Executive Summary

In 2015, China’s State Council announced “Made in China 2025” (MIC2025), a sweeping plan for China to become a “manufacturing great power,” seize the “commanding heights” of global manufacturing, and win the “new industrial revolution.”1 MIC2025 is the first installment of a three-part, three-decade series. That series is itself an extension of decades of Chinese industrial plans, strategies, and projects that comprise Beijing’s larger “Go Out” strategy, a long-standing program to deploy Chinese companies and institutions internationally. MIC2025 aligns closely with its predecessor plans under Go Out, including the 2006 “Medium- and Long-Term Plan for Science and Technology Development” and the National Development and Reform Commission’s 2013 “Strategic Emerging Industries” initiative.2

All of these initiatives reflect parallel ambitions and use similar tools to accomplish them. Beijing aims to capture the modern networks, technical standards, and technology platforms that will form the foundation of the 21st-century global economy. Doing so demands advanced technological and industrial capacity. However, Beijing does not seek to out-innovate its competitors through direct competition on a level playing field. Rather, China exploits partnerships with foreign companies, governments, and institutions to siphon technology. Those technologies and international partnerships enable Beijing to export and shape networks, standards, and platforms that lock in enduring advantages for China.3

Simply put, Beijing seeks to “leapfrog” the world’s developed countries. Its ability to do so hinges on Germany. MIC2025 targets Germany first as a source of technology, second as a partner through which to export standards favorable to China, and third as a competitor for the lead in the current industrial revolution. China focuses on fields in which Germany excels,4 including the automotive, machinery manufacturing, chemical, medicine, and electronics sectors as well as new energy and environmental technologies.5 China also targets areas where Germany has influence over global standards, such as banking, new energy vehicles, and energy. China also prioritizes emerging fields in which global leadership has yet to be established, such as 5G and financial technology.

China’s strategy rests not just on obtaining the technologies for, but also setting the standards shaping, the “Industrial Internet of Things,” which will be the architecture for Germany’s – and the world’s – manufacturing, transportation, and logistics. The goal is to collect and shape information, rules, and innovation to bring them under Chinese control.

To implement its agenda, Beijing relies on an arsenal of state-owned enterprises and ostensibly private companies whose incentives are shaped by China’s industrial strategy. Beijing describes its approach as “state-led, enterprise-driven.”6 Beijing uses subsidies and other forms of state support to guide Chinese companies to obtain technology from abroad, including through joint ventures and forced technology transfers within those partnerships. To proliferate favorable standards, Chinese companies build industrial zones, telecommunications infrastructure, and logistics information networks with little concern for immediate profit.

Beijing’s maneuvering in Germany has only accelerated amid the COVID-19 pandemic and will likely continue to ramp up after the global health crisis has abated. The Chinese Communist Party (CCP) sees the pandemic as a window of opportunity.7 Market share is up for grabs. Strategic assets have depreciated. Liquidity is in short supply. Economic woes may lead Beijing’s targets to downplay security concerns associated with Chinese investment. The CCP intends to seize this opportunity. Germany and the United States must find ways to respond.

In its bid to gain power and global influence, the Chinese Communist Party (CCP) seeks not only to acquire foreign technology, but also to secure industrial control. Cooperation with German industry lies at the heart of this strategy. Chinese primary sources and resource allocations reveal that Beijing sees German industry simultaneously as a tool for harvesting advanced technology and know-how, as a critical partner that can help proliferate technical standards favorable to China, and also as a competitor – one that Beijing intends to overtake. Germany is, in fact, a template for the CCP strategy to dominate the 21st-century economy and set the rules for the modern world. Beijing’s abuse of Sino-German cooperation poses a significant threat to the interests of Germany, the United States, and their democratic allies.

This report will begin with an overview of the CCP’s “Made in China 2025” (MIC2025) plan as well as China’s broader industrial policy mechanisms. The report will then detail China’s interaction with Germany as a tool, partner, and competitor. Finally, it will conclude with policy recommendations designed to help the U.S. and German governments counter the rising CCP threat.

Illustrations by Daniel Ackerman/FDD

Introducing Made in China 2025

On May 19, 2015, China’s State Council formally announced Made in China 2025 (中国制造2025). MIC2025 is a sweeping agenda for China to become a “manufacturing great power,” seize the “commanding heights” of global manufacturing, and win the “fourth industrial revolution.” The fourth industrial revolution, or “Industry 4.0,” is how China refers to the “new industrial revolution” brought about by advances in information technology (IT), most notably in the form of the so-called “Internet of Everything.”8 For Beijing, the revolution represents an opportunity to rewrite the current international hierarchy.9

Beijing aims to win this new industrial revolution by competing for networks of exchange, especially those enabled by IT; technical standards; and technological platforms.10 As Beijing sees it, a new world is emerging in which the physical and virtual worlds connect across IT backbones, such as telecommunications and Bluetooth systems. These backbones govern the global movement, exchange, and production of – and collect data on – goods and information. “Whoever controls the flow of resources, markets, and money,” wrote retired People’s Liberation Army (PLA) Commander Wang Xiangsui in 2017, “is hegemon of the world.”11

MIC2025 emerged from three years of deliberation led by the Ministry of Industry and Information Technology in conjunction with more than 20 departments of the State Council,12 50 academicians of the Chinese Academy of Engineering, and 100 additional experts. Beijing envisions MIC2025 as the first of three 10-year industrial plans that amount to a grand-strategic bid to win the new industrial revolution. MIC2025 focuses on honing manufacturing advantages and building dominance, as well as global dependence, in the industries projected to determine Industry 4.0.

Beijing describes MIC2025 according to a framework of “one, two, three, four, five, 10.”13 There is one goal: “Transform to a manufacturing great power.”14 China will achieve that goal through the “integration of two industries: informatization and industrialization,”15 or the merging of the real, production economy and the virtual, network one via the “Industrial Internet of Things” (IIoT).16 Beijing intends to accomplish this in three 10-year steps. MIC2025 presents the roadmap for the first decade. The next step, which may be unveiled as “China Standards 2035” or otherwise reflected in the CCP’s forthcoming 14th Five-Year Plan, will focus on technical standards and carry a target completion date of 2035.17 The third – the consolidation of manufacturing, economic, and information control – is to be achieved by 2049, the centenary of the People’s Republic of China.18

MIC2025 has four sets of paired principles. The project will be both market- and government-led; feature immediate action as well as long-term positioning; balance comprehensive, methodical advances with breakthroughs in key fields; and pair “independent development”19 with “win-win cooperation.”20

“Win-win cooperation” refers to the international cooperation on which MIC2025 rests, including Beijing’s acquisition of technological, information, and innovative resources through international partnerships.21 Beijing calls this process “introduction, digestion, absorption, and re-innovation.”22 After obtaining technological resources from abroad, Beijing seeks to develop and scale them at home through five major projects: “manufacturing innovation centers, projects to strengthen the industrial base, intelligent manufacturing projects, green manufacturing, and high-end equipment development.”23

Finally, China aims to achieve breakthroughs in 10 “key fields”: new generation IT,24 high-end computer numerical controlled machine tools and robots, aerospace equipment,25 marine engineering equipment and high-end ships, advanced rail transportation equipment, energy-saving and new energy vehicles, power equipment, agricultural machinery and equipment, new and advanced materials,26 biomedicine, and high-performance medical devices.27

Beijing frames its objectives across those fields in the same terms as the larger MIC2025 plan: the integration of industrialization and informatization. Whether in robots or aerospace equipment, the ambitions of MIC2025 extend past producing the tools and equipment to dominate the next generation of smart manufacturing (“industrialization”). China aims to influence the technical standards for the information systems into which those tools and equipment connect (“informatization”). Technical standards are the rules by which technological processes and products function, are replicated, and interact with each other. China seeks to write those rules.

