Drivers of Automation in China

Ongoing demographic shifts are putting pressure on China’s leaders to automate labor-intensive activities. For decades, China benefited from a demographic dividend that provided its manufacturing sector with a ready supply of cheap labor. The country now faces a declining birth rate and rapidly aging population. According to the Ministry of Human Resources and Social Security, China’s labor force will fall to roughly 700 million by 2050, down from 911 million in 2016. Automation could be the key to maintaining productivity as China’s traditional labor force shrinks.

China’s dwindling labor force is driving up the cost of doing business. The average hourly wage for factory workers hit $3.60 per hour in 2016, more than five times the average hourly wage in India. While salaries in China are still dramatically lower than those of mature economies – workers in US manufactories earned $21.60 per hour in 2016 – China must now compete against countries like Mexico and Brazil where manufacturing workers earn just over $2 per hour. Productivity, which measures economic output per hour worked, remains relatively low in China, at just 15-30 percent of the OECD average.

Automation could form part of the solution for China. The major paradigm shifts of the past, such as the invention of the steam engine and the emergence of information technology, have fundamentally transformed economies. According to McKinsey, automation could raise the global productivity growth rate between 0.8 and 1.4 percent annually. In comparison, the steam engine and IT raised the global productivity growth rate by 0.3 percent and 0.6 percent, respectively. PricewaterhouseCoopers estimates that by 2030, increased productivity and consumption resulting from AI and automation will contribute 26 percent of China’s GDP, equivalent to $7 trillion. According to the same report, it will contribute 14.5 percent or $3.7 trillion to the economies of North America.

Wages & Workforce Associated with Automatable Activities

CountryWages (trillion $)Workforce (million FTE)*China 3.6 395

US 2.3 61

Europe** 1.9 62

India 1.1 235

Japan 1 36

Rest of World 4.7 367*Full Time Equivalent **France, Germany, Italy, Spain, UK

Source:McKinsey & Company

China has made significant strides toward automating segments of its economy. The average number of robots per 10,000 employees in China’s manufacturing sector grewfrom 25 units in 2013 to 68 units in 2016. In 2017, China was the leading purchaser of industrial robots, with some 138,000 units added to its economy. In that year, industrial robot sales to China totaled 35.6 percent of global sales. The International Federation of Robotics estimates that through 2020, the robotics market in China will grow by 20 percent annually.

While China has become the largest market for industrial robots, its robotic usage remains low compared to its massive labor force. In 2016, China averaged only 68 robots per 10,000 employees in the manufacturing industry, falling short of the global average of 74, and well below South Korea (631), Singapore (488), and Germany (309).

Beijing’s Push for Automation

The Chinese government has taken a leading role in promoting automation. In a 2014 speech to the Chinese Academy of Sciences, President Xi Jinping called for an indigenous “robot revolution” with the goal of “capturing markets in many places.” Robotics is also listed as a priority under Made in China 2025, which is an initiative launched in 2015 that aims at comprehensively upgrading Chinese industry.

Low interest loans, tax relief, and other incentives are being offered to encourage growth in robotics, AI, and other key areas. There is some indication that these incentives may already be paying early dividends. The number of robot manufacturers in China doubledfrom 400 to more than 800 between 2014 and 2016. However, many of these companies focus on the lower end of the robotics manufacturing chain, which limits the potential economic gains for China. According to Xinhua, 1,686 new robotic companies were established in 2017, which may prove a promising sign for the country’s “robot revolution.”

In addition to attractive domestic financing, China has sought to acquire foreign robotics and AI firms to hasten its transition toward automation. This effort was outlined in Made in China 2025, which underscored the government’s “support [for] enterprises to perform mergers, equity investment and venture capital investment overseas.” One such acquisition was electrical appliance manufacturer Midea’s takeover of German robotics firm KUKA in 2017. The deal precipitated widespread backlash in Germany due to public concern that Beijing would be acquiring technologies vital to Germany’s economic competitiveness.

