The postwar global economy saw unprecedented growth of global trade and income. Explanations for this growth abound a sharp decline in information and communication costs, technological change allowing for increasing fragmentation of production, political developments such as the integration of Eastern Europe and East Asia into world markets, and international cooperation. The nature of the beast is such that quantifying the relative contribution of each of these explanations to the growth of trade defies clean identification and robust econometric evidence. Yet based on first principles, strongly suggestive empirical evidence, and anecdotal accounts, there is little doubt that a rules-based, predictable trading system contributed significantly to trade and trade-induced growth in many parts of the world, especially in Europe and East Asia. Unfortunately, not everyone participated. Several countries, particularly in Africa and Latin America, were left behind, and there is increasing evidence that the gains from globalization were not shared equally among those living in the countries that benefited from trade.

Still, trade has always been seen as an important driver of growth. The benefits of an open, rules-based, multilateral system go beyond lower tariffs and other trade barriers. Any country, small or large, that meets the requirements can participate. Rules reduce uncertainty and encourage much-needed investment in developing economies. They help countries discipline domestic protectionist lobbies. And they allow powerful countries to credibly commit not to abuse their bargaining power over smaller countries, thereby providing incentives for the smaller nations to participate in trade negotiations. Against this backdrop, recent trade tensions are of concern, particularly for developing economies that have not yet realized the benefits of globalization. Can such countries still count on a well-functioning multilateral trading system to help them integrate into world markets?

Structural factors

This concern is compounded by the slowdown in global trade growth, which was evident even before the onset of the current trade tensions. During the global financial crisis, trade collapsed. The world economy slowly recovered after 2008, but the trade never regained its previous momentum. Several explanations have been suggested - among them cyclical factors, such as sluggish demand, especially for durable and investment goods, which are more trade-sensitive; low corporate investment; and limited trade financing in the aftermath of the crisis. But the two dominant explanations are structural in nature and thus more disconcerting as they point to long-term factors that may be harder to overcome. These explanations are (1) the rebalancing of the Chinese economy and associated increase in China’s domestic value added and (2) the belief that the fragmentation of production has run its course, leaving only limited scope for further international specialization (Hoekman 2015; Constantinescu, Mattoo, and Ruta 2016). Here the term “fragmentation" refers to the process of breaking up production into separate stages that are carried out in different factories or firms, potentially located in different countries.

The data support the first hypothesis. Changes in domestic value added of exports are often used as a proxy for fragmentation. Higher fragmentation is typically associated with more imports of intermediate inputs and less domestic value added. China experienced a pronounced decline in its domestic value added - with a short interruption during the financial crisis - until 2011, consistent with the country’s famed participation in global value chains. But since 2011, domestic value added in China has been steadily increasing.

The data support the first hypothesis. Changes in domestic value added of exports are often used as a proxy for fragmentation. Higher fragmentation is typically associated with more imports of intermediate inputs and less domestic value added. China experienced a pronounced decline in its domestic value added - with a short interruption during the financial crisis - until 2011, consistent with the country’s famed participation in global value chains. But since 2011, domestic value added in China has been steadily increasing.

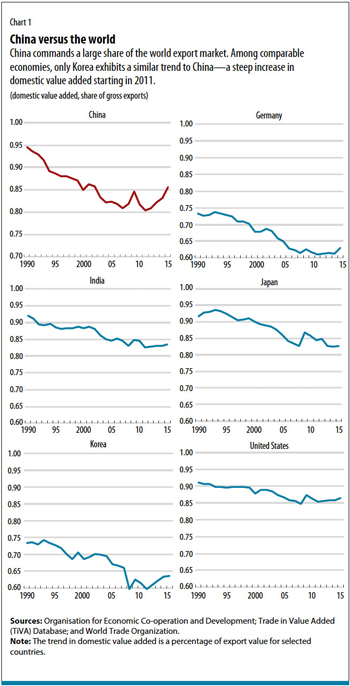

This trend matters for the measured growth of trade for two reasons. First, given that trade is measured in gross and not value-added terms, higher fragmentation and global-value-chain participation imply more trade, because there is double-counting of inputs crossing borders. So any decline in fragmentation and global-value-chain transactions will translate to less trade in gross terms. Second, China commands a large share of the world export market (see Chart 1). Only Korea exhibits the same trend as China - an increase in domestic value added after 2011. For all other countries, the domestic value added has either remained constant or declined slightly, consistent with further integration into global value chains. But China dominates export markets, so it has a large effect on the aggregate trend.

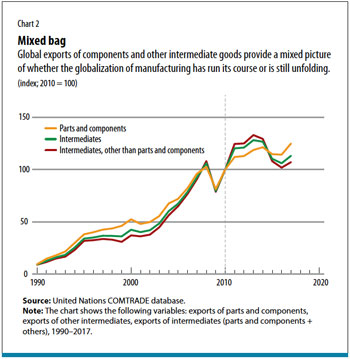

The evidence for the second hypothesis - that fragmentation has run its course - is more mixed (Gaulier, Sztulman, and Ünal 2019). One proxy for production fragmentation used in the literature is trade in intermediate products. Intermediate goods are the sum of semifinished products and so-called parts and components. Chart 2 displays the exports of intermediate products (green line) for 1990 - 2017.