MIC2025’s significance in the Chinese system is evident in the resource allocations that support it, including state subsidies, new government guidance funds, and national-level prizes for science and technology. That said, MIC2025 represents just the first in a three-part, three-decade series. This series is itself a continuation of decades of other industrial plans, strategies, and projects. MIC2025 is consistent with Beijing’s larger “Go Out” strategy, a long-standing program to deploy Chinese companies and institutions internationally. Indeed, MIC2025 aligns closely with its predecessor plans under Go Out, including the 2006 “Medium- and Long-Term Plan for Science and Technology Development” and the 2013 “Strategic Emerging Industries” initiative. These plans target parallel industries and fields. Their evolution underlines a growing Chinese emphasis on “new infrastructures,” or virtual systems such as telecommunications networks, data centers, artificial intelligence, logistics, the IIoT, and the digitization of traditional infrastructure.28 Those areas will define the modern information era and link the virtual and real economies through 5G telecommunications, the Internet Protocol version 6, the social credit system, and platforms such as e-commerce sites, mobile wallets, and global logistics interfaces.

To do this, China needs advanced technology, industrial capacity, and global influence. But Beijing does not pursue those objectives through direct competition on a level playing field. Rather, China uses partnerships with foreign companies, governments, and institutions to siphon technology.29 Beijing then uses those technologies – as well as its cooperative channels with foreign actors – to claim dominance in global supply chains (such as pharmaceuticals) and export its networks, standards, and platforms (such as 5G).30

In pursuing this asymmetric approach, China has advantages in its size and top-down system of governance. As a result of network effects, whereby an increase in the number of people using a product or service increases its value, China maintains an inherent upper hand in defining emerging global networks and standards.31 China’s estimated population of 1.4 billion ensures this advantage, as does Beijing’s ability to determine the systems that population uses. Beijing’s centralization also allows it to encourage its state-owned and state-directed companies to operate globally according to China’s industrial strategy rather than pursue short-term profit incentives.

Beijing calculates that control over the new industrial revolution’s foundational systems will allow it to “leapfrog” the world’s developed countries. According to Xia Yanna, the chairwoman of Shenzhen China Made Intelligent Manufacturing (深圳华制智能制造技术有限公司),32 and Zhao Sheng, of the People’s Government of Jilin City, who wrote the 2016 book Made in China 2025: Industrial Internet Opens a New Industrial Revolution, “[i]n the future, there will be a new world of the Internet of Everything. China has the opportunity to ‘overtake around the corner.’”33

More broadly, Beijing identifies opportunity in moments of flux, whether they come in the form of a global pandemic or the ongoing technological revolution, which Beijing sees as opportunities to reshape the international hierarchy.34 China is positioning itself to exploit this global dislocation by accelerating deployments of capital, industry, and information systems. This will likely reverberate in Germany. And it may accelerate the path along which Sino-German ties move from mutually beneficial to competitive and predatory.

MIC2025 in Germany

Tool, Partner, Competitor

Germany is critical to Beijing’s weaponization of cooperation and its MIC2025 ambitions. As Beijing sees it, Germany is a source from which China can siphon advanced technology. Germany is also a strategic node in which to “dock” Chinese networks, standards, and platforms and through which to export those networks, standards, and platforms across Europe and throughout the world. Ultimately, Berlin is a competitor in the contest for the foundations of the new industrial revolution.

With MIC2025, Beijing intends to use Germany’s capabilities to encourage Germany’s participation in projects that ultimately come at Berlin’s strategic expense. China looks to accomplish this through two parallel efforts. First, China seeks to import expertise and technology from Germany. Second, China seeks to export networks, standards, and platforms to Germany.

For decades, Beijing has weaponized technology transfer and industrial cooperation to catch up to Germany’s manufacturing capabilities.35 The practice began in 1984, with a partnership between Volkswagen and Shanghai Automotive (now SAIC), the first-ever foreign automotive joint venture approved by the CCP.36 China’s efforts to develop gas turbine technologies through cooperation with Siemens, including as part of the “Two Machines Special Project,”37 offer a more recent example.38 MIC2025 applies this playbook across the strategic emerging industries prioritized in CCP science and technology plans. And across these industries, the aims of MIC2025 extend beyond technology acquisition to a bid for consolidated industrial control that spans both horizontally across the industry as well as vertically from sources of supply to finished goods.

GERMANY AS A TOOL: OBTAINING ADVANCED TECHNOLOGY

Beijing’s industrial strategy hinges on leveraging cooperation and capital to acquire technology from developed countries, then scaling and applying that technology internationally to “leapfrog” the very countries from which the technology came.39 Germany’s advanced capability in hardware production and relative openness to Chinese partnerships make it a prime target.

China considers Germany to be on par with the United States in the first tier of global industrial players. In fact, argue Xia and Zhao, Germany is ahead in the fields most complementary to China’s leapfrog approach: Berlin’s Industry 4.0 strategy40 focuses on “development of intelligent equipment and intelligent production processes based on an extremely well-developed equipment manufacturing and information technology foundations.” By contrast, “the United States pays more attention to software, networks, and data… Germany’s Industry 4.0 is more micro while the US industry interconnection is more macro.”41

MIC2025 aligns with the German focus areas that Xia and Zhao identify: processes, advanced equipment, and other more tangible capabilities. After acquiring such capabilities from Germany, Beijing can then adjust its strategic positioning to compete for the more software-oriented areas the United States emphasizes. As Xia and Zhao put it, “[T]he gap between the US and China in virtual economic innovation is relatively big. But in the core technologies of ‘intelligent manufacturing’ (digitization, networking, and intelligent manufacturing),” which Germany is developing, “China can develop a unique advantage. Cooperation with Germany’s Industry 4.0 strategy will introduce more sophisticated technology to China, which will allow the level of manufacturing to leapfrog… This is why the Chinese government has chosen Germany.”42

