Main findings and conclusions

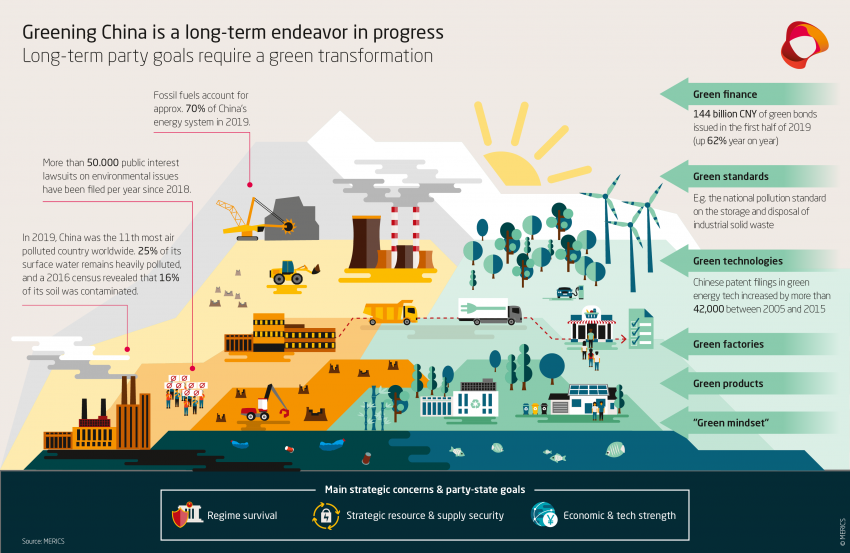

China’s leadership acknowledges climate change and environmental degradation as real and pressing threats to long-term regime survival and economic prosperity. However, while a trend towards a concerted push for sustainability shows in national-level policies, the lack of forceful sectoral and local-level incentives leaves China with a mixed track record on sustainability.

China’s Covid-19 stimulus measures are more targeted at investing in carbon-heavy infrastructure for economic stability. However, the pandemic has not stopped Beijing’s policy machinery for more sustainability and a greener economy.

China’s authorities pursue a non-disruptive and incremental green policymaking approach, always concerned about political stability and economic costs.

Beijing’s strategic bet for its sustainable future is on achieving state-guided and funded technological breakthroughs in, enabling a green transformation at home and global tech leadership in all areas, from renewables to environmental protection equipment.

China’s state-supported R&D efforts show first results in green technology innovation, but a large number of green tech patents (e.g., in wind power) does not necessarily translate into high-quality outcomes.

The greening of China’s manufacturing system is key for realizing a more sustainable economy. The transformation is making headways, but green growth and product performance are lagging.

China’s green ambitions will continue going forward: the forthcoming 14th Five-Year Plan (2021-2025) is expected to drive decarbonization and indigenous tech innovation, however, without proposing overly ambitious climate actions.

China’s ambitions should be taken seriously: building on past successes (e.g., in wind, solar and e-mobility), China strives to assume global leadership in green technologies and sustainable solutions.

China’s green trajectory comes with opportunities and challenges for European actors. International cooperation for the greater good of mitigating global warming is urgently needed. At the same time, competition for green tech and manufacturing process must be carefully managed.

1. China has grand ambitions for greening, but a mixed track record

China’s party and state leader Xi Jinping declared a carbon-neutral China by 2060 when he addressed the United Nations General Assembly in September. The target took many observers by surprise. China’s sustainability record has been mixed: Beijing’s Covid-19 stimulus has relied heavily on polluting industries, and China’s Nationally Determined Contributions (NDCs) to curbing global warming are considered weak by organizations tracking international climate policy (exhibit 1).1 Continued investments in fossil fuel have also cast doubt on China’s commitment to sustainable development.

However, recent pledges to sustainable development by high-level officials serve as reassuring confirmation that Beijing has not lost sight of its green ambitions. In November, President Xi emphasized the strategic importance of eco-environmental investments for China.2 Observers were hoping to see China use the UN Climate Conference (COP26) in Glasgow, initially scheduled for November 2020, as an opportunity to take “the driver’s seat on climate”3 by filling the void left by the Trump-led US administration’s retreat from international climate agreements. COP26 had to be postponed till November 2021, so China may yet step up to play a stronger role. A closer look at top-level policies reveals that a systemic transformation towards more sustainability is indeed taking place – slowly, but steadily.

