Patti Domm

The U.S. and China have a better chance of striking a trade deal, now that the U.S. is beginning to feel a bigger pinch from the trade war after Apple’s earnings warning and a sharp drop in U.S. manufacturing activity, economists said.

The U.S. and China have a better chance of striking a trade deal, now that the U.S. is beginning to feel a bigger pinch from the trade war after Apple’s earnings warning and a sharp drop in U.S. manufacturing activity, economists said.

There is a window of opportunity to strike a deal before the U.S. economy weakens further and China comes out of its slump later in the year, said one global economist.

U.S. officials see signs of progress in trade negotiations, ahead of formal talks next week, and see a weaker Chinese economy as a catalyst for it to join talks.

Apple’s sales shortfall in China and a sudden slip in the U.S. manufacturing economy are the latest signs that the Trump administration’s trade war with China is hitting home and that could help bring it to an end, some economists and analysts said.

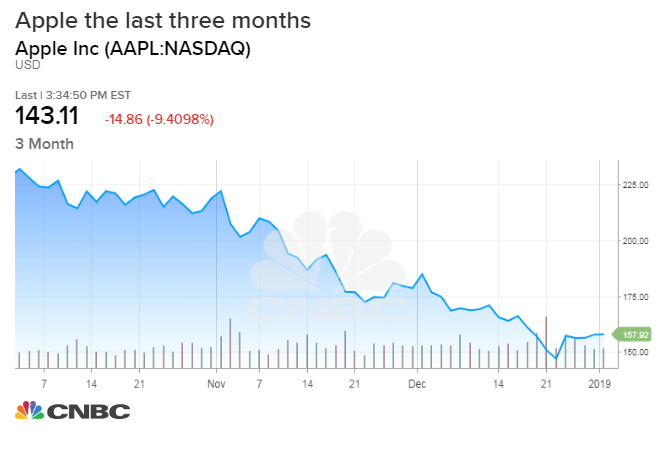

China’s economy has been limping, but Apple’s revelation Wednesday that its iPhone sales in China fell off sharply in November provided further proof that the U.S. trade war is hurting U.S. companies and potentially the domestic economy. Shortly after Apple’s announcement, ISM manufacturing data Thursday fell to the lowest in more than two years.

“This is probably one of the first data points that indicates things domestically in the U.S. economy might be slowing a bit,” said Michael Gapen, chief U.S. economist at Barclays.

More companies will be hit by tariffs like Apple, says Nuveen’s Stephanie Link

ISM manufacturing was at 54.1, a level showing continued expansion, but a sharp drop in orders from 62.1 in November to 51.1 in December concerned economists. According to economists, in the last 35 years, it’s only been down as much as the December hit two times. One was October 2001 when it fell 5.4 and again in October 2008 when it fell 9 points.

“Factories are struggling with the uncertainties around tariffs…as well as the appreciating dollar (the broad trade-weighted dollar index is up about 10 percent from its early-2018 lows), two factors that will likely hurt the factory sector worse than other parts of the economy,” Stephen Stanley, chief economist at Amherst Pierpont, wrote in a note.

‘Incentives are lined up’

Dan Clifton, head of policy research at Strategas Research, said the snowballing of negative news for the U.S. economy as well as the fact China has already weakened could push trade negotiators to find a resolution. A private survey on China’s manufacturing sector showed the first contraction in 19 months in December. The Caixin/Markit Manufacturing Purchasing Managers’ Index fell to 49.7 from 50.2 in November. A reading above 50 indicates expansion, while a reading below that level signals contraction.

“The incentives are lined up,” said Clifton. Weakness in China had been expected to bring Chinese officials to the table, but there was skepticism the U.S. would be able to agree to a deal by March 1. “That’s starting to be reconsidered,” he said.

“I believe on Nov. 1, the president’s tone changed towards a trade deal. It’s not a subtle change. It’s very direct. He was talking about tariffs, tariffs, tariffs, and then all of a sudden he was talking about doing a great deal.”

On Dec. 1, President Donald Trump and Chinese President Xi Jinping agreed to a cease-fire in the trade war, holding off on any further tariffs until March 1 so negotiators could seek a deal.

Cesar Rojas, Citigroup global economist, said he sees an opportunity for a deal now though there’s no guarantee one will be reached.