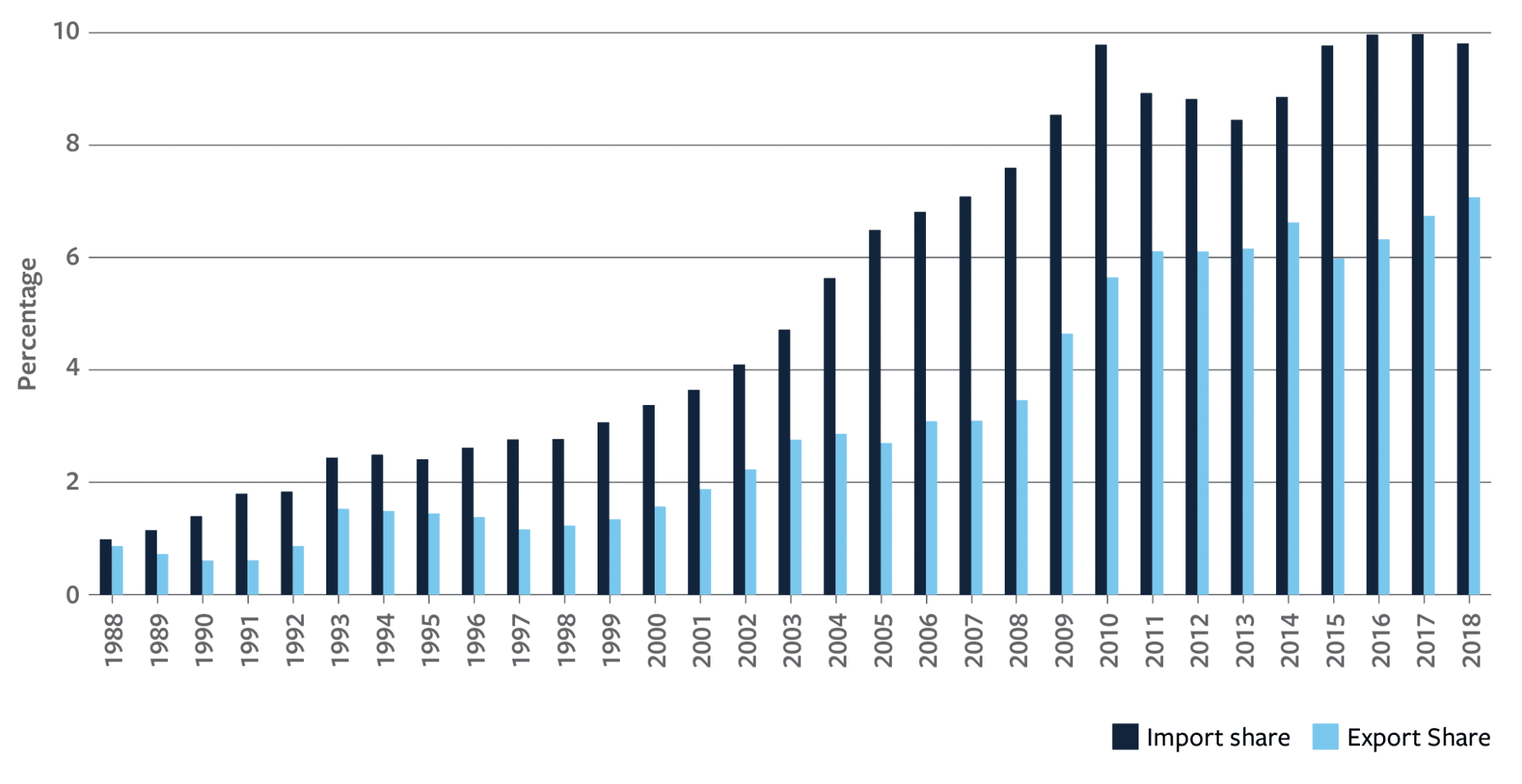

Figure 1: China’s Share of German Exports and Imports, 1988–201843

Chinese sources describe Germany as a relatively easy target. Berlin is more open to cooperation with Beijing than is Washington.44 From the Chinese perspective, Germany is also more amenable than other European countries. “The pragmatic attitude of the Germans has made their attitude toward China better than that of most other European countries,” writes the dean of Tsinghua University’s Institute of International Relations, Yan Xuetong.45

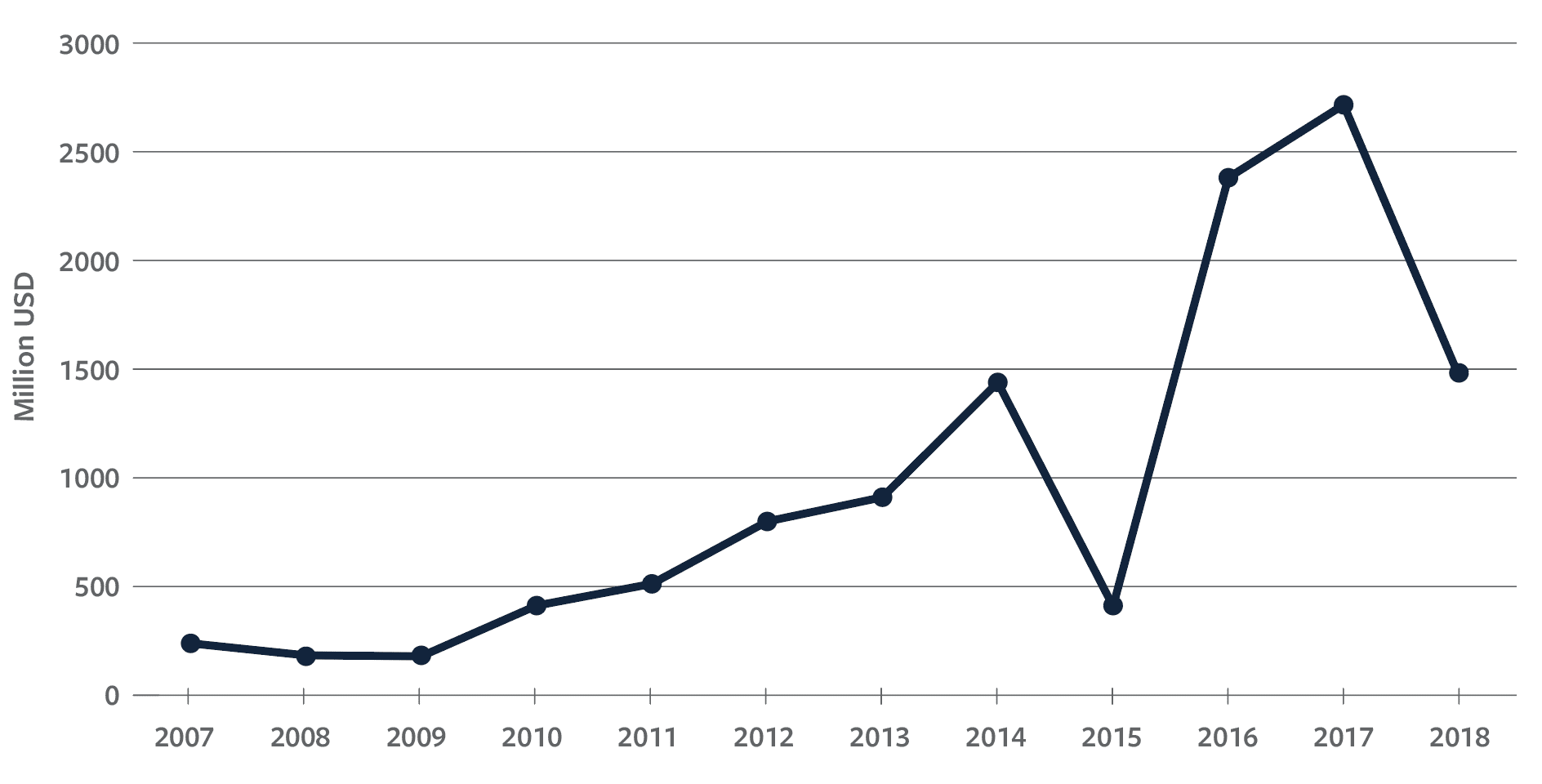

China’s resource allocations reflect a focus on Germany. China’s trade with and direct investment in Germany have grown steadily over the past 15 years. This trade and investment spiked after the global financial crisis in 2008, which Beijing viewed as an opportunity to accelerate its industrial strategy.46 China’s other economic relationships followed a similar pattern, but the focus on Germany, especially in the industrial sector, was particularly acute.47 In 2017, Germany was the primary target of Chinese direct investment in Europe. In 2018, Germany was second only to Luxemburg.48

