Alan Gelb , Anit Mukherjee and Kyle Navis

In Bangladesh, a mother can now receive her child’s education scholarship through her mobile phone account instead of having to stand in long lines at the school on a prearranged day for a cash handout. Not only does this save her time and effort and provide accurate and documented payment, it also relieves school officials of a burdensome administrative process and of the risk that—rightly or wrongly—they can be accused of corrupt handling of funds. In Kenya, a farmer can invest his or her savings directly in a small slice of a government bond through a mobile phone. He can become eligible for a small loan on the basis of a stable record of receipts and payments on his mobile account without posting collateral. In Andhra Pradesh, a state in India with 50 million people, the authorities can drill down through statewide reporting data, in real time and across thousands of delivery points, to monitor the provision of rations to poor beneficiaries. They can detect transaction failures almost immediately and require rapid follow-up and remediation.

Digital technology, notably in the areas of identification (ID), mobile communications, and financial payments, is impacting societies and economies in many ways. It is changing the way that citizens (in the sense of individuals) and states can interact and transact business with each other across a wide range of programs and services. This offers new levers to states to implement a wide range of policies and programs, to increase effectiveness and accountability, and also to include many who have been effectively shut out—whether through lack of recognition, high transactions costs, or the inability to ensure that payments or other services are delivered accurately, to the right person, and at the right time.

Expanding the policy possibility frontier

This report considers the potential of ID, mobiles, and payments to improve the capacity of governments to deliver more effective, inclusive, and accountable programs. This trinity has been termed “JAM”[1] in India, and the same terminology is used here for convenience, though the focus is more general than India alone. The programs can provide government-to-person (G2P) payments, or vouchers tied to the purchase of essential goods, or in-kind provision of goods and services—with or without conditionalities. They can also include fee-based services that require person-to-government (P2G) payments. These enable governments to implement a broader set of policies to reform citizen–state interactions—in other words, expanding the “policy possibility frontier.” In this report, we explore a wide range of these digitally enabled reforms and their implications across sectors, regions, and countries—and more importantly, on actual beneficiaries of public services, subsidies, and transfers.

The objective is not to cover this huge field exhaustively or to advocate for one approach over another, such as whether to provide food rations or cash, or education vouchers or public schools. It is, rather, to consider the potential for digital technology to enable three things—the precise identification of all parties to a transaction; low-cost communications; and accurate, accountable, and convenient payments—and so to improve the interactions between citizens and states.

No silver bullet

Even though this report stresses potential benefits, it recognizes that context matters more than technology, and that the latter is only a tool. On its own it does not necessarily lead to better policies or to stronger implementation—and it can also be used to implement bad policies more effectively. Much depends on the objectives to which it is applied and how well-implemented and inclusive the systems that use it are. This theme emerges clearly from the cases considered, together with some downside risks. ID systems can be used to exclude as well as include, and even well-intentioned innovations can increase the exclusion of vulnerable groups. The massive amounts of data generated by digital systems can facilitate profiling and tracking, including transaction records and locations, and can threaten privacy. And while it has the potential to increase state capacity and effectiveness, JAM imposes new demands on states and civil society, as well as imposing capability requirements on citizens who need to be able to navigate new systems.

Conceptual framework: The SDGs as a measure of state capacity

Is a capable state a “good” state? The record suggests not necessarily. In developmental terms, state capacity can only be assessed relative to some specified objectives. For these, we can turn to the global development consensus, as embodied in the Sustainable Development Goals (SDGs). They represent an ambitious elevation of aspirations relative to the Millennium Development Goals, placing new emphasis on the nexus between the state and the individual.

Box 1 sets out SDG goals and targets especially relevant for JAM. As shown in the first cluster, the SDGs recognize the importance of JAM; ID, mobile communications, and financial inclusion are intrinsic goals in themselves, in addition to being possible instruments to help achieve other goals and targets. Box 1 clusters the latter around several groups of SDG objectives: to increase environmental sustainability, including by reforming pricing in resource-based sectors while preserving or improving equity; to expand the coverage and effectiveness of social protection systems, whether cash-based or in-kind; to improve performance and reduce corruption in services requiring user charges and similar P2G payments; to render public services more accountable and increase client satisfaction; and to support affirmative measures to help close gender gaps, including in access to ICT.

These objectives should motivate governments to use digital technologies—especially ID and payments—to improve delivery of public services, subsidies, and transfers. Without an effective ID system, beneficiary lists are often replete with nonexistent individuals or “ghosts,” resulting in misuse of scarce public resources. Without increased access to financial accounts, it is difficult to pay beneficiaries electronically instead of in physical cash. Finally, without the capacity to gather feedback on the quality and timeliness of public services and payments, it is difficult to identify bottlenecks and improve the efficiency and accountability of service provision. Digital technologies, appropriately designed and implemented, can address these issues, improving the capacity of states to improve the efficiency and equity of delivery mechanisms over a broad range of public goods and services in developing countries.

