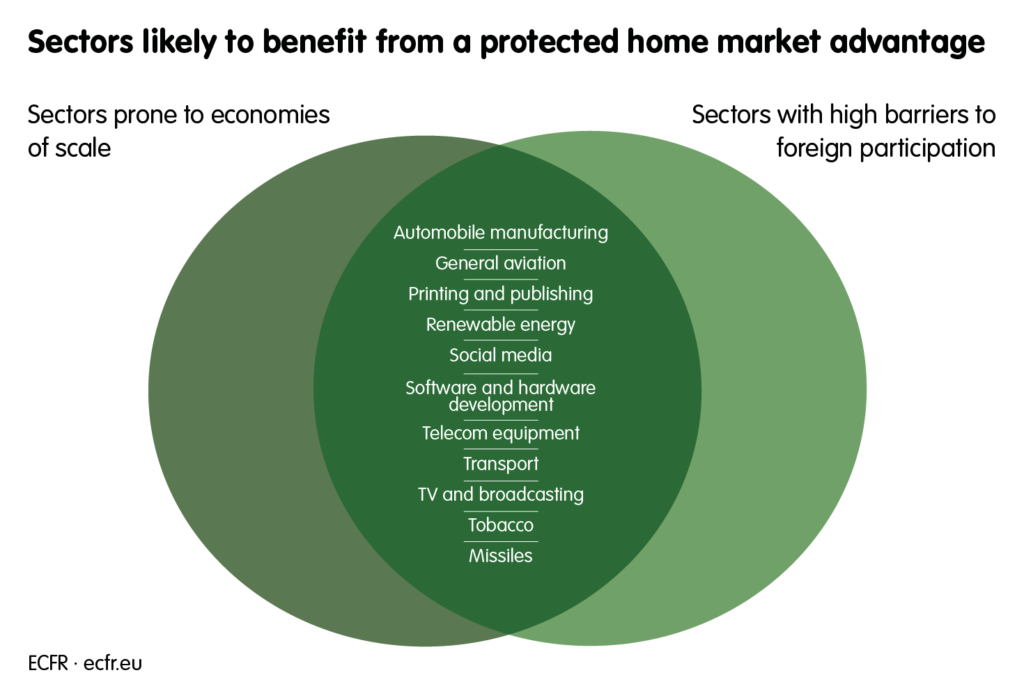

Not all firms in China can draw on the advantages of a large and protected home market: many sectors are open to foreign investors or traders in China, and many will not become more efficient as they grow. Europeans should be most concerned about sectors in which there are both high barriers to foreign competition and significant economies of scale.

Sectors that benefit most from large markets and extended productive capacities include capital-intensive industries such as automobile manufacturing, oil production and refining, steel production, and transport. In the automobile sector, for example, most operational costs come from the construction of factories and purchases of machines. Repaying these high fixed costs is easier as volumes produced and sold increase. Benefits from production scale also accrue disproportionately to sectors with high upfront costs, where investment is required before a firm can make its first product. These include pharmaceuticals, which requires massive R&D work before a drug can be put on the market; computer hardware and software, where a product needs to be developed before it can be sold; and aircraft, missiles, and telecommunications equipment.

Economies of scale also accrue to sectors in which network effects are important. These arise when firms need to develop and maintain a large single network, such as one made up of bank branches. Sectors in which network effects are important include telecommunications, computers, video gaming, and social media. In all these sectors, scale is crucial – as additional revenues help increase efficiency, reduce average costs, and generate profits.[5]

It is possible to identify the overlap between such industries and sectors characterised by formal and informal restrictions on foreign firms in China.[6] Doing so reveals which sectors are likely to benefit from a protected home market advantage. The following displays the overlap.

One would expect some of these sectors to face high restrictions anywhere, because of their national security significance (such as missiles) or their public service or monopoly status in some economies (such as television and broadcasting). Others are not a high priority for Europe (such as tobacco). And some have seen a continued dominance of non-Chinese players on the Chinese market despite barriers (such as automobiles). In short, it is not just because these two factors are present that a protected home market advantage will emerge. In some industries, foreign players will still use their competitive advantage to maintain an edge over their rivals.

However, many of the most at-risk sectors are also core to Europe’s future, and should therefore be monitored closely. This includes green technologies such as renewable energy and new energy vehicles, large parts of the new data economy, and transport or telecommunications equipment, all of which are building blocks of resilient critical infrastructure.

The potential effects on Europe

China’s protected home market advantage is primarily a challenge for European business. Chinese firms’ leveraging of a vast protected home base in a series of sectors could put a competitive strain on their EU competitors and diminish their revenue prospects and global market shares. Where this advantage is most extreme, it could lead to diminished financial performance, lower levels of investment, or even the bankruptcy of European firms. In short, China’s protected home market advantage has the potential to artificially shift revenues and profits from Europe to China, creating significant risks for European firms.