Figure 2: Chinese Overseas Direct Investment into Germany, 2007–201849

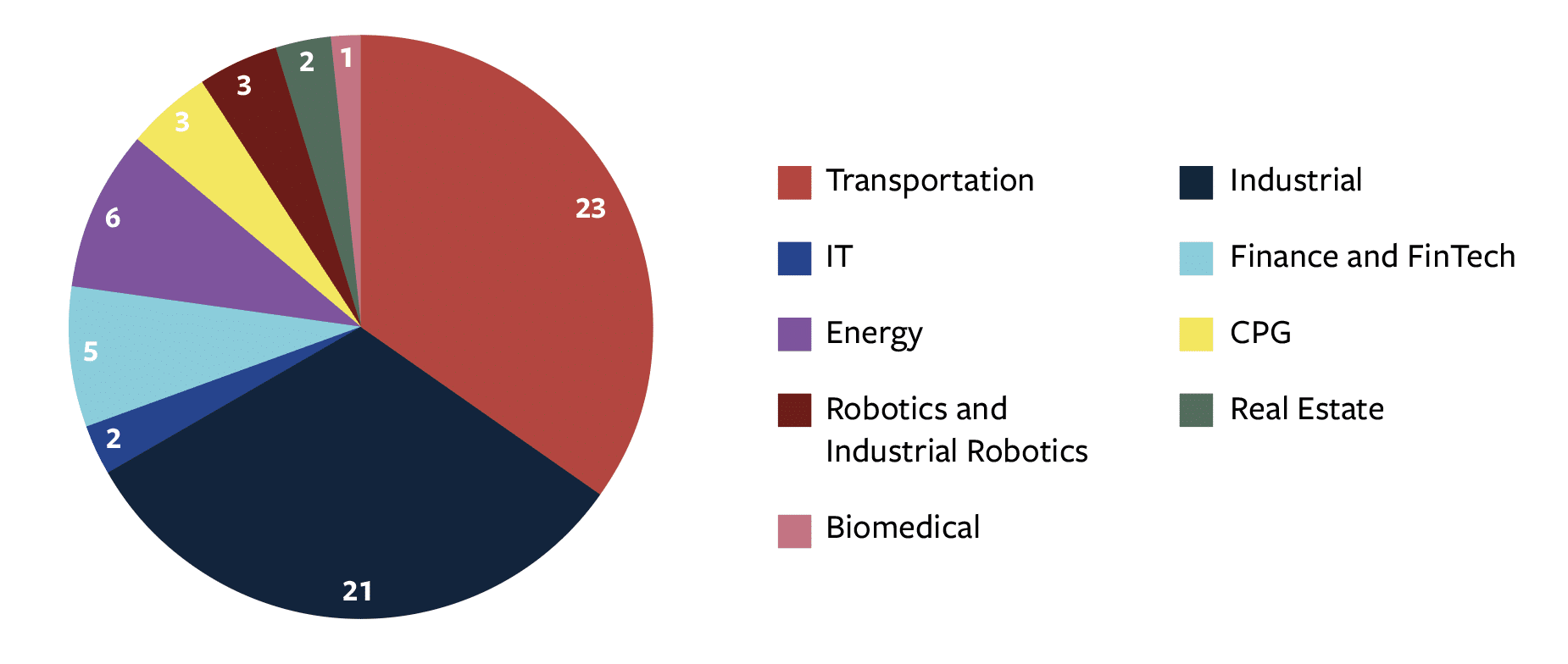

Of course, Germany has many trade and investment partners, and European investment into the country still trumps that from Beijing by a significant margin. The real story is what Beijing does with its investment. A sectoral breakdown of large Chinese corporate acquisitions reveals a focus on high-tech players in MIC2025 fields, with a particular emphasis on areas China identified as domains of advantageous cooperation with Germany:50 “[a]utomotive, machinery manufacturing, chemical, medicine, and electronics” as well as “new energy and environmental technologies.”51

A 2018 analysis by the Germany-based think tank Bertelsmann Stiftung arrived at a similar conclusion. The study found that 64 percent of analyzed Chinese mergers and acquisitions in Germany between 2014 and 2017 aligned with MIC2025 key areas, especially energy-saving and new energy vehicles (20.5 percent), electrical equipment (18.8 percent), biomedicine and medical devices (16.1 percent), and high-end machinery and robotics (15.2 percent). That proportion of MIC2025-relevant investment increased markedly after the announcement of MIC2025 in 2015.52

Figure 3: Chinese Corporate Acquisitions in Germany by Sector, 2007–201953

China’s investments in Germany directly align with the technologies in which Beijing seeks global leadership.54 Examples include: cooperation between Shanghai Electric and Siemens, Midea Group’s 2016 acquisition of the German robotics manufacturer KUKA,55 Haowu’s 2017 stake in leading crankshaft manufacturer FEUER powertrain,56 and Geely’s 2018 investment in Daimler AG.57 They all demonstrate the brazenness of China’s strategy, the role of Beijing’s military-civil fusion apparatus in the process, the emphasis on hollowing out core German capabilities, and China’s clever evasion of national security investment reviews. Every Chinese acquirer is either directly state-owned or a beneficiary of China’s non-market industrial-support mechanisms.

Beijing is explicit about targeting partnerships with German companies to obtain advanced technologies. Beijing’s “military upgrade” demanded jet engines as well as gas turbines. Foreign expertise, and German expertise in particular, offered access to both technologies.

The gas turbine industry offers a prime example. In 2001, China’s National Development and Reform Commission issued the “Implementation Opinions on Gas Turbine Industry Development Technology Introduction,” outlining ambitions to obtain gas turbine technology from abroad in exchange for market access.58 Under this guidance, specific Chinese champion companies cooperated with established foreign companies in the field, including Mitsubishi, General Electric, and Siemens.59 A public document from the Shanghai government outlines one example: “In the gas turbine project public bidding hosted by the National Development and Reform Commission, Shanghai Electric and Siemens joined hands to win the 9 F-class heavy-duty gas turbine power stations, opening a new era for Shanghai Electric to enter the gas turbine market.”60

In 2016, Beijing listed gas turbine technology, alongside aero-engine technology, as a key focus area in the “13th Five-Year Plan for Science and Technology Innovation.”61 That year, China’s Ministry of Industry and Information Technology, one of MIC2025’s institutional underwriters, launched the CCP’s Two Machines Special Project (两机专项). Focused on aero-engines and gas turbines, the Two Machines project is designed to foster domestic capabilities and enterprises rather than simply gain access to foreign technology and companies. As Chinese media coverage of the project in 2015, shortly before its launch, put it, “[T]here is almost no completely self-produced gas turbine in China… Despite this, the domestic manufacturing industry has never given up the dream of producing gas turbines with independent intellectual property rights.”62 In 2018, the Two Machines effort saw Siemens and the China State Power Investment Corporation sign an agreement in which Siemens promised to support the research and development of heavy-duty gas turbines and provide relevant training and consulting.63 A Chinese press outlet focused on Two Machines reported that “Siemens stated that this cooperation will take advantage of Siemens’ leading position in gas turbine technology to support China’s goal of independent research and development and manufacturing of heavy-duty gas turbines.”64

That press coverage credits two factors with driving China’s emerging advantages in the global gas turbine industry. First is Two Machines-related investment: “The country is increasing investment in heavy-duty gas turbine research and development through the aero-engine and gas turbine special project.”65 Second is China’s increasing freedom of action as Chinese companies secure additional foreign assets and technology. In particular, the article notes that Shanghai Electric’s 2014 acquisition of a 40 percent stake in Ansaldo Energia, an Italian power engineering company, and corresponding access to Ansaldo’s technological capabilities, has enabled Shanghai Electric to break its dependence on joint ventures with other foreign companies, namely Siemens. “Shanghai Electric took a stake in Ansaldo and broke up with Siemens,” the article said. “It is Siemens that suffered the most.”66 The article concludes by asking whether the technological cooperation between China State Power Investment Corporation and Siemens will “do for China’s heavy-duty gas turbine manufacturing industry what cooperation in high-speed rail did in that field.”67 As will be discussed later in this report, China sees itself as having captured an international lead in high-speed rail technology through “digestion, absorption, and re-innovation” of technology from Germany as well as Japan, including through partnerships with Siemens.68

FUSING MILITARY AND CIVILIAN

The Two Machines project is not unique or anomalous. MIC2025 is about military as well as civilian industrial upgrading. It is part and parcel of China’s larger, national-level “military-civil fusion” [军民融合] (MCF) strategy to integrate military and civilian resources and actors in pursuit of comprehensive national power.69 In many cases, China’s MCF intentions are obfuscated, buried in a web of Chinese holding companies, limited partners, and subsidiaries.

