By Phillip Orchard

Long-term economic competition is at the mercy of even longer-term geopolitical competition.

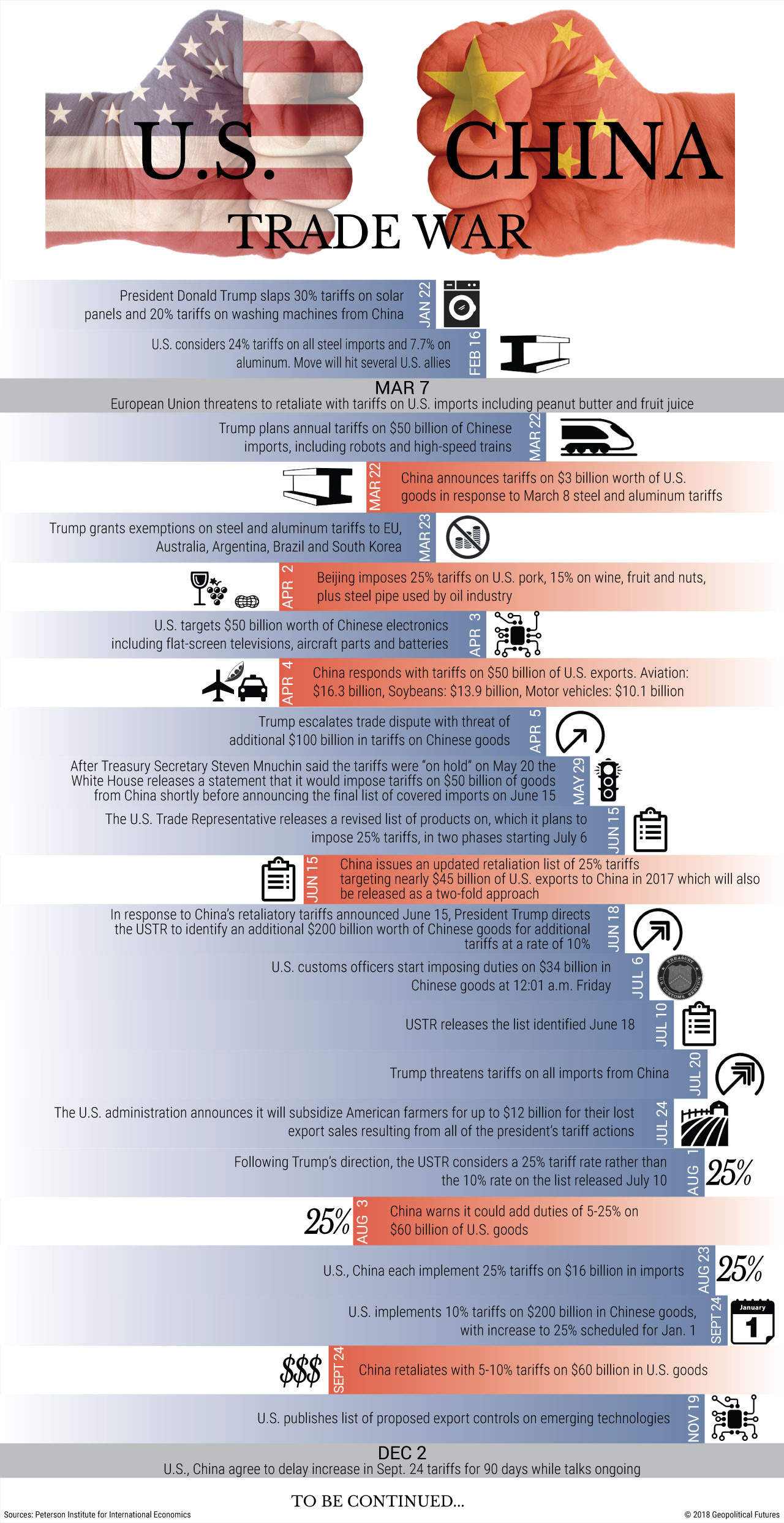

Last Saturday in Buenos Aires, over grilled steak and Malbec one assumes were produced domestically, U.S. President Donald Trump and Chinese President Xi Jinping reached something of cease-fire in the trade war. Four days later, it’s unclear whether they agree on what they agreed to. The official statements they’ve issued subsequently clashed in scope, tone and substance. Not that the finer points will make much of a difference for the next few years. The U.S. and China are just beginning what will surely be a long, ugly process of economic disintegration that will disrupt both countries and, given their economic influence, alter the structure of the global economy.

But when the dust settles, each will still have ample interest in doing business with the other, making a narrower yet mutually beneficial long-term arrangement possible in the future. The only way that changes is if the broader strategic competition with China dramatically intensifies, in which case the U.S. will have every reason to weaponize trade.