Local governments in China are also offering generous subsidies and financing options. Guangdong Province, for instance, has pledged roughly $138 billion (943 billion yuan) to expand the local robotics industry and encourage companies to automate. Dongguan is reported to have replaced 200,000 workers with robots and invested nearly $30 billion (200 million yuan) in automation. Guangzhou, one of China’s industrial powerhouses, aims to automate four-fifths of its workforce by 2020.

Employing systems that utilize AI is also critical for automation, and the advancement of AI systems benefits greatly from ready access to data. However, access to certain categories of data remains difficult in China. Detailed topographic maps and weather data, for example, are more tightly controlled in China on security grounds than they are in other countries, despite the critical need for this type of information in supply chain and distribution management. Furthermore, much of Chinese data is poorly collected and managed, making the consumption and analysis of these data by AI systems more challenging.

Regarding data protection, China has enacted stringent cyber security measures, such as the 2017 Cybersecurity Law that requires all personal data be processed inside the country. While Germany, Australia, India, and others have enacted their own data localization laws, China goes one step further. The 2017 Cybersecurity Law limits the cross-border transfer of all “important data,” an intentionally vague category that currently includes public communications, finance, and information technology. To comply with these regulations, foreign companies such as Apple have opted to build data centers within China.

Estimated Operational Stock of Industrial Robots in China (Thousands)

YearChinaWorld2010 52 1059

2012 97 1235

2014 189 1472

2016 340 1828Source:International Federation of Robotics

According to the Automation Readiness Index, China falls short in automation ethics boards, ranking 13 out of 25 countries. China’s AI Development Plan aims to begin establishing AI laws and regulations prior to 2025. Germany, most US states, and a number of other countries have already enacted legislation regarding automated technologies, such as accident liability and road regulations for self-driving cars.

Infrastructure investments, particularly in the form of industrial parks, are also part of China’s plan. So far, China has built more than 40 industrial parks that specialize in AI or robotics and more are on the way. Beijing, for instance, is looking to build a large park that will host 400 enterprises focusing on AI, big data, cloud computing, and deep learning. The park is slated to cost $2 billion and is expected to be completed by 2023. China’s ranking in the Automation Readiness Index reflects these efforts. China came in ahead of the US, Japan, South Korea and Germany in automation infrastructure cluster development, ranking second overall after the UK.