This report follows the SDG-based structure, drawing on selected examples for policy lessons on how these challenges can be addressed through the application of digital technologies strategically, through JAM. Each country is different, so the aim is not to provide a detailed blueprint. It is, rather, to set out a broad picture and important policy directions.

Box 1. SDGs Related to Digital ID, Mobile, and Payments

Cluster 1. Access to JAM

16.9 By 2030, provide legal identity for all, including birth registration; 17.8 Enhance the use of technology, in particular ICT; proportion of individuals who: own a mobile telephone; are covered by a mobile network; use the Internet; 8.10 Strengthen the capacity of domestic financial institutions to expand access to financial services for all; proportion of adults with a financial account or with a mobile money account

Cluster 2. Efficient Pricing and Sustainability with Equity

12.2 Achieve the sustainable management and efficient use of natural resources; 12.c Rationalize inefficient fossil-fuel subsidies, phase out to reflect environmental impact, and minimize the possible adverse impacts on the poor; 11.6 Reduce the adverse environmental impact of cities, including air quality; mortality rate attributed to household and ambient air pollution; 15.2 Sustainable management of forests, halt deforestation, restore degraded forests; 6.4 Increase water-use efficiency

Cluster 3. Poverty, Social Protection, and Service Delivery

1.3 Implement social protection systems for all; 1.3.1 Proportion of population covered by social protection systems; 2.1 End hunger and ensure access to safe, nutritious, and sufficient food

Cluster 4. Frictionless Payments

17.1 Strengthen domestic resource mobilization; 1.4.1 Proportion of population living in households with access to basic services; 3.8.2 Number of people covered by health insurance or a public health system; 10.c Reduce remittance costs to less than 3 percent;

Cluster 5. Effective and Accountable Governances

16.6 Develop effective, accountable, and transparent institutions at all levels; 16.5 Reduce corruption and bribery in all their forms; proportion of persons who had at least one contact with a public official and who paid a bribe to a public official, or were asked for a bribe during the previous 12 months; proportion of the population satisfied with their last experience of public services

Cluster 6. Gender-Related

5.a Give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance, and natural resources; 5.b Enhance the use of enabling technology, in particular ICT, to promote the empowerment of women

Report summary

The aim of the report is to consider the potential for digital technology that enables three things—the precise identification of all parties to an interaction; low-cost communications; and accurate, accountable, and convenient payment processes—to help reform citizen–state interactions, and to do this in a way that increases individual agency and improves efficiency in the delivery of public services, subsidies, and transfers.

Chapter 1: Common problems solved by JAM

Governments in developing countries face several challenges in delivering benefits and services to their citizens, such as identifying recipients, transitioning from physical cash to digital payments, monitoring implementation, increasing accountability, and gathering feedback on the quality of public services and transfers. Furthermore, effective governments desire to empower and build the agency of their citizens to grow and prosper. JAM provides the capacity to direct payments to verified recipients at convenient times; it allows governments to transfer benefits directly and target progressively instead of relying on economy-wide price ceilings and subsidies—thus enabling more equitable outcomes. But while digital technology has the potential to increase state capacity, it creates new demands on citizens, especially the poor and the vulnerable, who need to be able to access payments, services, and information in new, digital ways.

Chapter 2: A picture of JAM coverage

Citizens and states cannot interact with each other through JAM if people do not have ready access to its components that constitute the first SDG cluster in Box 1. In Chapter 2, an index of JAM inclusion shows that this is shaped by both country-level factors and layered individual attributes including wealth, education, workforce status, and gender. Access to an ID and a mobile increases the probability that an individual will have a financial account. When all of a person’s demographic attributes are favorable (i.e., employed men with high levels of income and education), their probability of financial inclusion is over 80 percent; when they are unfavorable (i.e., poor, unemployed, illiterate women), it is as low as 7 percent. Having an ID and a mobile phone boosts the chances of financial inclusion—the probability for the most disadvantaged group increases to 34 percent, an increase of nearly five times over the baseline case. Finally, receiving a government transfer increases the probability of financial inclusion by 31 percent for an individual at the midpoint of the attribute scale. G2P transfers therefore can be an effective means for greater financial inclusion. However, our analysis also shows that in addition to addressing country-level issues such as weak ID systems and inadequate mobile coverage, policies to provide for universal financial access will need to make special efforts to reach excluded groups, often including women but also, in some cases, ethnic minorities.