Though low-priced goods benefit European consumers in the short run, they can also affect them negatively in the longer run. By harming the health of European firms, they can have an impact on job creation across many industries and force economic restructuring – away from affected sectors – that typically comes with high and long-lasting adjustment costs. These costs will be greatest in high-tech sectors, which typically display significant positive economic externalities: these industries generate high-paid jobs and will often foster local innovation. Incidentally, a hollowing-out of certain leading European industries could erode public support for openness and free trade, fostering a desire for protectionism.

Finally, Chinese firms could eventually dominate sectors that Europeans consider to be key to their security, weakening the EU’s resilience and its quest for strategic autonomy. Recent national debates around the participation of Huawei and ZTE in the construction of Europe’s 5G infrastructure revealed the difficult balancing act of meeting operators’ preferences for low-cost equipment, addressing national security concerns, accounting for the overall political relationship with China, and ensuring the survival of European players in a contested market.

Key industries: What is at stake?

Three sectors illustrate the potentially acute implications of China’s protected home market for Chinese and non-Chinese firms: solar photovoltaic panels, rail rolling stock, and telecommunications. Together, these short case studies demonstrate that similar trends are playing out in other sectors too. While the dynamics are not identical across industries, the potential effects on European firms and markets are far from trivial.

Solar

China officially encourages foreign participation in the solar photovoltaic sector. However, foreign activity is constrained by a strong informal preference for local players in public procurement, which has resulted in a nearly 100 per cent market share for domestic firms. Thus, China’s informally closed market creates several advantages for its solar photovoltaic firms.

Firstly, and most importantly, because China is the largest global market for solar panels – with around one-third of globally installed capacity – Chinese firms have achieved significant internal economies of scales. Photovoltaic factories in China are typically four times larger than those in the US. This allows Chinese solar firms to use their machines more intensely, to standardise products, and to streamline production processes, resulting in lower production costs. Their scale also means Chinese firms enjoy a discount on most input materials compared to their foreign counterparts.

Furthermore, Chinese solar photovoltaic firms benefit from valuable external economies of scale. The growth and size of China’s solar industry means that dense, specialised clusters of producers and suppliers have formed, easing firms’ access to crucial inputs and further increasing efficiencies. As Gener Miao, former chief marketing officer of Chinese solar panel manufacturer Jinko Solar, stated plainly: “We build solar all over the world but China is the only place where every component we need is available just a few kilometres away.”

Combined with subsidies, low input prices in China, and preferential access to credit, these advantages have allowed Chinese solar photovoltaic manufacturers to bring down production costs drastically and, with them, global prices. Amid the emergence of China’s solar players, world prices of photovoltaic panels fell by 80 per cent between 2008 and 2013. By 2019, China was producing 76 per cent of all solar cells globally, compared to 33 per cent a decade earlier. European regulators have not succeeded in dealing with this issue through the established mechanisms for anti-dumping and anti-subsidy cases, but have now – in the CAI – at least made an attempt to condition Chinese investment in these sectors in Europe on a reciprocal opening of China’s market.

Telecommunications equipment

China’s telecommunications equipment market is the largest globally. Half of the world’s 4G base stations are installed in China, and the country has already built 700,000 5G base stations, compared to 115,000 in South Korea, which has the next-largest number. However, China allows only limited participation from foreign players: the government issued informal guidance to China’s state-owned telecoms operators to allocate no less than 70 per cent of 4G orders to Huawei and ZTE. This creates advantages for China’s telecommunications equipment leaders in three main ways.

Firstly, significant profits generated from domestic sales give Chinese companies the ability to offer more attractive packages abroad, characterised by lower prices (crucial in the cost-driven and highly competitive telecommunications market, particularly in Europe) and a much greater level of customisation, despite the costs of this. Abundant domestic profits also allow Huawei to invest significant amounts in R&D, and hence to develop cutting-edge products that are often technologically on par with those of their international competitors.

Secondly, Chinese telecommunications equipment vendors benefit from preferential access to a dense, diverse, and specialised workforce – such as China’s southern provinces can provide. This is particularly important in an industry with much shorter product life cycles than rail and solar, which require fast development of new equipment design and technology solutions.

Thirdly, the strong home position that gives Huawei its financial strength increases its credibility with foreign clients, as does its track record in building China’s 4G and 5G networks, with its products widely seen as technically reliable.

Combined with other direct advantages – including government subsidies, tax breaks, and export credits, as well as political backing for overseas activity – Chinese vendors have priced their products around 10-30 per cent more cheaply than the competition on global markets. Huawei has thereby increased its global revenue share from around 20 per cent in 2014 to 31 per cent in mid-2020. Furthermore, it has forced intense industry restructuring, with former telecoms companies Alcatel and Lucent merging in 2006 and major Canadian company Nortel collapsing in 2009. European vendors are now struggling to compete on an uneven playing field in a sector of the highest strategic importance to Europe’s future prosperity.

Rail rolling stock

China’s rail market remains largely closed to foreign participation. Foreign players are officially authorised to operate in China. However, China’s main rolling stock manufacturer, CRRC, commands 86 per cent of China’s total rolling stock market volume and close to 100 per cent of its high-speed rail rolling stock market. The reason for this is, again, the strong informal preference for local players of China’s main rail operator and main equipment purchaser, China Railway.