Labor for an Automated Economy

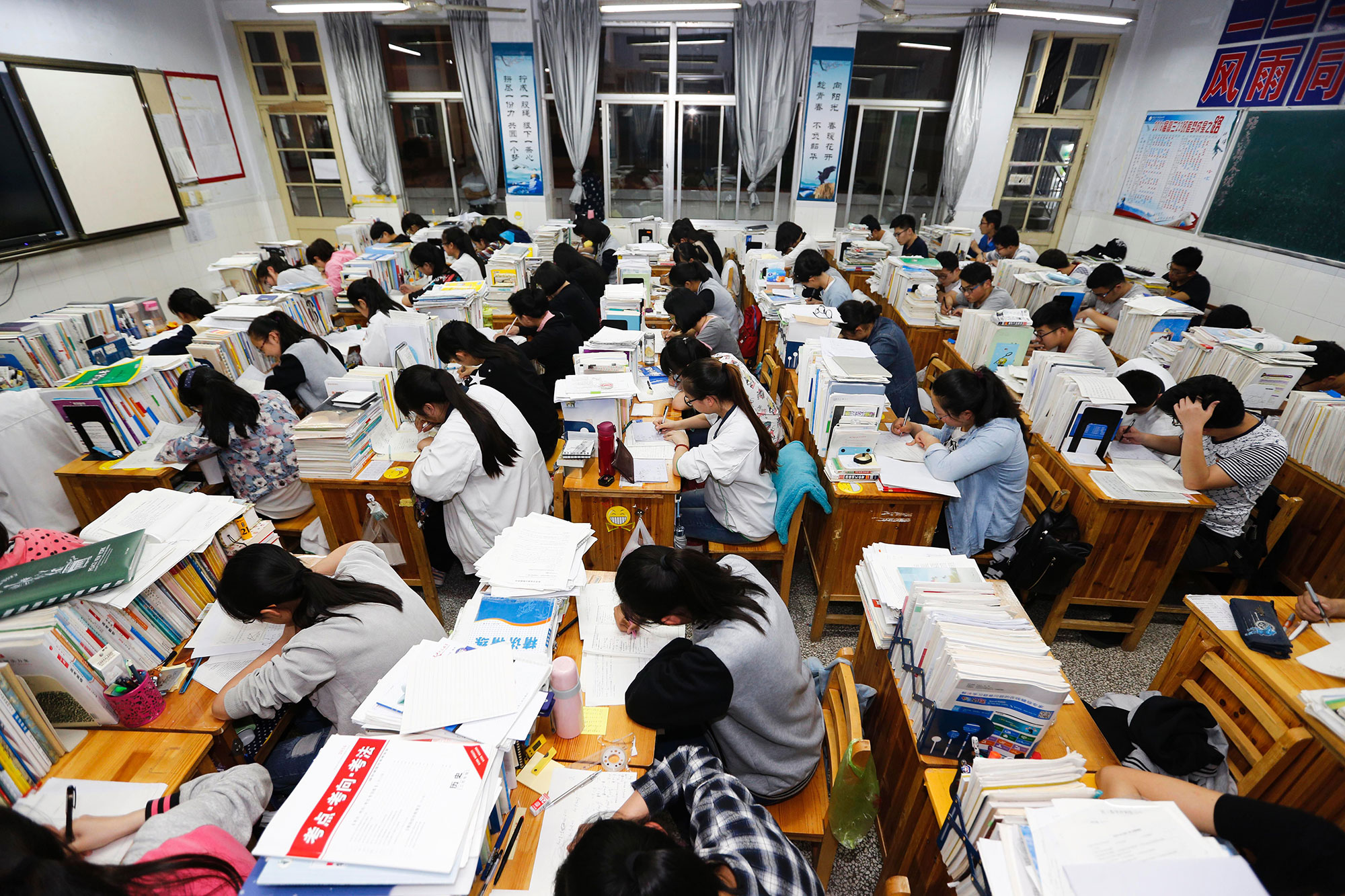

Creating a highly skilled labor force that can design, build, and program automation technologies is critical. To promote the development of skilled labor, China has oriented its education system to prioritize high-proficiency in science, technology, and engineering.

The Chinese government has issued several policy directives toward this end. Chief among these is the National Medium- and Long-term Education Reform and Development Plan (2010-2020), which established national education attainment targets and increased the national education budget. Such reforms have hastened the development of a high-skilled workforce. Tertiary enrollment rates in China are booming. Roughly 8 million students graduated from Chinese universities in 2017, ten times more than in 1997.

China has improved its science and engineering (S&E) education programs, particularly in higher education. Since 2000, the number of Chinese undergraduates awarded S&E degrees has increased by over 450 percent. In 2014, Chinese universities awarded nearly one quarter of the 7.5 million S&E bachelor’s degrees conferred across the globe, second only to India.

At the doctoral level, the US led the way with 40,000 degrees awarded, followed by China (34,000), Russia (19,000), and Germany (15,000). Importantly, overseas Chinese citizens form a significant portion of doctoral candidates in countries like the US. Between 2005 and 2015, American universities awarded more than 40,000 S&E doctoral degrees to Chinese citizens, more than double those awarded to Indian and South Korean international students.

This uptick in S&E graduates might pay future gains for economic development, but at present most automation-related educational sectors are still nascent. Only a handful of top Chinese universities specifically offer AI or robotics engineering courses, severely limiting the number of graduates capable of programming and designing machines critical for automation. In comparison, over 60 US universities offer robotics programs to their undergraduates.

To fill this knowledge gap, Beijing seeks to attract talent from overseas. For example, the Thousand Talents Program, launched in 2008, is designed to incentivize foreign and Chinese experts based abroad to work in China. Over 7,000 scholars and researchers have been brought to China through the program. The US government estimates that about 22 percent of these individuals are industrial technology experts and eight percent are computer scientists.

