By Kyle Stock

It took 20 years for e-commerce to bring on the shopping mall apocalypse. The next transformation will happen much faster.

It took 20 years for e-commerce to bring on the shopping mall apocalypse. The next transformation will happen much faster.

Anita Berisha turned her jewelry-making “side hustle” into a $10,000-a-month business. Photographer: Amy Lombard for Bloomberg Young, distracted and styled just-so, Anissa Kheloufi is part of a growing genus of Instagram junkies. As the 21-year-old flits around the Paris suburb of Saint Ouen, she’s incessantly snapping photos and videos. Usually they’re of her friend Cynthia Karsenty, who preens for the camera in swanky clothes ranging from high-waisted shorts and pin-striped jumpers to big, fuzzy slippers.

It is, by all appearances, a parade of self-indulgence — a life over-edited and ultra-shared. But what the eye-rolling onlooker doesn’t understand is that Kheloufi is building an apparel empire one snap at a time, one that pulls in close to $40,000 a month. Her social media fodder sends a steady stream of shoppers to Belmiraz, the apparel company she founded after tiring of law school. It includes a web store as well as boutiques located in Casablanca and Paris. Mostly, however, Kheloufi’s customers purchase their items in the same way she sells them: by app.

“I think I have the phone sewn onto my hand,” Kheloufi told Bloomberg. “My loved ones are fed up with it.”

The future of retail isn’t e-commerce or omni-channel or pop-up shops or geo-fenced flash sales. The future of retail is palm-sized. As social media consumerism cultivates a growing crop of scrappy brands, these retail entrepreneurs are skipping the computer altogether (let alone brick-and-mortar shops), instead displaying and selling products exclusively via smartphone.

And the phenomenon is accelerating. Two big reasons for this entrepreneurial shift are video and Instagram (and video on Instagram). In recent years, both have had an increasingly outsized impact on how consumers shop, one that shows no signs of abating. Big retailers have grown wise to it, too, as more of them are lured away from a traditional focus on desktop transactions.

Back in August 2016, Facebook Inc.-owned Instagram began letting its users click through the phone app to a brand’s retail site. It also added “Stories,” a Snapchat-like feed of temporary posts better suited for video. A few months later, Instagram let 20 select companies, including J. Crew, Macy’s and Warby Parker, tag products in Instagram posts and route people to a store link where they could “shop now.”

Just like that, a virtual shopping mall was born.

The virtual mall. Photographer: Amy Lombard for Bloomberg

The virtual mall. Photographer: Amy Lombard for Bloomberg

Unlike the old kind, replete with dingy food court and shabby Sears, Instagram doesn’t have any problems generating “foot traffic,” given the 800 million people actively scrolling through its portal every month. In May, the company took the next logical step, quietly enabling a feature for users to add credit or debit cards. Soon, Insta-crowds may not have to leave the platform at all to make a purchase.

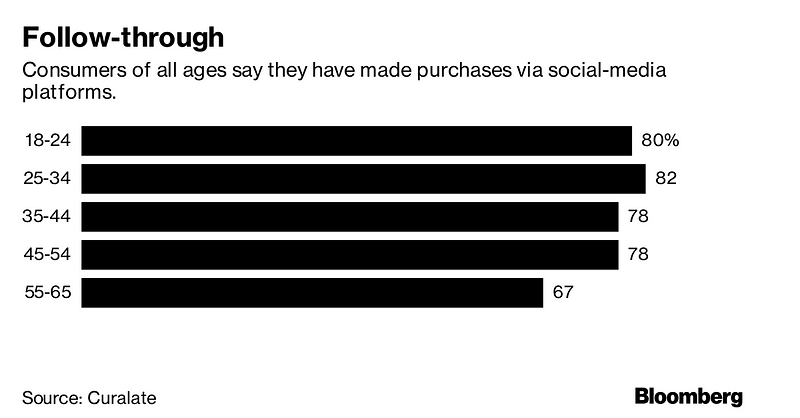

Salesforce.com says 5 percent of digital retail traffic now flows through social channels. ViSenze, a visual search company, found that, of people who use social media, one in three makes a purchase every month through a platform such as Instagram, Facebook, Pinterest or Snapchat. At companies like Belmiraz, which mostly sell to young buyers, the numbers are far higher. Kheloufi says 90 percent of her company’s revenue flows through Instagram, where she connects with 119,000 followers.