This vast protected home market creates several important advantages for CRRC. As with the solar photovoltaic industry, the size of China’s rail rolling stock market is significant – it accounts for more than one-quarter of global revenues and half of the global high-speed trains market. This enables CRRC to achieve extensive internal economies of scale. CRRC is almost four times larger than its two main competitors. And its biggest plant is six times larger than that of European rail giant Alstom (now Alstom-Bombardier). Increases in firm, production, and factory size allows for extensive standardisation and streamlining of the production processes. Significant and predictable domestic demand for CRRC’s products also allows it to invest more in automation than its international rivals. Finally, as it accounts for such a large share of China’s rolling stock market volume, the company has strong bargaining power with its suppliers, allowing it to keep production costs down and to preserve its profit margins.

The protected home market advantage has also allowed CRRC to accumulate significant profits in China that the firm has invested in extensive R&D efforts. Combined with direct government support, these factors have allowed the firm to offer both high-quality products and prices consistently 10-30 per cent below those of its competitors. This helped it quickly increase its global revenues and market share from a low base in just ten years.

Though not yet as drastic as in the solar and telecommunications sectors, this protected home market effect on European players could be significant in the longer run, especially in third markets: in emerging markets, European rolling stock companies are facing fierce competition and are quickly ceding market share to CRRC. This competitive shock has already driven attempts at industry reorganisation, with the failed Siemens-Alstom merger in 2019 and the successful Alstom-Bombardier merger in 2021.

Recommendations

The EU’s efforts to tackle spillovers from China’s economic model have, to date, mainly involved two approaches. The first is to attempt positive engagement with the Chinese government, with the aim of opening up the Chinese market to European firms. The goal of this engagement is to achieve greater reciprocity in the relationship – through, for example, the CAI. The second is to explore defensive measures that shield the EU market from Chinese market distortions. Examples of this approach include the foreign subsidies white paper and the European Commission’s renewed emphasis on the International Procurement Instrument.

Neither of these approaches tackles the protected home market directly or fully. In all, with these efforts and any others it makes, the EU needs to consider the additional distortions for European firms and consumers created by China’s protected home market advantage.

In responding to this challenge, the EU should adopt three overarching principles as part of a refreshed approach to its strategic economic dealings with China:

Clarity. A protected home market advantage does not apply to every industry in China. It is present only in sectors where scale and protection combine to produce extreme price and competitive advantages. A focus on the distortions arising from this advantage should not become an excuse for Europe to blame all its competitive woes on China. Therefore, being transparent about where the problem exists (and where it does not) will be key to tackling it effectively and ensuring that policymakers and political leaders do not misuse the issue to promote costly protectionist responses across the board.

Creativity. As the issue of China’s protected home market advantage sits at the crossroads of trade law, international investment law, competition law, industrial policy, and strategic planning, the EU will need to assemble a similarly multifaceted response. The bloc already has many tools to tackle certain aspects of the issue and some of its effects. It may need to develop some new tools. In all cases, the EU will need to creatively use a variety of instruments – spanning trade, competition, and investment – and do so more forcefully.

Competition. History shows that protecting home industries can prove highly inefficient in the long term, especially when protection weakens domestic competition and leads to too much scale and concentration in home markets. Therefore, Europe should not respond by mimicking China – by reserving its substantial home market for European players only. Any approach Europe takes should promote rather than constrain healthy competition in the EU’s internal market and foster fair competition in third markets.

There are several ways for Europeans to apply these principles in concrete ways.

Press for more and fuller market openness from China

In its negotiations for the CAI, the European Commission secured openings in a series of sectors, including some industries in which a protected home market advantage is likely to emerge, such as new energy vehicles. If the agreement endures despite current tensions in bilateral relations, the Directorate General for Trade will need to monitor the implementation of China’s pledges closely to ensure that European firms reap the benefits. This will require the Commission to undertake data gathering and communication with businesses on the ground. It should call out any delays in opening or any remaining informal barriers if the CAI is to realise its full value.

Because the CAI is far from being a done deal – due to the sanctions imposed on the European Parliament – and is in any case no panacea, the EU should also increase pressure on China to open up other areas, such as procurement markets. Some of the strongest barriers to foreign participation in China are erected through procurement (as all three of the case studies in this paper demonstrate). China’s accession to the Agreement on Government Procurement could, if Beijing’s offer is comprehensive enough, open doors to European businesses in sectors in which a protected home market advantage may emerge – though, again, the EU would need to closely monitor the implementation process. Key to this will be the negotiation and adoption of the International Procurement Instrument. China’s participation in European procurement markets is limited, but is growing quickly enough to provide Europe with leverage. Europe could use the instrument to incentivise opening in the sectors that are both most likely to see a protected home market advantage and most crucial for its competitiveness and economic resilience.

Still, a major push for further market opening cannot be the only tool that Europe uses to tackle the issue of China’s protected home market advantage. Recent signals from China suggest only a limited commitment to further opening and a desire to protect rather than open most strategic industries. As a result, and more importantly, a European response will need to include an effective defensive agenda at home and a more offensive agenda in third markets.