Exhibit 1

1.1. China upholds efforts for sustainable development even in Covid times

China’s rapid economic growth since 1978 has been fueled mainly by coal. Combined with poorly regulated impacts of industrial production, this led to severe environmental damage to air, land and water. China overtook the US as the world’s largest emitter of greenhouse gasses in 2006. Today, it is the source of over a quarter of global carbon dioxide (CO2) emissions. China’s government acknowledges the unsustainability of this development path and has started to attach greater importance to green growth and climate action, especially with regard to pollution.

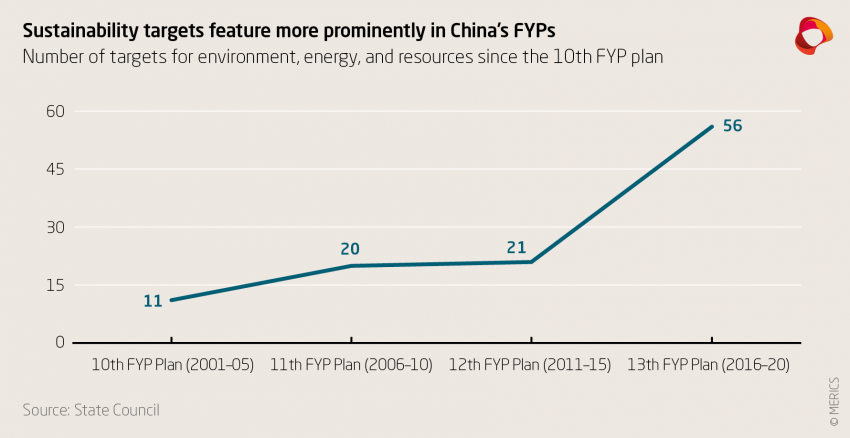

Domestic sustainability targets have been included in China’s Five-Year Plans (FYPs) for social and economic development since 2001 (the 10th FYP). Since then, targets for the environment, energy transition and resource efficiency have proliferated (exhibit 2). Concepts promoting sustainability have become intrinsic parts of national policymaking (exhibit 3). Environmental regulations and emission standards are becoming stricter, and fighting pollution has become a top-level priority.

Exhibit 2

Exhibit 3

China’s green trajectory has been slowed down by the Covid-19 crisis, but it will remain high on Beijing’s long-term agenda. The government’s Work Report presented at the National People’s Congress (NPC) in May emphasized damage control, employment, and economic stability. These priorities may slacken sustainable development and counteract China’s green goals. For instance, prioritizing support for the domestic job market could drive up emissions as local governments tend to favor low-risk investments in heavy and polluting industries such as coal power plants. However, though China’s post-Covid economic stimulus lacks an explicitly green dimension, the pandemic crisis has not halted efforts to promote sustainable development (exhibit 4).

Exhibit 4

1.2. Strategic concerns ensure a green transformation stays on Beijing’s agenda

The Party-state has three strategic concerns that suggest Beijing’s ambitions for greater sustainability must be taken seriously. Firstly, regime stability is the main driver of Party-state leadership. With the CCP ruling everything,4 delivering both a livable environment and continuous growth are key to regime survival and its notion of legitimacy. A healthy climate and environment are increasingly important to the public as well. Severe pollution causes a million premature deaths and costs hundreds of billions of Chinese yuan a year.5

Secondly, worsening relations with the US and other providers of strategically important goods and raw materials lead Beijing to strive for more strategic autonomy and security. China is a net-importer of grain, soy, oil, gas and other vital commodities. Food and energy security are thus highly susceptible to external shocks. Sustainable policy for industry and agriculture is furthermore aiding the goal to make domestic supply chains more efficient and self-reliant, especially when it comes to reducing imported critical resources.

Thirdly, more sustainable economic upgrading is seen as a great opportunity for assuming tech leadership. Programs such as “Made in China 2025” (MIC25) push for rapid advances in domestic innovation. “Green technologies” (绿色技术) are means of high strategic value in this regard. Beijing hopes to repeat success stories like the domination of the global solar panel market by Chinese companies, such as Jinko Solar and Suntech Power. It wants to clean up China’s environment without foregoing growth, with the added benefit of establishing China as a globally competitive innovator and high-tech superpower.

To establish sustainability in all spheres of life and fulfill the ambitious goal of creating a “beautiful China”, Beijing has launched a centrally orchestrated, non-disruptive and incremental push affecting science, technology, industry, policy making and everyday life. China’s top-level policy making is gradually moving towards promoting green notions at all levels, albeit at variable speeds and scope.