The White House’s version of events is as follows: China pledged to buy a “very substantial” amount of U.S. agricultural, energy and industrial goods, with purchases of farm products beginning immediately. Beijing also agreed to negotiate immediately on Chinese practices such as forced technology transfers, intellectual property protection, non-tariff barriers and cyber theft. In exchange, the U.S. promised to delay until March a planned 15 percent jump in the September round of 10 percent tariffs targeting some $200 billion in Chinese exports. (It wasn’t until Monday that Trump said China, home to the world’s largest auto market, would remove tariffs on U.S. auto exports, which increased to 40 percent in July.)

But Beijing has said nothing about the 90 day extension, nor about which goods it’s planning to buy, nor how it will buy them. (It has yet to confirm Trump’s announcement about auto exports; neither have Trump’s trade advisors, for that matter.) At no point did China even exhibit a willingness to talk about the trade practices that helped spark the trade war in the first place, at least not publicly. According to Beijing, the upcoming talks will focus on scrapping all tariffs imposed by both countries and on reaching a consensus on trade.

To be clear, the differences in the statements reflect the necessity of political salesmanship. But they also attest to the difficulties that confound a more permanent agreement: China can’t concede on the biggest issues at stake, and the U.S. isn’t under enough immediate economic or political pressure to back down. So regardless of what’s up for discussion, extending talks by a few months is won’t make these challenges any less difficult.

Why the U.S. Won’t Back Down

The difficulties lie not in the arithmetic of tariffs and trade but in the nature of the trade relationship itself. China’s trade surplus ($375 billion in goods) is certainly an issue – bringing it down was a centerpiece of Trump’s presidential campaign – but it isn’t the main issue. In many ways, it testifies to the power of U.S. consumers and the sophistication of the U.S. economy, and fixating on reducing the headline figure won’t bring back labor-intensive jobs lost to China. The U.S and China could have a mutually beneficial trade relationship and still run a hefty trade imbalance — so long as the U.S is able to compete with China on a level playing field. Currently, it’s not. What the U.S. needs is the ability to sell what the U.S. specializes in (high-end goods and services) in China’s rapidly growing market without facing informal tariffs or fearing, for example, loss of sensitive intellectual property to emerging Chinese competitors that have unlimited access to state lending. It means playing by the common set of rules China agreed to when it joined the World Trade Organization in 2001, and abiding by WTO rulings to resolve complaints, just as the U.S. and its other trading partners do when disputes inevitably arise. Ad hoc, state-directed purchases of U.S. goods by China to dent the deficit won’t address these underlying structural issues.

The difficulties lie not in the arithmetic of tariffs and trade but in the nature of the trade relationship itself. China’s trade surplus ($375 billion in goods) is certainly an issue – bringing it down was a centerpiece of Trump’s presidential campaign – but it isn’t the main issue. In many ways, it testifies to the power of U.S. consumers and the sophistication of the U.S. economy, and fixating on reducing the headline figure won’t bring back labor-intensive jobs lost to China. The U.S and China could have a mutually beneficial trade relationship and still run a hefty trade imbalance — so long as the U.S is able to compete with China on a level playing field. Currently, it’s not. What the U.S. needs is the ability to sell what the U.S. specializes in (high-end goods and services) in China’s rapidly growing market without facing informal tariffs or fearing, for example, loss of sensitive intellectual property to emerging Chinese competitors that have unlimited access to state lending. It means playing by the common set of rules China agreed to when it joined the World Trade Organization in 2001, and abiding by WTO rulings to resolve complaints, just as the U.S. and its other trading partners do when disputes inevitably arise. Ad hoc, state-directed purchases of U.S. goods by China to dent the deficit won’t address these underlying structural issues.

Early on, Beijing thought it could buy its way out of the trade war by dramatically ramping up purchases of high-dollar U.S. goods it needed anyway, such as oil and gas, and by implementing modest reforms on market access and foreign investment. (In May, Xi’s top economic adviser, Liu He, thought he had reached a temporary deal with U.S. Treasury Secretary Steven Mnuchin, who even declared the trade war “on hold,” only to see the deal quickly scuttled by more hawkish figures in the White House.) Beijing would happily buy however much stuff it would take to allow Trump to claim victory on the deficit. Doing so would certainly be cheaper and easier than trying to bail out all the Chinese exporters that were about to get slammed by the U.S. tariffs at an economically inopportune time.

Reinforcing Beijing’s strategy was the (correct) belief that tariffs would take a financial toll on the U.S. too. They would hurt U.S. consumers whose living standards had improved thanks to cheap Chinese goods, U.S.-based firms dependent on inputs made in China, and U.S.-owned exporters with factories in China. (This doesn’t even account for the pain caused to U.S. exporters by Chinese counter-tariffs.) Beijing assumed that with midterm elections around the corner, Trump would have little appetite for a mutually destructive trade war that would rattle markets and put the White House at odds with constituenciessuch as farmers and free-traders that traditionally vote Republican. And this, Beijing hoped, would discourage the U.S. from pushing for structural overhauls in Chinese trade practices.