Protect and advance Europe’s competitiveness and market power

In the past five years, the EU has invested in developing its toolbox to deal with China-related distortions that spill over to the European market. None of these tools is tailored specifically to China’s protected home market advantage. However, the EU could easily mobilise some of them to address its effects on the European market and European firms.

To begin with, the bloc should encourage national tendering authorities to make greater use of EU public procurement directives in cases where Chinese firms bid for public contracts at abnormally low prices. The EU is not yet using the directives to their full potential. But they could be particularly relevant for tackling China’s protected home market advantage, given that many procurements in the sectors identified in the Venn diagram above occur in public markets.

The EU could also make more frequent use of its trade defence instruments, particularly its anti-dumping tools, where the prices proposed by Chinese firms are abnormally low. The Directorate General for Trade has done so in the past, including for telecommunications, but the European Commission could ramp this up.

Finally, if the EU adopts its new Instrument on Foreign Subsidies, a protected home market advantage should be part of the framework. For this to happen, the European Commission’s final proposal should at least retain the notion (which appears in its July 2020 white paper) that a close or restricted home market accentuates distortions from foreign subsidies. The EU could even consider extending the definition of foreign subsidies to formally include the advantage. This move would need to align with EU’s state-aid definitions and be mirrored in reforms of the World Trade Organization, so that the EU’s treatment of subsidies does not diverge from domestic and international rules and commitments.

To be effective, these three approaches will require three ‘boosters’. The first of these is a greater understanding among EU enforcement officers of the sectors where this advantage is most likely to play out. The second is early warning mechanisms for the growth of imbalances in these industries (based on market share monitoring and other relevant indicators). The third is greater industry participation, to help the EU build successful cases. This might require additional regulation and strengthened political cover for firms in relevant sectors. This is because companies have thus far proven reluctant to share relevant market and company data; they are worried about the response from the Chinese authorities and the impact on their business in China. This effort will also require greater member state awareness and mobilisation, especially for filing public procurement cases.

Play offence – plurilaterally

In the sectors that are most strategically important to Europe’s economic resilience (and only in those), policymakers might also decide to temporarily offset the cost of China’s protected home advantage for European firms by providing temporary support to these companies, or by incentivising the emergence of a domestic network of alternative suppliers. This would broaden the options available to European companies and governments and ensure China’s advantage does not result in the absolute dominance of Chinese actors in strategic industries.

Europe should pursue such a project in close coordination with allies and partners across the Atlantic and in the Indo-Pacific region, to avoid misunderstanding and pushback if certain policies appear protective of home firms. This would also limit the risk of duplication cancelling out one another’s efforts if these countries were considering similar steps. More broadly, working together would also increase the impact of this approach.

At the most basic level, a plurilateral response should start with building a common understanding with like-minded partners of the distortions that stem from China’s vast yet protected home market. This should include the US and Japan, but could also broaden to India, South Korea, Canada, and Australia. Together, Europe and its partners could identify the sectors to prioritise for domestic or plurilateral action. Such sectors are likely to include data-driven industries, telecoms, and green technologies.

The EU could lead these efforts by promoting the publication of joint reports documenting the effects of China’s protected home market advantage. The OECD is already producing highly credible reports on state support in industries in China – it could spearhead this research. These efforts could also involve information sharing and coordination between the EU, US, and Japanese administrations, or through European, American, and Japanese business associations and chambers of commerce.

Joint or coordinated use of defensive instruments – such as the ones mentioned above – would also reduce the scope for retaliatory measures from China and provide heightened cover for European firms that feared that their participation in these efforts would lead to China privileging international competitors. The EU could be in the vanguard of this effort, sharing best practice from its growing economic toolbox, and encouraging its partners to act.

At a more ambitious level, like-minded partners could also consider cooperating to create scale for their own firms, including through new plurilateral free trade agreements and matched provisions in bilateral free trade agreements or other economic agreements. This could also include a common approach to data. There are significant economies of scale in digital industries. And China’s large but mostly closed digital markets will likely become a new challenge in the near future. Yet, together, Europe and its partners could achieve a similar scale by promoting more seamless movement of data across borders among themselves. Creating scale in other sectors, such as high-tech manufacturing, might be harder because many value chains are already internationalised. But one way to gain critical mass would be to promote interoperability between similar products, companies, or standards.

Finally, the EU and its partners could align their industry support through increased funding for joint R&D. More coordinated or joint approaches would maximise complementarity, reduce the risk of inefficiencies in spending, and ensure that opportunities for building critical mass expand rather than set off mutually damaging rounds of subsidies competition.

Enhance the single market

Finally, from the perspective of scale, although China is the largest global market for many of the sectors that may see a protected home market advantage develop, the EU is often the second largest, or the third largest after the US. In practice, however, many intra-European market barriers – such as regulations, standards, market fragmentation, and language – make it hard or impossible for European firms to build scale at home to begin with. Addressing these barriers is crucial to keeping European firms competitive. Enhancing Europe’s single market would, therefore, be a major contribution to tackling the issue. It would be not just a defensive measure, but a proactive step towards improving European leverage and strategic sovereignty.

