By Aimee Kim, Lan Luan, and Daniel Zipser

Chinese consumers are now the engine of worldwide growth in luxury spending. The fast-expanding bulge of affluent citizens combined with a small but very wealthy coterie means there’s much more income to spend on luxury goods and services—from fashion, jewelry, and prestige cosmetics to artwork and high-end travel.

1. China leads the world in luxury

It’s a burgeoning market and maybe the deepest pool of spending on high-end products the world has ever witnessed. Understanding the new dynamics is important for luxury brands, of course, but all companies will benefit from insights into the purchasing power and aspirations of these new, mostly younger consumers.

The explosion

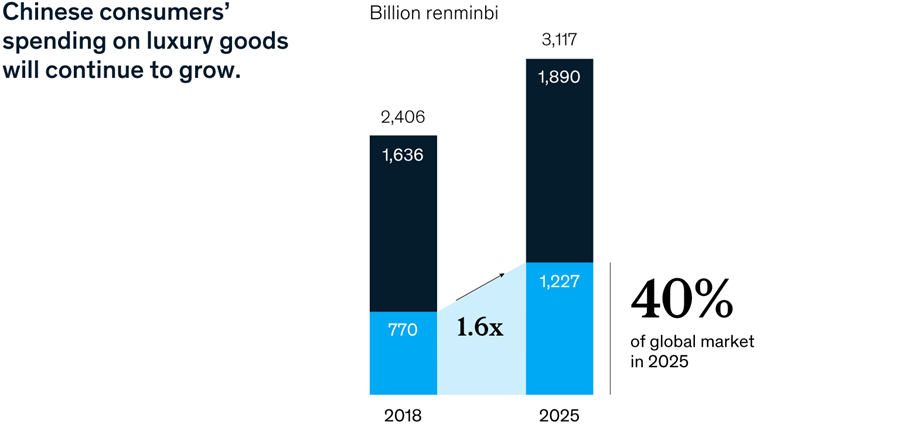

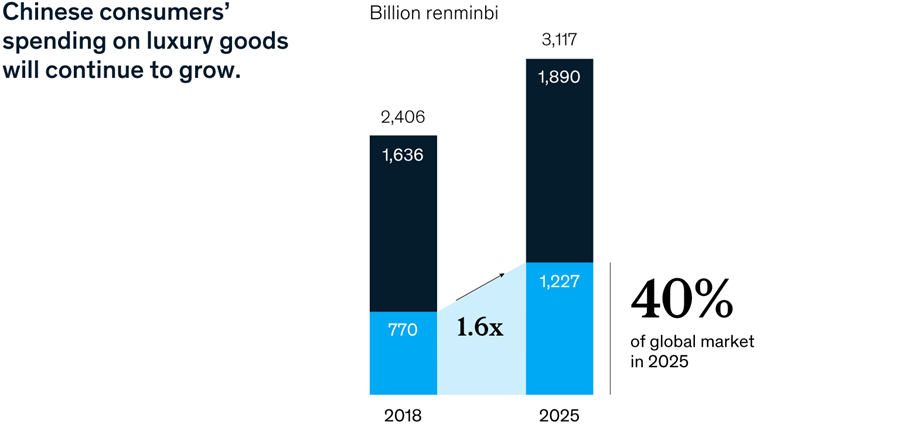

China’s luxury spending will nearly double between now and 2025. Propelling this growth (nearly three-quarters of all new spending globally) is an explosion in upper-middle-class households, which continue to purchase in luxury categories even as growth in China’s economy has eased. The majority of these consumers—about 70 percent, in fact—will be doing their luxury spending overseas, a result of an increasing affinity for outbound travel. Over time, that ratio may shift in favor of domestic spending as a result of moves to cut luxury import taxes.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

Beauty is boomingContinue to next section

“Our sales in China are really growing, up more than 30 percent this year, and China is our number-two market now, bigger even than the US. Also, Chinese consumers are traveling. More than 130 million people went out of China [in 2017], and ten million of them came to Japan. Chinese consumers love to buy cosmetics and visit travel retail businesses, as well as duty-free shops at airports; they do a lot of shopping.”

—Masahiko Uotani, CEO of Shiseido

For the full interview with Masahiko Uotani, see “How a cosmetics giant reaches Chinese consumers: An interview with Shiseido CEO Masahiko Uotani.”

2. Generational differences

On this bustling terrain, companies will find youthful spenders with a keen desire to be different, the newly affluent with deep pockets, and the truly wealthy.

