By Mercy A. Kuo

Trans-Pacific View author Mercy Kuo regularly engages subject-matter experts, policy practitioners, and strategic thinkers across the globe for their diverse insights into U.S. Asia policy. This conversation with Dimitri Zabelin – currency analyst specializing in international political economy and geopolitics with DailyFX.com – is the 216th in “The Trans-Pacific View Insight Series.”

Trans-Pacific View author Mercy Kuo regularly engages subject-matter experts, policy practitioners, and strategic thinkers across the globe for their diverse insights into U.S. Asia policy. This conversation with Dimitri Zabelin – currency analyst specializing in international political economy and geopolitics with DailyFX.com – is the 216th in “The Trans-Pacific View Insight Series.”

As the U.S.-China trade tensions persist, explain the impact on capital markets and commodities.

Capital markets have been held hostage by the U.S.-China trade war, which has led the world into an industrial recession. Equity markets have become increasingly reliant on central banks to boost liquidity provisions since underlying demand is no longer able to keep economic activity adequately vivacious by itself.

As a result, monetary authorities all over the world embarked on an easing cycle to offset the growth-hampering effects of the trade war. Investors frequently cheer the prospect of looser credit conditions, but the underlying message in central banks’ decision to cut rates appears not to have fully settled in. The question then becomes: how long can central banks keep sentiment afloat with stimulus measures before investors accept the dark reality of current circumstances?

Analyze the impact of the Hong Kong protests on Asian capital markets.

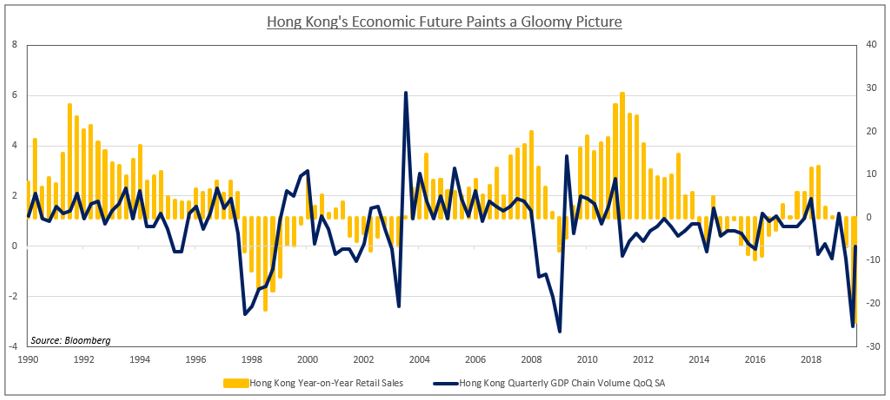

Unrest in Hong Kong amid ongoing protests and the U.S.-China trade war have caused the city to slip into a recession for the first time in over a decade. Clashes between the police and protesters have hurt businesses’ bottom line and reduced tourism. The political unrest there may drive a wedge between the U.S. and China as they attempt to ratify a long-awaited trade deal. Against this backdrop, U.S. President Donald Trump recently signed the Hong Kong Human Rights and Democracy Act into law. Beijing has vowed to retaliate with unspecified countermeasures.

Identify three key trends in commodities amid growing uncertainty in U.S.-China trade negotiations.

Cycle-sensitive commodities like crude oil have been bruised by the U.S.-China trade war. Brent’s weak performance comes despite announcements by OPEC of deeper production cuts and the geopolitical risk premium of escalating tensions with Iran. If the trade spat between the U.S. and China continues to undermine global growth, the demand for vital inputs – like crude oil – will fall in tandem.

However, the trade war may benefit gold. The yellow metal has risen in large part as a result of easing measures by central banks all over the world to counter the disinflationary impact of the Sino-U.S. conflict. Gold’s attraction as anti-fiat hedge is amplified in an environment of low interest rates where the cost of holding a non-interest-bearing asset is comparatively lower. Therefore, if tensions escalate, the urgency for central banks to cut rates may rise alongside gold demand.

Palladium has been one of the top performing metals in 2019. Its use as an input in the production of catalytic converters to reduce auto emissions has been a key factor behind its ascent. Growing car exports out of China have boosted demand for the precious metal, with supply shortages complementing its gains. However, since the Asian giant is the biggest buyer of palladium, a smaller volume of purchases thanks to weakening demand could undo some of this year’s gains.

The U.S.-China trade war has also been a thorn in the side of businesses whose confidence in the outlook has been undermined. Producers are naturally expressing trepidation in expanding their enterprises if they believe the demand for their products will not be aligned with the supply they intend to create. This has made for a logistical nightmare as businesses scramble to shift their supply chains beyond China’s borders.

Vietnam has emerged as the primary destination. However, the shift in trade flows has put pressure on Vietnam’s still-developing infrastructure, which has been struggling to accommodate increased traffic from abroad. Supply chain analysts have cited higher shipping costs, delayed timetables, and port congestion – in large part because the capacity to rapidly absorb a much higher level of commercial activity is absent. As a result, businesses will likely keep most of their Asia-based enterprises in China, where the underlying infrastructural base is fit for purpose. But by doing so, they are putting their company’s profits at risk since the trade war is pointedly aimed at China’s economy.

There is also a concern that turning away from a rules-based system in international trade is creating political contagion. India, Malaysia, South Korea, Japan, and many others are all embroiled in their own respective trade tiffs that threaten to further disrupt global supply chains. The potential impact of this cannot be overstated, and history can prove it. The Smoot-Hawley tariff of the 1930s shrunk global trade by over 60 percent, with many believing it was the leading cause of the Great Depression.

What is your 2020 outlook on capital markets and commodities, if U.S.-China tensions escalate, and why should U.S. and international policy and business leaders be concerned?

What policymakers are growing increasingly worried about are the knock-on effects that an escalated trade dispute might have on financial stability in 2020. The IMF has warned that approximately 40 percent of corporate debt in major economies could be at risk in a global downturn. A recession half as severe as the one in 2008 could put over $19 trillion worth of debt at risk of becoming delinquent. As a result, equity and commodity markets may experience unprecedented convulsions. An explosion in the cross-continental leveraged loan market pushed the highly-integrated global financial system to the brink of collapse just over a decade ago. Will it happen again?

No comments:

Post a Comment