By Mark N Katz and Nikolay Kozahanov for Center for Security Studies (CSS)

In this edition of the RAD, Mark N Katz first examines how President Putin’s Russia seeks to maintain good relations with multiple actors in the Middle East that consider one another as adversaries, and the limits to this policy. Nikolay Kozhanov then considers the Russia-Saudi Arabia relationship, noting that the efforts to promote better relations between the two have not as yet been derailed by various stress-tests in their relations. The two articles featured here were originally published by the Center for Security Studies (CSS) in the Russian Analytical Digest on 3 May 2018.

In this edition of the RAD, Mark N Katz first examines how President Putin’s Russia seeks to maintain good relations with multiple actors in the Middle East that consider one another as adversaries, and the limits to this policy. Nikolay Kozhanov then considers the Russia-Saudi Arabia relationship, noting that the efforts to promote better relations between the two have not as yet been derailed by various stress-tests in their relations. The two articles featured here were originally published by the Center for Security Studies (CSS) in the Russian Analytical Digest on 3 May 2018.

One of the most remarkable achievements of Russian foreign policy towards the Middle East under Putin is that Moscow now has good relations with every state in the region and many of the major non-state movements there too, despite the fact that many of these Middle Eastern actors are bitterly opposed to one another. This achievement, though, is not just the result of Putin’s own diplomatic prowess, but also of the willingness of various Middle Eastern actors to build and maintain good relations with Putin despite the fact that he also has close relations with their regional adversaries. This article will explore the seeming contradiction of why so many Middle Eastern actors opposed to one another maintain positive relations with Putin’s Russia, and what the limits to this phenomenon might be.

Good Relations with Everyone

Russia, not surprisingly, has good relations with the major anti-American and anti-Israeli actors in the region: Iran, Syria, and Hezbollah. Moscow also has good relations with the two main Palestinian movements: Fatah and Hamas. At the same time, Putin has built up good relations with what have traditionally been America’s allies in the Middle East: Saudi Arabia and the other Gulf Cooperation Council states (including Qatar, which Riyadh and others are at odds with), Egypt, Jordan, and even Israel. The Russian–Israeli relationship has grown especially close since Putin first came to power. The addition of Israeli technology enhances Russian arms exports to several markets, and Israel itself serves as an important source of Western military technology for Russia.

Moscow’s relations with Turkey deteriorated sharply after the latter’s forces shot down a Russian military aircraft flying in the vicinity of the Turkish–Syrian border in November 2015, but they rebounded just as sharply in mid-2016 when Turkish President Erdogan apologized for this incident and later when Putin more quickly expressed support for Erdogan than Western governments did during the coup attempt against him that summer. At the same time, Moscow maintains good relations with Syrian Kurdish forces which Turkey opposes. In war-torn countries such as Iraq, Libya, and Yemen, Moscow maintains good relations with the internationally recognized governments in each of them, but also with some of their principal antagonists—including the Kurdish Regional Government in Iraq, General Haftar in Libya, and the Houthis in Yemen. The only important Middle Eastern actors Moscow does not have good relations with are Al Qaeda and the Islamic State (also known as ISIS)—and they do not have good relations with anyone, including each other.

Reasons for Russia’s Success

Explaining why Iran, Syria, and Hezbollah seek good relations with Russia is not difficult. Each of them shares with Russia the desire to oppose American foreign policy in the region—especially its calls for President Assad to step down and its support for his opponents. Iran, Syria, and Hezbollah also see Israel—which America backs strongly—as a common enemy. Anti-American actors, of course, can and do have important differences with Russia. Iran in particular has had many over the years, including over Moscow’s close relations with Tehran’s adversaries. But so long as they view America as more of a threat, Russia—especially through its willingness to forcefully defend the Assad regime—is a useful partner for all three.

But America’s traditional allies have also sought good relations with Russia despite its support for their anti-American adversaries. Saudi Arabia and the other GCC states, Egypt, Jordan, Turkey, and even Israel have all come to fear a lack of commitment on the part of the US. Russia’s willingness to sell them weapons without regard for human rights issues is an especially useful way for Middle Eastern governments to ward off or get around actual or potential American restrictions on arms sales over such concerns (as Egypt’s al-Sisi did in response to Obama’s objections to Cairo’s crackdown on its domestic opponents, and Saudi Arabia now faces from Congress over its intervention in Yemen). Improving relations with Russia, then, is useful both as a means of motivating greater US support and of hedging against the possibility that it might not be fully available.

Putin has also portrayed Russia as a firm upholder of the status quo in the Middle East—something that governments in the region see Moscow doing more consistently than did either George W. Bush (with his interventions in Afghanistan and Iraq and stated desire to promote democratization throughout the Greater Middle East) and Barack Obama (with his outreach to Iran, half-hearted intervention in Libya, and unwillingness to intervene in Syria). And compared to the highly erratic and unpredictable Donald Trump, Putin is viewed as more consistent and reliable in his policies.

But Middle Eastern motivations for improving relations with Russia are not just related to dissatisfaction with, or a desire to shape, American foreign policy. Another motive is the desire to balance against regional rivals: When Russia is supporting one’s rival, but is also willing to support oneself, then it makes sense to work with Russia as a means of 1) giving Moscow an incentive to balance between rivals as opposed to only supporting one against the other; and 2) possibly undercutting Russia’s relations with one’s rival. Israel and Saudi Arabia, for example, do not appreciate Russian support for Iranian activity in Syria. But Israel and Saudi Arabia having good relations with Moscow gives it more of an incentive (at least they hope) to restrain Tehran than their not having good relations with Russia. And the fact that Tehran complains about Moscow having close ties with Israel and Saudi Arabia is something that pleases these two governments.

In addition, there are sometimes other pragmatic reasons for cooperation with Moscow despite differences with it. For example, while Saudi Arabia does not appreciate Putin’s close ties to Iran or support for Assad, Riyadh and Moscow have developed a common interest in restraining oil production in order to support higher oil prices. As Moscow had previously been unwilling to join in Saudi-led OPEC output restraints, their recent cooperation on this is a significant development—even if it was motivated primarily by their joint fear of the “threat” to oil prices from expanding American shale oil.