Beijing’s green policies are mostly industry or region-specific, often rolled-out in a piecemeal fashion, and tend to clash with policies aimed at fostering fast growth and social stability. Officials are often reluctant to promote green initiatives, because they fear negative socioeconomic impacts like job losses and a decline in output performance.

If such discrepancies between strategic vision at the top level and practical implementation on the ground prevail, the transformation involved in greening China will remain partial and slow. If structural shortcomings are overcome, however, Beijing’s sustainability agenda could lead to system-wide change.

1.3. Grand rhetoric and mixed results characterize China’s sustainability drive

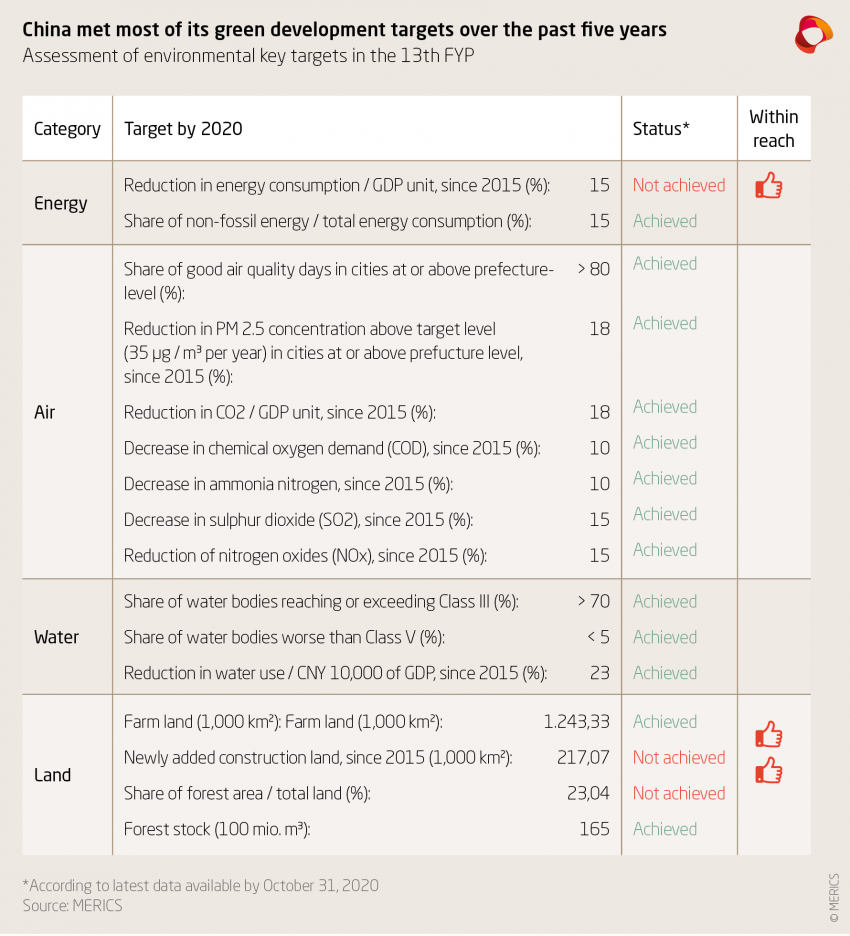

China’s road to sustainability is paved with grand rhetoric. In spring 2020, President Xi said an “ecological environment itself is the economy.”6 China’s green development has certainly progressed under the current 13th FYP (2016-2020). Thirteen out of 16 major green targets have already been met – and the remainder are about to cross the finish line (exhibit 5).

