Japanese researchers began studying transistors three months after they were invented at America’s Bell Labs in 1947. Japanese companies then used transistors and other electronic parts and components to produce radios, television sets, Sony Walkmans, video cassette recorders, and computers. As the yen appreciated by 60% following the 1985 Plaza Accord, Japanese companies lost competitiveness in final electronics goods and moved upstream in electronics value chains. They focused on exporting electronic parts and components and capital goods to producers of final electronics goods abroad.

Japan’s declining comparative advantage in electronic parts

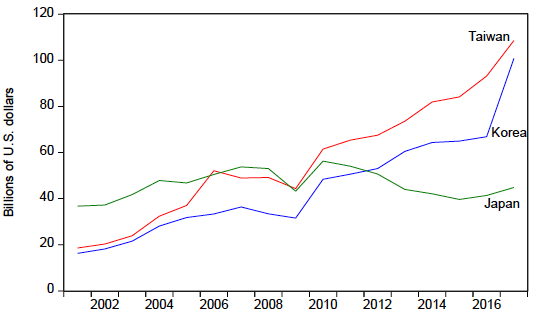

In every year since 1994, electronic parts and components has been Japan’s second leading export category at the International Standard Industrial Classification 4-digit level. However, Japan’s comparative advantage in this category, as measured by Baldwin and Okubo’s (2019) method, tumbled after the Global Crisis, while Korea’s and Taiwan’s soared. Japan was the world’s largest exporter of electronic parts and components before the crisis, but by 2017 Taiwan and South Korea each exported more than twice the value that Japan did (Figure 1). Why did Japan lose its comparative advantage in producing microprocessors, flat-panel displays, integrated circuits, and other parts and components?

Figure 1. The value of electronic parts and components exports from Japan, South Korea, and Taiwan

Note: Electronic parts and components correspond to the International Standard Industrial Classification code 3210.

Source: CEPII-CHELEM database.

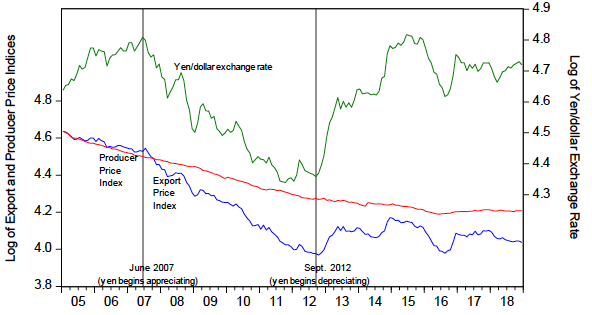

Katz (2012) observed that integrated circuits and similar goods have become commoditised and that Japanese firms compete in these products based on price. Facing fierce competition from Korea and Taiwan, Japanese firms may lack pricing power and thus suffer compressed profit margins when confronting adverse shocks. Japanese companies faced a negative shock in the form of an appreciating yen beginning in June 2007. The Global Crisis generated safe haven capital inflows that caused the yen to appreciate by 45 % against the US dollar between June 2007 and September 2012. Figure 2 shows that the yen price of electronic parts and components exports over this period fell by 35 % relative to yen production costs, where production costs are measured using the Japanese producer price index for electronic parts and components.

Figure 2. The yen/dollar exchange rate, yen producer price index and yen export price index for Japanese electronic components and devices

Source: Bank of Japan and CEIC Database.

Why Japan lost its comparative advantage in producing electronic parts and components

In recent work I investigated why Japan lost its comparative advantage in producing electronic parts and components (Thorbecke 2019). Results from estimating pass-through equations indicate that yen appreciations lead to one-for-one decreases in yen export prices. This implies that exporters keep the foreign currency prices of their exports constant in the face of exchange rate changes. These findings also indicate that the lion’s share of the fall in yen export prices between June 2007 and September 2012 was due to the appreciation of the yen.

Results from estimating export elasticities, using a panel of Japan’s exports to major importing countries, indicate that a 10 % appreciation would reduce electronic parts and components exports by between 2.1 and 2.7 %. Exchange rates thus exert only a small effect on export volumes. This is what one would expect, given that Japanese firms keep foreign currency prices constant in the face of yen appreciations. An implication of these findings is that Japan’s loss of comparative advantage in electronic parts and components exports cannot be attributed to the impact of the yen on export volumes.