Domestic political concerns within Middle Eastern states may also militate toward improved ties with Moscow. For al-Sisi in Egypt, being seen to cooperate with Putin is useful in portraying the image that he is not overly dependent on Washington. Crown Prince Mohammad bin Salman (often referred to as MBS) of Saudi Arabia may have seen Putin’s seizure of property from the Russian oligarchs when the Russian leader first rose to power as a role model for MBS’s treating his royal relatives in a similar fashion more recently.

How Long Can It Last?

There are numerous reasons, then, why a wide range of Middle Eastern actors have sought good relations with Russia. And up to now, Putin has been remarkably successful in balancing between Middle Eastern actors that are bitterly opposed to each other. But can this continue indefinitely? There is a real possibility for change in this pattern if conflict between regional rivals increases. In an escalating conflict between Iran and its allies on the one hand and either the Gulf Arabs and/or Israel on the other, the US (especially under Trump) is highly likely to strongly support the latter. If Russia responds by strongly supporting Iran, it may well lose influence with the Gulf Arabs and Israel. But trying to maintain balance or remain neutral while the US supports Iran’s adversaries will lower Russia’s usefulness to Iran.

Similarly, while an expanded Turkish–Kurdish conflict will further strain Turkish–American relations, it could also strain Turkish–Russian ones. While Russia would like to see Turkey’s alliance with the US further undermined, it (along with Iran and the Assad regime) does not want to see Turkey play a larger role in Syria. Supporting Syrian Kurds might appeal to Moscow as a means of both thwarting Turkey’s ambitions and preventing the US from acquiring predominant influence with the Kurds. But opposing Turkish actions against the Kurds risks another crisis in Turkish–Russian relations that could be much worse than the one that occurred after the November 2015 shoot down incident.

Finally, by aligning itself so strongly with status quo governments, Russia may find (as America and others have, or should have) that this strongly alienates the forces seeking change—which, as history shows, do not always remain suppressed. And it is not at all clear that Moscow would be willing to intervene elsewhere in the Middle East to defend existing regimes to the same extent that it has intervened in Syria to defend Assad.

At present, though, Putin’s policy of working with most Middle Eastern actors courting Moscow despite their antagonism toward each other is very much a success. The continued success of Putin’s Middle East policy, though, is dependent not just on his own tactical brilliance or the likelihood that Washington will continue to make mistakes in the region which Putin can exploit. Putin’s future success is also dependent on regional actors actively seeking, or just fearful of doing without, cooperation with Moscow despite its cooperation with their adversaries. The problem with this approach is that while as successful as Moscow has been up to now, Middle Eastern states and other actors would all prefer that Russia (as well as all other external great powers) support them more than it supports their adversaries. The fact that Russia does not do this results in Middle Eastern actors being wary of Russia’s motives and reliability. However unhappy they may be with American foreign policy, those Middle Eastern actors whom Washington supports against its adversaries are hardly likely to switch from being primarily American allies to primarily Russian ones if they cannot trust Moscow fully. And the continued cooperation of Moscow with those Middle Eastern actors which fear the consequences of not doing so is dependent on that fear continuing, but also being kept within bounds. Those who become convinced that Moscow is doing far more to support their adversaries than them are going to seek external support and/or cause problems for those Moscow-backed adversaries if they can. Yet those who no longer fear what Moscow does may react in the same way. Such a situation might arise if a Middle Eastern government decides, for whatever reason, that Moscow needs it more than it needs Moscow.

Thus, while Putin has so far been successful in his policy of balancing among Middle Eastern adversaries instead of firmly backing some against others (as the US does), there is no guarantee that he can maintain this balancing act indefinitely. Indeed, to the extent that Putin’s successful Middle Eastern policy has raised expectations on the part of regional actors about what Moscow can and will do for them, which were lowered at the end of the Cold War, Putin may face difficulties in fulfilling them. And if Russian policy either does not prevent or actually contributes to wider conflict that Moscow cannot contain (such as between either Turkey and the Kurds or between Iran on the one hand and Israel and/ or the Gulf Arabs on the other), then Putin’s current policy may be contributing to the decline of Russian influence in the Middle East at some point in the future.

About the Author

Mark N. Katz is Professor of Government and Politics at the George Mason University Schar School of Policy and Government. He was a Fulbright Scholar at the School of Oriental and African Studies (SOAS) in early 2018.

Russia and the Kingdom of Saudi Arabia: Between Syria and OPEC

By Nikolay Kozhanov

Abstract

During the last decade, Russian relations with the Kingdom of Saudi Arabia (KSA) have experienced several stress-tests. The active support provided by Moscow to the regime of Bashar al-Assad was expected to turn Russia into one of the main geostrategic opponents of Riyadh. Unexpectedly, in 2015, dialogue between the countries resumed and demonstrated a tendency for normalisation. Among the most important factors in this process was the Saudi recognition of Russia as one of the important players in the region after Moscow’s ‘success’ in Syria.

Russian March toward the Gulf

Traditionally, the idea of reaching the warm waters of the Gulf and Indian Ocean was a part of the Russian geostrategic agenda. However, until the 2000s, any attempts to establish a solid Russian presence in the region resulted in clear failure. The Russian diplomatic mission in Saudi Arabia was opened only in 1991, whereas Saudi Arabia was really opened up for Russia only in the mid-2000s by Putin, who in the early 2000s stated that Russia should cooperate more closely with the Islamic world and the Arab countries. In 2007, he backed this statement up with official visits to the Kingdom and demonstrated the Russian intention to have a presence in the region and to try to stay there for the long-term.

The intention to establish relations was mutual. Not only was Russia making steps towards Saudi Arabia, but Riyadh had decided not to close the doors before the Kremlin. Initially, it was Prince Bandar and the late King Abdullah Al-Saud who promoted the idea of active dialogue with Moscow. Yet, even the death of the latter in 2015 did not deter the development of bilateral relations. In June 2015, a high-level Saudi delegation, led by the son of the new Saudi monarch, Mohammed bin Salman, was received by Putin in St. Petersburg and signed a series of agreements and memorandums, including ones on peaceful nuclear cooperation, infrastructural development and investment. On 11 August 2015, these agreements were reconfirmed during the visit of the Saudi minister of foreign affairs, Adel Al-Jubeir, to Russia.

