Jim Vinoski

Round Top Mountain, Texas IMAGE COURTESY USA RARE EARTH

A whole slate of new bad behaviors by China’s repressive regime have been laid bare by the COVID-19 crisis. There were already plenty of complaints before the pandemic began, but the coronavirus seems to be supercharging the pressure on U.S. companies to reduce their Chinese sourcing. One of the biggest recent challenges in that regard has been China’s dominance in mining and processing critical rare earth minerals. These are vital building blocks for everything from smart phones, EV batteries and medical imaging machines to advanced defense weaponry, so our reliance on a less-than-friendly nation for our supply presents a huge political and economic risk. But right now China controls 90% of global rare earth production.

It’s amazing good fortune, then, that out in the barren scrub of the West Texas panhandle 85 miles east of El Paso, an unassuming 1,250-tall mountain called Round Top holds the promise of making America largely self-sufficient in these critical minerals. The mountain contains five out of six light rare earths (such as neodymium), 10 out of 11 heavy rare earths (dysprosium, for example), and all five permanent magnet materials. What’s more, Round Top has large deposits of lithium, critical for batteries in EVs and power storage.

USA Rare Earth is a privately held Delaware LLC that was formed specifically to develop the project to extract and process Round Top’s valuable ore. One of the company’s primary investors is Navajo Transitional Energy Company (NTEC). Texas Minerals Resources Corporation had previously invested $25 million in the Round Top project, and is now a 20% junior partner in the endeavor.

“The risk here has been well-established since President Xi’s not-so-veiled threat last year,” said Pini Althaus, CEO of USA Rare Earth, referring to a visit by Xi Jinping last May to a Chinese rare earth facility that coincided with state media reports about potential bans on rare earths exports to the U.S. as a trade war retaliation. “From a national security standpoint, having the U.S. military rely on China for rare earths for their fighters and Tomahawk cruise missiles is just not prudent. And there’s also the high-tech world and US manufacturing to think about.”

It’s not only the political threats that are a concern. “China is prioritizing their domestic consumption,” Althaus pointed out. “They manufactured $1 trillion worth of product from their rare earths materials last year. Heavy rare earths in particular are in short supply – they’re not endless.”

Round Top, however, offers a 130-year supply of the critical minerals. And USA Rare Earth is looking at benefits beyond the ore itself. “It’s not just about supply,” said Althaus. “We want to reinvigorate the processing industry that’s been offshored.” Toward that end, the company is constructing the first U.S. plant to produce high-purity rare earth oxides, first in a pilot plant opening in Denver, Colorado, scheduled to be fully-functional in May, and later in a full-scale continuous process operation on the Round Top site. The focus there is on sustainable processing, using renewable energy for power and an environmentally-friendly continuous ion exchange separation method, which has the added benefits of low capital and operating costs and streamlined permitting.

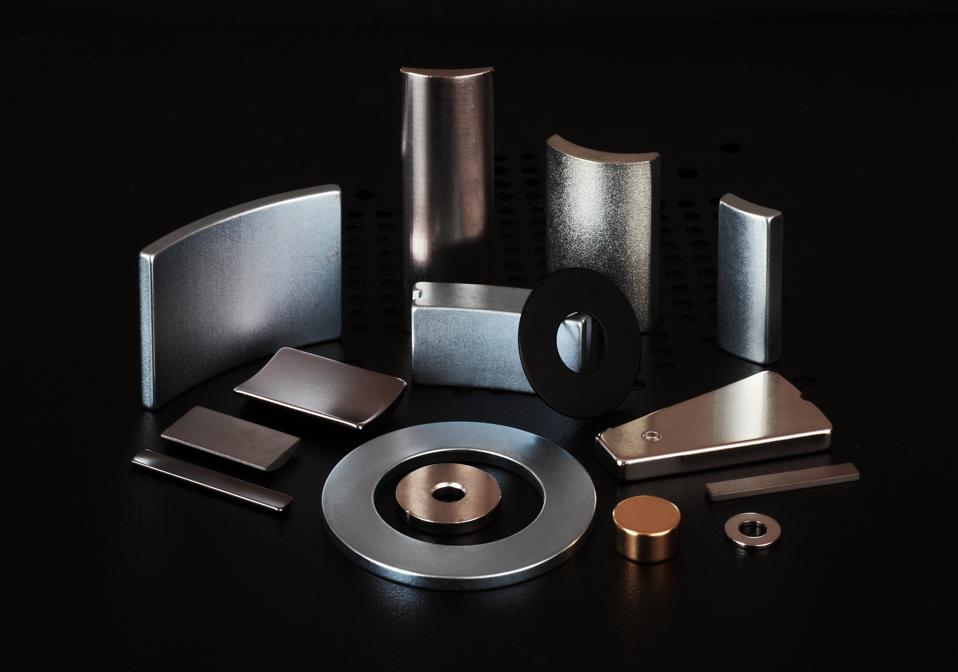

Neodymium rare earth magnets GETTY

What’s more, USA Rare Earth today announced the acquisition of the neodymium iron boron (NdFeB) permanent magnet production equipment formerly owned and operated in North Carolina by Hitachi Metals America, Ltd. Those magnets are critical in many of the product applications listed above, but currently there is no domestic manufacturing capacity. The company will warehouse the equipment while they search for a suitable location for the new magnet production facility. The planned operation will eventually produce 2,000 tons per year of rare earth magnets, filling 17% of domestic demand, and will generate $140 million in annual sales.

The mining and processing project’s financials appear robust as well. USA Rare Earth estimates that, over the first 20 years of the project, annual gross revenues will average $422 million, with an annual average EBITDA of $282 million. The project payback period is 1.8 years. “The first 20 years, we expect to generate $8.4 billion in revenue,” Althaus said. “That’s based on extracting 20,000 tons per year. But that’s just for the U.S. – we’ve been approached by other governments who are interested too, which may justify increasing our annual production from our current projections.” Feasibility work and permitting for the mine continue this year, with construction slated to begin in late 2021. Commercial production at the mine is anticipated in 2023.

The opportunities here aren’t lost on the defense community. “If you look at the national security profile, last summer President Trump invoked the Title III Defense Production Act regarding five links in the rare earth supply chain,” said Dan McGroarty, USA Rare Earth’s Head of Government & Regulatory Affairs. “The Department of Defense has put out two Requests for Proposals for that already. More will follow, and we expect those to encompass all segments of the rare earth element supply chain eventually. They’re one of our most critical materials, our current domestic production of rare earth oxides is zero, and the COVID crisis underscores our vulnerability when a critical supply chain originates in China. It’s not just about defense – we’re trying to compete in the 21st century tech wars, and we’ve given all the leverage to one of our key competitors.”

The challenges haven’t been missed by other governments. “There’s an alliance building here between the U.S., U.K., Australia and Canada,” Althaus said. “The EU has its own initiatives to source independently of China as well. “Leading governments in manufacturing are extremely concerned. Defense contractors want to produce domestically, but they can’t because of the current sourcing reality. It’s been a concern for years now – in a press conference in 2015, President Obama talked about establishing a U.S. rare earth stockpile. This is a national security risk, relying on a country that we’ve got some level of adversity with. And they’ve used their leverage here before – in 2011 they cut off supplies to Japan.

“It’s about more than security, though,” he continued. “Practically speaking, we have to bring jobs back to the U.S., especially in high tech manufacturing. Being able to make things like EVs for ourselves will enable even more manufacturing, and create even more jobs. And we won’t have to be reliant on China for everything we do.”

No comments:

Post a Comment