Chapter 3: Policies towards universal JAM

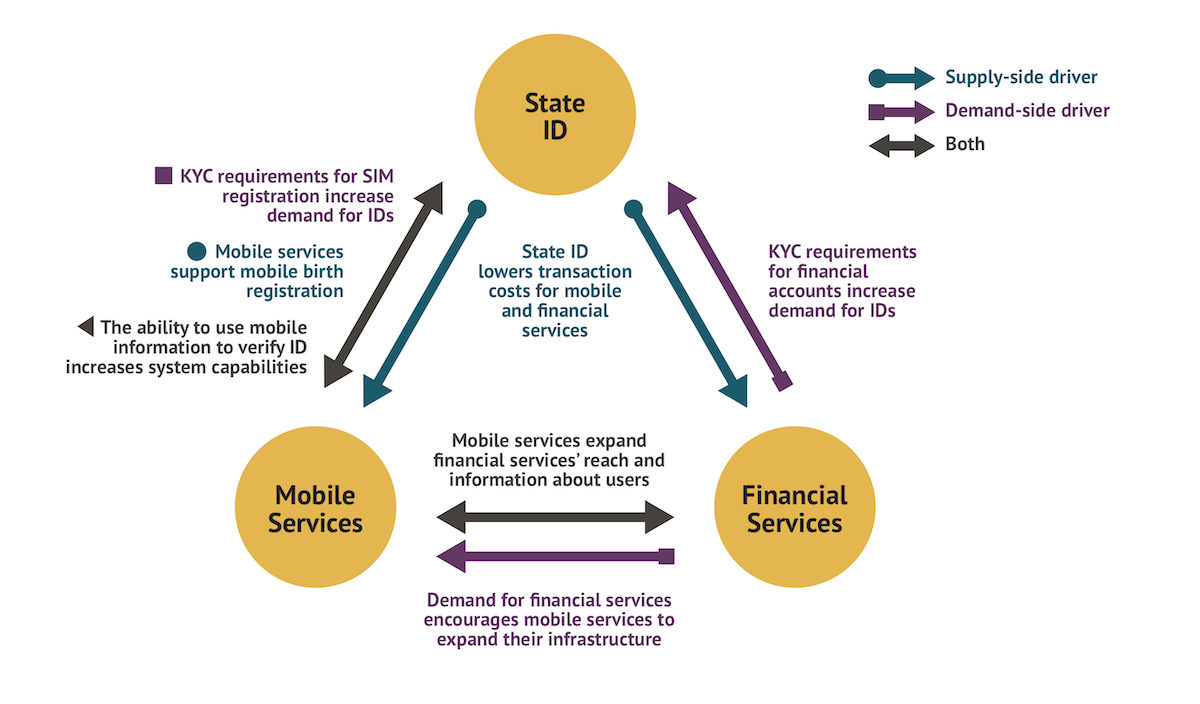

JAM is greater than the sum of its parts. Chapter 3 demonstrates the wide range of synergies between its three components, including economies of scope that can reduce the costs of essential infrastructure. For example, the provision of mobile financial services, as well as voice and data, boosts the business case for constructing cell towers to expand mobile coverage. There are also two-way supply-side and demand-side drivers between JAM and its use in the delivery of public services. As noted in Chapter 2, routing G2P transfers and other payments through bank or mobile accounts can help drive financial inclusion and encourage competition, especially if recipients have a choice of payment providers. Figure 1 illustrates how each component fits into supply- and demand-side drivers that reinforce their shared utility for payments and transactions.

