by Steven Hansen

The recent U.S. tariffs on China are expected to reduce economic efficiency. First, the higher tariffs will render some of China's exports to the U.S. uncompetitive, thus reducing imports. The move from a more efficient producer in China to a less efficient domestic source is an efficiency loss.

Second, the tariffs could lead to what trade economists refer to as "trade diversion." A less efficient producer in, say, Vietnam may become competitive relative to a more efficient Chinese producer due to tariffs, incentivizing the U.S. to switch imports from China to Vietnam. This would also be an efficiency loss for the U.S. as imports would be sourced from a less efficient nation.

Is it economic efficiency to allow a completely untaxed product (the exporting country returned all taxes collected from the exporter) to be imported where the domestic industries have paid a whole slew of taxes including property, employment, income, et al?

Is it economic efficiency to have a trading partner putting tariffs on your goods but you put no tariff on their goods?

Is it economic efficiency for a trading partner to put technology sharing as a requirement for your production in the trading partner's country?

Is it economic efficiency to allow imports to enter with no tariffs that are produced in an inferior labor environment, or significantly pollute the environment?

In a command economy (say China), the government can choose to export products at a competitive price even with tariffs.

Trade historically has resulted from the need to buy products not available in that marketplace. In more modern times, trade morphed into importing products that are cheaper than domestically produced products.

The U.S. is far from innocent by contributing to the root cause of an uneven playing field. The system in the U.S. taxes corporations at the federal, state and local levels - but the Asian imports arrive, for the most part, without any taxes being paid to the exporting countries. Thus, the U.S.-produced goods have a significant production cost disadvantage - which makes one wonder why most companies would produce goods in the U.S. with such a favorable situation for imported items.

The playing field could be leveled by setting import tariffs equal to taxes which would have been paid if the item was manufactured domestically - or not tax domestic corporations at all and instead taxing all domestic or imported goods equally with some form of value-added tax.

And yes, economists believed (and many still believe) that free trade produces goods and services that satisfy domestic needs that are produced more inexpensively or efficiently by other countries. This is only true if the playing field is level. Even the playing field between states in the U.S. have different cost profiles.

This is an side but worth mentioning. Who is making any effort to assess externalities associated with production in various places (environmental impacts, especially long-term, being an example)? It seems that most assessments just consider the transaction costs up front for goods and services to be delivered.

The penalty for the U.S. not maintaining a level playing field was the destruction of domestic production which resulted in lower employment relative to goods consumed. One must continuously monitor the trade environment and take corrective actions are necessary to maintain the level playing field.

It will a cold day in Hades when I believe that trade diversion is even a factor in the current trade war. I see little evidence that Vietnam is displacing China to any significant degree. I hope they are not teaching this in school.

I wish all a happy and prosperous New Year - and a great year investing and trading.

Economic Forecast

The Econintersect Economic Index (December 2019) forecast fell again this month and is now in contraction. The continuing weakness of manufacturing, transport, and exports/imports continues to weigh on our economic forecast.

Although our index is now in negative territory similar to 2016, the penetration into negative territory is not severe or persistent - and our opinion is that our index is not suggesting an economic contraction at this point.

The fundamentals which lead job growth are now showing a significant slowing growth trend in the employment growth dynamics. We are currently predicting the jobs growth to be below the growth needed to maintain participation rates and the employment-population ratios at the current levels.

Economic Releases This Past Week

The following table summarizes the more significant economic releases this past week. For more detailed analysis - please visit our landing page which provides links to our complete analyses.

Overall this week:

there was no news this week that was positive

new home sales slowed

durable goods slowed

transport continues weak and in contraction

Economic Release Summary For This WeekReleasePotential Economic ImpactCommentNovember New Home Sales growth was soft but is still better than average

The headlines say new home sales improved month-over-month - but the year-over-year growth significantly declined from 27,9 % to 18.2 %.

The market expected (from Econoday) seasonally adjusted annualized sales of 715 K to 750 K (consensus 735 K) versus the actual at 719 K which was at the low end of expectations. Still, growth in 2019 still exceeds every year since 2007.

November Durable Goods the major problem with durable goods is Boeing and the 737

The headlines say the durable goods new orders significantly declined. Our analysis shows the rolling averages declined and this sector remains in contraction.

In the adjusted data, the major weakness was civilian aircraft - blame Boeing ant the 737. This series has wide swings monthly so our primary metric is the unadjusted three-month rolling average - which declined and remains in contraction. The rate of growth of the rolling averages is below the values seen over the last year.

November Chicago Fed National Activity Index growth is soft but improved

The economy's rate of growth improved based on the Chicago Fed National Activity Index (CFNAI) 3 month moving (3MA) average - but the economy continues well below the historical trend rate of growth.

The three-month moving average of the Chicago Fed National Activity Index (CFNAI) changed from -0.35 (originally reported as -0.31 last month) to -0.25

A value below zero for the index would indicate that the national economy is expanding below its historical trend rate of growth, and that a level below -0.7 would be indicating a recession was likely underway.

CFNAI Three Month Moving Average (blue line) with Historical Recession Line (red line)

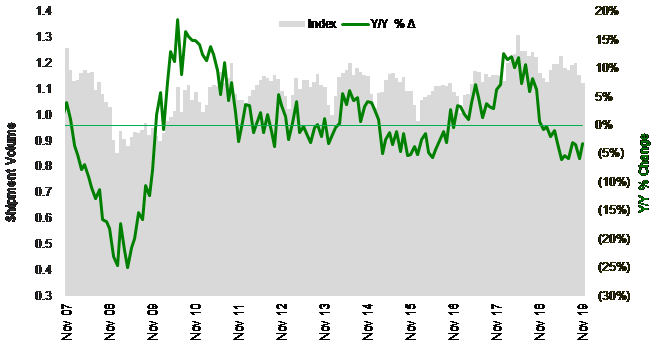

November Truck Transport growth continues in contraction

Headline data for the American Trucking Association (ATA) and the CASS Freight Index reported the year-over-year growth rate continues in contraction.

The CASS index is inclusive of rail, truck, and air shipments. The ATA truck index is inclusive of only trucking industry member movements (ATA's tonnage data is dominated by contract freight).

December Chemical Activity Barometer forecasts soft growth into 3Q2020

The Chemical Activity Barometer (CAB) was stable (0.0 percent change) in December on a three-month moving average (3MMA) basis following a 0.1 percent gain in November. On a year-over-year (Y/Y) basis, the barometer rose 0.4 percent (3MMA) and follows two months of negative year-earlier comparisons.

Per Kevin Swift, chief economist at ACC:

The CAB signals slow gains in U.S. commerce into the third quarter of 2020

Surveys manufacturing remains very soft

Richmond Fed Manufacturing - The important Richmond Fed subcategories (new orders and unfilled orders) remain in contraction. This survey again was worse than last month. From the Richmond Fed:

Fifth District manufacturing activity slowed in December, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite index fell from −1 in November to −5 in December, weighed down by decreases in the already negative indexes for shipments and new orders, while the third component — employment — increased slightly. Manufacturers also reported weakness in local business conditions and capacity utilization, but they were optimistic that conditions would improve in the coming months.

Movements Definitely not positive news

Rail so far in 2019 has changed from a reflection of a strong economic engine to contraction. Currently, not only are the economic intuitive components of rail in contraction, but the year-to-date has slipped into contraction.

Links To All Of Our Analysis This Past Week

No comments:

Post a Comment