Currently, the top priorities of Russian diplomacy towards Saudi Arabia could be formulated as following:

Making the Kingdom of Saudi Arabia (KSA) less determined to confront Russia in Syria

Joining efforts to stabilise the oil market

Drawing Saudi investments into the Russian economy

Entering the Saudi gas market.

First and foremost, Russia needs Saudi money. In 2015, the Russian Direct Investment Fund (RDIF) signed an agreement with the Saudi Public Investment Fund (PIF). According to this document, the PIF is expected to invest up to USD 10 bln in the Russian economy. In 2015, the RDIF also signed a cooperation agreement with the Saudi Arabia General Investment Authority (SAGIA). In April 2017, the speaker of the upper chamber of the Russian parliament, Valentina Matvienko, stated that the Saudis have already invested up to USD 0.6 bln in the Russian economy. She also stated that, in 2018, Moscow and Riyadh will start the implementation of several important projects worth up to USD 3 bln. From the long-term perspective, the Russian authorities would like to see the Saudis participating in projects aimed at the development of Russian LNG-producing capacities and establishing with Russians joint ventures to research, design and produce oil and gas equipment.

Russia also needs the KSA money to finance its economic projects abroad. In 2014–2015, Moscow substantially intensified its relations with Egypt. It has ambitious plans regarding the development of economic cooperation with Cairo in such fields as nuclear energy, arms trade, and the hi-tech, automobile and space industries. The Egyptian authorities are unable to invest significant sums of money in the majority of these joint projects without external sponsors. Russia does not have enough funds as well. Consequently, the Kremlin expects that the UAE and Saudi Arabia could help to boost the development of these projects by investing in them. Experts argue that Riyadh can also potentially help to fund Russian–Jordanian joint projects in the nuclear field.

Oil, Politics and Russian–Saudi Political Dialogue

After the drop in oil prices, Russia started to develop active dialogue with other hydrocarbon producers to stabilize the situation in the market. As a result, after decades of negligence, Russia declared its intention to develop closer relations with OPEC. This decision was driven largely by domestic political considerations. Fluctuations of the oil price immediately affect key Russian macroeconomic figures, whereas it is important for the Kremlin to demonstrate a strong economic performance and to show that Putin is able to deliver on his promises of economic growth. Consequently, 2016–2017 was marked by the intensification of the dialogue between Russia and Saudi Arabia. Moscow and Riyadh managed to work out a common stance on the adoption and, later on, extension of the so-called OPEC+ deal, a 2016 agreement signed between OPEC and non-OPEC members including Russia aimed to decrease their oil production in order to encourage the growth of oil prices on the international market.

By the end of November 2017, both Moscow and Riyadh appeared to be interested in the extension of this deal until the end of 2018. As a result, they worked hard to coordinate the prolongation of the agreement fulfillment with the other members of the deal. Consequently, in November 2017, they agreed to extend it. One month later, during his phone call with King Salman, Putin personally confirmed the Kremlin’s intention to strengthen cooperation with Riyadh in the oil and gas sphere. Currently, the Russian side positively estimates the current experience of cooperation with Riyadh within the framework of the OPEC+ agreement. Moreover, the Kremlin is convinced that, even after the end of the OPEC+ agreement, the two countries will continue to cooperate and exercise joint efforts to stabilize the international oil market.

The Russian interests in cooperation with Riyadh in the oil and gas field are not only limited by the extension of the OPEC+. On 8 December 2017, Saudi minister of oil, Khalid al-Falih, visited Russia to take part in the inauguration of the Yamal LNG factory. On the sidelines of this event, he met with Putin who in the presence of journalists proposed that the KSA leadership consider purchasing Russian gas. In response, al- Falih said that he came to Russia to discuss this question as well. Gas market experts argue that the Saudis are actively discussing their participation in the LNG projects in Russia as well as technical details of LNG exports from Russia to the Kingdom, although no final decision has been taken on either of these matters.

For Russia, the promise to export LNG to the KSA plays the role of a ‘carrot’ that can help Moscow to strengthen relations with the KSA. In their negotiations with the Saudi side, Russian officials actively emphasize that the exports of Russian gas will help the Kingdom to develop its program aimed at the replacement of oil with natural gas as a fuel for the Saudi domestic market and, thus, to allocate more oil for exports. The final goal pursued by the Russians is twofold. On the one hand, they want to motivate Riyadh to invest its money in the Russian LNG projects, thus, compensating the lack of funding. On the other hand, Moscow has political considerations. Russia believes that, if successful, economic cooperation can turn Riyadh into one of Moscow’s political partners in the region.

It can hardly be a coincidence that, during Putin’s phone call with the Saudi king in late-December 2017, the Russian and Saudi leaders discussed not only the implementation of the OPEC+ deal, but the political situation in the Middle East, including Syria and Yemen. For a long period, the Russian support for Bashar Assad remained one of the main deterrents for the development of Russian–Saudi contacts. Since the beginning of the civil war, Riyadh heavily criticized the Kremlin for its stance on the conflict. Yet, Moscow used the strategy of stick and carrot to change this trend. On the one hand, after the deployment of its military forces in Syria in 2015, Moscow has been persistently weakening those military groupings supported by Saudi Arabia. By 2017, the Kingdom was put in the situation in which it had to talk to Russia. Otherwise, its remaining assets on the Syrian ground could have been taken out of the game. On the other hand, Russia offered a number of incentives for the intensification of the political dialogue. First of all, by mid-2017, Russia approved the Kingdom’s role in assembling the united opposition group to take part in the Geneva talks. Secondly, the Kremlin demonstrated to Riyadh that there are other topics of mutual interest (including the OPEC+ agreement) that could be discussed if the disagreements are put aside. Finally, by mid-2017, Russia also agreed not to voice any objections against Saudi actions in Yemen. Moreover, on 21–23 January 2018, Russia hosted the visit of Abulmalik al-Mekhlafi, the foreign minister of the Saudi-supported Yemeni government of Abdrabbuh Hadi. Previously, Moscow avoided voicing open support to Hadi’s team.