A luxury vanguard

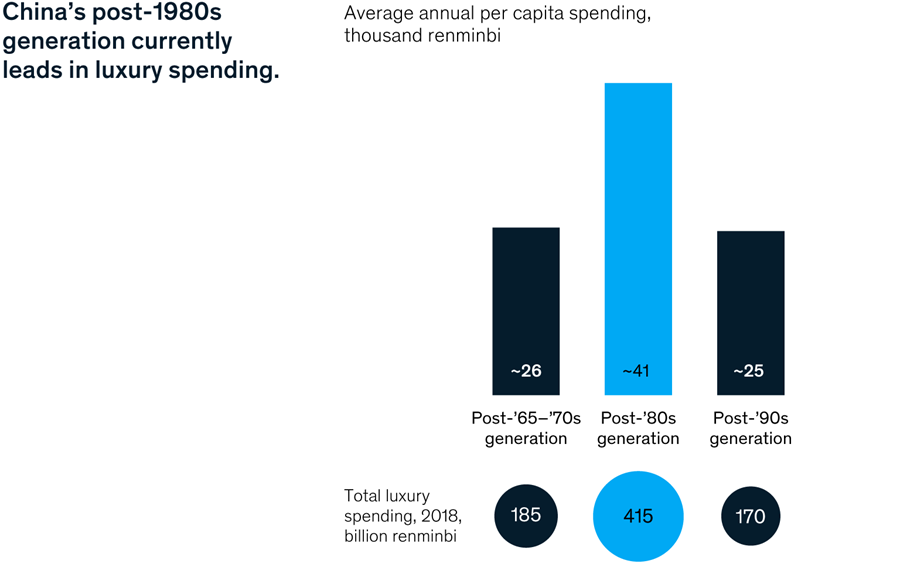

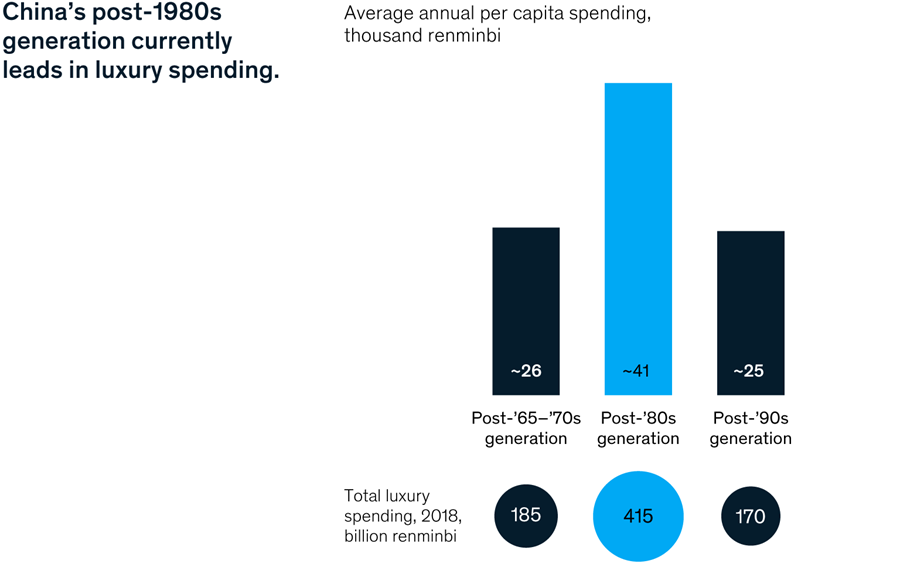

China’s affluent post-1980s generation is fueling luxury buying right now. They grew up as China emerged as an economic power and are now at the peak of their career and earnings, travel frequently, and spend to demonstrate their individualism and success. The post-1990s millennials are the emerging powerhouse. The vanguard of China’s urban middle-class spenders, they’re a dynamic and digitally engrossed cohort.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

Affluent travelersContinue to next section

“Ctrip serves the most affluent segment in China. The most expensive tour we’ve sold costs about $200,000 per person per trip, and it only took us about 17 seconds to sell these packages. That gives you an idea of how exclusive consumers can go when it comes to choosing their package. We see an uptick in demand for tailor-made tours.”

—Jane Sun, CEO of Ctrip

For the full interview with Jane Sun, see “How China’s largest online travel agency connects the world: An interview with Ctrip CEO Jane Sun.”

