By Mathieu Duchatel

Europe may need to think more strategically about its approach if a new camp does emerge in the Indo-Pacific region to counter growing Chinese influence

Europe may need to think more strategically about its approach if a new camp does emerge in the Indo-Pacific region to counter growing Chinese influence

As Asia is arming, Europe is selling equipment to states in the Indo-Pacific while maintaining strict restrictions on transfers of military technology to China. It looks like taking sides, but it is more complicated than that. European exporters seek commercial opportunities and operate in a set of political constraints, but no clear strategic vision guides Europe’s approach to arms sales and controls over critical technologies. However, this could change in the coming years if the structure of the order in the Indo-Pacific region evolves towards open strategic rivalry opposing China to a quadrilateral camp composed of Australia, India, Japan and the United States seeking to counterbalance China’s military power and growing influence.

The build-up of the People’s Liberation Army is the most dynamic factor affecting the military balance in the Indo-Pacific. Looking at raw numbers only, the annual increase in volume of China’s official military spending is higher than the sum of Vietnam’s and the Philippines’ annual defence budget combined. And even though China does not provide statistics for its total spending on military-related research and development, it is widely estimated that it exceeds the defence budget of all states in Southeast Asia.

This widening power gap creates demand for European weapons systems and defence industry cooperation. Australia’s defence ministry has announced an 80 per cent increase of the country’s military expenditure by 2025. After a decade of budget stagnation, Japan is introducing far-reaching transformations of its military posture. The country could move to production of a land-attack cruise missile and is debating a possible transformation of its helicopter destroyers into aircraft carriers equipped with vertical landing versions of the F-35 fighter jet.

This widening power gap creates demand for European weapons systems and defence industry cooperation. Australia’s defence ministry has announced an 80 per cent increase of the country’s military expenditure by 2025. After a decade of budget stagnation, Japan is introducing far-reaching transformations of its military posture. The country could move to production of a land-attack cruise missile and is debating a possible transformation of its helicopter destroyers into aircraft carriers equipped with vertical landing versions of the F-35 fighter jet.

According to SIPRI data, India is by far the largest importer of arms for the period 2012 to 2016, accounting for 13 per cent of the international arms trade. Vietnam’s military is also upgrading, with a planned budget of US$6 billion in 2020, an increase of more than 30 per cent from 2015. Just as China has sought to deter a US intervention in the Taiwan Strait by seeking asymmetries, anti-access and area denial capacities, these states adjust their defence posture to China’s present and future power projection capacities. In many ways, their game is about avoiding an excessive imbalance that would leave them too vulnerable to China’s political leverage.