In 2017, China’s Haowu Group and Germany’s FEUER powertrain agreed to a strategic partnership and joint venture in China.70 As part of the transaction, Haowu claimed a 50 percent stake in FEUER powertrain.71 Organized through Haowu’s subsidiary Neijiang Jinhong Crankshaft, the joint venture was labeled the “Neijing German Crankshaft Project.” In March 2019, two years later, the Sichuan Military-Civil Fusion Fund, a CCP fund dedicated to MCF,72 acquired the German Crankshaft Project. The acquisition aimed to “introduce internationally leading engine crankshaft production and manufacturing technologies” for enhancing MCF. The total investment was estimated at RMB 1.01 billion (about $142 million).73

Midea’s acquisition of KUKA in 2017 offers another MCF example. Already controversial, the deal may have caused even greater controversy had it been publicly known that China viewed the acquisition as an MCF investment. KUKA has since been integrated into Beijing’s MCF infrastructure: The firm’s engineering center in Sichuan’s China Science and Technology Center connects to the Youxian Military-Civil Fusion Industrial Park, which focuses on “intelligent manufacturing, new materials, explosives, nuclear technology and support industries for aviation.”74 KUKA also operates in an MCF industrial park in the Chinese city of Foshan,75 launched in 2018 to focus on intelligent equipment manufacturing, next-generation IT, and aerospace.

KUKA also has a joint venture, Chang’an Laisi (Chongqing) Robot Intelligent Equipment, with Chang’an Industry (Group) Co., Ltd., one of Beijing’s largest and best-established MCF champions. Chang’an Industry is a subsidiary of the China Ordnance Equipment Group Corporation, a state-supported military enterprise that the U.S. Department of Defense classified in June 2020 as tied to the PLA.76 The KUKA-Chang’an Industry joint venture focuses on industrial robotics system integration, engineering design and assembly, display, training, and services. According to China’s Xinhua News Agency, the partnership “will allow [Chang’an Industry] to build a new paradigm for military-civil fusion.”77

TARGETING THE TARGETS’ CORE COMPETENCIES

China targets Germany’s automotive industry.78 This is hardly surprising, given the latter’s excellence in automotive engineering. Beijing tailors foreign industrial partnerships based on a diagnosis of its target’s “advantageous areas of cooperation.”79

In addition to its joint venture with KUKA, Chang’an Industry also has partnerships with other German automotive actors. Chang’an Industry’s core car business boasts a research and development center in Germany and a joint venture with the automotive arm of the German firm Benteler.

With Geely’s investment in Daimler AG, China demonstrated not only its appetite for cutting-edge German automotive technology, but also its ability to circumvent regulatory barriers to foreign investment. In February 2018, Geely acquired nearly 10 percent of Daimler, aiming to leverage this stake to force technology cooperation.80 In January 2020, the two partners announced a new joint venture focused on building premium and intelligent electrified vehicles.81 Daimler AG’s investment evaded Germany’s investment-review mechanism, which is only triggered by ownership stakes of 10 percent or above.82

GERMANY AS A PARTNER: PROLIFERATING CHINESE STANDARDS

MIC2025, as part of China’s broader industrial strategy, is not only about obtaining and developing technology. China also seeks to proliferate its technical standards. Standards constitute technical rulesets. They create a foundation that shapes how technological systems work, work together, and are replicated. Rule setting affords economic returns and the ability to shape how technology evolves. Beijing encourages German adoption of Chinese standards, seeking to place the German technological and industrial system within a framework of Chinese rules.

Beijing understands that the standards Germany adopts are poised to proliferate regionally and globally. As Beijing’s Blue Book on China’s Foreign Trade Development from 2017–2018 puts it, “Germany is the core country of the European Union and has a leading role.”83 China thus sees Germany as “China’s most important partner in Europe,” explains the People’s Daily.84

More broadly, China sees Europe as a core influencer of global industrial norms. “Building a network between Europe and the [Chinese] Mainland will change the status quo for China,” writes retired PLA Commander Wang Xiangsui.85 He describes Europe as the tipping point in China’s competition with the United States: “Europe and Asia together will pose a strategic danger to the United States, because such a composition will outweigh the United States economically and, finally, militarily.”86

To promote German adoption of Chinese standards, Beijing seeks to connect Germany’s Industry 4.0 plan – and European industrial plans more broadly – to MIC2025. In practice, this means encouraging German firms to develop technologies and industrial processes to operate according to Chinese standards and on Chinese infrastructure. Chinese sources describe this as the “docking” of Industry 4.0 into MIC2025. A 2016 article in the state-run magazine Guidance on Property Rights explains that this “docking can foster new momentum, promote the transformation and upgrading of China’s manufacturing industry, and inject fresh impetus into China’s economy.”87

From 2015 until 2017, the Ministry of Industry and Information Technology and China Made Intelligent Manufacturing jointly sponsored an annual conference on the docking of MIC2025 and Industry 4.0.88 Beijing prioritizes this docking in emerging high-tech areas where global standards are still being contested, including smart manufacturing, biomedicine, new energy vehicles, finance, modern logistics, 5G, graphene, and electronic materials.89