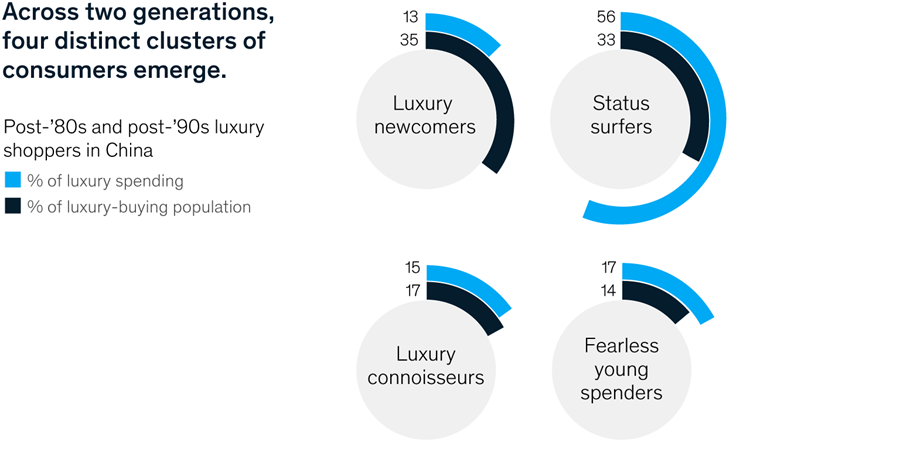

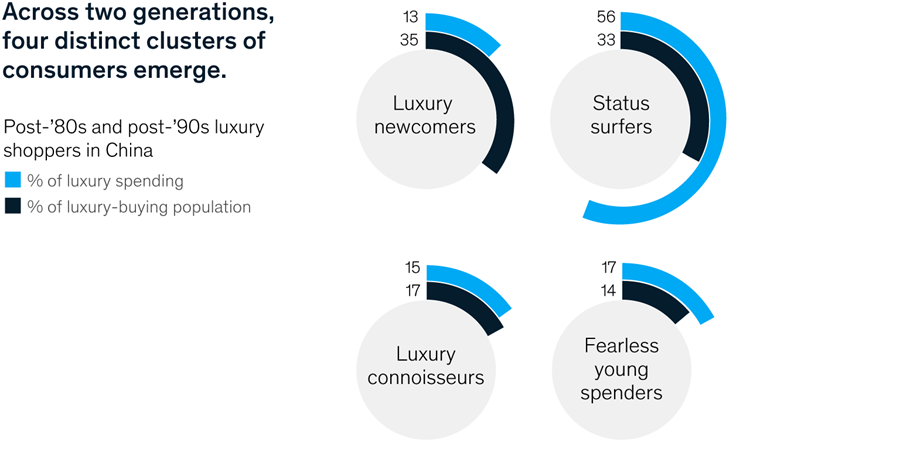

Newcomers and status seekers

Across China’s post-1980s and post-1990s generations, there are four distinct clusters of buyers. Luxury newcomers care most about brands, while status surfers are the least brand loyal. Together they account for 70 percent of the young luxury market. Luxury connoisseurs, with more sophistication and higher aspirations, often are business owners with higher incomes or substantial family money. Fearless young spenders shop for what’s trendy rather than branded products.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

The connoisseurContinue to next section

“It’s interesting: even with [an internet-entrepreneur] background, people still come into Christie’s looking to buy a vase, perhaps from the Qing Dynasty. They could be buying a Chinese painting by Zhang Daqian or a painting by a contemporary artist like Zao Wou-Ki. But I would say the majority, if they’re trying an auction house for the first time, tend to look for art from their own country, with which they can associate emotionally, feel they understand, and can enjoy day to day.”

—Rebecca Wei, chairman of Christie’s Asia

For the full interview with Rebecca Wei, see “Navigating Asia’s booming art market: An interview with Rebecca Wei, chairman of Christie’s Asia.”

3. Action plan

Knowing how China’s luxury consumers think and how they connect with products is useful for any business competing in China. We offer some priorities for action.