About the authors

Agatha Kratz is an associate director at Rhodium Group. She leads Rhodium’s research on European Union-China relations and China’s commercial diplomacy, and contributes to Rhodium’s work on China’s global investment, industrial policy, and technology aspirations. Kratz is a non-resident adjunct fellow of the Reconnecting Asia Project at the Center for Strategic and International Studies. She holds a PhD from King’s College London, and was formerly an associate policy fellow at the European Council on Foreign Relations

Janka Oertel is director of the Asia programme at the European Council on Foreign Relations. She previously worked as a senior fellow in the Asia programme at the German Marshall Fund of the United States’ Berlin office, where she focused on transatlantic China policy, including on emerging technologies, Chinese foreign policy, and security in east Asia. Oertel has published widely on topics related to EU-China relations, US-China relations, security in the Asia-Pacific region, Chinese foreign policy, and 5G.

Acknowledgments

The authors would like to thank the Rhodium Group team for their research support and feedback on drafts of this paper. They would also like to thank all interviewees for their precious time and advice, and reviewers for their helpful feedback. Andrew Small shared his intellectual input and helped the authors in structuring their thoughts, drafts, and recommendations.

Solar photovoltaic panels

China has the largest national photovoltaic cell market in the world. As of 2019, the country accounted for about one-third of global installed capacity of solar panels (see below), as well as one-third of newly installed capacity. This is more than any other country and two and a half times more than the next-largest market, the United States (see below). By 2024, China’s cumulative photovoltaic panel installations could reach 486GW, far exceeding the US (179GW by 2024), India (112GW by 2024), Japan (95GW), and Germany (81GW).

China has officially encouraged foreign participation in China’s solar power industry since 2011. However, strong informal barriers have led to an absolute dominance of domestic solar panel manufacturers: they now supply almost 100 per cent of the domestic market. These barriers come principally in the form of a strong preference for domestic firms over foreign ones.[7] Price is a factor but, as the rail and telecommunications case studies also show, public procurement processes have been driven by state entities, which have incentives to favour local players or respond to the government’s aim to promote China’s solar industry. Foreign industry leaders have lamented that doing business in China is only possible by partnering with particular state-owned enterprises or local companies, and even this comes only at very low margins.

The combination of China’s closed market, and of its significant solar photovoltaic market size, creates several advantages for China’s solar photovoltaic firms.

Firstly, and most importantly, this has allowed Chinese solar photovoltaic firms to achieve significant internal economies of scale and bring down production costs – and hence sale prices. Serving the world’s largest market for their product but facing almost no foreign competition at home, Chinese solar firms have built up a much larger production capacity than their US or European counterparts.[8] China’s solar cell production capacity was 164GW per year in 2019, accounting for 76 per cent of world production capacity. In comparison, the Unites States’ and Europe’s share of photovoltaic cell production in 2019 was 1 per cent and 0.2 per cent respectively.

The decade-long advantage of large production capacity that China has enjoyed helped it created photovoltaic panel factories in China that are typically four times larger than those in the US. Larger production volumes and plants are crucial for cost reduction in this industry, as they mean more intensive machine utilisation. As early as 2013, researchers found that Chinese solar photovoltaic plants were more efficient than foreign counterparts overall because their machines were scheduled to run for longer with more production and output, thereby spreading costs over a larger number of produced goods. This is of particular importance to solar cell manufacturers, which can automate the production of solar photovoltaic panels without too much labour input.

Product and process standardisation is another benefit of larger production volumes and factories. Producing more allows the accumulation of expertise and thereby enables more efficient product manufacturing, such as the ability to produce thinner and larger silicon wafers. Process standardisation is a similar story: by producing in a larger quantity, plants can improve every step of the manufacturing process, such as finding better and more efficient ways to mount cells in a panel by using more advanced machines or processing techniques. Large solar photovoltaic manufacturing plants have a better chance of standardising their manufacturing processes and products, forming a virtuous cycle whereby the more they produce, the more proficient they become – and, in turn, the more they can standardise and increase efficiency, leading to lower per unit production cost.

Another internal economy of scale is a reduction in input prices. Researchers have found that, thanks to their market dominance, Chinese firms generally have a 10 per cent discount on most input materials compared to their foreign counterparts. Production equipment is, on average, 50 per cent cheaper for Chinese solar firms. The exact discount level differs depending on the size of the Chinese solar firms and their procurement strategies. But, overall, it contributes to lower production prices.

Chinese solar photovoltaic firms also benefit from valuable external economies of scale created by China’s uniquely dense and specialised manufacturing clusters. As Gener Miao, former chief marketing officer of Chinese solar panel manufacturer Jinko Solar, stated plainly: “we build solar all over the world, but China is the only place where every component we need is available just a few kilometres away.” In China, solar photovoltaic manufacturers benefit from a highly reliable and specialised supply chain, as well as from the assurance of smooth and continuous running of factories thanks to limited supply disruptions. This also means more tailored inputs, as well as more convenient and cheaper logistics, all of which reduce per unit production cost. Finally, it means cheaper intermediary goods, as a higher density of specialised production tends to lead to lower input prices.

