China, sensing America’s internal political difficulties amidst social justice protests and a poor COVID-19 response, is taking off the gloves: Beijing is said to be in the final stages of approving a $400 billion economic and security deal with Tehran. In addition to massive infrastructure investments, the agreement envisions closer cooperation on defense and intelligence sharing, and is rumored to include discounts for Iranian oil. If finalized, the PRC would gain massive influence in this geopolitically critical region, and simultaneously throw a lifeline to the embattled Mullah Regime.

China, sensing America’s internal political difficulties amidst social justice protests and a poor COVID-19 response, is taking off the gloves: Beijing is said to be in the final stages of approving a $400 billion economic and security deal with Tehran. In addition to massive infrastructure investments, the agreement envisions closer cooperation on defense and intelligence sharing, and is rumored to include discounts for Iranian oil. If finalized, the PRC would gain massive influence in this geopolitically critical region, and simultaneously throw a lifeline to the embattled Mullah Regime.

The United States is likely to push back against this partnership, which threatens US security and energy interests in the Middle East and Eurasia. It’s little secret that Washington’s foreign policy interest constantly clash with those of Tehran and Beijing.

In the 20th century the main political rival of the US was the Soviet Union, whose collapse in 1991 ushered in the unipolar world of the late 90’s and early 2000’s. In the 21st century that there is no question of America’s new ‘near’ peer competitor: the People’s Republic of China, a country with a much bigger economic base than the USSR ever had. China’s Belt and Road Initiative (BRI), the flagship of Chinese President Xi Jinping’s global ambitions, is a powerful policy tool that puts US foreign policy influence to the test.

When it comes to geopolitical strategy there’s a saying among foreign policy experts: Russia play chess, China plays Go, and the United States plays football. Iran – with its strong anti-American sentiment, large military, and vast hydrocarbon reserves – is an important piece of China’s global Go board.

The China-Iran deal is the latest step in Beijing’s attempt to expand from a regional hegemony to a world power via BRI. China is often criticized by Western policy analysts for its so-called “Debt Diplomacy” – the policy of indebting an economically weak nation with predatory investment packages. Often times, this manifests itself as leverage for key infrastructure grabs, one of the most famous examples being Sri Lanka’s Hambantota port, which the government was forced to lease to China for 99 years after it failed to repay Chinese loans. Similarly, Pakistan owes China at least $10 billion in debt for the construction of Gwadar Port, and the territory is leased to the Chinese government through 2059. Another country in the region, The Maldives, owes China roughly $1.5 billion in debt which is about 30% of its GDP.

The giant deal with Iran would increase Chinese investments in Iranian banking, telecommunications, and transportation infrastructure including airports, railways and free trade zones (FTZs). China is also eyeing a central role in Iran’s cyber space with the country offering "greater control over what circulates." The prospective agreement also extends a number of potential defense cooperation projects and underscores increased intelligence sharing.

While the arrangement could offer new life to Iran’s sanction-choked economy, there is also the distinct possibility that it could leave the Islamic Republic inescapably beholden to Beijing. Many in the Iranian geopolitically savvy elite understand that.

China Plays The Long Game

Beijing is exploiting Tehran’s growing desperation exacerbated by the COVID health and economic crises. Recent cyber-attacks on its nuclear and naval infrastructure are also pushing to government into the arms of China. After all, the rising superpower offers an insatiable oil market, military and civilian technology, massive investment, and a potential political cover on the global stage, including a veto power in the UN Security Council – all things that Iran is in dire need of.

Both countries see the deal as mutually beneficial, but also as a potential mechanism for confronting US dominance in the Middle East.