The evidence for the second hypothesis - that fragmentation has run its course - is more mixed (Gaulier, Sztulman, and Ünal 2019). One proxy for production fragmentation used in the literature is trade in intermediate products. Intermediate goods are the sum of semifinished products and so-called parts and components. Chart 2 displays the exports of intermediate products (green line) for 1990 - 2017.

Exports of intermediate goods exhibited strong growth until 2013, with a short disruption during the global financial crisis, but declined steadily between 2013 and 2016. This measure, based on the value of exports, is influenced by several factors, including commodity prices. Chart 2 also offers an alternative measure of fragmentation that is more closely associated with global-value-chain goods trade: the share of parts and components in volume terms in manufacturing trade (red line). This share has increased at a moderate pace since the 1990s and has not shown any signs of reversal since the global crisis. Moreover, as Gaulier, Sztulman, and Ünal (2019) show, these dynamics are not the result of sectoral composition effects. Within the electronics sector - one of the most internationally fragmented sectors, with a 40 percent share in parts and components trade - there have been contrasting developments. While the share of parts and components trade relative to total trade for office machinery and computers has decreased, it has risen for telecommunications equipment. Finally, global value chains are still expanding in terms of product and country coverage: there is growing geographic and product diversity of parts and components trade as measured by the number of product-country combinations, net of new products (Gaulier, Sztulman, and Ünal 2019).

In conclusion, trade growth in the parts of trade most associated with fragmentation does not show clear signs of a slowdown. Along the same lines, arguments that automation and artificial intelligence will lead to onshoring and less trade in the future have not found empirical support. If anything, there is evidence that these advances will lead to more trade by boosting productivity. If a slowdown in global trade growth is not inevitably dictated by technology, the policy can have a key role in shaping its future. But amid high uncertainty and a backlash against globalization, the appetite for trade liberalization seems to be waning. As an indication, the number of new regional trade agreements in 2018 fell to its lowest level since the early 1990s.

Silver lining

How did we get here? Increasing inequality within advanced economies has certainly contributed to creating an environment that is receptive to protectionism if not actively demanding it. Furthermore, long-standing frustration with the functioning of the current multilateral trading system has led to requests for reform or even dismantlement. Some complain that not everyone has played by the rules and that the current trade system is not “fair." Concerns about state subsidies, intellectual property rights, forced technology transfer, and exchange rate manipulation abound. The silver lining is that discontent may give way to constructive reform and a better-designed trading system in the future.

One source of dissatisfaction relates to processes and interpretations of rules. Views on the effectiveness of the present dispute settlement mechanism, the reach of subsidy disciplines, and the proper treatment of state-owned enterprises vary. Moreover, the World Trade Organization’s (WTO’s) traditional all-or-nothing approach, in which all WTO members must agree on all issues, has become a straightjacket. The Kennedy Round took four years to complete, but the Doha Round, which started in 2001, is considered all but dead. Ironically, the very success of the WTO, which resulted in near-global membership and reach, is proving its biggest challenge, because it makes it increasingly hard to reach consensus.

On the positive side, recognition of this challenge has led to a push for more flexible approaches, including plurilateral agreements among a set of like-minded countries (IMF-WB-WTO 2018). In multilateral deals, all WTO members must participate, but plurilateral agreements involve only a subset of countries and allow members to adopt the new rules if they choose. The WTO still prefers multilateral agreements. But when these are not feasible, plurilateral agreements may offer a second-best alternative. Compared with bilateral or regional deals, they offer the advantage that they are in principle available to other WTO members if these members decide to join later. Hence, they overcome the potential inertia associated with fully multilateral negotiations, without undermining the basic principles of multilateralism. There are encouraging developments in this direction, among them the Information Technology Agreement, originally signed in 1996 and expanded in 2016, in which 53 members agreed to tariff cuts that they then applied to all WTO members. Alternatively, the WTO has sought to increase flexibility by pursuing multilateral agreements that unbundle specific issues from broader initiatives. The 2013 Trade Facilitation Agreement, aimed at improving customs practices, is a prime example. The adoption of these two agreements is a testament to the effectiveness of a more flexible WTO.

The second source of dissatisfaction concerns the appropriate focus for international negotiations and new agreements. The digital revolution has changed the nature of trade. Many enterprises now operate as links in global value chains reaching multiple countries; several services, such as banking and insurance, can now be purchased from firms in other countries; and e-commerce plays an increasingly important role in cross-border transactions. Growth in these areas demands more than tariff reductions. It also requires addressing “behind the border" measures that stand in the way of cross-border trade (Mattoo 2019). These include harmonization of domestic regulations; agreement on intellectual property rights protection; and consensus on how to deal with data and delicate privacy issues. These issues have proved challenging so far, even among countries with past success in liberalizing their goods markets. Cross-national regulatory differences can reflect valid concerns about quality standards, exploitation of international market power, and data privacy. Policymakers must strike a balance between the legitimate use of domestic regulations to protect consumers and protectionist abuse. Trade policy alone will not bring about progress in these areas; regulatory cooperation and coordination are needed as well.

Contemplating the future, the kind of cooperation needed to spur growth in trade, especially in services, seems more likely to materialize if it involves economies at similar stages of development with similar objectives. Against this backdrop, regional trade agreements could serve as a useful starting point and complement to multilateral platforms. International trade is not doomed to a permanent slowdown. But it is at a critical juncture. Its future will crucially depend on the policy choices we make.

No comments:

Post a Comment