Not surprisingly, digital platforms that cater to aspiring e-commerce titans like her are hustling to tweak their products for iPhone-only use. Tictail, the do-it-yourself marketplace where Kheloufi’s Belmiraz sells her wares, overhauled its platform recently to allow vendors to post directly to Instagram’s Story forum. It also lets retailers add text “stickers” and links that make it easier for shoppers to click through to purchase or figure out their shipping costs. When Tictail rolled out a feature allowing sellers to directly post video product listings, the platform promptly saw engagement on those items almost quadruple, according to Chief Executive Officer Carl Rivera.

“It’s very Snapchatty,” he explains.

Tictail made the shift toward handheld retailing after noticing that mobile purchases had jumped from being 40 percent of its transactions to 70 percent in the span of 18 months. Rivera figured that if shoppers were switching to smartphones so fast, sellers would quickly follow. The transformation, he says, has everything to do with how mobile tech enables visuals to dominate internet retail.

“What it really is is a shift in what the main input type is,” he says. “If you sit in front of a computer, it’s easy to enter text and really difficult to enter photos and videos. With a phone, it’s the opposite.”

Shopify, which hosts digital stores for some 600,000 merchants, has made similar moves, launching its deep integration with Instagram in October. Half of Shopify’s clients are actively using a mobile app it built exclusively for merchants. Over the past year, the shopping site has seen a three-fold increase in retailers who do business entirely by phone, according to Lynsey Thornton, vice president of user experience.

“They’re not necessarily on the go. They simply want the flexibility to do whatever they need to do,” she says. “It’s the time pressure that’s actually pushing a lot of this: ‘How can I do things faster?’”

Miranda Kerr counts herself among these iPhone-touting entrepreneurs. In running Kora Organics, the Australian model says she rarely opens a computer — handling social posts, fielding conference calls and somewhat obsessively tracking order fulfillment via mobile.

Berisha at her home workplace in New York.

Berisha at her home workplace in New York.

Ultimately, social shopping platforms are bulldozing yet another of retail’s barriers to entry.

In the 1990s, e-commerce sites such as Amazon.com declared war on department stores and malls. More recently, drop-shipping services (in which sellers have third parties fill orders) began to take hold, empowering digital disruptors. A would-be Phil Knight or Kate Spade no longer has to hustle for capital and retail partners — all they need is buzz and followers. With the rise of handheld retail, a virtually unlimited commercial space is opening up, one in which marketing, shipping and catalogs cost the wannabe retailer next to nothing; the only real overhead is the price of an iPhone.

The wave is growing. Of the almost 2 million people selling items on Etsy’s online marketplace, roughly half are using the company’s purpose-built vendor app. Meanwhile, Intuit says half of the almost 700,000 self-employed entrepreneurs using its Quickbooks accounting software are tracking their income and expenses via its mobile platform.

“They’re very experiential sellers,” Thornton, at Shopify, says of iPhone-focused entrepreneurs. “And they care a lot about building a brand.”

Berisha’s markets handmade jewelry to 32,000 Instagram followers. Photographer: Amy Lombard for Bloomberg

Berisha’s markets handmade jewelry to 32,000 Instagram followers. Photographer: Amy Lombard for Bloomberg

Without a smartphone, Anita Berisha would likely still be working a full-time job in marketing or inventory management — her jewelry-making habit confined to a mere “side hustle.”

About two years ago, she launched her eponymous brand and started posting a few pieces — delicate chokers and fine wire earrings bent into the shape of flowers. With a few well-timed and unsolicited endorsements, Berisha’s following grew from a few hundred people to almost 32,000. Now she’s making up to 30 pieces a day and collecting about $10,000 in monthly revenue — all from her apartment in Manhattan’s Harlem neighborhood.

“When I started, every single thing I did was through my phone,” Berisha says. “I had to explain to my husband: ‘I know it doesn’t seem like it, but I’m working here!’”

No comments:

Post a Comment