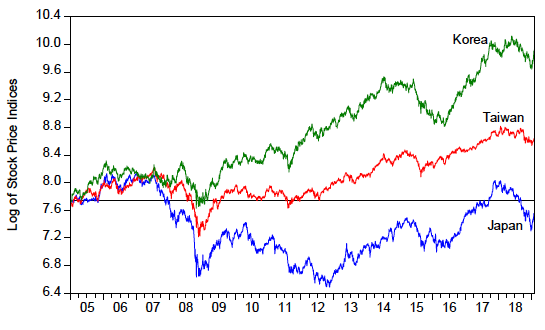

Since an appreciation causes yen export prices to fall relative to yen production costs, exchange rates should affect the profitability of electronic parts and components producers. To examine this issue, I estimate exchange rate exposure equations for Japanese semiconductor producer stocks. Theory implies that stock prices equal the expected present value of future net cash flows, and hence provide information about future profitability. The results indicate that yen appreciations lead to large decreases in semiconductor stock prices, and that New Taiwan dollar depreciations also lead to large decreases in semiconductor stock prices. With the advent of the Global Crisis, not only did the yen appreciate but the New Taiwan dollar depreciated. Both of these currency movements acted as negative shocks that lowered the profitability of Japanese semiconductor producers.

The appreciating yen and weakening New Taiwan dollar after the Global Crisis thus harmed Japanese parts and components makers. While the yen subsequently depreciated and the New Taiwan dollar appreciated, however, Japanese electronic parts and components makers never regained their competitiveness relative to Korean and Taiwanese producers. This is clear from Figure 1 which shows that Japan’s electronic parts and components exports have fallen since the Global Crisis while Korea’s and Taiwan’s have soared.

Why did Japan’s electronic parts exports not recover after the yen depreciated in 2012? Maintaining competitiveness in this industry requires massive investment in physical capital and in research and development (e.g. Rastogi et al. 2011). Following the profitability shock, Japanese firms could not sustain investment at pre-crisis levels. Rather, investment in tangible fixed assets by Japanese electronic parts and components firms tumbled and never recovered. The ‘endaka’ shock, where the yen’s value is higher than that of other currencies, thus triggered hysteresis effects that contributed to a long-term decline in the industry.

By contrast, Taiwanese and Korean electronic parts and components firms have seen their profitability increase. Figure 3 shows that stock prices for Taiwanese and Korean semiconductor producers have soared, while prices for Japanese producers in 2019 remain below their values from 2005. Rising profits at firms in Taiwan and Korea have enabled them to invest heavily and maintain their comparative advantage in producing electronic parts and components.

Figure 3. Semiconductor stock prices in Japan, South Korea, and Taiwan

Source: Datastream database.

High-end Japanese electronics parts producers and the yen

Japanese electronic parts and components companies that do not produce commoditised products, such as semiconductors, have fared better. An example is Murata Manufacturing, which produces ceramic components such as multi-layer ceramic capacitors. It left the low end of the market to Taiwanese firms to focus on high-end multi-layer ceramic capacitors (Electronic Components News 2018). It also dominates the market in certain parts and sensors. The value of the yen does not affect the return on Murata stocks. Since Murata produces high-end products and dominates the market share in several product categories, it faces less pressure to reduce yen prices to keep US dollar prices constant in response to yen appreciations. Thus, yen appreciations do less to damage its profitability. The New Taiwan dollar also does not affect Murata stocks. For products such as multi-layer ceramic capacitors, Murata produces the higher-end items and Taiwanese firms produce the lower-end items. Thus, there is less price competition between Murata and Taiwanese firms.

Interestingly, a depreciation of the Korean won increases the return on Murata’s stock. This could reflect the phenomenon that Patel and Wei (2019) highlighted. They noted that there can be a complementary relationship between Japanese parts and components makers and downstream producers. A depreciation of the won that increases the demand for Korean final goods exports can increase the demand for Japanese parts and components that go into these goods.

Lessons for Japanese firms

Japan’s experience with electronic parts and components offers a couple of lessons. First, unexpected shocks can cause an industry’s outlook to turn on a dime. Companies should save during good times to be prepared for downturns. During the bad times, they should focus on maintaining long-term viability and resisting hysteresis effects. Second, competing based on price in commoditised industries is onerous. Japanese companies should specialise in products where craftsmanship is valued and profit margins are large. Examples of these are the ceramic filters that Murata produces or the image sensors that Sony makes. By finding niches where they have market power, firms can reduce their exposure to safe haven capital inflows and volatile exchange rates.

No comments:

Post a Comment