“There is a window of opportunity for the U.S. and China to come to a deal,” he said. “Growth is moderating in China, equity markets have been falling in the U.S. and China and this basically opens a window of opportunity. This may close soon.”

Rojas said the U.S. economy is still strong, giving it more leverage against China, where its stimulus has so far failed to stem weakening. But that should change, and China could stabilize as the U.S. growth weakens later in the year, shifting the advantage to China.

There could be a scenario where the March 1 deadline passes without new tariffs. “Even if there is no tariff increase, we describe this situation as tariff limbo. This uncertainty is having affect on the economic decisisions which is already having an impact,” he said.

‘We’re vulnerable’

Stocks were already weak Thursday after Apple’s warning but dropped even more when the ISM data signaled that investors’ fears about a slowdown may be realized.

“Up until now most of the bad news was out of China. Now the story is we’re vulnerable and we’re going to get hurt too,” said Art Cashin, UBS director of floor operations at the New York Stock Exchange.

We’re in a sick market, says UBS’ Art Cashin

The Dow closed Thursday down 2.8 percent, or 660.02 points, at 22,686.22.

“You look at things like the new orders data, which has been trending lower not just in the U.S. but globally. That is reflecting weaker growth expectations by manufacturers in the U.S. and part of those are attributed to trade policy tensions,” said Gapen.

Economist said the tightening of financial conditions from a falling stock market could be a factor in the ISM. “That could be part of it but the stock market is also going down due to concerns about global growth, profitability, protectionism. I don’t think you can separate those things out,” Gapen said.

In an unusual warning Wednesday, Apple said its fiscal first-quarter revenue would be $84 billion, down from the $89 to $93 billion it previously expected. It blamed the shortfall on a weaker Chinese economy and lower-than-expected iPhone revenue, “primarily in Greater China.” Apple also blamed upgrades to new iPhone model in other countries that were not as strong as expected.

Clifton said what investors are trying to discern now is how much of Apple’s problems are the Chinese economy, the iPhone upgrade cycle and how much is a possible boycott of U.S. goods.

“There may be some consumer backlash to American companies, a form of nationalism,” said Bernstein analyst Toni Sacconaghi. But he said there are many things at work with iPhone sales, including a weaker upgrade cycle and the macro picture of a weaker China.

The U.S. has been cracking down on Chinese telecom companies ZTE and Huawei for suspected cyber espionage, and could still extradite Huawei’s CFO who is under arrest in Canada.

Clifton said he expects to see other companies follow Apple, now that it has given them “cover” to blame China’s economy. Some companies have already pointed to China, while others, like Nike have not seen an impact. But Tiffany, for one, said its sales were impacted by softer spending from Chinese tourists in Hong Kong and New York.

According to Coresight Research, China’s retail sales grew 8.1 percent in November, the slowest pace in 15 years. Some economists said the ISM data also reflects the decline in the stock market, denting confidence and causing manufacturers to pull back. But some is also trade, as reflected in comments by companies in the survey.

“The perception is at least a portion of that is going to be due to trade,” said Clifton. “There’s no fighting the narrative itself. That’s why I think it could accelerate the progress that’s being made in these talks. I think they’re much further along than anyone anticipates. I think the process has been going on for a year. They understand they were going to have a deal on Dec. 1, and the market didn’t believe it.”

Trade negotiators meet next week. The administration, including Trump, has sounded optimistic on a deal lately.

White House says policies working

Kevin Hassett, chairman of the White House Council of Economic Advisers, told reporters Thursday that Apple could be the first of many companies hit by a slowdown in China.

“You look at U.S. multinationals. It’s natural that their profits, to the extent they’re generated in China, would be going down. But good news is that has put a lot of pressure on China to come to the table and make a deal with us,” said Hassett. He said Trump indicated he expects good news on trade. “I am as well.”

“Make no mistake: Chinese economy is on a path we’ve not seen in decades. That’s something that will affect companies operating in China. But, upside is we estimated China was stealing $500 billion a year in intellectual property. we’ve got them to the table now,” said Hassett.

“There’s a lot of room for positive gains ... and the fact their economy is having trouble right now is a sign that our policies have been effective in getting them to the table,” said Hassett.

No comments:

Post a Comment