Exhibit 5

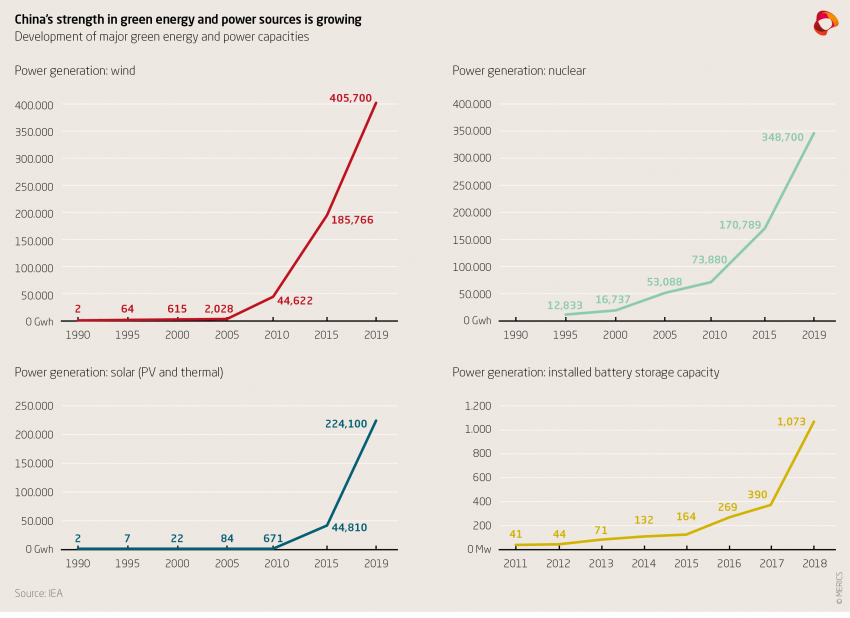

However, these achievements must be put in context. For instance, China’s energy transition has made remarkable progress over the past 20 years (exhibit 6), and state-owned utility corporation State Grid has become a global behemoth in ultra-high voltage (UHV) electricity transmission technology – enabling swift distribution of renewable energy. Yet China’s share of renewable energy in domestic total primary energy consumption in 2018 was 12.7 percent, lagging behind the EU which had 14.1 percent.7

Exhibit 6

Progress has also been made in other areas: China’s government stepped up efforts to promote municipal waste recycling and wildlife protection. China’s first national fund focusing on the ecological environment was set up in July. It has already raised 88 billion CNY and is expected to become the country’s second largest national fund, smaller only than the “Big Fund” for China’s chip industry.8 And Tsinghua University published a roadmap for China‘s carbon neutrality by 2060 – the most authoritative research on the matter so far – only 20 days after President Xi’s pledge.9

There are, however, many to-do items left on China’s sustainability agenda. Beijing has not yet imposed strict limits on Chinese investments in carbon-intensive projects abroad. And China is still banking on “dirty” energy sources, even though it is a leader on annual installments of renewable energy.10 Nonetheless, China added almost 20 gigawatts (GWs) of coal power capacity in the first half of 2020, and approved an additional 48 GWs from new coal plants – more than Germany’s entire coal fleet.11 Furthermore, the launch of China’s emissions trading scheme, which was officially announced in 2017 and slated for nation-wide implementation in 2020, has recently been postponed.

2. Technological innovation is a key pillar of China’s green transformation

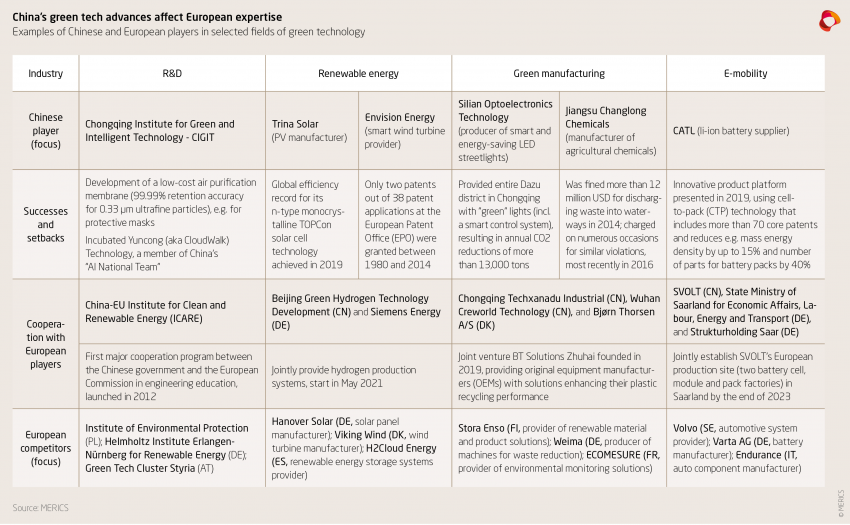

China’s green transformation is being pushed forward by advances in energy-related technologies (e.g., energy conservation and alternative energy) and smart grid and transportation technologies (esp. charging stations for electric vehicles, EVs).12 China’s tech giants such as Alibaba are also major promoters of green tech. Alibaba’s subsidiary Ant Financial co-founded China’s “Green Digital Finance Alliance”. It also launched the Ant Forest app, which gamifies carbon footprint tracking and had already contributed to 150,000 tons of CO2 savings by February 2017.13 In the course of expanding Chinese companies’ tech capabilities, there have been both successes and setbacks (exhibit 7).