Combined with subsidies for the entire photovoltaic value chain (photovoltaic plant and distributed photovoltaic power generation) and preferential access to abundant credit, [9] these advantages have allowed Chinese solar panel manufacturers to bring down production costs drastically and, with them, global prices. Worldwide, the price of solar panels fell by 80 per cent between 2008 and 2013. Some of this was caused by growing global demand due to abundant consumer subsidies in key target markets such as Germany. However, much of it was also precipitated by the emergence of China’s solar players. One study showed that, in 2013, Chinese photovoltaic system prices were up to 70 per cent cheaper than in the US, 63 per cent cheaper than in France, and around 50 per cent cheaper than in Germany and the United Kingdom.

Leading the world in low-priced solar, Chinese manufacturers captured international market shares in the early-to-mid 2010s, driving many US and European solar manufacturers out of business. By 2019, China produced 76 per cent of all solar photovoltaic cells globally, compared to 33 per cent a decade earlier; and seven of the top ten solar panel companies were Chinese. European regulators have not succeeded in dealing with this issue through the established mechanisms for anti-dumping and anti-subsidy cases, but have now – in the Comprehensive Agreement on Investment – made an attempt to condition Chinese investment in these sectors in Europe on a reciprocal opening of China’s market.Top 10 solar photovoltaic module manufacturers by shipment 2019

RankCompanyCountry2019 shipmentGrowth between 2018 and 2019Estimated market share1 Jinko Solar China 14.2GW +25 per cent 11.6 per cent

2 JA Solar China 10.3GW +17 per cent 8.4 per cent

3 Trina Solar China 9.7GW +20 per cent 8 per cent

4 Longi Solar China 9.0GW +25 per cent 7.3 per cent

5 Canadian Solar Canada* 8.5GW +20 per cent 7 per cent

6 Hanwha Q Cells Korea 7.3GW +33 per cent 6 per cent

7 Risen Energy China 7.0GW +46 per cent 5.7 per cent

8 First Solar US 5.5GW +104 per cent 4.4 per cent

9 GCL China 4.8GW +17 per cent 4 per cent

10 Shunfeng Photovoltaic China 4.0GW +21 per cent 3.3 per cent

Source: GlobalData; PV InfoLink. *The founder of Canadian Solar was born and raised in China, but the company is registered and based in Canada. Different research firms have different opinions about the company’s origins, with some listing it as a Chinese firm and others as a Canadian firm.

Chinese solar firms’ economies of scale are likely to increase. Jinko Solar recently started the construction of a 20GW solar cell manufacturing plant in China, which will be the world’s largest single cell-production plant, covering an area of around 666,500 square metres. Another manufacturer, GCL, is also planning to build a 60GW solar module factory in Anhui province. By contrast, South Korean firm Hanwha Q Cells’ largest solar module factory can produce up to 2.2 million solar cells per day, with an annual production capacity of 4.5GW as of 2020. No other foreign manufacturers have built, or are looking to build, plants of this size. This scale advantage has helped Chinese solar firms create a streamlined and scaled manufacturing process and enabled them to make highly reliable products. In the future, China looks set to continue to dominate the market and leverage its vast economies of scale.

Telecommunications

China’s telecommunications equipment market is the largest in the world. There are about 3.7 million 4G base stations in the country, accounting for around half of the global total. China also has one of the largest 5G markets in the world. As of 2020, it had already built 700,000 5G base stations, which is more than all other countries combined. By contrast, South Korea, which was the first country in the world to provide 5G services, is a distant second, with only 115,000 5G base stations in operation. China’s telecommunications equipment market is not only large but also growing quickly. Telecoms research agency Dell’Oro estimates that the global 5G equipment market will be worth $200 billion between 2019 to 2024, while China’s own estimates set 5G equipment expenditure at $87 billion between 2019 and 2023.

China supports the rapid development of its 4G and 5G networks for the same reason that it maintains a dominant market share for its firms at home: top Chinese political leaders (much like their European counterparts) see telecommunications technology as the backbone of a host of national priorities, including digitising the economy and building secure critical infrastructure. As a result, China has – unlike Europe – selectively walled off this market for years, first through formal market access barriers and now through a series of unofficial guarantees of market shares to local telecoms firms.

Since the late 1980s, foreign telecommunications companies have been permitted to sell and operate in China, although Chinese rules obliged them to do this through joint ventures with a local partner. They also had to transfer part of their technologies in exchange. This model benefited local firms such as Huawei and required compromise from foreign firms – but access to the new and fast-growing China telecommunications market meant that companies or governments were generally keen to pursue the opportunity.

In the mid-2000s, China switched to a strategy of effectively guaranteeing Chinese firms a sizeable share of the domestic market. This involved informal guidance issued by the government for China’s state-owned telecoms operators to allocate no less than 70 per cent of 4G orders to Huawei and ZTE. Such guarantees seem to have been replicated for 5G: in the 2020 tenders for 5G base station equipment held by China Mobile, China Telecom, and China Unicom, Huawei won around 50 per cent of total contract value. ZTE won 30 per cent, while Ericsson won just 10 per cent and Nokia almost nothing.