Figure 1

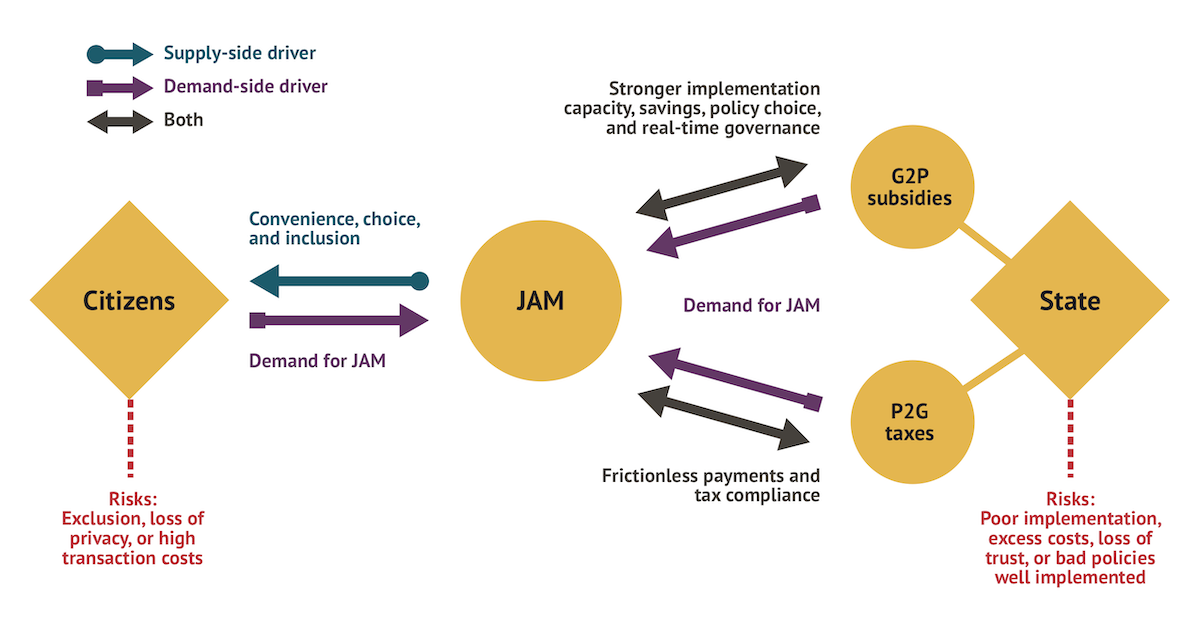

Figure 2 situates JAM as a digital mediator in the middle of citizen–state interactions, highlighting the supply- and demand-side drivers as well as risks for each side of the transactions. With the population financially included, fee-for-service programs can be facilitated by frictionless and accountable digital P2G payments, as described in Cluster 4 of Box 1. While we do not address this area in detail in this report, the available literature indicates the need for an enabling digital payments acceptance ecosystem to reap the full benefits of digital G2P transfers. Because so many different regulatory agencies and service programs are involved, governments need to adopt a strategic approach based on JAM as an integrated platform for service delivery and governance. Each country starts from a different place, so the details will differ, but the framework presented here would be relevant for most cases.

The next three chapters illustrate the various contexts where this can be applied: reforming energy and agricultural subsidies, strengthening social protection, and facilitating beneficiary feedback mechanisms.

Figure 2

Chapter 4: Towards sustainability: Efficient pricing with equity

Fuel subsidies continue to be a major concern in many countries; many governments also offer price subsidies on other products with environmental effects, such as fertilizers. In addition, countries have been slow to levy “green taxes” to price fuels “efficiently” to allow for carbon emissions and other externalities. They also fail to price natural resources, such as water or forests, to reflect their scarcity and the environmental services they provide. All these examples reflect the importance of reforming prices (Cluster 2 in Box 1), a policy made more difficult because of its distributional implications.

As noted in Chapter 3, use of JAM can help to personalize subsidies, to move away from inefficient, distortionary, and inequitable price subsidies towards individualized vouchers or transfers. This enables the price system to be liberated from distributional constraints and allows resources to be priced at efficient levels. India’s massive LPG cooking gas program demonstrates that personalizing subsidies can also facilitate new approaches to targeting and more fiscal flexibility to respond to unexpected price shocks. Moreover, it can also address existing gender inequalities within the household distribution of labor and access to public benefits through greater use of ICT, as described in SDG Cluster 6. Reforms of fertilizer subsidies in several countries show different ways of engaging JAM, and also varying degrees of success. However, as confirmed by recent protests in France, Iran, and other countries, it is also clear that technology is no substitute for effective communication and the political will to overcome vested interests.

Chapter 5: Social protection and associated goals

Social protection features prominently in the SDGs, as described in Box 1, Cluster 4. At first sight, the use of JAM argues for moving all social protection towards transfers, increasingly delivered through financial intermediaries. There may indeed be a trend in this direction, but the choice of modality needs to be assessed carefully for each program, taking into account any wider objectives it might have. The cases examined in this study from Bangladesh, India, and Pakistan indicate that digitized delivery systems can improve the performance of both cash-based and in-kind social protection programs (and service programs more generally) along some critical dimensions—better service, greater user convenience—as well as possibly providing fiscal savings. But the cases in Chapter 5 also show that results are heavily dependent on the institutional context, the objectives of the reform, and whether incentives along the delivery chain are also reformed as it is digitized, to encourage service providers to reach out to their clients. Ill-designed reforms can raise transactional costs and access barriers for poor beneficiaries, and can increase exclusion.

Programs can also be structured to provide advantages to women, including launching their first steps on the road to financial inclusion. At the same time, in strongly patriarchal settings, women may face structural barriers to agency, impeding their access to the opportunities that digital reforms are able to provide. This warrants careful attention in the design of reforms (see Table 2 below).

Chapter 6: Towards real-time governance

With accurate identification, mobile communications, and payments, citizen–state interactions and payments can be tracked individually and in real time. Even as the huge volumes of data produced by such digital systems raise certain risks, they can be used to monitor performance and increase accountability, as illustrated in Chapter 6, directly related to SDG Cluster 5. Monitoring can also draw on rapid citizen feedback, including from providing choice between different service providers or, indeed, alternative programs. Real-time feedback systems are not new in the commercial world, but in the development context this area is still nascent. While some programs have moved towards collecting real-time data, few have yet developed comprehensive systems to analyze it in real time, to combine administrative data and customer feedback, and to cycle the information back into implementation. These capabilities as developed by the state of Andhra Pradesh, for example, represent the most advanced phase of the digital service revolution and are still very much at the frontier.

Cross-cutting theme: Gender-based digital and financial inclusion

Throughout each chapter, we consider how gender differences reflect structural barriers that impede uptake among potential users. Globally, there is a 1.4 percentage point gap in identification coverage, a 6.0 percentage point gender gap in financial inclusion, and an 8.1 percentage point gap in mobile phone ownership between men and women. Getting to universal JAM coverage presents a challenge and an opportunity for women, but there is a need for policies that facilitate their engagement with digital public service delivery platforms.