The 2017 Visit of Saudi King Salman to Moscow and the Future of Russian–Saudi Relations

At the current stage, the development of Russian–Saudi relations culminated in the visit of Saudi King Salman to Moscow where he was welcomed on 5–8 October 2017. Both Russian and Saudi media sources deemed his visit an important milestone in bilateral relations. To a certain extent, Salman’s visit was, indeed, historical: this was the first official trip of a Saudi monarch to Moscow since the foundation of the Kingdom. Before this, none of the members of the House of Saud had ever visited Russia in the capacity of a king.

The agenda of the visit was intense. Moscow and Riyadh managed to discuss a wide range of issues. However, the priorities of Russia and Saudi Arabia in this discussion were slightly different. Moscow emphasized the discussion of economic issues. Thus, the Kremlin was interested in discussing the prospects for Saudi investments in the Russian economy as well as bilateral cooperation in the high-tech, military-industrial, infrastructural and nuclear spheres. Moscow also wanted to discuss the future of the OPEC+ agreement and options for the participation of Rosneft in the privatization of Aramco. King Salman, in his turn, came to Moscow to discuss political issues, such as the situation in Syria, Yemen and Iraq as well as Saudi concerns about the regional policies of Iran.

Nevertheless, in spite of their different priorities, the two sides seemed to come to an understanding on a large number of political and economic issues. They signed around 15 agreements on cooperation in different areas including space, nuclear energy, telecommunications and culture. Russia confirmed the leading role of the Gulf Cooperation Council in the settlement of the Yemeni crisis. The Saudi leadership supported the Astana format of negotiations on settling the Syrian conflict, while Moscow assured Riyadh that it will play one of the key roles in forming the delegation of the Syrian opposition at the Geneva talks. On the economic side, Gazprom, Sibur and Aramco signed agreements on cooperation. Apart from that, the PIF and RDIF declared their intention to finance joint oil, gas and petrochemical projects as well as scientific and technological research and to invest in Russian transport infrastructure. The overall volume of potential investments is estimated to be USD 2.1 bln.

And, yet, it was too early to speak about a breakthrough in Russian–Saudi relations. First of all, on the political track, the sides merely confirmed unofficial agreements that had existed between them since mid- 2017 when Russia traded its silence on Saudi actions in Yemen for Riyadh’s support of the Astana process. For the Kremlin, this was an easy decision and profitable bargain: Moscow had no vital interests in Yemen whereas Saudi support at the negotiation table in Astana and Geneva was needed. Riyadh also benefitted: the Kingdom was interested in international support for its efforts in Yemen, whereas further confrontation with Moscow in Syria could only deprive the Saudis of any substantial role in the post-conflict future of this country. Neither Moscow nor Riyadh had to go against their own interests or give serious concessions to the other side to reach an understanding on this question.

The future of the economic dialogue between the two countries is also unclear. Most of the documents signed during Salman’s trip were non-obligatory memorandums of understanding (MoU). The sides are still to negotiate practical details. And there is a strong feeling of deja vu about it. In the past twenty years, Moscow and Riyadh periodically signed ambitious but non-obligatory documents. However, the track record of the practical implementation of these MoUs remained negligible. The biggest question was related to agreements reached between Moscow and Riyadh in the military-industrial sphere. First of all, there is no confirmation that the two sides signed a real agreement on the supply of S-400 missile systems to Riyadh. It looks like the Saudi side simply expressed the intention to discuss the purchase of S-400s in the future. The agreement on cooperation in the military sphere signed in Moscow was mostly related to smaller arms produced by the Kalashnikov consortium: the Russians plan to provide Riyadh with an assembly line. This will help the Saudis to arm their proxies in the region and save money on buying Kalashnikovs in Eastern Europe. However, the size of the deal (USD 1 – 1.5 bln) looks small if not negligible against the volume of military contracts signed by Riyadh with the US.

Under these circumstances, while Russia and KSA managed to make another step towards each other, the visit itself does not open a new page in relations between the two countries. Moreover, during his trip to Moscow, the Saudi King failed to come to terms with Russia on a very serious issue: Iran’s presence in the region. Riyadh obviously wanted to persuade Moscow to decrease its cooperation with Iran in exchange for the development of economic ties and political dialogue. Yet, given the importance of Iran for Russia, Moscow only suggested to play the role of mediator between Tehran and Riyadh to decrease the degree of tensions between them. From this point of view, the Iranian factor remained a serious constraint for the development of dialogue between Moscow and Riyadh. Russia will hardly agree to abandon Iran. However, in the past, a cool-down in Moscow’s relations with Tehran was the main precondition set by the Saudis for the development of an effective dialogue between them and the Kremlin. There are almost no reasons to think that the Saudi leadership will give up this demand.

About the Author

Nikolay Kozhanov is an academy associate at the Russia and Eurasia Programme of Chatham House. He is also a visiting lecturer in the political economy of the Middle East at the European University at St. Petersburg.

