By ARIE EGOZI

The balance of power in Israel’s arms industry, long dominated by state-owned firms, is rapidly shifting to the private sector. Elbit System’s recently completed acquisition of state-owned Israeli Military Industries (IMI) for US $495 million is just the latest victory in a long-running war. It’s a contest in which the publicly traded Elbit has repeatedly outmaneuvered state-owned rivals that must run every decision past the Israeli government.

The balance of power in Israel’s arms industry, long dominated by state-owned firms, is rapidly shifting to the private sector. Elbit System’s recently completed acquisition of state-owned Israeli Military Industries (IMI) for US $495 million is just the latest victory in a long-running war. It’s a contest in which the publicly traded Elbit has repeatedly outmaneuvered state-owned rivals that must run every decision past the Israeli government.

No one is more worried than the longtime national champion, Israeli Aerospace Industries. “Before I took office,” IAI chairman Harel Locker said at a recent conference, “I held endless meetings, I read endless documents, and in a very short time (I) realized that if the company did not change, it could collapse within a few years.”

“There is politicization and regulation,” Locker lamented. “IAI has strong markets, but there is no strategy, no growth and profit targets, and with the new FMF (Foreign Military Financing) agreement with the US , the possibility of converting US dollars into local currency will disappear.”

That FMF change is critical: After decades of allowing the Israeli government to spend about quarter (26.3 percent) of their US loans on Israeli firms, converting dollars to shekels, the US government is now requiring all Foreign Military Financing to be spent in dollars by 2028. To survive the shift, Israeli companies are creating US subsidiaries to capture contracts. But the state-owned firms have been slower to adapt, with IAI’s US subsidiaries struggling for a foothold while Elbit’s subsidiaries thrive.

It’s not just the US market, either. After years in which the Indian market for drones was dominated by IAI, Elbit is now breaking in. Elbit and India’s Adani Defense & Aerospace have a joint venture in Adani’s industrial park near Shamshabad, where the two companies will build Elbit’s Hermes 900 and Hermes 450 drones outside Israel for the first time, targeting international markets. Worldwide, the authoritative Stockholm International Peace Research Institute (SIPRI) now ranks Elbit as the No. 28 defense firm, compared to IAI at 41, down from No. 33 in 2016.

IAI’s LORA (LOng Range Attack) missile is competing with IMI’s Extra rocket — which will soon belong to Elbit.

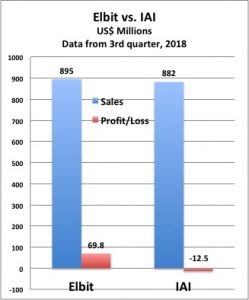

For the third quarter of this year, IAI reported it had 14,000 employees, total sales valued at US $882 million, and a net loss of $21 million. Elbit reported 13,500 employees, $895 million in sales — and a net profit of $69.8 million. The only area where IAI’s ahead is in its backlog of orders: $12.5 billion versus Elbit’s $8.1 billion.

For the third quarter of this year, IAI reported it had 14,000 employees, total sales valued at US $882 million, and a net loss of $21 million. Elbit reported 13,500 employees, $895 million in sales — and a net profit of $69.8 million. The only area where IAI’s ahead is in its backlog of orders: $12.5 billion versus Elbit’s $8.1 billion.

And those numbers are all from before Elbit bought IMI for $495 million. Elbit will pay the government an additional $27 million if IMI beats certain undisclosed performance targets — something which at least one observer suggested to Breaking Defense creates a conflict of interest for the government.

IMI is already competing with state-owned Rafael (No. 45 on SIPRI’s list) to build Active Protection Systems for US Army armored vehicles, designed to shoot down anti-tank missiles and rockets in flight. With the merger, IMI will now have help from Elbit’s extensive US subsidiaries. In Israel, meanwhile, the merger gives Elbit access to IMI’s line of long-range surface-to-surface missiles, allowing it to compete with IAI for an Israeli Defense Force contract valued at $1 billion US.

IAI sources told Breaking Defense that while the new chairman and president are working hard to turn around a “heavy ship,” they don’t have adequate experience: “Running such a company in a growing international competition requires above all business experience, and that is lacking.” Both current and recently departed IAI staff agreed that only a rapid 180-degree turn will enable IAI to compete in the global and Israeli markets.

IMI’s Iron Fist launcher, shown here, shoots down incoming anti-tank rockets and missiles.

But there’s tremendous resistance to change at the state-owned company. When Prime Minister Benjamin Netanyahu recently proposed to sell 25 percent of IAI’s shares — currently all controlled by the Israeli government — on the open market, he met with fierce objections from the IAI’s powerful workers’ committee. The committee has also blocked efforts to lay off even one hundred employees.

The former chairman of that committee, Haim Ktaz, is now welfare minister in Netanyahu’s cabinet, while the current chairman, Haim’s son Yair Katz, leads some 14,000 workers, a powerful bloc on election day.

So while an IAI spokesperson told Breaking Defense the company will continue to provide Israel with top-quality technology “as we have done in recent decades,” anonymous sources were more cynical.

No comments:

Post a Comment