Key messages and principles for policy

Digital technology, including ID and payments and supported by mobiles (JAM), can enhance state capability to deliver a wide range of policies and programs relating to multiple SDGs in the areas of sustainability, social protection, and governance. Improvements can include better accountability, service and user empowerment, greater equity, and sometimes fiscal savings. The latter can come mainly from three sources: lower transaction costs, eliminating ghost and duplicate beneficiaries (both within and across programs), and reducing leakages in subsidies delivered through G2P and P2G payments as well as goods delivered through digitally controlled supply chains. Shifting from physical cash payments to financial transfers, for example, can ease the burden of managing cash on frontline service providers, such as teachers in the case of education supplements in Bangladesh.

Gains are not automatic, however. Technology is only a tool. Even as it opens up new opportunities, its impact will be shaped by institutional and economic conditions as well as the aim of the reforms. In some cases, state capacity has been a constraint on implementing better policies (Nigeria), but expanding the policy possibility frontier does not necessarily lead to better policies, either to address sustainability (Bolivia) or to improve social protection. Reforms are inherently political and often require sustained effort to overcome strong vested interests. A shift to digitized programs places new demands on the capabilities of the state to regulate the new systems and to apply them in programs, and on citizens to navigate them.

Technology amplifies the power of data, and its impact on development depends on how this power is used. States can use data to improve service delivery, but they may not be benign users of data. The rapidly evolving tools available to governments also have the potential to leave marginalized groups behind, or to further isolate them. New checks and balances will be needed to ensure that digital technology serves the needs of all citizens.

JAM is a flexible platform, and it is being applied in different ways. The principles that follow are based on cases to date, but there is still a great deal to learn about the introduction of digitized service programs.

Access

Universal access to well-functioning ID, connectivity, and financial inclusion has to be a first principle when considering moving citizen–government interactions in this direction.

The details differ but there are common policy directions. A full treatment of policies to increase access to JAM is beyond the scope of this report. However, drawing on a range of material in addition to our own studies, Table 1 shows policy directions acting on both the supply side and the demand side, applicable to many countries. Some have the primary objective of increasing access; others of increasing functionality, value, and user trust which, in turn, encourages take-up. Many require coordination across several ministries or regulators to reap the benefits of common physical or agent infrastructure, which can expand the reach of JAM components and increase the convenience of users, such as common payment arrangements across programs.

Fiscal windfalls from the mobile revolution can be exploited to encourage access. For example, the rapidly growing demand for high-speed internet increases the value that governments can obtain from spectrum auctions. Part of this can be allocated to cross-subsidize at least basic connectivity for more remote or disadvantaged groups. Increased access, in turn, enables government to shift more programs and services onto a JAM-based platform (including those that require fees and other P2G payments), to improve services, and, in many cases, to create fiscal savings.

Table 1. Policy directions for universal JAM

No.GoalDescription

1

Access to ID and building trust

Robust ID for all with strong authentication ecosystem.

Free, easy enrollment with minimum possible data requirements.

Coordination with civil registration to facilitate updating.

Clear accountability for data protection, managing grievances, and handling technology failure.

2

Access to mobiles and finance

Simplify KYC documentation around ID and move to risk-based KYC and e-KYC to cut onboarding costs.

Level the playing field: uniform requirements for SIM registration and basic mobile money or bank accounts.

3

Access to mobile

Encourage universal access to at least 2G.

Cross-subsidize coverage through proceeds and conditions of spectrum auctions.

Consider subsidies or tax breaks on feature phones; avoid excessive taxation.

Provide for number portability.

4

Access to finance, and trust

Allow nonbanks (notably MNOs but also other businesses) to offer payment services as a low-cost way to extend financial access to poor customers.

KYC, along the lines of SIM registration subject to trust account arrangements and prudential oversight.

5

Access to mobile and finance

Encourage shared infrastructure—cell towers, perhaps through tower companies—and agents.

Promote nonexclusivity to share fixed costs and facilitate expansion.

6

Value and convenience of finance

At an appropriate stage of market development, encourage payments interoperability.

Support technology switch (like UPI) and encourage mutually beneficial interchange agreements between providers.

Encourage innovations such as tokenized addresses to increase convenience and trust.

7

Accountability and access to finance

G2P payments through common platform able to pay to any general-purpose financial or mobile account.

Minimize cash and special-purpose channels, while recognizing that these may be essential in some areas.

Develop a common approach to paying for “last-mile delivery” through general-purpose instruments, and for separating out identity verification from payments.

8

Value, acceptance, and convenience of finance

E-Payment Gateway to enable P2G payment for government-provided services to be made easily through any account.

Enforce use progressively as financial inclusion increases.

Use Gateway and possibly other measures to incentivize wider merchant acceptance ecosystem for digital payments.

9

Value, acceptance, and convenience of finance

Avoid excessively high taxation of digital transactions that may discourage use and merchant acceptance.

Consider fiscal incentives to encourage acceptance, such as temporary VAT reductions on digital transactions.