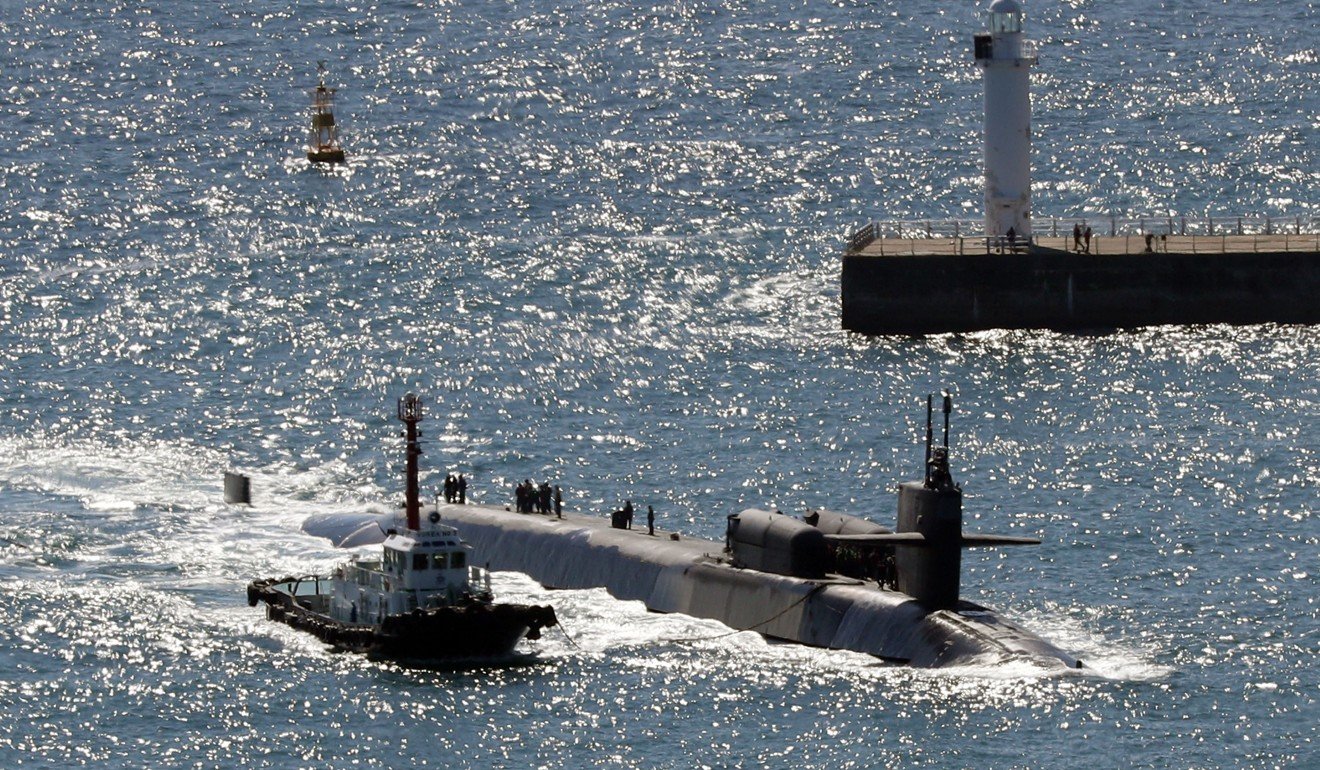

European arms producers take advantage of these concerns. Exports perform well in areas that are not dominated by the US, such as diesel submarines, no longer produced in America, and some niche naval systems. Submarines have been or are being transferred to Australia, India, Malaysia and Singapore, and cooperation in submarine technology is taking place with South Korea. France and the United Kingdom have begun arms industry cooperation with Japan for advanced items such as air-to-air missiles and space-based maritime surveillance, in the context of very close assessments of regional security trends.

It is no secret that Europe’s arms producers need export markets to maintain a technological edge, and in some cases a production line. But the current trend is about more than just commercial interests. There is a political dimension as well. However, the strategic rationale differs from state to state and is non-existent at the level of the EU. In the UK, the logic seems to be mainly support for US goals in the Indo-Pacific. France insists on its strategic identity as a Pacific power, with an interest in a maritime order based on international law. Germany’s approach stresses cooperation with like-minded states perceived as part of a Western camp, such as Singapore and Australia. For Europe’s big three, democratic solidarity facilitates the development of defence cooperation.

It is no secret that Europe’s arms producers need export markets to maintain a technological edge, and in some cases a production line. But the current trend is about more than just commercial interests. There is a political dimension as well. However, the strategic rationale differs from state to state and is non-existent at the level of the EU. In the UK, the logic seems to be mainly support for US goals in the Indo-Pacific. France insists on its strategic identity as a Pacific power, with an interest in a maritime order based on international law. Germany’s approach stresses cooperation with like-minded states perceived as part of a Western camp, such as Singapore and Australia. For Europe’s big three, democratic solidarity facilitates the development of defence cooperation.

Turning to China, the dynamic regarding access to European military technology has completely changed over the past five years. Obtaining the lifting of the embargo used to be a central demand from the Chinese side during meetings with Europeans, but it is no longer the case. Chinese President Xi Jinping has put an end to the practice of making any progress on international security cooperation with Europe conditional on the lifting of the embargo. This is the result of China’s arms industry’s progress. The priority is on civil-military integration as the country is closer than ever to fulfilling the Maoist dream of a self-sufficient arms industry. The need for a full weapons system is marginal. What takes precedence today is access to critical technologies to overcome specific bottlenecks, but also to create the conditions for innovation and leadership for the next generations of arms. As Xi said in his work report to the Communist Party congress in October, “We must keep it firm in our minds that technology is the core combat capability”.

In this context, Europe’s exports of military components and parts to the Chinese military are no longer controversial, nor relevant in Japan and the United States. Because it is a political guideline and not a compulsory law, the “arms embargo” never prevented such transfers. The EU’s Official Journal makes clear that they have continued to take place at an average value of approximately €300 million (US$373.6 million) per year. The licensed equipment includes items incorporated in Chinese military helicopters, ships and submarines. But under the new phase of China’s military development, what now receives more attention than direct exports are intangible transfers occurring in the form of research cooperation and investment in hi-tech firms. There is ample anecdotal evidence that they contribute to the progress of the country’s arms industry.

Europe is not an offshore balancer in the Indo-Pacific and has so far avoided attaching clear strategic goals to arms transfers. At the same time, the intra-European discussion on conventional arms control is shaped by human security ideas rather than an ambition to shape the global strategic balance. Could Europe move to a catch-all approach that would seek to prevent all transfers of dual-use technology to China? It is unlikely. The EU’s goals towards China stay focused on rebalancing the bilateral trade and investment relationship and developing cooperation on global governance. But the investment screening discussion in Europe is to a large degree about protecting Europe’s critical technology. And the re-emergence of the idea of quadrilateral cooperation between Australia, Japan, India and the United States to contain the growth of Chinese influence may well result in Europe having to think more strategically about its approach to arms transfers and export controls.

No comments:

Post a Comment