Opinion Polls

Attitudes in the Middle East towards Foreign Involvement

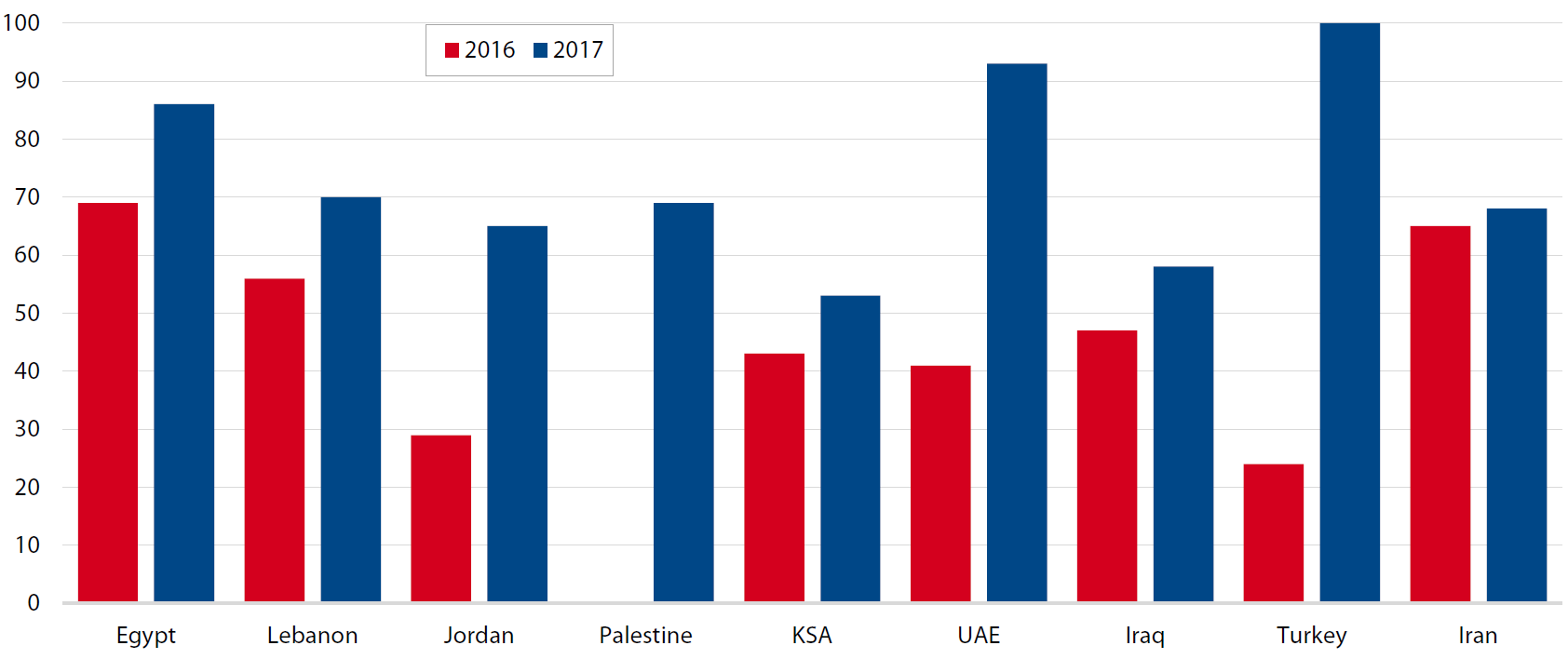

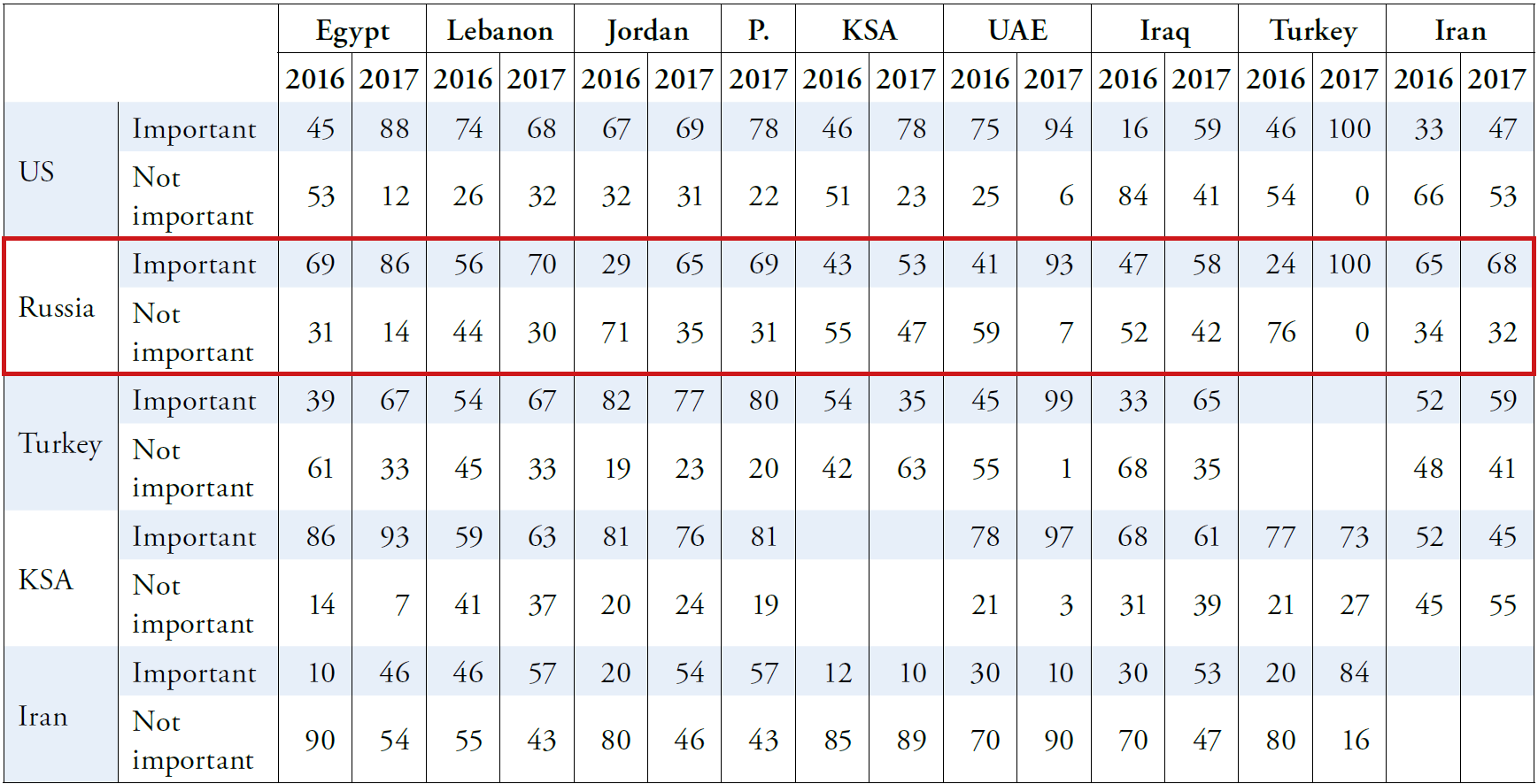

Figure 1: How Important Is It That Your Country Have Good Relations With Russia? (2017 Compared to 2016; Answers “Important” Only)