Review tax administration and audit requirements to reduce need for paper receipts and records, since these undermine the benefits of moving to digital systems.

10

Value/access, benefits of digital governance, trust in digital data

Use digital data to monitor implementation and performance of government programs (towards real-time digital governance).

Monitor beneficiary experience to ensure that poor and vulnerable groups are not excluded by digital divide.

Take steps to secure the large amounts of transactional and other data that will be generated by the use of JAM.

11

Access to ID, mobile, and finance

Ensure that applications and interfaces are designed to meet the unique needs and preferences of vulnerable and marginalized groups, including but not limited to women, linguistic/ethnic/religious minorities, differently abled people, etc.

12

Capability for wider access and functionality

Encourage partnerships, including with service providers, self-help groups, and NGOs, to promote digital education and capacity across the population, in particular among women.

Accountability

Accountability for service delivery is a second principle that emerges from the cases.

The primary aim of reform should be to improve quality and inclusion, with fiscal savings a secondary objective, to be obtained from efficiency gains. Cases suggest that a single-minded focus on fiscal savings risks increasing exclusion because there is little effort to put in place the monitoring and protocols needed to prevent it (see the Jharkhand food rations case in Chapter 5). They also show that large fiscal gains are often possible, whether through eliminating ghosts or duplicates from beneficiary rolls or from eliminating leakages and corruption in the distribution and payments process, even when fiscal saving is not the prime driver of the reforms (see the biometric smartcards and food rations cases in Andhra Pradesh in Chapter 5, and the LPG cooking gas case in Chapter 4). In extreme cases a hurried emphasis on cutting costs may even backfire, as in the abortive effort to introduce stock reconciliation in the ration system in Jharkhand. It is better to take a phased approach, first putting in place the new systems, ensuring that they work well, and then using them to help trim beneficiaries and reduce leakage (see discussion of the LPG cooking gas case and Andhra Pradesh’s implementation throughout Chapters 4 and 5) than to attempt to do it all simultaneously (see the Rajasthan case in Chapter 5).

Digital approaches can open the door to new ways to approach targeting. Targeting offers another opportunity for phased approaches. Because they enable benefits to be provided accountably to well-identified recipients, governments can invoke “soft targeting” through moral suasion and other indicative approaches (see the LPG cooking gas case in Chapter 4). Targeting can then be progressively “hardened,” including through mechanisms such as legally binding self-declarations, to focus the benefits more tightly on poorer citizens. A further phase, using data analytics on consumption patterns to screen potential beneficiaries on an ongoing basis, is increasingly feasible in a digitally connected world but may be seen as overly intrusive.

Incentives throughout the delivery chain are a critical counterpart to accountability and need to be factored into rollouts and reforms. If digital reforms eliminate avenues for diversion and corruption, margins for service providers will probably need to be increased to compensate for reduced opportunities to exercise their discretion. Cooking gas distributors, for example, as well as owners of ration shops in Rajasthan and Andhra Pradesh, saw increases in commissions; many would probably not have stayed in business otherwise. In the latter case, dealers also benefited from reforms higher up the supply chain that increased the accuracy and predictability of deliveries to their shops. Inadequate compensation for business correspondents probably was a factor in the unsatisfactory performance of the banking system in delivering pensions in Andhra Pradesh. It may be necessary to adopt tiered service margins to compensate for higher last-mile delivery costs, especially as services and benefits are extended to sparse or poor regions. Also, charges for authentication and other “platform” services should not be set at levels that compromise inclusion.

It is essential to have effective policies and procedures in place to monitor technology failures and grievances and to resolve them, especially as reforms move important elements of delivery out of the hands of local officials and towards more remote systems and data. By and large, people respond pragmatically to the introduction of new systems. They like them when they feel empowered, with better service and more control; they disapprove when faced with difficulties in executing transactions, even in cases where these are not so serious as to result in actual exclusion. No system is perfect, and even the best technology is subject to failures, whether due to poor connectivity, authentication failures, or other factors.

Even programs seen as “good” by the majority of beneficiaries and customers can increase the marginalization of vulnerable groups. For this reason, there needs to be a special focus on such groups when assessing the impact of changes. This can include technological challenges—for example, to provide alternative options for authentication through an ID system. Examples show that performance can improve over time (see the experience of various Indian authentication cases in Chapter 5, and the fertilizer cases in Chapter 4), but human processes are essential as a last resort. Innovative use of technology can also limit the amount of discretion in these processes (see the case of Andhra Pradesh in Chapter 6), thereby maintaining a high level of accountability.

Reforms can also involve transitional frictions such as reconciling data errors and inconsistencies as previously manual or scattered systems are integrated. These problems will be more serious for groups with less capacity—the poor, elderly, or women—who are frequently the most dependent beneficiaries of public programs. It is essential to have well-working systems to resolve such difficulties, as well as to enable the easy updating of personal information.

Choice and voice

Digital technology should empower citizens by increasing agency, expanding choice, and strengthening voice through better and more effective use of feedback systems.