VENTURE CAPITAL TRANSACTIONS, A LEADING INDICATOR

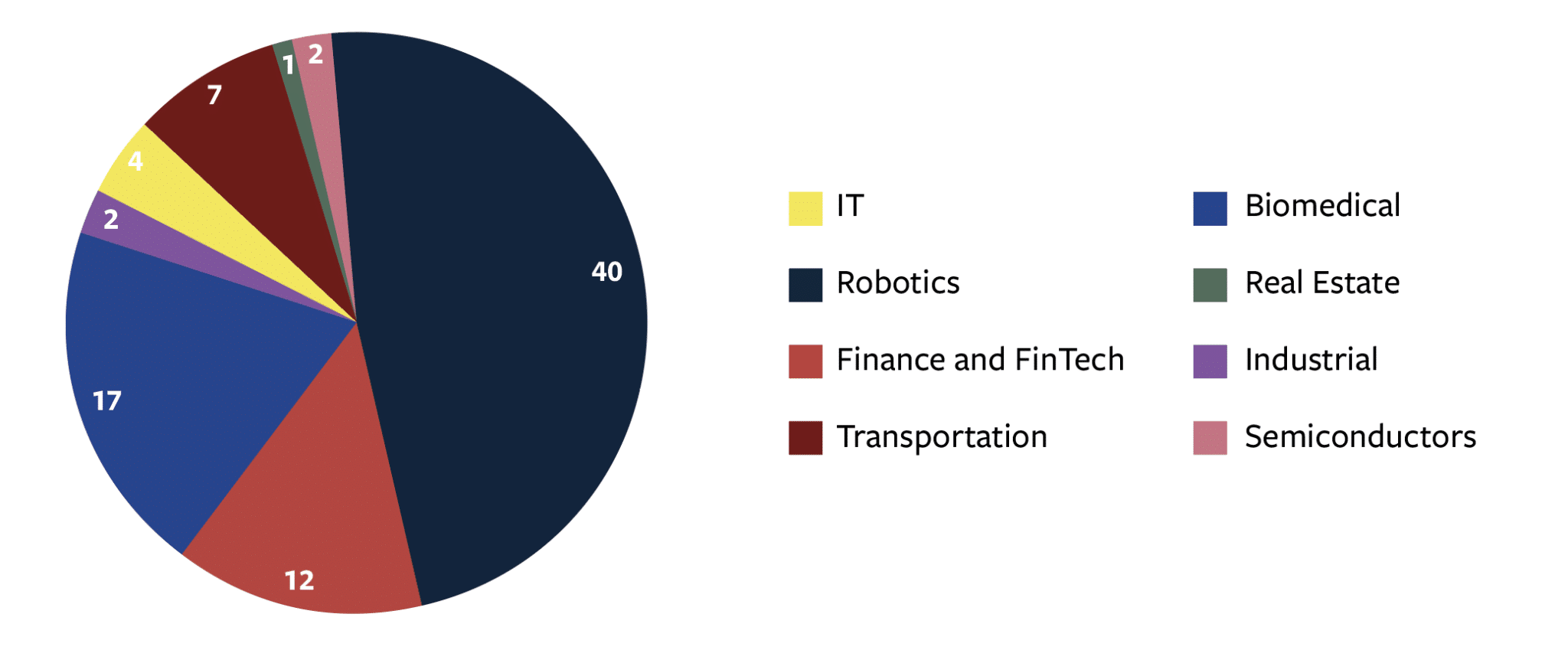

China’s venture capital transactions in Germany illustrate Beijing’s focus on proliferating favorable standards. China’s corporate acquisitions in Germany tend to focus on traditional technological domains, such as transportation and industrial machinery. But China’s venture capital investments in Germany overwhelmingly target emerging domains where standards are still being set, such as IT, the biomedical and fintech fields, and the newest segments of the transportation sector, such as new energy vehicles.

Figure 4: Chinese Venture Capital Investments in Germany, 2008-202090

The difference between China’s approaches to venture capital and corporate acquisition makes sense. Venture capital investments allow Chinese investors to secure initial stakes in emerging areas of interest. Then, as the competitive and technological field matures, China can add to its investments with larger corporate transactions. This trend is already starting to play out in the energy sector. In 2016, Beijing Enterprise bought the German firm Energy from Waste,91 and China Three Gorges bought Meerwind.92 The next year, Hong Kong’s CK Infrastructure and Cheung Kong Property Holdings, both owned by Hong Kong’s richest man, Li Kashing, bought the Germany metering and energy management group Ista.93

Just as Beijing’s strategic export of standards frequently goes overlooked, the venture capital ecosystem often evades regulatory safeguards against strategic foreign investment. Beijing strives to skirt investment-review protocols as it deploys Chinese companies to invest strategically abroad.94 The fragmented, diverse operating and financial ecosystems in early-stage technology industries make this possible. Those areas face far less scrutiny than legacy corporate priorities and modes.95

INFRASTRUCTURE CONSTRUCTION: HUAWEI AND TELECOMMUNICATIONS

China also proliferates its standards through infrastructure. Beijing has exported port, rail, and telecommunications standards and platforms to Germany. Chinese telecommunications firm Huawei’s bid for Germany’s 5G networks stands out. MIC2025 revolves around the IIoT and Beijing’s larger strategy around the Internet of Everything. 5G may be a critical enabler of both.96

In 2007, Huawei relocated its European headquarters from the United Kingdom to Dusseldorf, Germany. Huawei then set up a corresponding innovation center. In 2014, Huawei won the North Rhine-Westphalia’s investment award, which honors “foreign companies that have made outstanding contributions to the state.”97 The next year, Huawei and Deutsche Telekom signed an agreement to launch the “Open Telecom Cloud” plan, which, according to Chinese reports, would allow the companies to “compete with Amazon in the United States.”98 Also in 2015, Huawei promised to invest more than €400 million in German research and development by 2018.99

In April 2018, Germany approved Huawei’s 5G base station.100 In September 2019, the city of Duisburg announced Huawei as its partner in “establishing the first European smart city project.” The two sides would “deepen cooperation in the fields of smart government affairs, smart port logistics, smart education, 5G, and broadband.”101

COOPERATIVE INDUSTRIAL PARKS: STANDARDS FOOTHOLDS

While 5G has become a hot-button global issue, Beijing’s cooperative industrial parks are less well-documented. China builds these parks at home and abroad to develop “interconnectivity” – encouraging global industrial and commercial players to adopt Chinese systems and standards and share their technology and data with China. There are more than 25 Sino-German cooperative industrial parks in China, with another four in the works – more than any other country. Sino-German industrial parks focus predominantly on advanced manufacturing and automobiles. For example, the China-Germany Shenyang Equipment Manufacturing Industrial Park, established in 2012, focuses on “German small and medium enterprises in intelligent manufacturing and advanced machinery manufacturing that transfer technological achievements.”102

China also has three industrial parks in Germany: the Sino-German Science and Technology Park in Heidelberg, the Bremen Port Logistics Park, and the Parchim Central European Airport Industrial Park. These cooperative projects focus on attracting logistics and e-commerce firms, the nodes through which China deploys its industrial systems.

“China’s oversees cooperation parks are mainly dedicated to manufacturing industries,” explains the General Manager of China-Europe Business Trade and Logistics Cooperation Park Company. But the Bremen Park “is a trade and logistics-based industrial park.” He explains that the park serves as a platform through which “China’s Go Out companies can extend throughout the European market” while also creating “a logistics network that will proliferate Chinese systems.” The park “expands new space for China’s economy” under the guise of localization.103

The Parchim Park is part of a partnership with the Henan Xuchang Sino-German Industrial Park. The latter, located in China, “focuses on introducing technology, resources, and equipment from Germany in high-end manufacturing.” By contrast, the former, located in Germany, focuses on “exporting the cross-border development of China’s e-commerce and logistics industry,” two fields that feature prominently in Chinese discussion of standard-setting ambitions.104

GERMANY AS A COMPETITOR: RACING FOR THE FOURTH INDUSTRIAL REVOLUTION

Should China’s standards play succeed, it would bend the global economy toward Beijing’s rules. Germany’s industry could find itself bound to Chinese technical standards and platforms. This could mean, for example, that BMW’s electric-vehicle batteries would be based on technical protocols and material inputs emanating from Beijing. Germany’s e-commerce might then process its transactions through a Chinese platform such as AliPay.

Beijing sees Berlin as a competitor in China’s ambition to seize the foundations of the new industrial revolution, the IIoT. Both MIC2025 and Germany’s Industry 4.0 strategy outline intentions to lead the world in intelligent manufacturing. For Beijing, this is a zero-sum contest. Chinese sources make it very clear that Beijing’s strategic ambitions run contrary to Germany’s interests.

“Germany wants to maintain its leading position in manufacturing, and China wants to seize this leading position,” explains the state-run magazine Guidance on Property Rights.105 According to Beijing’s Blue Book on China’s Foreign Trade Development from 2017–2018, “the [industrial] gap with Germany has been narrowing. Therefore, the competition between the two countries [China and Germany] has become increasingly fierce. The manufacturing competition between China and Germany is particularly prominent.”106 Xia and Zhao elaborate:

“In 2012, the United States proposed the “Industry Interconnection” plan. In 2013, Germany proposed the “Industry 4.0” strategy. The two leading manufacturing nations began a contest. China followed suit, launching Made in China 2025, in 2015. At its essence, this is a dispute over the standard for the new industrial revolution. It appears to be a dispute between the US and Germany – with China following the German path. But of course, China is not limited to this: China is taking the opportunity to ‘overtake’ around the corner.’”107

Beijing calculates that it has fundamental advantages. China’s scale gives it an upper hand in competing for technical standards, networks of exchange, and technological platforms.108 In addition, Beijing’s relative control over the country’s own supply chains and industries allows it to deploy commercial actors for strategic ends and to maintain relative independence while fostering the dependence of foreign players.

