Jessica Larsen

Many Western observers consider Chinese President Xi’s projected multibillion-dollar Belt and Road Initiative (BRI) to be an economic and foreign policy tool helping China reach global power status. Developing roads, ports, railways and telecom networks across the world, China is criticised for trying to take control of foreign states’ critical infrastructure, even in the EU. The Chinese logistics giant COSCO is the majority stakeholder in operations in Greece’s largest port, Piraeus, as well as in container terminals and dry ports in Spain. Increasingly, China is also approaching the Baltic states of Latvia, Estonia and Lithuania.

This policy brief explains the Baltic states’ paradoxical experience, the implications for the Baltic states – and, by inference, for the EU.

China targets a Baltic sweet spot

Seeking to close a gaping Eurasian infrastructural gap since the collapse of the Soviet Union, the BRI ambitiously aims to carve out an economic corridor straight to the Baltic Sea. This means direct access to the EU’s common market and should also be seen as part of China’s interest in the Northern Sea Route as a self-proclaimed ‘near-Arctic’ state. Several projects are being considered, such as port construction in Lithuania, a massive underwater corridor between Estonia and Finland, and the omnipresent Huawei 5G option.

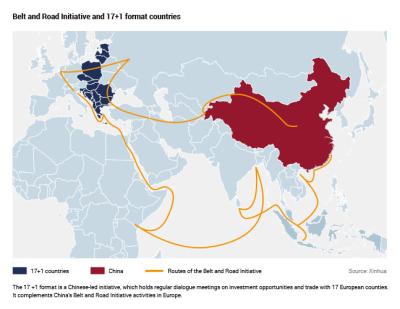

Complementing the BRI, the recent Chinese-led initiative called the ‘17+1 format’ holds regular dialogues on investment opportunities and trade with seventeen Central and Eastern European states, including the Baltic states, nine other EU member states and EU candidates.

China potentially hits a sweet spot. There have been calls in the Baltic states for improvements to basic physical and digital infrastructure. The recent Three Seas Initiative attests to this need. Chaired until recently by Estonia, this Initiative convenes the twelve EU member states that sit around the Baltic, Adriatic and Black Seas, though it is a format outside the EU framework.

In 2020 the Three Seas Initiative established an investment fund to attract much-needed resources for infrastructure in the transport, energy and digital sectors. It points to the region’s outdated infrastructure and the related economic disparity that this results in within the EU. The coronavirus pandemic only increases these needs, as states question their supply chains and critical infrastructure. Is China able to tap this potential?

There have been calls in the Baltic states for improvements to basic physical and digital infrastructure.

China alienates Baltic democracies

So far, the answer has been no. The reason is China’s behaviour in economic, diplomatic and security matters.

First, China’s economic impact is negligeable. The BRI has so far failed to deliver because business cases have proved unprofitable, violate environmental standards or are incompatible with EU law. Chinese foreign direct investment (FDI) is also insignificant: its cumulative value in each Baltic state since 2000 has been EUR 0.1 bn, compared to EUR 1.2 bn in Denmark and EUR 22.7 bn in Germany. Likewise, while the Baltic business community may see the 17+1 format as a good opportunity, its structures are ambiguous, and there is disappointment that China only uses the format to feel out states sympathetic to its agenda, like Hungary and Serbia. No project has thus far materialised in the Baltic. Far from the envisioned megaprojects, China mostly sits on bits and pieces with shares in Baltic engineering and manufacturing.

Secondly, China interferes in domestic politics when the Baltic states show support to democratic freedom movements. China froze diplomatic ties with Estonia following a visit to the latter by the Dalai Lama in 2011. Lithuania’s engagement with Taiwan sparked strong reactions from the country’s Chinese embassy, and a 2019 event in Lithuania in support of Hong Kong ended in violent counter-protests with allegations of Chinese support. Given that the Baltic states are still acutely conscious of earlier Soviet oppression, China is gnawing on an open wound.

Thirdly, China figures as a security concern. The Baltic security community is increasingly discuss Chinese cyber espionage in its threat assessments and believes that state-funded Confucius Institutes provide cover for Chinese intelligence operations.

No less alienating from a Baltic perspective, is China’s military cooperation with Russia, the Baltic number one security threat. Most visible are the joint naval exercises in the South China Sea (from 2012), the Mediterranean (2015) and the Baltic Sea (since 2017).

In sum, China has not delivered on its economic promises, and the way it interferes in domestic politics and collaborates with Russia crosses a major Baltic red line.

Redirecting EU attention

Still, observers warn of China’s general ability to undermine European unity by using investments to establish lasting influence over strategic sectors inside the EU. The warning has been heard: the EU’s 2019 China Strategy calls China a systemic rival, and the EU’s Cyber Security Act was updated the same year. A 2020 toolbox – with input from the Baltic states – seeks to help member states secure their 5G networks. Moreover, the European Commission increased funding for the 2018 EU Connectivity Strategy, widely considered a response to the BRI, to enhance the Trans-European Transport Network.

In sum, China has not delivered on its economic promises, and the way it interferes in domestic politics and collaborates with Russia crosses a major Baltic red line.

The Baltic states have also responded. Lithuania finds use it its screening law limiting foreign investments in strategic sectors. Latvia and Estonia are working on similar bills. Memoranda of Understanding with the US on the Baltic states’ position regarding 5G are also on the table. But while these policy initiatives support the EU and its member states’ outward engagement with China and protect against the potentially adverse effects of Chinese investments, they do not help direct attention inwards within the EU to the reason for the Chinese interest in the first place: the gaps in the Baltic states’ infrastructure.

Amid the EU’s mounting policy focus on China, the EU also needs to direct attention to the Baltic states to show that it can deliver a convincing alternative. EU institutions must be more visible in dedicating resources to the short- and long-term economic and security needs of the Baltic states (and their neighbourhood) to ensure that the EU’s interests, values and goodwill remain intact in areas where China is seeking influence, thus countering potential centrifugal tendencies. With Denmark’s coming value-based foreign policy, this is an area where Denmark can push the EU agenda. It is a matter of moving beyond EU policies shaping the image of China as a systemic rival and establishing a level playing field – to playing on this field as well, in other words, to walk the talk.

Concretely, the EU should strengthen support to internal connectivity in transportation, energy and digitalisation by, for example, tightening the links between the Trans-European Transport Network and the Three Seas Initiative. The Baltic states could coordinate their approach on screening laws, and EU toolboxes could be firmed up through binding rules. On security, Baltic states’ perceptions of China as a security threat relate not only to 5G and cyber espionage, they are also shaped in part by China’s relations with Russia. The US pivot to Asia leaves the Baltic states with the feeling of dwindling US interest, despite NATO’s Enhanced Forward Presence in the Baltic states. This is hardly a disadvantage for China and Russia. And NATO is still thinking about its posture. The EU’s renewed talk of strategic autonomy is of little help here; the Baltic states’ position is that, although European defence cooperation may complement NATO, it can never replace it. Denmark would tend to agree. Therefore, to move this agenda forward, China should be a recurring agenda item – starting with the Nordic-Baltic 8 meetings and involving even NORDEFCO, with Danish help – with the aim of introducing a common position into EU and NATO discussions.

No comments:

Post a Comment