Digitized delivery systems generate enormous quantities of data, much of it in real time, which can provide critical feedback to programs and transition towards a system of real-time governance. With fully identified participants and mobile communications, delivery can in principle be monitored continually at every service point (as shown in Rajasthan and Andhra Pradesh). This enables governments to identify underperforming service areas and failed individual transactions. The example of Andhra Pradesh suggests that the feedback loop from a failed transaction can intervene with the dealer (one of some 24,000 in the state) within as little as 10 minutes. This degree of monitoring may not be realistic on a large scale, but it illustrates something about the possibilities of such systems. Clients can also receive timely information on the status of their requests (orders for LPG cooking gas cylinders, for example).

Because benefits are personalized and attached to the beneficiary, they can be made portable, subject to logistical constraints. The exercise of choice by users provides a second important real-time feedback signal to program administrators. Choice of service provider has been an important element of beneficiary empowerment in some programs (see the case of LPG cooking gas in Chapter 4 and the Andhra Pradesh food rations and pensions cases in Chapter 5). Surveys suggest that this is much welcomed by beneficiaries. It adds convenience, especially for mobile populations, and provides the option of moving to suppliers who provide better service. Efficient portability within an in-kind delivery system is not possible without real-time monitoring of transactions to reconcile stocks and flows and avoid excessive buildup of inventory or stockouts. Choice might not be feasible in all situations (for example, in sparse regions), but even there it can sometimes be facilitated through more flexible arrangements—enabling transfers to be cashed out at shops and other local service points and enrolling businesses as smaller-scale rural distributors, as in the case of the LPG cooking gas program.

User responses can provide a third feedback loop, operating in almost real time. This can include star ratings of distributors and beneficiary surveys through robocalls (see the LPG cooking gas and Andhra Pradesh case in Chapter 6) as well as phone-based systems for filing complaints. Complaints need to be routed rapidly to the responsible department, with time-bound and monitored deadlines for response. Such real-time systems have great advantages over more traditional user surveys and studies that may take years to yield results, during which time administrators and officials will have turned over. Rapid feedback can help to focus the bureaucracy and feed into systems that rate providers on service delivery, increasing competitive pressure for improvement.

Although elements of the approach could be included in many programs, not all jurisdictions will have the motivation and capability needed to operate a full real-time governance feedback system. While JAM opens up new possibilities for real-time governance, cases suggest that there are some preconditions for such systems to be effective.

First is sustained political will, to prioritize service delivery over other political interests. The successful cases studied for this report benefited from support at the highest levels of government. This is needed to counterbalance the tendencies for lower levels of the administration to work against such a governance system, since it severely constrains their discretion.

Second is program and funding stability, together with a degree of preexisting capacity. Reforms of this type typically take several years to transition to steady-state systems. Feedback loops will not resolve problems that originate outside the delivery system, such as erratic funding or severely disrupted supply chains (see the fertilizer reforms in Nigeria and Zambia in Chapter 4). In a low-performing program, a real-time feedback system would probably be overwhelmed by complaints and quickly become ineffective.

Third is the social and political acceptability of ID systems with the capabilities of Aadhaar, together with the retention of transaction records to build large data sets. Only now are governments, as in the case of Andhra Pradesh, beginning to grapple with the question of how to manage the data generated by their reforms.

Ensuring the long-term political sustainability of real-time feedback systems is difficult, but transparency can help build citizen demand and buy-in. The real-time governance cases studied in Chapter 6 feature real-time aggregated scores based on beneficiary feedback, but some of these are only visible internally. The results generated by feedback systems will need to be readily available and easily accessible to the public to establish it as a citizen expectation and a useful tool for civil society.

Cross-cutting goals: Gender equity and financial inclusion

Even as digitizing programs can contribute to more effective service delivery, it can support women’s empowerment and provide a stimulus to financial inclusion. These are useful steps towards the goal of changing gender norms, although this is a much longer-run proposition.

While this report focuses on service delivery in general, several programs are particularly significant for women. These include the LPG cooking gas program, which aims to improve time use and health outcomes for women; Rajasthan’s Bhamashah program designates women as the head of household for program purposes; Bangladesh’s program to provide education supplements to women through mobile phones; and Pakistan’s BISP program to support poor women. The case of Andhra Pradesh highlights the role of women in the new digital economy as business correspondents of commercial banks.

A growing body of evidence shows that women and other marginalized groups such as ethnic and linguistic minorities, as well as differently abled persons, face extra structural barriers to adopting the JAM components. This report shows that globally, the 8.0 percentage point gender gap in financial inclusion would close by 5.5 percentage points if women had the same socioeconomic characteristics as men (the same level of education, income, workforce status, etc.). Women’s economic empowerment through education, workforce participation, and access to mobile technology would contribute significantly to closing the gaps.