Source: representative opinion poll by Zogby Research Services in Egypt, Lebanon, Jordan, Palestine, Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Iraq, Turkey, and Iran, N = 7,800, 24 August – 19 September 2017, ; see also Table 1

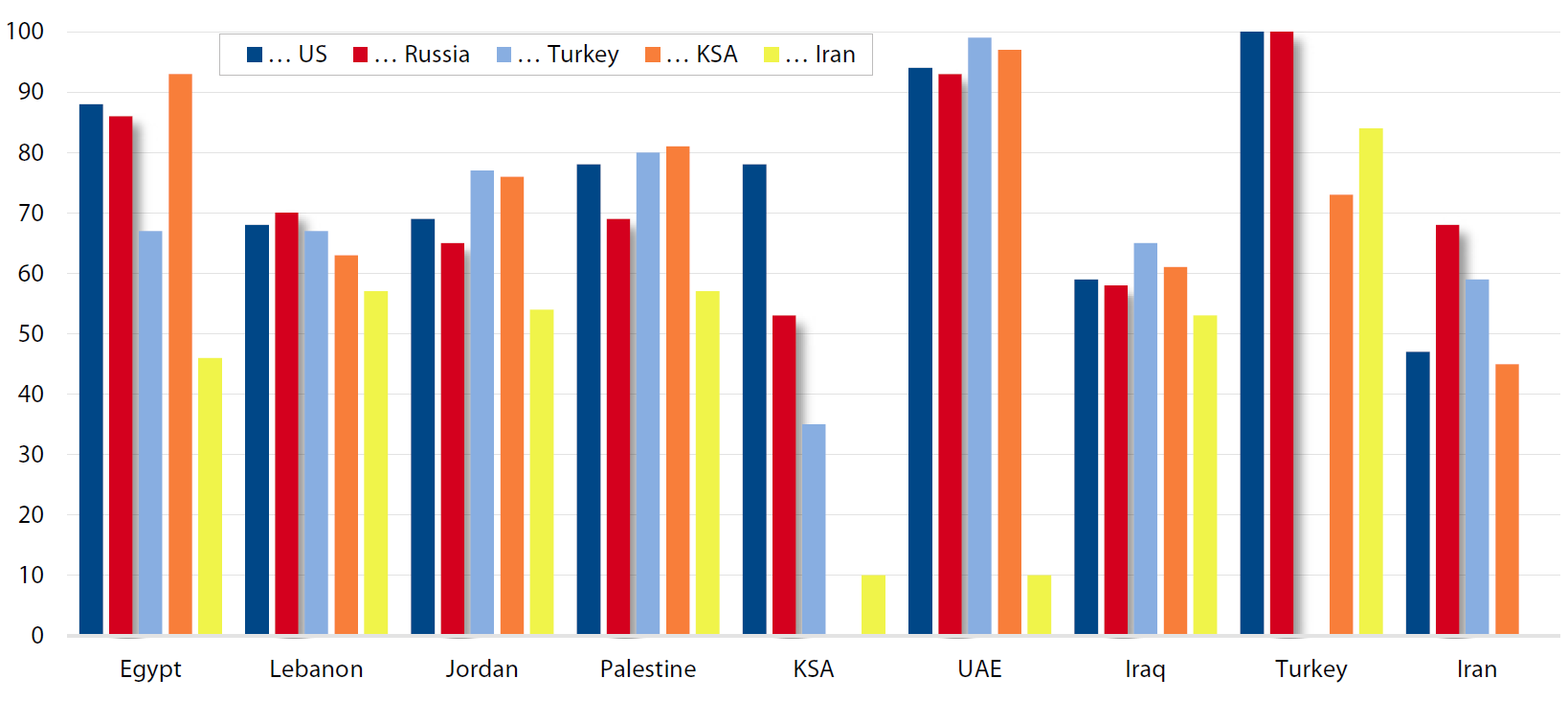

Figure 2: How Important Is It That Your Country Have Good Relations With …? (Answers “Important” Only)

Source: representative opinion poll by Zogby Research Services in Egypt, Lebanon, Jordan, Palestine, Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Iraq, Turkey, and Iran, N = 7,800, 24 August – 19 September 2017, ; see also Table 1