Secondary Vocational Enrollment in China

YearNumber of Students (million)2000 12.8

2005 16

2010 22.4

2015 16.6

2016 16Source:China Statistical Yearbook

Beijing is also making a concerted effort to reform vocational school curricula to enable workers to operate in heavily automated environments. The Ministry of Education expanded its catalogue of majors in vocational and technical schools in 2015 to include Industrial Robots Technologies and Smart Product Development, among others. By the end of the following year, more than 300 vocational schools had created similar programs.

These reforms are in line with a 2014 government initiative to boost post-9th grade vocational school enrollment to 23.5 million (50 percent of the middle school student population) by 2020. However, efforts to attract students to vocational schools are falling short. In 2016, vocational school enrollment reached only 16 million, a 28.6 percent decline from a peak of 22.4 million in 2010.

In an effort to push the Chinese economy up the global value chain, Chinese leaders have sought to improve educational quality and increase access across the country. Learn more about education in China.

In an effort to push the Chinese economy up the global value chain, Chinese leaders have sought to improve educational quality and increase access across the country. Learn more about education in China.

While Beijing is increasingly receptive to curriculum changes designed to improve soft skills that cannot be automated — such as critical thinking, creativity, and emotional intelligence — other countries are leading the way. South Korea passed the Character Education Promotion Act in 2015, which is aimed at improving the ability of students to communicate and cooperate, as well as heightening their sense of responsibility. Many OECD countries, including Austria, Chile, Estonia, and Japan, also prioritize social and emotional skills in their national education systems.

Labor Displaced by Automation

Automation has the potential to displace a significant portion of the world’s workforce. McKinsey estimates that automation could push 375 million workers to switch occupations by 2030. For China, automation could displace up to a fifth of all manufacturing jobs, forcing nearly 100 million workers (12 percent of the total labor force) to find new work. Service-based economies face similar challenges. Up to 30 percent of the labor force in the US and 46 percent of the labor force in Japan may be displaced by automation.

China’s labor market is already experiencing some disruption. According to the China Development Research Foundation, automation has replaced up to 40 percent of workers in some companies. For example, one of China’s most popular beverage brands, Wahaha, has trimmed an assembly line workforce from 200-300 workers down to just a handful of individuals. Foxconn — a company based in Taiwan that has factories across the Chinese mainland — replaced 400,000 jobs with robots between 2012 and 2016.

However, tracking workforce displacement can be difficult. Estimates of the number of jobs displaced under Dongguan’s “Robot-Replaces-Man” initiative range from 71,000 to 86,000; but some reports suggest that this displacement was not entirely caused by automation. Cheung Kong School of Business asserted that many of the workers laid off under Dongguan’s program were displaced because of relocation not automation, as many firms have relocated facilities to China’s interior where wages are cheaper.

Job Loss & Gain by Sector due to Automation between 2017-37 (millions)

SectorJob LossJob GainNet GainServices 72 169 97

Construction 15 29 14

Industry 59 63 4

Agriculture 57 35 -22

Total 204 297 93Source:PricewaterhouseCoopers

Although automation will make some forms of human labor obsolete, it also brings with it the promise of new jobs. The WEF estimates that automation will create 58 million more jobs than it replaces by 2022. According to PricewaterhouseCoopers, between 2017 to 2037, China’s service, construction, and industry sectors will experience positive net job creation from AI and related technologies. The agriculture sector, however, will see permanent job loss as some of China’s automation programs are looking to eliminate human labor. For instance, Jiangsu Province launched a pilot program in 2018 that employs unmanned tractors, rice transplanters, pesticide applicators, and fertilization equipment aided by a navigational satellite in lieu of human labor.

Chinese workers will need to develop the skills required for the new jobs created by automation, making continuing-education programs increasingly valuable. Beijing has taken steps towards building a lifelong education system, but its progress on this front is behind that of other wealthy countries. The EIU ranks China’s workforce transition programs for vocational training at 21st place. This ranking is well behind Singapore, which offers funding for employee training at small and medium enterprises, and Germany, which funds up to 80 percent of fees for human resources transformation projects. To close this gap and prepare its workforce for automation, China will need to intensify its continuing-education efforts.

No comments:

Post a Comment