By Richard P. Rumelt

During hard times, a structural break in the economy is an opportunity in disguise. To survive—and, eventually, to flourish—companies must learn to exploit it.

There is nothing like a crisis to clarify the mind. In suddenly volatile and different times, you must have a strategy. I don’t mean most of the things people call strategy—mission statements, audacious goals, three- to five-year budget plans. I mean a real strategy.

For many managers, the word has become a verbal tic. Business lingo has transformed marketing into marketing strategy, data processing into IT strategy, acquisitions into growth strategy. Cut prices and you have a low-price strategy. Equating strategy with success, audacity, or ambition creates still more confusion. A lot of people label anything that bears the CEO’s signature as strategic—a definition based on the decider’s pay grade, not the decision.

By strategy, I mean a cohesive response to a challenge. A real strategy is neither a document nor a forecast but rather an overall approach based on a diagnosis of a challenge. The most important element of a strategy is a coherent viewpoint about the forces at work, not a plan.

What’s happening?

The past year’s events have been surprising but not novel. Historically, land bubbles, easy credit, and high leverage often make a dangerous mixture. Real-estate debt triggered the first US depression, in 1819. A land mortgage boom was directly behind the 1873–77 crisis: innovative forms of mortgage lending in Europe and the United States generated an unsustainable boom in land prices, and a four-year global depression followed their collapse and the accompanying credit crunch. Another credit crunch, this one triggered by the failure of traded railroad notes, led to the Long Depression of 1893–97. Japan’s 1995–2004 “lost decade” followed a period of high leverage and wildly inflated land values brought to an end by a financial crash.

Leverage lies at the heart of such stories. Archimedes said, “Give me a lever long enough and a fulcrum strong enough, and I will move the world.” He didn’t add that it would take a lever many light years long to move the Earth by the width of an atom, and if the Earth twitched, the kickback from the lever would fling him far and fast. The current crisis is about kickback from leverage in two places: households and financial services. Without leverage, downturns would be disappointments, but mortgages would not be foreclosed nor companies bankrupt. Leverage spreads the pain in ever-widening waves.

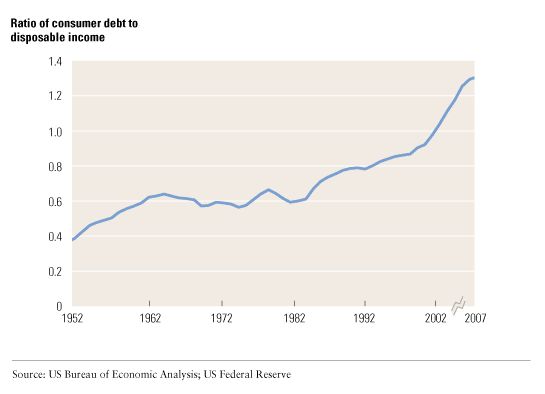

The way these dynamics played out is well known. US household debt started rising in the early 1980s, and its growth accelerated in 2001 (Exhibit 1). Leverage among Wall Street’s five largest broker–dealers (Goldman Sachs, Merrill Lynch, Lehman Brothers, Bear Stearns, and Morgan Stanley) rose dramatically after 2004, when the US Securities and Exchange Commission exempted these firms from the long-standing 12-to-1 leverage ratio limit and let them regulate themselves. From 1990 to 2007, the whole financial-services sector expanded 2.5 times faster than overall GDP, and its profits rose from their 1947–96 average of 0.75 percent of GDP to 2.5 percent in 2007. Then falling home prices led to an unanticipated rise in foreclosure rates and a drop in the value of certain mortgage-backed securities. That decline quickly undid highly leveraged financial firms, whose failure spread loss and uncertainty throughout the system. US consumer spending continued at a high level through the first half of 2008 but by the third quarter had dropped at a 3.1 percent annualized rate. A recession—potentially a deep one—had arrived.

Exhibit 1

The runaway US consumer

US household debt started rising in the early 1980s, and its growth accelerated in 2001.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

A structural break

Discerning the significance of these events is harder than recounting them. I think we are looking at a structural break with the past—a phrase from econometrics, where it denotes the moment in time-series data when trends and the patterns of associations among variables change.

A corporate crisis is often a sign that the company’s business model has petered out—that the industry’s underlying structure has changed dramatically, so old ways of doing business no longer work. In the 1990s, for instance, IBM’s basic model of layering options and peripherals atop an integrated line of mainframe computers began to fail. Demand for computing was up, but IBM’s way of providing it was down. Likewise, newspapers are now in crisis as the Internet grabs their readers and ads. Demand for information and analysis is increasing, but traditional publishing vehicles have difficulty making money from it.