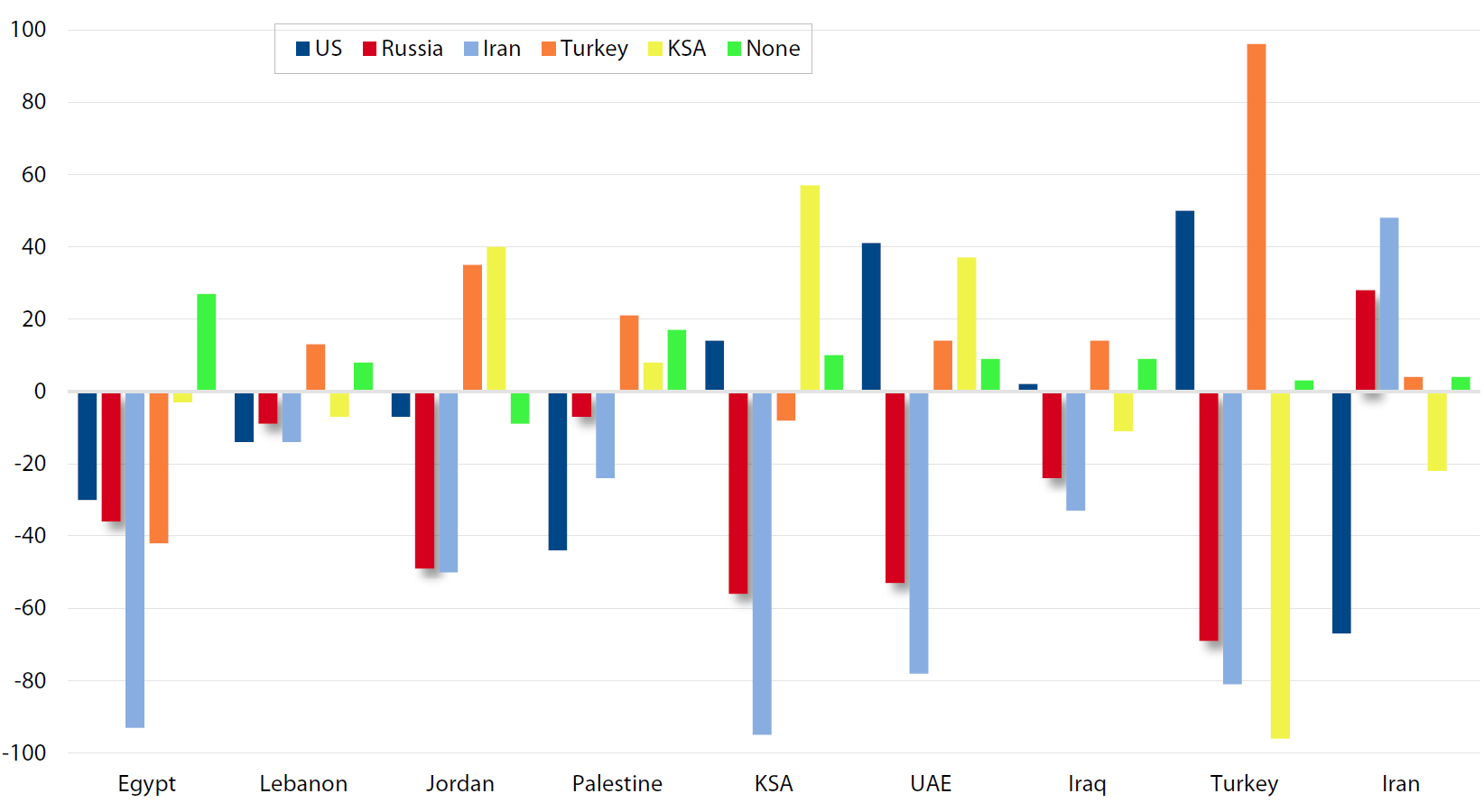

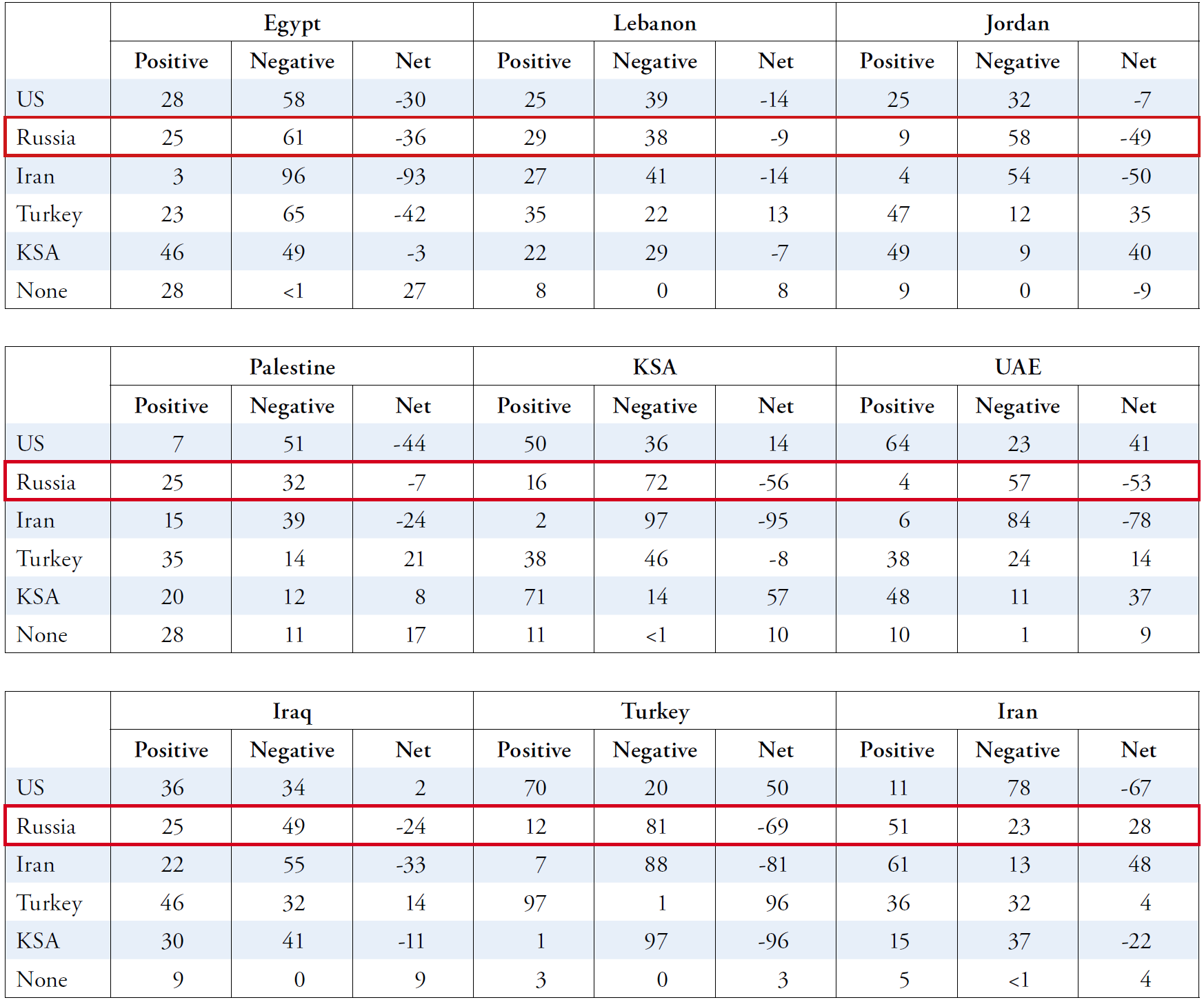

Figure 3: With Regard to the Conflict in Syria, […] Which Countries Do You Believe Are Playing a Positive Role? Which Countries Do You Believe Are Playing a Negative Role? (Net Difference between “Positive” and “Negative”)