Exhibit 7

2.1. Green tech development is well-supported at many levels of government

Beijing attaches high strategic value to green technologies – a term that in the Chinese policy context refers to virtually any technology, material or equipment that is conducive to climate action and promotes a circular, sustainable economy. A slew of plans including the “13th FYP for Strategic Emerging Industries”14 and MIC25 push for advances in such green technologies.

China has also made inroads into technologies that are less obviously green but may still contribute to greater sustainability, such as artificial intelligence (AI) and cloud computing. Alibaba’s ”City Brain” platform, for instance, has been applied to urban areas around the globe to streamline traffic and thus reduce air-polluting travel time.

Governments at all levels provide financial support and promote pilot projects to advance both the development and use of green technologies. Jilin province, for instance, incentivizes the use of special pumping technologies for climate control in energy-saving buildings with subsidies of up to 60 yuan per square meter.15 The Chinese leadership also releases catalogues and sets targets to guide companies, research institutions, and investors towards green tech upgrades.

China’s leadership recently also started to push for low carbon data centers. The environmental impact of this sector needs to be reduced urgently: last year, China accounted for 23 percent of data centers worldwide and they are still mainly powered with coal-generated electricity. If nothing changes, they could produce 163 million tons of CO2 emissions by 202316 – roughly equivalent to the United Kingdom’s annual emissions of passenger cars.

2.2. China’s green tech research starts to pay off

Breakthroughs in technologies and equipment that enable more efficient resource use, for instance, are highly desired. The government has therefore nominated 60 “Comprehensive Industrial Resource Utilization Bases”.17 The Beijing-Tianjin-Hebei region aspires to become a major hub within this field: 50 centers for industrial resource utilization are due to be set up there during the next two years.18

Private companies are the main actors in the renewable resource industry, producing more output and operating more profitably than state-owned enterprises (SOEs). Some of them even excel internationally: In 2018, for instance, Chinese waste and resource recycler GEM – the world’s biggest battery recycler and thus a crucial part of China’s EV supply chain – won the World Economic Forum-sponsored runner up award as a “Circular Economy Multinational”. Gree Electric Appliances, one of the China’s leading appliance manufacturers, is a finalist for the Global Cooling Prize thanks to its “breakthrough technology” – an innovative and green residential cooling solution jointly developed with Tsinghua University.

China’s green technologies have benefited greatly from national R&D efforts. The number of projects as part of the “National High-Tech R&D Program” (863 Program) in resource and environmental sciences increased significantly between 2009 and 2013. The government also raised the share of the respective budget allocation from 9.7 percent in 2012 to 14.8 percent in 2013,19 underscoring both the growing importance of green tech innovation and China’s commitment to it.

On the output side, the number of environment-related patents in China increased too, growing more than 60 times between 1990 and 2014, compared to only three times across the Organization of Economic Cooperation and Development (OECD) area.20 Last year, China even held the highest number of world-class patents in three fields for future green technologies: recycling, water, and waste treatment. China is also on its way to the global forefront of renewable energy technologies. With only two percent of China’s patents in wind power technology having qualified as world-class patents in 2019, however, China’s research efficiency in this field is remarkably low.21 The ratio of green patents in all Chinese patents is also still lower than that of OECD countries.

Overall, China’s government must find a balance between strict enforcement of environmental regulations and a drive for green tech advances versus the need to avoid undermining the existing – often heavily polluting – industrial base upon which the livelihoods of millions of Chinese depend. The example of Guiyu, an infamous e-waste processing site, showed how government measures to regulate environmentally hazardous recycling practices led to not only a greener environment but also shutdowns of workshops that thousands of people had relied on for a living.

The relocation of polluting industries from northern and coastal regions to sites further inland – for the purpose of evading stricter international and regulatory scrutiny – is another example of unsustainable approaches to the greening of China’s industry.22

3. The green transformation of manufacturing is making headway

Manufacturing lies at the core of China’s efforts to develop a greener and more competitive economy. Between 2003 and 2011, the green growth efficiency of China’s manufacturing industry notably improved. To support green industry transformation, localities such as Beijing and Shanghai announced major initiatives,23 and the Green Manufacturing Association of China (GMAC) was launched in 2017.