Surveys paint a broadly favorable picture in most cases but point to the need for attention to the constraints on women that limit their agency. This can dilute the gains from digitizing programs or even cause more difficulties. Programs like these can improve women’s lives even though the immediate outcome may represent only a modest step towards the ultimate goal of gender equality. But multiple overlapping attributes can contribute to individuals falling below an “agency threshold” needed to benefit from the reform. For example, if the shift towards digital services and payments reinforces structural barriers to financial access rather than providing alternative solutions, reforms can reduce women’s agency. Measures may be needed in multiple areas; the gender gap in mobile ownership, for example, appears to be related to that in financial inclusion and is of similar magnitude. Technology can help to ensure that women receive their benefits in person (as in the Pakistan case in Chapter 5), but they may still face particular hurdles to accessing service points to cash out transfers, or to transacting independently.

The road from digital transfers to full use of financial accounts is long, but specific measures can help. By and large, very few of the women receiving transfers into bank or mobile money accounts are doing more than cashing them out. They are financially included, but more in a formal sense than in a real sense. This is not unexpected; it will take time to build experience with the saving, payments, and other services that financial accounts can offer, as well as to build the wider acceptance system for payments. Digital and financial literacy is a hurdle for many women; partnerships with self-help groups and NGOs could help to improve these capabilities and empower them to function in the digital economy. Government can complement this with active measures to link the provision of mobile phones to programs and to support the provision of messaging and interfaces in the local language (as shown in the case of Bangladesh in Chapter 5).

Combining policy and technology

Drawing from the SDG framework and analysis of cases, this report suggests several principles that can be helpful in formulating or assessing digital governance systems. Do they provide for universal access? Do they embody clear accountability for performance? Do they empower beneficiaries by providing them with choice over service provider and effective voice? Does the design of reform exploit the potential for favorable externalities, such as gender equity and women’s economic empowerment? Each of these elements has both a policy design and a technology component that should be considered together to achieve better developmental outcomes (Table 2).

Table 2. Digital governance principles: Design and technology

Policy designTechnology

Inclusion

“No person left behind” principle

Address last-mile access issues and vulnerable groups

Shift from generalized approaches towards personalized interventions and instruments

“Bottom of digital pyramid” approach

Ease of use

Ability to reach last mile

Flexibility to facilitate progressive targeting

Accountability

Identify vulnerable people and processes to monitor

Integrate clear human fail-safe option and processes in case of failure of technology including backup alternatives

Resolve queries and provide remediation quickly

Remedial alternatives if mainline approach fails

Use administrative data to document service transactions in real time and monitor service delivery, for example, to identify cases of exclusion

Link to performance measures, including from beneficiary assessments

Choice

Offer multiple agencies/channels to access benefits (portability)

Restructure incentives to encourage service and to promote competition between providers

End-to-end digitization of front-end delivery systems as well as supply chains

Use authentication capability of ID system to render service entitlements fully portable

Develop option for personalized choice over in-kind to cash transition

Voice

Integrate digital feedback loop (both implementing agency and beneficiary) as well as user surveys of perception and experience

Identify and address inclusion and accountability gaps

Personalized feedback systems including text messages, robocalls, interactive voice response, etc., along with human interface

Ratings of service quality and providers

Integration in digital dashboards for monitoring, accountability, and redesign

Externalities

Identify desirable externalities and combinations, for example, women’s empowerment and financial inclusion

Design intervention to favor such outcomes in addition to efficiency and inclusion

Assess technology access, capabilities, and gaps in terms of externality objective

Explore special measures to complement technology rollout to increase access and use (for example, financial literacy classes for women)

Concluding comments

There is a large unfinished agenda to extend JAM access and use. JAM cannot be used as a delivery platform for services unless it is widely accessible. While there has been spectacular growth in coverage, the cross-country picture is uneven, including in reaching the poor and vulnerable groups who are often the highest priority for service. Similarly, the wide gap between leading use cases and others indicates how much further there is to go in using JAM to reform citizen–state engagement. Addressing this challenge will require strategic approaches that build on natural synergies, especially since ID systems, mobile communications, and payment systems are multiuse platforms that can be applied to many programs and services.

Governance will need to evolve as citizens increasingly adjust to—as well as demand—"digital first” interactions with the state. There are still many questions around the longer-run implications of digitization. While digitization of government payments has been motivated largely by the objective of governments to improve the efficiency of public expenditure, we have yet to see its impact on revenue mobilization, especially in developing countries. To what extent ubiquitous citizen–state digital payments (both G2P and P2G) would lead individuals to change their preferences for cash versus financial transactions is also an open question. The impact of digitization is complex—for example, the trade-offs between greater transparency and accountability of transactions enabled by digital ID and payments on the one hand and the incentive to deliver better services by those who benefited from the previous system on the other. Digitization would entail significant realignment of incentives between the government, its intermediaries, and citizens.

More monitoring and research are needed as the use of JAM extends to more countries and programs. While this report has sought to build on available evidence, this is still sparse. Few system reforms are adequately monitored, so provision for this—including client surveys—should be built into their design at the start. There is also a need to better understand how the shift towards digital mechanisms influences social and gender norms over the longer run.

No comments:

Post a Comment