Source: representative opinion poll by Zogby Research Services in Egypt, Lebanon, Jordan, Palestine, Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Iraq, Turkey, and Iran, N = 7,800, 24 August – 19 September 2017, ; see also Table 2

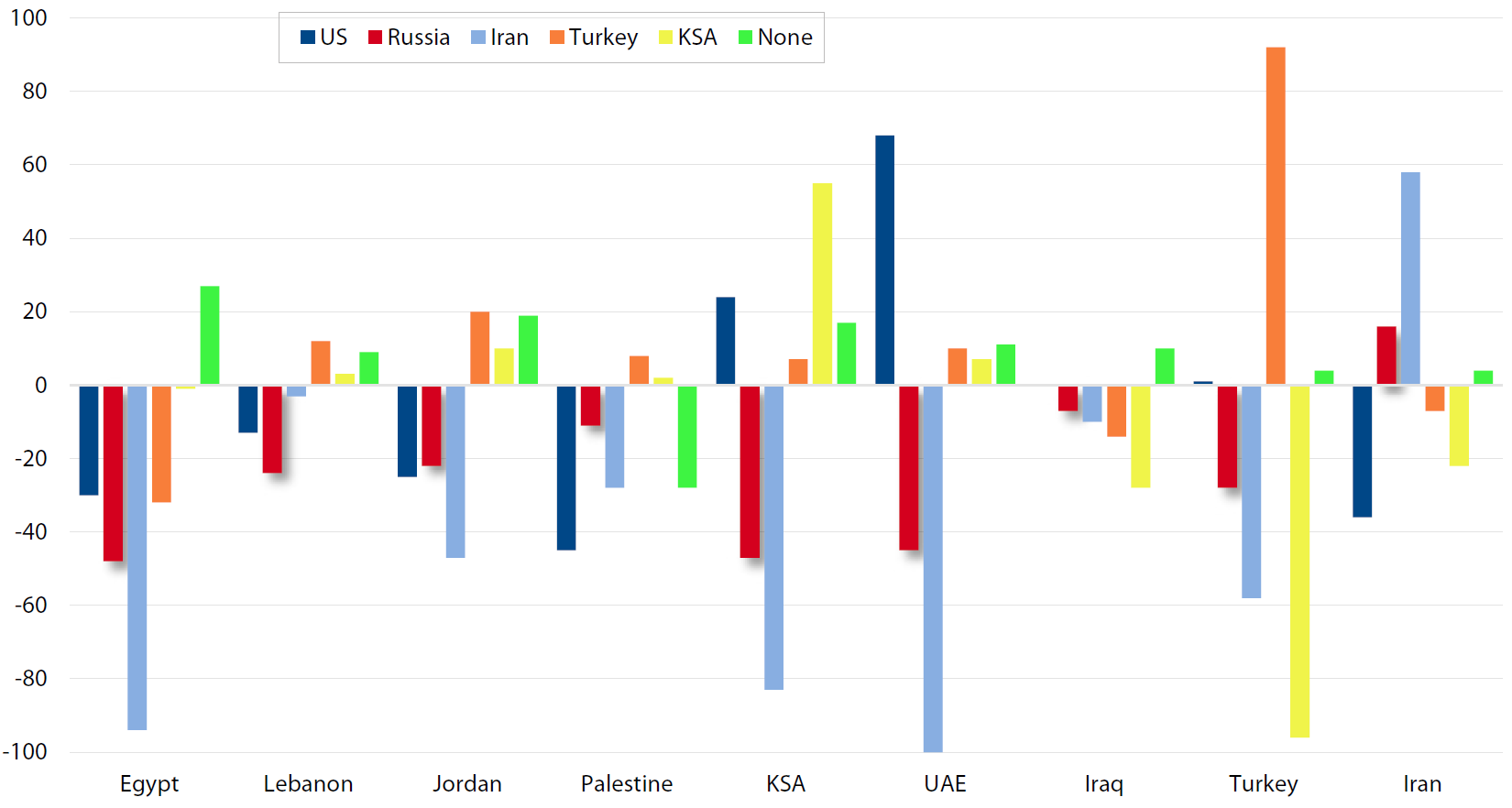

Figure 4: With Regard to the Conflict in Iraq, […] Which Countries Do You Believe Are Playing a Positive Role? Which Countries Do You Believe Are Playing a Negative Role? (Net Difference between “Positive” and “Negative”)

Source: representative opinion poll by Zogby Research Services in Egypt, Lebanon, Jordan, Palestine, Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Iraq, Turkey, and Iran, N = 7,800, 24 August – 19 September 2017, ; see also Table 3

Table 1: How Important Is It That Your Country Have Good Relations With …?

Source: representative opinion poll by Zogby Research Services in Egypt, Lebanon, Jordan, Palestine (P.), Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Iraq, Turkey, and Iran, N = 7,800, 24 August – 19 September 2017,

Table 2: With Regard to the Conflict in Syria, […] Which Countries Do You Believe Are Playing a Positive Role? Which Countries Do You Believe Are Playing a Negative Role?

Source: representative opinion poll by Zogby Research Services in Egypt, Lebanon, Jordan, Palestine, Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Iraq, Turkey, and Iran, N = 7,800, 24 August – 19 September 2017,

Table 3: With Regard to the Conflict in Iraq, […] Which Countries Do You Believe Are Playing a Positive Role? Which Countries Do You Believe Are Playing a Negative Role?

Source: representative opinion poll by Zogby Research Services in Egypt, Lebanon, Jordan, Palestine, Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Iraq, Turkey, and Iran, N = 7,800, 24 August – 19 September 2017,

No comments:

Post a Comment