China also seeks to manipulate competition between Germany and the United States – letting them race to develop flashy tools of next-generation industry, and partnering with them as they do so, while itself building the systems and framework into which those capacities will fit.

“Against the United States, we have a strong manufacturing capability,” write Xia Yanna and Zhao Sheng. “Against Germany, our informatization and interconnectedness are strong. It is like avoiding the horse race. As long as we use the right strategy, we can remain unbeaten.” They further explain: “Drawing on the development experience of intelligent manufacturing in Germany and the United States, China’s intelligent manufacturing system architecture should be a general-purpose model; its role is to provide a framework for the construction, development, integration, and operation of foreign intelligent manufacturing technology systems.”109

In other words, Beijing intends to develop the foundational architecture according to which America’s Industry Interconnection and Germany’s Industry 4.0 will operate. If Beijing succeeds, it can ensure that both American and German expertise and innovation fuel China’s ambitions.

This mirrors China’s experience with high-speed rail. As described by China’s official blue book on the overseas development of its enterprises in 2018, Beijing acquired high-speed rail capabilities “through digestion, absorption, and re-innovation” from Japan and Germany. China thus developed the technological capabilities that allowed its companies, supported by government funding, to “define today’s global high-speed rail technologies” and “standards.” That allowed China to “narrow the gap” with Germany and engage in “increasingly fierce competition.”110

A more recent example is China’s advancement in logistics information systems.111 In 2013, China’s State Council announced the “Medium and Long-term Plan for the Development of the Logistics Industry (2014–2020).” The plan was designed to expand the National Transportation Logistics Public Information Platform (or, in international discussion, LOGINK). LOGINK is an information network controlled by China’s Ministry of Transport and National Development and Reform Commission, operated by the China Communications and Communication Information Center.112 It links a web of transportation companies, logistics companies, and infrastructure hubs across roads, ports, waterways, industrial parks, airways, freight, and railways, in China and abroad. LOGINK collects and aggregates information on logistics regulations and standards; facility-specific operations and systems; credit information for vehicles, employees, companies, and other service providers; real-time status information, including location of vehicles and activity at logistics nodes; and customs information.

In short, LOGINK provides China comprehensive information on commercial exchange. LOGINK may allow Beijing to shape that information. For example, participants on LOGINK are tagged with credit ratings. Beijing can decide the standards for those credit ratings. It can also manipulate the information different users receive.113 Lian Zheng of China’s Wenzhou Highway Administration explains that LOGINK affords opportunities “for the government to shape markets in the Internet era.”114

To accomplish this, LOGINK requires international partnerships. Beijing acquires some of these partnerships through its commercial state champions. For example, Alibaba’s logistics subsidiary Cainiao promotes LOGINK in its partnerships with foreign companies. China also internationalizes LOGINK through partnerships with foreign ports, port operators, and relevant industrial alliances and multilateral bodies. More than 30 international ports feed into LOGINK. Most of those are in Asia, especially South Korea and Japan, via the decade-old Northeast Asia Logistics Information Service Network, or NEAL-NET.

More recently, Beijing has begun to incorporate Europe, with notable inroads in Germany. In 2017, China Communications Construction Company won a bid to build a new container terminal in Hamburg. Soon thereafter, LOGINK secured a cooperative agreement with the Port of Hamburg. The Port of Bremen has also initiated the process of joining LOGINK.115 Once part of LOGINK, the Hamburg and Bremen ports will feed information to it, while relying on it for information, services, and communication channels. LOGINK is also working with the International Port Community Systems Association (IPCSA) – a strategic partner as of December, 2019116 – to develop international standards for “global intelligent logistics.”117 The outputs, as IPCSA puts it, will “inform ISO standards and become de facto industry standards.”118 The Port Authority of Hamburg, as well as those of Rotterdam and Antwerp, is participating.119

As LOGINK and parallel foundational systems for the IIoT extend globally, production, transportation, and exchange will depend increasingly on Chinese platforms. This positions Beijing to collect and shape the information and rules that govern modern industry. It positions Beijing to privilege Chinese companies with better access to information and prioritize their place on the platform. It also positions Beijing to shape the operating environments and incentives of foreign companies. The IPCSA sums it up neatly: “LOGINK’s mission covers three broad areas: standard setting, information interchanging and data services.”120 Or, per Zhu Hongru, head of standardization at Alibaba, “This will inform ISO [International Organization for Standardization] standards and become industry de facto standards, which will be used in the construction of global smart supply chains.”121

Conclusion

MIC2025 is part of Beijing’s larger Go Out strategy – a long-standing bid to co-opt international resources to serve China’s positioning. MIC2025 itself focuses on establishing strategic footholds in global manufacturing and then using them to assert control over the international economy. These footholds require capabilities and positioning unique to Germany. Beijing therefore pursues partnerships with German actors, encouraging “complementary” cooperation and “docking” in advanced manufacturing, automobiles and transportation, aerospace, medicine, and energy.

Beijing’s intentions are not benign. China’s “complementary” cooperation is designed to use capabilities and leverage siphoned from Germany to export China’s control to Germany by proliferating standards, locking in critical dependencies, and ensuring information dominance. To that end, MIC2025 pursues beachheads everywhere from critical supply chains to telecommunications to logistics standards. Throughout, Beijing’s MCF apparatus will convert cutting-edge advances from German’s innovators, such as KUKA, into coercive tools for China’s armed forces.

Beijing’s grand strategic bid rests on setting global standards. MIC2025 is unequivocal about the ways ostensibly economic objectives and tools can fuse with Beijing’s security ambitions and apparatus to propel a larger competitive strategy.122

China’s tack demands a deliberate response. Both Germany and the United States are positioned to craft and implement such a response, separately and together. Doing so will require communication, compromise, and multilateral engagement between the United States and Germany, both at the political level and among their respective business and scholarly communities. This engagement must focus not only on economic issues but also on narrative.

IMPLICATIONS FOR GERMANY

Germany is the market most critical to China’s strategic ambitions in Europe and beyond. Germany also represents a crucial beachhead for China’s next step: a globally proliferated set of standards established by and for China. While Germany may be less dependent on China than other European economies, it has much at risk. Beijing siphons Germany’s legacy industrial advantages to subvert Germany’s Industry 4.0 plan and proliferate not just Chinese-made industry but also Chinese-governed industrial architectures.

MIC2025 leverages Germany’s traditional strengths of innovation and free markets to propel China’s strategy rather than a competitive response. This asymmetry takes multiple forms. First, Beijing leverages its centralization against Germany’s (and the world’s) open and fragmented system. Go Out responds to China’s centralized government direction. Through subsidies, preferential lending, and direct state control, Beijing creates incentive structures whereby Chinese companies pursue government objectives and follow top-level design. In turn, these companies shape the profit mechanisms according to which foreign firms, individuals, governments, and other institutions operate. The interests of these disparate actors end up tied to Beijing’s own interests.

The time horizons according to which Chinese actors measure their results represent a second asymmetry. The West operates based on quarterly results and annual financial objectives. But China is all too willing to sustain short-term profit losses for the long-term gain of strategic market penetration.123

A third asymmetry is the overlap between security and economic ambitions codified in Beijing’s MCF strategy. MIC2025 is predatory not only on an economic level, but in terms of security as well. China leverages resources siphoned from its foreign partners for military as well as commercial gain. The Two Machines state project that targets gas turbine and aero-engine technology provides a telling example: Technology transferred through commercial partnerships benefits not just Chinese industrial partners but also the PLA.