This year, a group led by the Chinese solar product manufacturer LONGi initiated the “RE100 China Pathfinder Pledge” to get more Chinese companies to commit to the global RE100 initiative for businesses that pledge to go 100 percent renewable on energy. Previously, only two Chinese companies had signed up for it by 2018.

Despite some progress, major green goals for China’s manufacturing industry have not been met, such as the 2020 targets to reduce industrial energy intensity by 18 percent and CO2 intensity by 22 percent compared to 2015.24 A 2017 study on the green growth performance of 30 industries still identified seven “light brown” (e.g. transport equipment manufacturing), five “dark brown” (e.g. metal products) and nine “black” pollution-intensive industries (e.g. pharmaceuticals).25 The greening progress of China’s economy is still highly fragmented.

3.1. China uses a variety of tools to stimulate industrial greening

The Chinese leadership uses different tools to promote a green transformation of industry. Most notably, these include local clustering, incentives for more private sector participation and green funding, state procurement and standardization.

The government banks on a cluster approach in promoting showcase areas of expertise, e.g., in the form of “Circular Economy Pilot Cities” (such as Tianjin) and “Green Industry Demonstration Bases” – a new initiative aimed at creating market-oriented green innovation systems and green champions in qualified industrial parks. How successful these bases will be is yet to be seen. China’s eco-industrial parks (EIPs), however, have already shown promising results according to a study by German development experts.26 They stepped-up the reuse of both water and solid waste by more than 90 percent each between 2011 and 2015, yet still managed to remain competitive. However, EIPs account for only ten percent of China’s industrial parks, and challenges remain with regard to upscaling and insufficient private sector participation.

With a view to getting more private companies on board, Beijing in May released recommendations to improve market conditions for private companies that engage in energy conservation and environmental protection, e.g., via tax relief.27 Public-private partnerships (PPPs) have also gained prominence. Last year, almost 60 percent of China’s PPPs dealt with pollution prevention and green low-carbon technologies.28 More than 500 environmental non-governmental organizations (NGOs) and foundations are also contributing to greater sustainability in Chinese industry, e.g., by raising awareness of green product consumption.

It is estimated that China’s green transition requires an additional 40.3 trillion CNY.29 Encouraged by the state, green financing has become a big deal in China. Almost 200 green bonds worth 282 billion CNY were issued domestically last year.30 China thus ranked second only to the United States in this regard, followed by France and Germany. However, much more capital is required for a full-fledged greening of China’s economy.

To accelerate and improve China’s sustainable industry transformation, the government also engages in priority procurement of green products and services. By the end of 2018, more than 90 percent of products acquired by the bureaucracy were considered energy-efficient and environment-friendly.31

Finally, a standards system for green manufacturing that covers all aspects – from resource input to emissions reporting and eco-design evaluation – is envisioned for industry-wide use by 2025. Things are progressing fast. The framework for green factories was largely completed last year, and hundreds more standards are in the making. However, company inspections reveal that green standards are not always adhered to. In 2017, 70 percent of almost 14,000 inspected companies in northern China failed to meet air pollution standards.32 And as the government acknowledged itself in a report last year: “Laws, regulations and standards for green manufacturing are underdeveloped” and “resource utilization in the manufacturing sector is still far below world-class efficiency levels”.33

3.2. Work remains to be done on green products

In addition to a national plan, about 80 provinces and cities drew up their own schemes for green manufacturing. Taken together, this should create a nation-wide manufacturing system that adheres to green standards and focuses on clean production and resource utilization at all stages of a product’s lifecycle and supply chain. Both the upgrading of traditional industries, such as steel, and the creation of internationally competitive, outright green industries such as new energy vehicles (NEVs) are key aspects of greening China’s manufacturing industry.

Exhibit 8

Beijing identified four elements that are crucial for walking “a highly-efficient, clean, low-carbon, and circular green development path”34: green factories, green products, green industrial parks and green supply chains. These are the cornerstones of China’s green manufacturing system, which is rapidly taking shape. It already consists of more than 2,120 green factories (mainly in machinery, electronics, building materials and light industries) and 170 green industrial parks (exhibit 8) – much more than what was aimed for by 2020.