The same principle applies to the economy as a whole. In most of the recessions of the past 40 years, demand caught up with capacity and growth returned in 10 to 18 months. This recession feels different because it is hard to imagine the full-steam reexpansion of financial services or a rapid turnaround in housing. Beyond these two hot spots, there seem to be unsustainable trends in commodity prices, oil imports, the nation’s trade balance, the state of our schools, and large entitlement promises. Already, the idea that the United States can grow by borrowing money from China to finance consumption at home has begun to seem implausible. We know in our bones that the future will be different. When the business model of part or all of the economy shifts in this way, we can speak of a structural break.

Such a break often means hard times. Adjustment is neither easy nor quick. Difficult and volatile conditions wipe out some organizations—yet others prosper because they understand how to exploit the fact that old patterns vanish and new ones emerge. The first order of the day is to survive any downturns in the real economy (see sidebar, “Hard times survival guide”), but the second is to benefit from these new patterns. A structural break is the very best time to be a strategist, for at the moment of change old sources of competitive advantage weaken and new sources appear. Afterward, upstarts can leap ahead of seemingly entrenched players.

Hard times survival guide

In several industry sectors, the most recent structural break occurred in the 1980s, with the development of microprocessors, which led to much cheaper computing, personal and desktop computers, and the rise of a new kind of software industry. Those innovations begat the Internet and electronic commerce. More important for strategists, the break shifted the nature of competitive advantage dramatically. In 1985, for example, a telecom-equipment company needed sufficient scale to serve at least two of the three main continents—North America, Europe, and Asia—and skill at coordinating thousands of development engineers, manufacturing engineers, and workers. By 1995, firmware had become the primary source of advantage. Cisco Systems came out of nowhere to dominate its whole industry segment by deploying what at first was about 100,000 lines of elegant code written by a small team of talented people. That structural break allowed Silicon Valley’s small-team culture to overtake Japan’s advantages in industrial engineering and in managing a large, disciplined workforce. This shift in the logic of advantage changed the wealth of nations.

Structural breaks render obsolete many existing patterns of behavior, yet they point the way forward for some companies and at times even for whole economies. The Long Depression of 1893–97 marked the end of the railroad boom, for example, and the start of the transition to an economy based on sophisticated consumer goods. Milton Hershey built his early chocolate brand and distribution advantages in the middle of those hard times. General Electric was a product of the same period, for the structural break also marked the rise of a new economy based on electricity.

Although the 1930s were very hard times for the United States, not every industry or business declined. As the economy shifted massively from capital goods to consumer goods, some industries—such as steel, rubber, coal, glass, railroads, and building—suffered greatly, but consumer brands such as Kellogg’s hit their stride. Campgrounds and motels blossomed along highways. Airline passenger traffic grew robustly. Entertainment surged with the growth of the radio and movie industries, and of their audience, during the Golden Age of Hollywood.

Likewise, during the decade from 1996 to 2005, overall consumer spending remained fairly flat in Japan. Still, the economy rotated into new things. The country, for example, has more than 200 brands of soft drinks, and each of Seven-Eleven Japan’s small convenience stores carries more than 50 at any time. About 70 percent of these brands vanish each year and are replaced by new ones.

Many aspects of such structural changes will depend upon the government’s policy response. Today, nuclear power, infrastructure repair, and fiber to the home are already on the list of possible stimuli for the economy. In examining such business opportunities, it’s important to recognize that competition for government funds is fierce. Nonetheless, the state can provide first-mover advantages in new growth areas. During Franklin Roosevelt’s New Deal, for example, the federal government vastly expanded its record keeping. Since it needed something better than handwritten or typed notes, it turned to IBM’s new-fangled punch card system. In the growth industry of aviation, Boeing lost its airline business as a result of the Air Mail Act of 1934 but also built substantial advantages by performing well on key military contracts.

The wrong way forward in a structural break during hard times is to try more of the same. The break and the hard times are sure indications that an old pattern has already been pushed to its limits and is destroying value. As an example of such a pattern, consider the financial sector’s compensation incentives. Decades of careful research shows no evidence that anything but luck explains why some fund managers outperform others. Yet fund and even pension fund managers who supposedly outperform get huge pay and bonuses. Incentives are good in principle, but did Bear Stearns get competent risk management in return for the $4.4 billion bonus pool it distributed in 2006? Does any organization have to give its CEO a $40 million bonus to secure his services? If you pay people enough money to make any future payment beside the point, don’t be surprised when they take vast long-term risks for short-term wins. In almost any pattern, overshooting produces negative returns.

Another pattern that may generate diminished or negative returns is the baffling complexity of our business and management systems. The financial-services industry is a poster child for the costs of this kind of complexity, as well. Calls to regulate such complex systems are misguided—regulators can’t comprehend them if their creators don’t. The best regulators can do in this case is to ban certain kinds of behavior.