Beijing’s strategy evidently fell short. The U.S. economy is humming along at the peak of the business cycle. The trade war has certainly hurt certain U.S. sectors, and there will be long-term costs to the U.S. economy if it loses access to China’s gigantic consumer market — especially if high-value exporting countries in Europe and Asia don’t face the same barriers. But the pain has been subtle enough, and trade policy esoteric enough, to prevent the trade war from becoming a major political issue. In fact, the congressional districts in which trade influenced voters’ decisions tended to be the those that have benefited from new tariffs, particularly on steel and aluminum. There weren’t very many of them, but they generally supported the trade war.

More problematic for Beijing is that something of a bipartisan consensus has formed in the U.S. that China has stopped making progress on its WTO commitments and that the onus is on the U.S. to stop China from enjoying the benefits of the global trade system without abiding by its rules. (This view isn’t exactly new; it was the main impetus behind the Trans-Pacific Partnership, from which Trump withdrew.) There’s also a growing consensus that Chinese practices such as forced technology transfers, outright technology theft, and its overt, state-backed “Made in China 2025″ plan to dominate high-tech industries are indeed a threat to U.S. interests and the “rules-based order” — even if there’s ample disagreement over whether punitive tariffs are an effective way to address them.

Add to this the suspicions surrounding Chinese geopolitical ambitions. For those who think Washington and Beijing are sliding inexorably toward a new Cold War, the goal of forcing a change in Chinese industrial policy is beside the point. For them, anything that weakens China is worthwhile: There is no compromise.

Why China Can’t Back Down

China, for its part, can’t make the sweeping changes Washington demands without giving up the tools it thinks it needs to solve its own political and economic problems — problems Beijing thinks far outweigh those created by losing access to the U.S. market.

Beijing needs to be able to tightly control the yuan, intervene on behalf of domestic firms, and use the tools of the state to export excess industrial capacity (i.e. the Belt and Road Initiative). Large state-owned firms are needed to soak up excess labor. To deal with rising wages, slowing growth and an unenviable demographic outlook, China needs to make a mad dash up the manufacturing value chain into high-tech sectors. But during the decades when high-tech exporters like Japan, South Korea, Taiwan and Germany were moving to the technological and industrial vanguard, China was an isolated backwater. It’s playing from behind, and the government is willing to do whatever it takes to skip to the front of the line. Hence why the state is (allegedly) encouraging tech transfer by forcing foreign firms who want to operate in China to form joint ventures with local firms. It’s (allegedly) supporting commercial espionage. It’s (overtly) shoveling money into state-owned firms in industries deemed “strategic.”

The U.S. just doesn’t have the leverage to change China’s priorities. The cost of U.S. tariffs is likely to be, at most, around 2 to 3 percent of GDP. The cost of failing to keep people employed, moving into high-end exports and spurring sustainable long-term growth may well be the Communist Party’s time in power.

Beijing can make some modest reforms and thus some modest concessions, of course. For example, it’s been taking small steps to boost intellectual property protections and lifting caps on foreign ownership of firms in China. But these are improvised measures meant to reward friendly countries and reassure investors, and more importantly, they are largely in line with Xi’s broader reform agenda. They aren’t going to fundamentally change anything about the Chinese model, and thus they are unlikely to satisfy Washington as it negotiates an agreement. Moreover, China has pledged to do these sorts of things before. Even if China’s intentions are pure this time around, it will take time to convince Washington of its sincerity.

Trade as a Weapon

All this suggests that the U.S. and China are beginning to dramatically rewire their respective economies. The U.S. will stop indirectly helping China, either by creating incentives for multinational firms to reroute supply chains around China or by encouraging U.S. exporters to tailor their products to other markets (or both). Most of what the U.S. buys from China is made by multinational firms, which will become more willing to take on the costs of relocating if it becomes clear that tariffs are here to stay. To expedite this process and bolster a rules-based global trading system, the U.S. will eventually once again embrace the benefits of multilateral trade blocs such as the TPP.

China, meanwhile, will have little choice but to shift focus to preserving market access in Europe and other wealthy states. It will also crack down on any social fallout from the intense but ultimately temporary disruption that follows, while hoping that increased domestic consumption will ease the pain. The truth is, China’s dependence on the U.S. market was shrinking before the trade war even began, and rather than force Beijing to rethink its trade policies, that war has convinced the government that it must reduce its dependence on foreign markets and technology. With enough partners outside the U.S., and with enough money to throw at the challenge, it may actually succeed.

Even so, there’s no reason to think the world’s two largest economies are inevitably headed toward a wholesale disengagement, the likes of which the world hasn’t seen since the Cold War. If the U.S. cannot compel China to change, it will eventually lose interest in futile measures that cut off trade in areas where trade is mutually beneficial.

Cheap Chinese electronics are not a national security threat. And the Chinese consumer market will remain nearly irresistible to U.S. exporters. It’s easy to see the two countries settling on a limited but largely healthy trade relationship in the future, even if the thornier points of contention never go away. Whether or not this happens will really come down to the broader geopolitical competition between the U.S. and China. If the overriding goal is to contain China or to bring down the ruling party, then the U.S. will need every tool at its disposal to do so.

No comments:

Post a Comment