This aligns with a final asymmetry: the role of illicit activity. China is the world’s leading perpetrator of technology theft.124 Beijing celebrates the acquisition of appropriated technology. Government funding mechanisms explicitly encourage and direct this activity. Many Westerners wrongly assume that a rules-based order provides a reliable basis for intellectual property protection and the rule of law. China’s conception of economic competition contradicts these fundamental assumptions. The appropriation of foreign knowhow is, in fact, encoded in China’s particular definition of innovation. Beijing allocates research and development resources to applied rather than basic work, based on the calculus that it can obtain otherwise expensive, risky innovation from abroad through its diverse illicit technology-transfer toolkit.

This poses a direct threat to Germany. China uses theft, centralization, and non-market incentives to establish partnerships through which Berlin’s advanced capabilities prop up Beijing’s champions. China also deliberately encourages the dependence of German actors to cement such one-sided arrangements, even after malign behavior is revealed. There is no sign of this changing.

Frequently, flawed analysis suffering from mirror-imaging bias suggests Beijing’s calls for “indigenous innovation” indicate that China will run a fair innovation race. Unfortunately, that is not the case. Instead, Beijing’s “indigenous innovation” refers to the process of “introduction, digestion, absorption, and re-innovation,”125 or the acquisition of innovative resources from abroad and then their application under Beijing’s control.

Beijing seeks to reap the rewards of Germany’s investments in basic, fundamental research and development. Washington faces a similar threat. In both cases, foundational norms and positions are at stake.

IMPLICATIONS FOR U.S.-GERMAN RELATIONS

Ideally, common threats would compel cooperation between Washington and Berlin. Unfortunately, fragmentation, short-term thinking, and a naïve belief that China will adhere to the rule of law all too often cloud the judgement of both U.S. and German decisionmakers. Moreover, Berlin seems reluctant to join forces with the United States against China. The U.S. government has responded to China’s subsidized technological theft by restricting the participation of U.S. firms in Chinese joint ventures. Washington, however, cannot restrict German firms from doing so.

Beijing continues to attract potential German partners through short-term rewards, such as access to the Chinese market, investment from Chinese companies and financial institutions, and opportunities to establish production facilities in China. With U.S. competitors restricted, those rewards become even more attractive. The firms that stand to benefit are incentivized to lobby the German authorities for the sake of short-term self-interest. The reverse also holds: While the U.S. government has recently taken a more forward-leaning approach to China, American firms and the U.S. government likewise face enormous pressure to prioritize short-term gains over the long-term strategic threat from China. In this way, Beijing has pitted the United States and Germany against each other.

Similar coordination challenges stymied the Cold War-era Coordinating Committee for Multilateral Export Controls (COCOM) – a body which established and enforced restrictions on exports of strategic technologies to the Soviet Union.126 But the nature of modern technology – and China’s shrewd approach to technology transfer and economic competition – has undermined already-poor U.S.-German cooperation. This creates an imperative for better U.S.-German coordination. No single bilateral axis is as important at this stage in China’s rise. And no partnership has as much potential to rival China’s networks and standards strategy. Together, the United States and Germany can lead a community of partners to challenge Beijing’s offensive.

The 5G debate offers a prime example of the challenges facing the United States and Germany. China has unilaterally protected its own telecommunications user base. Huawei therefore boasts a structural advantage in terms of unmatched market size. Joining China therefore becomes a cost-conscious decision for foreign consumers and supply chain participants. China deploys its 5G Go Out champions accordingly: Huawei seizes a series of lowest-price, technically acceptable bid opportunities in cash-strapped markets. And China’s “Belt and Road Initiative” provides diplomatic top-cover for Huawei’s entrees into these markets, Germany among them. The more the United States or any other foreign actor pushes back, the more the Chinese state supports Huawei to sweeten the pot for other potential partners. As those partners join Beijing’s network, China increases its advantages of scale, injecting more technological capabilities into the system and subjugating more players to Beijing’s standards and information control.

This dynamic demands U.S.-German cooperation to promulgate policy, build economies of scale, and produce alternative, ally-friendly solutions. Beijing’s strategy targets the weakest point in any network, seeking to enter with the lowest risk of reaction. Given its structural advantage, Beijing needs only to prevent a comprehensive or coordinated reaction to its approach.

Ideally, the Berlin-Washington dynamic could serve as both a model for other bilateral engagements and a catalyst for multilateral U.S.-EU mechanisms. Germany has an opportunity to serve as a pivot point in the world’s response to China’s ambitions. EU partners will follow Germany’s lead. This offers Berlin leverage. It also confers a great deal of responsibility – to Germany’s people, its allies and partners, and its core national values.

POLICY RECOMMENDATIONS

The values shared by the United States and Germany have ushered in an unprecedented era of global peace and prosperity. But these values are under siege. The United States and Germany must work together.

An alliance strategy for responding to China’s commercial offensive begins with narrative. First, the United States and Germany must identify and combat disinformation, misinformation, and the malign leverage that Beijing claims by twisting narratives. China obscures the intentions behind its investments and commercial activity. But they are coercive levers. The U.S.-German alliance should share information about these realities – not just bilaterally, but also among allies and partners throughout the European Union. Key to this effort will be documenting Beijing’s non-market investments (such as state subsidies and forced technology transfers) and official sources that reflect the CCP’s intent.

Second, the United States and Germany should jointly define a new toolkit of cooperative export restrictions and investment-review mechanisms tailored to China’s subversive bid. During the Cold War, Germany served as a core member of COCOM. Berlin has remained a key signatory of COCOM’s successor, the Wassenaar Arrangement. However, export restrictions address only a portion of Chinese technology theft. Beijing appropriates the world’s cutting-edge technology not only through imports, but also by deploying capital. Export restrictions need to operate hand-in-hand with investment restrictions.127 There must be comprehensive and common definitions applied across multilateral fora, reflecting China’s centralized, long-term, direct and indirect efforts, spanning critical domains. These should be incorporated throughout EU and U.S.-EU agreements and should apply to technology, infrastructure, and data. They should also be incorporated into U.S. trade negotiations with the European Union. At a bilateral level, the United States and Germany should form an intelligence task force focused on Chinese investment in the European Union. The work of such a cooperative effort could help shape a National Intelligence Estimate assessing the risks associated with Chinese investment globally and across the European Union.

Third, the United States and Germany should utilize NATO’s tremendous potential as a coordinating mechanism. The body is positioned to defend against MCF while defining a positive vision of multilateral security cooperation that imposes costs on Beijing. First-order information sharing could include a list of Chinese military companies and MCF entities that operate within NATO members’ territories and alongside members’ firms. NATO might also consider targeted investments to protect critical technology, infrastructure, and data. Intelligence sharing via NATO should also help in the narrative fight against China’s disinformation tactics. Member states should further be expected to collaborate on force-structure reviews and revisions that reflect the nature of great power competition in the information era. NATO members should also aim to coordinate resource allocations according to a long-term, peacetime competition mandate that responds to the tactics shared by Moscow and Beijing as they attack the existing global order.128 Such efforts could pave the way for expanding joint operational capabilities that provide options for escalation in response to Beijing’s asymmetric offensive.129

China’s designs on Germany require an urgent, cooperative Western response that spans the economic and security domains. Beijing seeks to weaponize cooperation with Germany to subvert traditional German strengths, exploiting them to propel Chinese technological advancement and dominate the 21st-century economy. If left unchecked, China’s strategy will undermine, and produce a world hostile to, the prosperity, security, and values of Germany, the United States, and their liberal democratic allies. The malign intent and subversive tactics that define MIC2025 must be recognized broadly and countered locally. There is no time to waste.

No comments:

Post a Comment