Access to this large and partially walled-off home market grants China’s telecoms equipment firms several advantages. Firstly, significant profits generated from domestic sales give them – and especially Huawei as the market leader – the ability to offer more attractive packages abroad, characterised by lower prices (crucial in the cost-driven and highly competitive telecommunications market, particularly in Europe) and a much greater level of customisation, despite the costs of this.[10] Huawei’s revenues and profits are significantly higher than Nokia’s and Ericsson’s: it earned $46 billion from its carrier business segment in 2019, compared to $27 billion and $28 billion for Ericsson and Nokia respectively. The same year, Huawei generated a profit of $17 billion compared to $10 billion for Nokia and $10 billion for Ericsson.

Higher revenues and profits also allow Huawei to invest more in research and development (R&D). Between 2015 and 2019, Huawei invested €59.13 billion in R&D, 50 per cent more than the combined R&D spending of Nokia (€21 billion) and Ericsson (€18 billion) – but only 12 per cent of its revenues, whereas Nokia and Ericsson respectively spent 20 per cent and 14 per cent of their revenues. Even assuming that only half of that amount went to Huawei’s telecoms equipment business unit, it is substantially more than that of its two European competitors.

Secondly, China’s telecommunications equipment vendors benefit from external economies of scale in the form of preferential access to a dense, diverse, and specialised workforce. With much shorter product life cycles than the solar and rail sectors also covered in this paper, telecoms equipment requires the rapid development of new equipment design and technology solutions. Hence, access to a large pool of specialised engineers is key to achieving a competitive advantage in the industry. The average R&D personnel cost in Europe is $120,000-150,000 per annum; at Huawei, it is only $25,000 per annum. Of Huawei’s 150,000 employees worldwide, around 45 per cent work in R&D. This advantage is recognised by the founder of Huawei: “thanks to the large number of talented individuals in China, we have gained a unique competitive advantage – low R&D costs.”

Thirdly, Huawei’s size and financial strength increase its credibility with foreign operators, which believe that the firm will still be operating and able to provide equipment and services by the end of their contract. That credibility is enhanced by Huawei’s track record of building China’s 4G and 5G networks, which means its products are widely tested and perceived as technically reliable.

These factors are the most crucial for Huawei’s line of business, but they are possibly not the only advantages that it derives from its size. Huawei’s scale may also allow it to obtain cheaper inputs, for example, which might contribute to lower financing costs. Combined with other direct advantages – including government subsidies, tax breaks, and export credits, as well as political backing for overseas activity – this has allowed the company to be highly competitive in foreign markets and to quickly gain market share in different countries. Today, Huawei is typically able to price its products around 10-30 per cent more cheaply than its competitors. Combined with high-quality, innovative, and popular products, and credibility with buyers, this has led to growing Huawei market shares in countries around the world. Dell’Oro figures show that Huawei’s global revenue share jumped from around 20 per cent in 2014 to 31 per cent in mid-2020, at the expense of Nokia – which dropped from 21 per cent in 2014 to only 14 per cent now – and Ericsson, whose global revenue share has decreased by around 4 percentage points over the last five years.

The effect on competition of China’s ‘protected home market advantage’ is already visible in the telecommunications sector, even if it has not yet been as significant as in the solar photovoltaic industry. Huawei’s low pricing in the international market is often given as the reason for the merger of telecoms companies Alcatel and Lucent in 2006, and for the collapse in 2009 of major Canadian company Nortel, many of whose assets were sold to Ericsson. Huawei’s arrival in the European market in the mid-2000s eroded these companies’ profitability to the point where restructuring became essential.

Huawei has recently experienced setbacks such as market share losses in various advanced economies following security concerns. However, the company will continue to leverage its economies of scale by providing reliable and affordable telecommunications equipment in the global market and expanding its footprint in cost-sensitive developing countries.

Rail rolling stock

Foreign companies such as Alstom, Bombardier (now Alstom-Bombardier) and Siemens (now Siemens Mobility) have formally been able to operate in China via joint ventures for several decades. Since the mid-2010s, they have even been allowed to set up wholly owned subsidiaries on the ground. However, strong informal market barriers have kept their participation very low. As in the solar and telecoms sectors, the main buyer of rolling stock in China is a state-owned entity, China Railway, which has tended to favour home players in its procurement processes. Preferential procurement is typically hard to document. However, China’s main rolling stock manufacturer, CRRC, accounts for 86 per cent of China’s total rolling stock market volume (with the remainder mostly taken up by other Chinese players) and close to 100 per cent of the high-speed rail rolling stock market.

This vast protected home market creates several important advantages for CRRC. Firstly, the size of China’s rail rolling stock market means the company can achieve significant internal economies of scale. As with solar and telecoms, China now has the largest rolling stock market in the world, accounting for more than one-quarter of global rail rolling stock revenues between 2017 and 2019, as well as 67 per cent of global high-speed rail length, and almost 50 per cent of all rolling stock in operations.