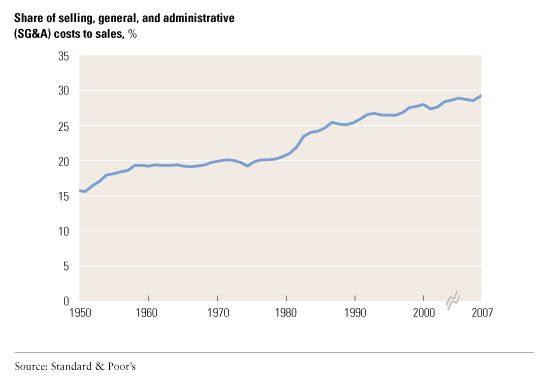

Complexity also manifests itself in the soaring volume of e-mail. Philip Su, a Windows Vista software engineering manager, reports that the intensity of coordination on this project created “a phenomenon by which process engenders further process, eventually becoming a self-sustaining buzz.”1 We have all experienced this unanticipated side effect of apparently cheap communications. Unfortunately, lowering the cost of sending a message dramatically increases the amount of messaging. E-mail to a group of coworkers triggers immediate responses, the group of respondents expands, and responses proliferate like neutrons in a critical mass of plutonium. Messages are requests to do something, change something, or look at something. All that has a high cost. It was in the 1980s, as computing became a necessary part of the paraphernalia of management, that the percentage of pretax expenses accounted for by selling, general, and administrative costs (SG&A) began to accelerate (Exhibit 2).

Exhibit 2

The rising cost of administration

Administration costs began to grow in the 1980s as computing became an essential tool.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

In part, this rising administrative intensity shows the increasing importance of knowledge-based workers and the outsourcing of manual labor. It also reflects a more intense commitment to very complex systems comprising individual parts whose productivity is almost impossible to measure. Despite the claims of IT, marketing, and human resources that their programs generate strong returns on investment, corporations are betting on a whole approach to business, not on any one element. The risk is that in hard times, the system becomes the problem.

Consider an analogy. When oil is cheap and plentiful, we create a vast infrastructure that works well if oil remains cheap and plentiful. When it becomes expensive, we wish we had a different infrastructure. Similarly, when economic opportunities abound, we invest in a management infrastructure that harvests them very well. When the field of opportunities becomes less verdant, we must change our management infrastructure. A system that requires companies to spend at least $300,000 a year in wages, benefits, support personnel, and systems to enable one educated person to do his or her job could be unsustainable in a less luxuriant world.2

Doing things differently

It’s hard to fix infrastructure when times are good and demand is growing. From 1993 to 1995, I served as director of INSEAD’s Corporate Renewal Initiative, which studied and worked with companies trying to become more competitive. As business turned up in 1996, the interests of these companies flipped, as if by a switch, from reengineering to growth.

In the years since, most companies have indeed grown. They have also spent money on increasingly complex overhead structures to address the diversity of products and geographies and the demands of employees and governments. Now, in hard times, scope and variety will be cut, but costs won’t automatically follow. The costs of managing scope and variety have been baked into the infrastructure—IT systems, sourcing systems, and processes for designing and marketing new products.

So during structural breaks in hard times, cutting costs isn’t enough. Things have to be done differently, and on two levels: reducing the complexity of corporate structures and transforming business models. At the corporate level, the first commandment is to simplify and simplify again. Since companies must become more modular and diverse, eliminate coordinating committees, review boards, and other mechanisms connecting businesses, products, or geographies. The aim of these cuts is to provide lean central and support services that don’t require business units to spend time and energy coordinating their activities. Break larger units into smaller ones to reveal cross-subsidies and to break political blockades. You may think that coordination costs will rise if you fragment the business, but you must do so to expose what ought to be streamlined.

Then start reforming individual businesses. There is a large and useful body of knowledge about how to go about doing so, and this is not the place to reprise it. In general terms, the first task is to understand how a business has survived, competed, and made money in the past. Don’t settle for PowerPoint bar charts and graphs. If the business is too complex to comprehend, break it into comprehensible parts. Once you gain this critical understanding, you can start the work of reshaping. There is no magic formula. Reforming a business always takes insight and imagination.

In ordinary hard times, the traditional moves are reducing fixed costs, scope, and variety. But in hard times accompanied by structural breaks, you must rethink the way you manage. Companies that survive and go on to prosper look beyond costs to the detailed structure of managerial work. Several new issues come to the forefront:

How much extra work results from the way incentive and evaluation systems relentlessly pressure managers to look busy and outperform one another?

Which information flows can you omit? Information that doesn’t inform value-creating decisions is a wasteful distraction.

Which decisions and judgments can you standardize as policy rather than make in costly meetings and communications?

How can you work with customers, suppliers, and the government to simplify their processes so that you can simplify yours?

No comments:

Post a Comment