However, recent data, such as the manufacturing Purchasing Managers’ Index, has been unimpressive, suggesting more policy support is needed to relieve the pressure on growth. More economic stimulus measures can be expected, but Beijing is not about to revisit its policy of pumping money into the economy at the expense of long-term sustainability. This round of policy easing is likely be more cautiously managed and executed to minimise the side effects associated with a previous stimulus package. Already, there is some evidence of this. Watch: Jack Ma urges business leaders to help stop US-China trade war

However, recent data, such as the manufacturing Purchasing Managers’ Index, has been unimpressive, suggesting more policy support is needed to relieve the pressure on growth. More economic stimulus measures can be expected, but Beijing is not about to revisit its policy of pumping money into the economy at the expense of long-term sustainability. This round of policy easing is likely be more cautiously managed and executed to minimise the side effects associated with a previous stimulus package. Already, there is some evidence of this. Watch: Jack Ma urges business leaders to help stop US-China trade war

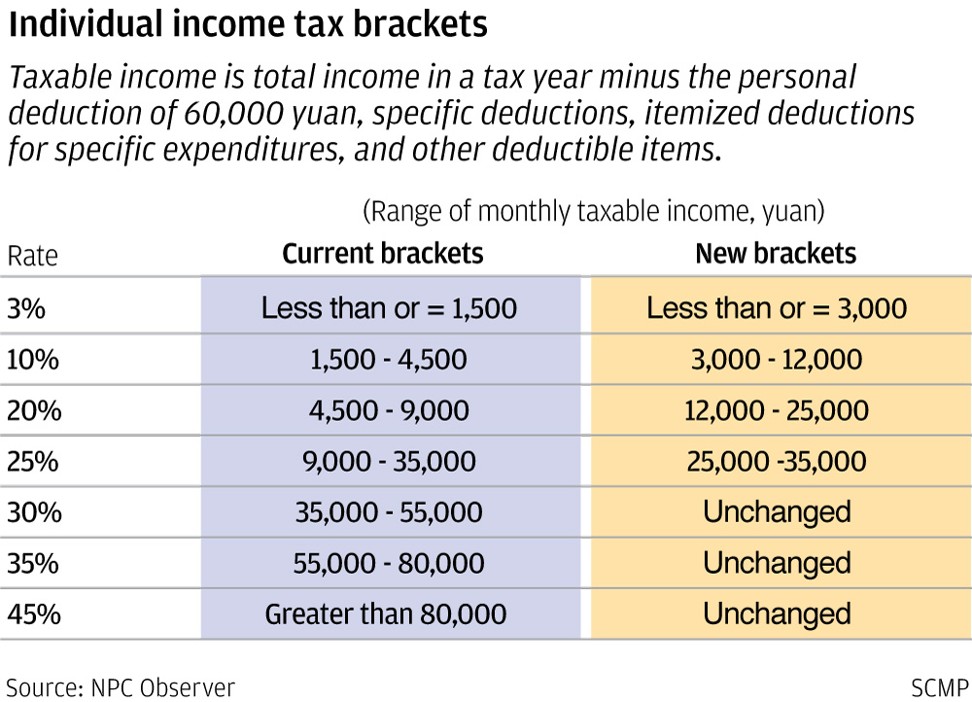

First, instead of just pouring liquidity into the economy, Beijing is relying more on fiscal policy to boost growth. The reduction in income tax, the lowering of business fees and costs, and expediting budget disbursement to ramp up infrastructure spending are just some examples of the fiscal authorities’ heavy lifting.

Second, the People’s Bank of China is using monetary tools more judiciously. Compared to 2008-9 and 2015-6, when the central bank slashed the reserve ratio by 600 basis points (200 basis points for big banks and 400 for small banks) and 300 basis points for all banks respectively, it has announced three targeted reductions since April. And the banks must use a large amount of the freed-up liquidity to repay loans obtained from the central bank’s medium-term lending facility, among others.

In addition, the PBOC has kept benchmark interest rates stable so far, in contrast to the previous series of cuts. Furthermore, the supply of non-bank credit has been restricted by tightened controls on shadow banking. This clearly reflects Beijing’s intention to preserve the progress of the past two years towards deleveraging.

Finally, the implementation of short-term stimulus measures has been accompanied by some structural reforms. The latter include a restructuring of the income tax regime – which goes beyond cutting tax rates, towards a freer domestic financial system and lower trade barriers (for example, tariffs) for non-US imports.

Despite these efforts, critics still warn that Beijing’s recent policy actions could result in a setback in deleveraging, which would worsen the nation’s debt dynamics going forward.

Such criticism is not completely unfounded. As recent history has shown, every policy stimulus in the past decade has been followed by an acceleration in debt growth in subsequent years. Even though the authorities have tried to be less reliant on credit this time, the side effects could still be too powerful to overcome and the economic imbalance could deteriorate further.

Beijing understands the long-term risks associated with its recent actions. But these risks can only be managed; they cannot be averted. Had Beijing chosen inaction – giving no support to an economy that is facing formidable challenges – it could have led to a greater disaster.

Imagine if Beijing had not adjusted its policies in the past three months and had continued to press on with deleveraging (further tightening credit supply and fiscal spending), all against the backdrop of an intensifying trade war and a likely financial market meltdown. The Chinese economy would be in far worse shape. Concerns over a hard landing for China would spread, causing a severe rout on the world markets.

Counter-intuitively, in such a scenario, China’s aggregate leverage ratio could in fact worsen despite Beijing’s insistence on deleveraging. This is because, as an economy plunges into recession, GDP, the denominator in the debt-to-GDP ratio, may fall faster than debt, the numerator.

Thus, a mindless pursuit of deleveraging, or any other reforms that cause short-term pain, could backfire without careful consideration of the changing macroeconomic environment and its capacity for absorbing the short-term impact of policy actions.

When it comes to managing macroeconomic polices, Chinese policymakers have to keep a delicate balance between short-term stability and long-term sustainability. Walking a tightrope is not easy even in calm conditions, but Beijing has to persevere against stiffening winds.

No comments:

Post a Comment