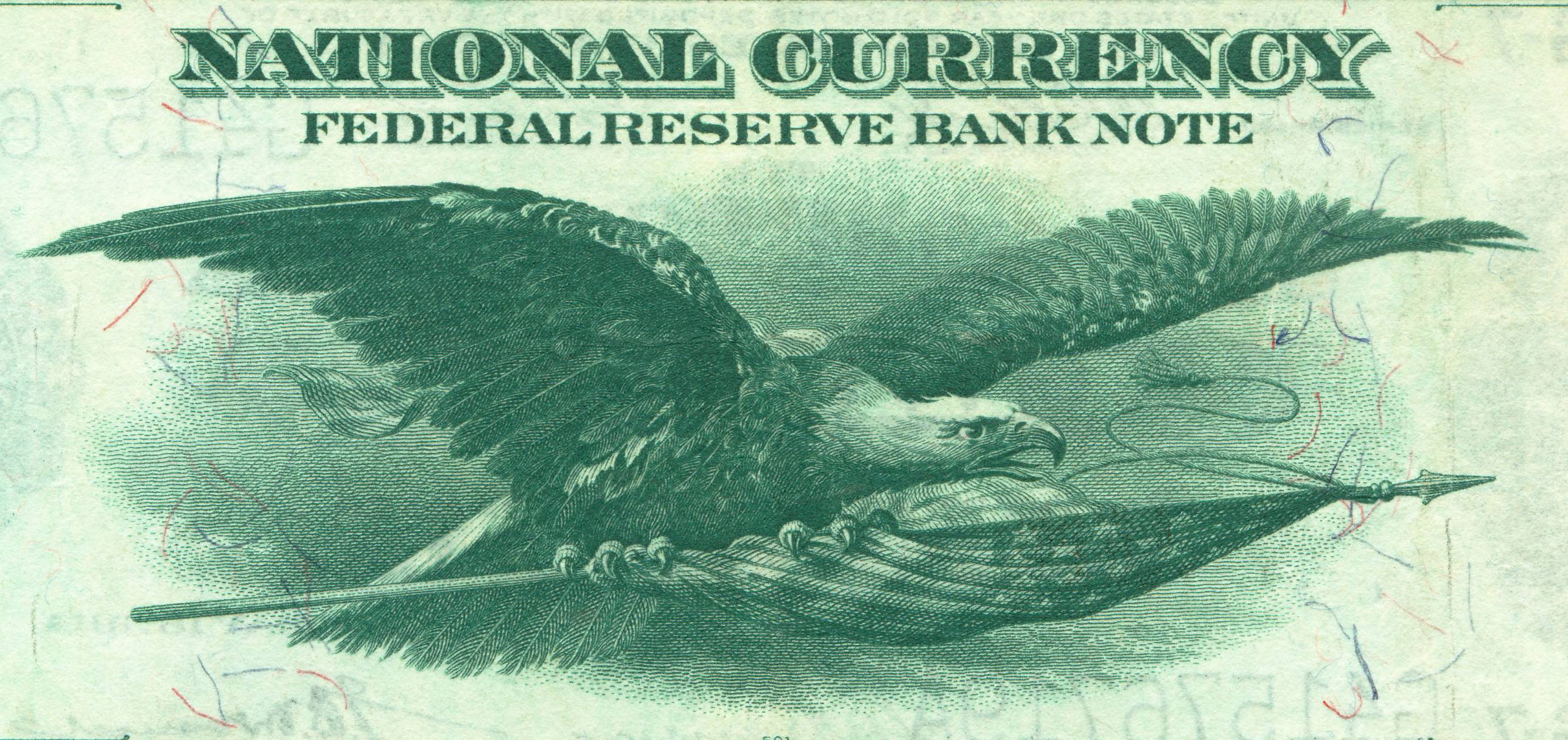

Although it hasn’t commanded the same attention as US President Donald Trump’s tweets and tariffs, America’s increasingly aggressive use of the dollar as a means of diplomatic coercion could bring about a sea change for the global economy. Is America wading too far into the unknown?

Although it hasn’t commanded the same attention as US President Donald Trump’s tweets and tariffs, America’s increasingly aggressive use of the dollar as a means of diplomatic coercion could bring about a sea change for the global economy. Is America wading too far into the unknown?

In this Big Picture, Harvard’s Jeffrey Frankel notes that while the dollar is still the uncontested global reserve currency, America’s abandonment of global leadership and abuse of its privileged position could prompt other countries to seek alternatives. Chief among those will be China, which, according to Paola Subacchi of the University of London, is already hankering for international monetary reform in response to the Trump administration’s trade and currency war. And, as Zaki Laïdi of Sciences Po adds, Europe, too, is realizing that its reliance on the dollar system implies a loss of control over its own foreign policy.

Against this backdrop, MIT’s Simon Johnson points out that digital currencies such as Facebook's recently unveiled Libra represent an entirely new kind of threat to the dollar. And as former Greek Finance Minister Yanis Varoufakis argues, Libra, if taken out of Facebook's hands, could serve as the basis for a “new Bretton Woods” system to replace the dollar-centric status quo.

No comments:

Post a Comment