Furthermore, given its dominant position in China, CRRC is now the world’s largest rolling stock manufacturer. It is almost four times larger than Siemens Mobility, the second-largest player (CRRC’s revenue was €32 billion in 2019 versus €9 billion for Siemens). CRRC’s scale comes with significant production capacity and plant size. The company’s largest plant, Sifang, has a turnover of €5.85 billion for rolling stock only. Combined with CRRC’s second-largest plant, in Changchun, they reach a turnover of more than €10 billion, or more than any of Siemens Mobility’s, Bombardier’s, or Alstom’s entire rolling stock businesses. Moreover, the Sifang factory covers 1.77 million square metres – approximately the size of Monaco. By comparison, Alstom’s largest production site, a high-speed train manufacturing plant in La Rochelle, occupies an area of 300,000 square metres – nearly six times smaller.

In the rail equipment sector, larger factories and production capacity are key to achieving internal economies of scale. Because they allow for more standardisation of the production process – single tasks that are set up and repeated – they help increase production efficiency. In turn, factory size and process standardisation favour capital investment and automation, which also contribute to greater productivity.[11]

These advantages are further amplified in China because China Railway tends to demand very similar features from one contract to the next. As a result, CRRC only produces a handful of train models at any point in time, further raising efficiency. This contrasts with Europe, which has a large but more fragmented market. In the European Union, requirements from rail operators will often differ from one contract to the next, forcing rail companies to readapt production processes each time. This creates higher set-up costs and longer production cycles than for Chinese competitors.

Beyond more efficient production processes, CRRC’s size also means it has strong bargaining power with its suppliers. For example, in the past few years, China Railway has pressed rolling stock manufacturers to cut the price of new trains, but CRRC maintained its profitability by using its market power to demand lower prices from its own suppliers. Multi-year plans for rail, set by the government, also enable CRRC to plan manufacturing volumes years ahead, allowing it to order inputs in bulk and likely negotiate lower costs. In contrast, firms such as Siemens Mobility and Alstom-Bombardier face unpredictability in terms of future contracts because of the competitive processes in their main markets. They need to order from suppliers one contract at a time, which gives them less bargaining power.

A vast protected home market also allows CRRC to accumulate substantial profits in China – which the company can, in turn, reinvest in research and development (R&D) or global expansion. CRRC registered €1.76 billion in net profits in 2019, compared to €983m for Siemens Mobility and €630m for Alstom. This allowed CRRC to invest significant amounts in R&D: €1.57 billion in 2019, or double the combined R&D expenditure of Alstom (€302m), Bombardier (€112m for the transport unit), and Siemens Mobility (€351m). Higher R&D levels help CRRC produce high-quality and cutting-edge rolling stock products, and compete more intensely with its European rivals.

Combined with direct government support (CRRC receives around €450m per year in subsidies), these factors enhance CRRC’s ability to challenge its rivals in overseas markets. Reviewing available tendering information, the authors found that CRRC sets prices typically 10-15 per cent lower than the next-best offers in overseas bidding. In some cases, that difference can be as much as 30 per cent, with CRRC bidding even below clients’ official budget. Part of that difference derives from CRRC’s low production costs, and part from its financial strength: high profit margins in China give the firm more pricing flexibility abroad.CRRC bidding prices on various contracts

City/countryDateCRRC bidding pricePrice difference (with next best offer)Mexico City metro 2020 37,374.7m pesos -31 per cent

US Boston 2014 $567m -20 per cent

US Philadelphia 2017 $138m -20 per cent

US Chicago 2016 $1.3bn -15 per cent

India Bangalore Metro 2020 Rs 1578 crore -14 per cent

Portugal Porto 2020 €49.6m -13 per cent

Romania 2019 €306m -10 per cent

Istanbul* 2016 €277m -6 per cent

US – Los Angeles 2017 $178m (base order); could reach $647m -11 per cent (base)

-4 per cent (total)

Ukraine – Kharkiv* 2020 €44m -1 per cent

Source: Rhodium Group. *In Ukraine and Istanbul, CRRC faced local rather than European or Canadian competitors, which helps explain the smaller price difference.

CRRC’s price advantage, coupled with its high-quality and innovative products, has allowed it to gain ground in global markets. As of 2019, CRRC’s global market share of rolling stock was more than 50 per cent, up from 24 per cent in 2014 (see below). This far exceeds its three largest competitors combined: Alstom, Bombardier, and Siemens Mobility together held 38 per cent of global market share as of 2019. Although much of CRRC’s revenue comes from China – and CRRC’s revenue outside China also remains behind that of Bombardier (€6.8 billion), Alstom (€8 billion), and Siemens (€8.5 billion) – its growth is impressive. CRRC’s overseas revenue has increased from €298m in 2010 to €2.5 billion in 2019 – much more than the single-digit growth of the rail rolling stock market outside China.

Though it is not yet as drastic as in the solar and telecommunications sectors, the protected home market effect on European players has already driven industry reorganisation, with the failed Siemens-Alstom merger in 2019 and the successful Alstom-Bombardier merger in 2021. Its effects could be even more significant in the longer run, especially in third markets.

No comments:

Post a Comment