The development of green products, however, seems to be lagging. But even though efforts were stepped up this year, the current number of 3,240 green products is far from the envisioned 10,000. One reason for the faltering expansion of green, that is, organic and certified products could be consumer dissatisfaction. A survey of more than 9,000 Chinese consumers in 2016 showed that almost 23 percent were unhappy with the quality of green products; about 47 percent even called the credibility of producers into question.35 In spite of rapid progress in greening China’s manufacturing industry, a lot of work still needs to be done.

4. The way ahead: Is China’s green deal good for Europe?

The upcoming 14th FYP (2021-2025) represents the next big opportunity for China to push for the structural changes needed to facilitate a green transformation. The FYP, which is being finalized for release in March 2021, will define the near-term trajectory of China’s development.

4.1. The 14th FYP emphasizes climate action and innovation, but no change in gear

The 14th FYP’s outline document confirms that Beijing will remain committed to sustainable development over the next five years. The “Proposal”, which was passed in October, suggests that energy reforms, decarbonization, environmental protection and a green transformation of the development model will play a key role. More support for Chinese companies and innovation in green technologies such as hydrogen and carbon capture are also planned.

With emissions set to peak before 2030, the upcoming 14th FYP will likely include emission caps or quotas, more barriers to investments in coal capacities, and support for renewable energy investments. The Proposal also promotes “a comprehensive green transformation of economic and social development”,36 using much stronger wording than before. It seems likely that the integration of environmental standards into China’s corporate credit system will be strengthened to increase company involvement and compliance. Sustainability will most likely also become more important as a performance indicator for state officials. Finally, the Proposal suggests an even stronger focus on indigenous innovation in the upcoming FYP-period with a view to taking the lead in future (green) technologies.

These signals should be taken seriously as previous advances in green energy have demonstrated how effectively a policy push from Beijing can translate into global industry and tech dominance. However, a green transformation of China’s economy can only be achieved if the balancing act between regional and national as well as economic and environmental interests is handled successfully.

4.2. China’s sustainability drive requires Europe to square cooperation with competition

If China manages to put its economic model on a greener trajectory, it will have a transformative impact on both business and public sector engagement with China. European stakeholders will have to strike a difficult balance; they will need to cooperate for the greater good to mitigate global warming while also competing for leadership in green technologies and manufacturing.

Recent high-level pledges and the dynamism of China’s internal green transformation must be taken seriously. But the coming months will put China’s global sustainability drive through a series of critical tests.

First, if China’s leadership pushes ahead on its sustainability agenda this will take China closer to its goal of global dominance in future green technologies such as green hydrogen. China already has an impressive track record in scaling up clean energy technologies. Its domestic market is vast and highly dynamic, functioning as a major catalyst in these fields. It will therefore be a matter of growing strategic importance for international stakeholders to ensure that foreign companies have access to and encounter a level playing field on the Chinese market. It will have major long-term consequences whether the development of green technologies such as new energy, e-mobility and environmental protection plays out with equal market opportunities for all in China, or not.

Second, the 2021 diplomatic calendar contains real opportunities for China to support a green transformation beyond its borders, e.g., when hosting the UN Convention on Biological Diversity (CBD COP15) in May. As the world approaches the COP26 meeting in November, the key question is whether China’s high-level talk will translate into more concrete commitments in global climate negotiations, with positive ripple effects for other countries – especially in the global South – to follow suit. Mechanisms such as the “EU-China Partnership on Climate Change” and the novel “High-Level Environment and Climate Dialogue” are promising vehicles for advancing an emissions trading scheme and climate-related tech cooperation on common terms. However, China’s commitments to a mutually beneficial and greener course have often failed to result in concrete actions in the past.

Finally, China is the biggest creditor worldwide and could thus take the lead in managing global investments in a more sustainable manner. Overall, however, Chinese investments in the “Belt and Road Initiative” (BRI) have neither promoted a circular economy nor lived up to international green standards.37 As new Chinese projects come online across the globe, the energy and climate footprint of these projects will show how serious China is about curbing emissions and promoting green investments. China should thereby be held accountable if it chooses “greenwashing” of its global industry and tech expansion instead of promoting sustainable development abroad.

The EU needs a clear roadmap to balance its cooperative agenda with efforts to strengthen its own green industrial and tech base. China’s push to take the lead in future technologies should be a wake-up call for European companies and governments alike. There is a real risk that while Europeans march ahead jointly with China on the global climate agenda, they will be outrun by China’s state-led global green innovation drive. The new 1 billion EUR innovation fund for low-carbon technologies in support of European innovations and green tech applications is a step in the right direction.

No comments:

Post a Comment