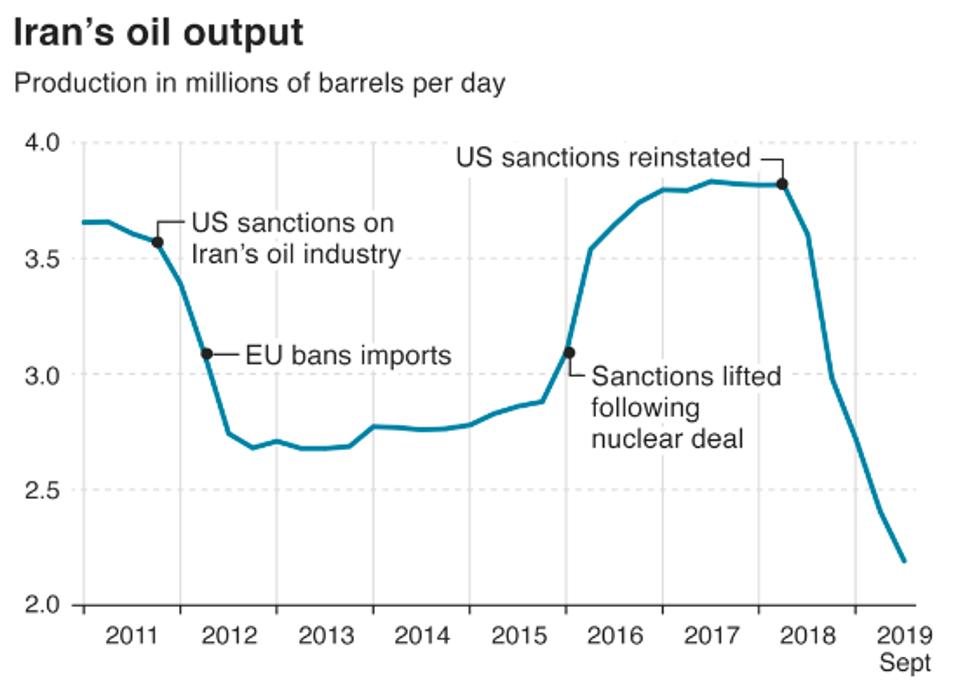

Iran is one of world’s the top five natural gas producers and sits atop 15% of OPEC's crude reserves but as of October last year their economy was projected to shrink by some 9.5% due mostly to the reintroduction of US sanctions. Oil output and revenues have plummeted — falling from nearly 4 million bpd in 2018 to just 2 million bpd today. This dire situation preceded the outbreak of COVID 19, which hit Iran particularly hard (and crushed demand for its chief export).

US sanctions and Iran's oil exports BBC/OPEC

Clearly, the anti-American edge of the deal is what attracts Washington’s attention. It would bolster China’s new digital currency e-RMB as a way to bypass American financial systems, and reduce the power of the dollar. It would also serve to benefit the world’s most voracious energy consumer and provide a mechanism to sell Iranian oil while evading US sanctions policy.

China’s strategic investment together with military cooperation would boost one of the most anti-American powers, threaten American allies in the Middle East from Riyadh to Jerusalem, and provide Chinese companies preferred access to trillions of dollars in untapped hydrocarbons and markets. India, which traditionally maintained good relations with Iran, and recently clashed with China militarily in the Himalayas, is looking wearily at the double encirclement Beijing is executing against it.

Beijing Bites More Than It Can Chew

Yet there is some Iranian concern about a full economic embrace of China. In late-June former President Mahmud Ahmadinejad warned in a speech that policymakers were “handing Iran's purse to other countries without informing the nation." Others have since joined the criticism, including former conservative lawmaker Ali Motahari, who appeared to suggest on Twitter that before signing the pact Iran should raise the fate of Muslims who are reportedly being persecuted in China. And Crown Prince Reza Pahlavi, an exiled opposition leader, join the choir of opponents to the deal.

It is also worth bearing in mind that while China likes to talk a big game about its BRI initiative, there is mounting evidence that Beijing’s goals are too lofty for their own good. As COVID-19 impedes the trend towards globalization, Central Asian countries, a cornerstone of China’s Belt and Road stratagem, are also seeing their economies slow down. The BRI land route has also been criticized for waste and fraud, which is certainly part of a broader pattern.

The US will continue to take action against any Chinese company breaking sanctions, according to a US State Department source. Beyond that, companies which are getting involved in the Sino-Iranian honeymoon will be doing so at their own peril, while high economic and security risks are only mitigated by Beijing’s strategic commitment, focus, and implacability.

No comments:

Post a Comment