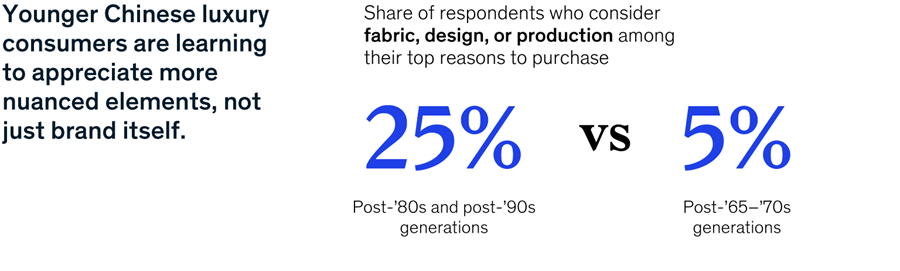

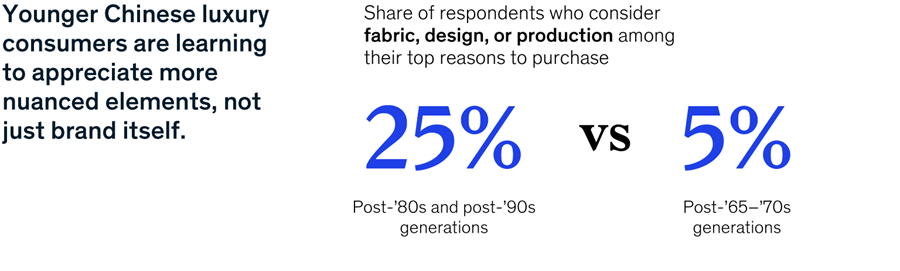

Invest beyond the brand

First off, companies need to think outside the brand box. Brands matter in informing tastes across generations. Young consumers, while still brand conscious, aren’t loyal to brands in the same way that older cohorts were. They’re more willing to venture beyond them for new luxury experiences and tend to churn through them more quickly than older, more loyal consumers do.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

Would you like to learn more about McKinsey Greater China?

Social influencers create greater luxury discernment among younger buyers. They are more likely to appreciate product nuances, and they’re drawn to brand–product combinations, such as bags from one designer and dresses from another. Luxury companies need the right mix of incentives to get young consumers to try a new brand. And there’s a premium on renewed and refreshed product lines and marketing that creates an aura of novelty.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

Target the influencers

Second, luxury companies should earn the digital attention they need by influencing the influencers. After all, media is everything and social media is everywhere. Digitally savvy younger consumers are better able to navigate across channels to get a better deal and use digital media for intensive research before buying. They are heavily influenced by opinion leaders, often global or Chinese celebrities, who talk about and display their purchases on social media. They want personalized digital experiences—from their interactions online to apps that use games to heighten engagement.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you.

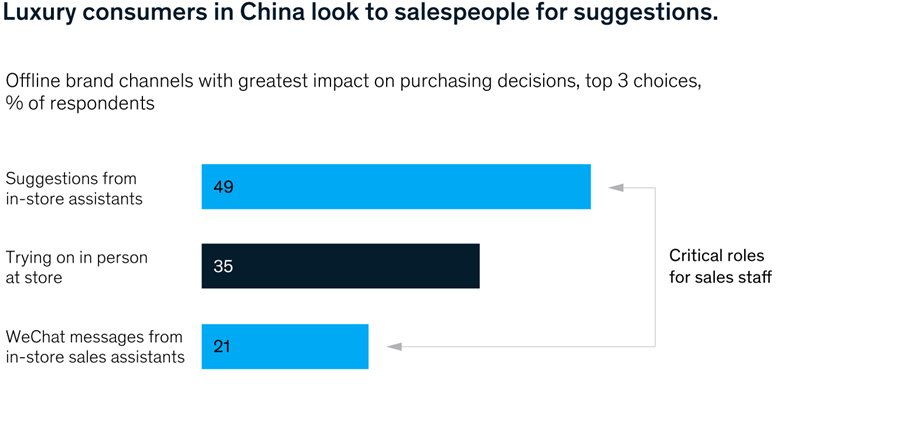

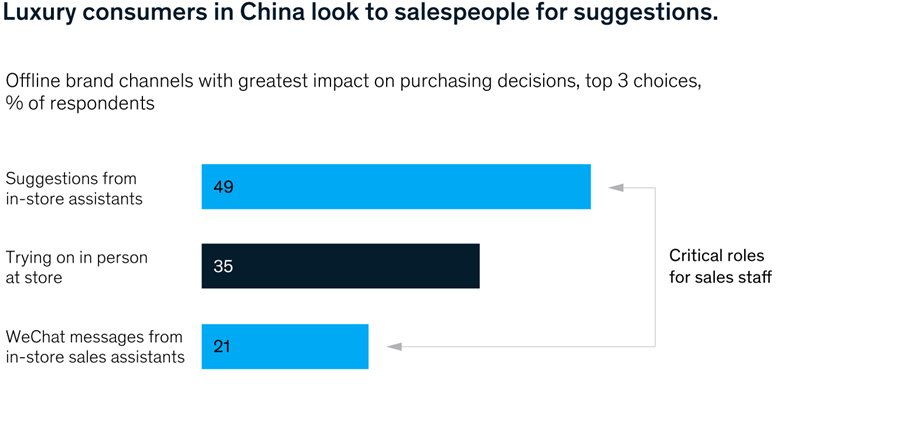

Finally, as much as digital matters, companies should look to close the sale in brick-and-mortar stores. Despite their affinity for digital, nine out of ten young Chinese consumers favor in-person experiences with sales staff in brand stores when it comes to making a purchase decision. Brands need to reimagine in-store experiences; catering to young consumers’ desire to feel different and valued is important. They should think of the store as its own media channel. That means better execution across a range of brand stores, premium malls, duty-free shops, and other outlets.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com

Stay current on your favorite topics

No comments:

Post a Comment