by Gail Tverberg, Our Finite World

March 21st, 2016

We have been living in a world of rapid globalization, but this is not a condition that we can expect to continue indefinitely.

We have been living in a world of rapid globalization, but this is not a condition that we can expect to continue indefinitely.

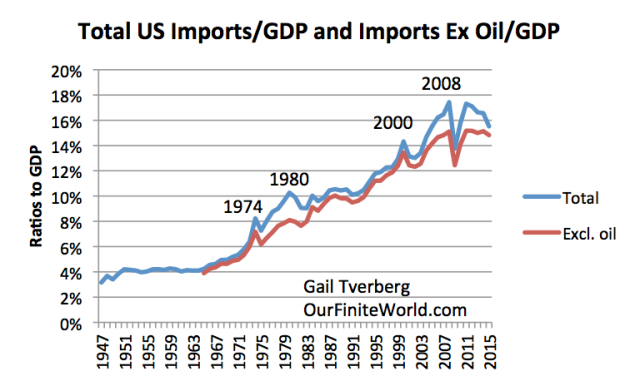

Figure 1. Ratio of Imported Goods and Services to GDP. Based in FRED data for IMPGS.

Each time imported goods and services start to surge as a percentage of GDP, these imports seem to be cut back, generally in a recession. The rising cost of the imports seems to have an adverse impact on the economy. (The imports I am showing are gross imports, rather than imports net of exports. I am using gross imports, because US exports tend to be of a different nature than US imports. US imports include many labor-intensive products, while exports tend to be goods such as agricultural goods and movie films that do not require much US labor.)

Recently, US imports seem to be down. Part of this reflects the impact of surging USoil production, and because of this, a declining need for oil imports. Figure 2 shows the impact of removing oil imports from the amounts shown on Figure 1.

Figure 2. Total US Imports of Goods and Services, and this total excluding crude oil imports, both as a ratio to GDP. Crude oil imports fromhttps://www.census.gov/foreign-trade/statistics/historical/petr.pdf

If we look at the years from 2008 to the present, there was clearly a big dip in imports at the time of the Great Recession. Apart from that dip, US imports have barely kept up with GDP growth since 2008.

Let’s think about the situation from the point of view of developing nations, wanting to increase the amount of goods they sell to the US. As long as US imports were growing rapidly, then the demand for the goods and services these developing nations were trying to sell would be growing rapidly. But once US imports flattened out as a percentage of GDP, then it became much harder for developing nations to “grow” their exports to the US.

I have not done an extensive analysis outside the US, but based on the recent slow economic growth patterns for Japan and Europe, I would expect that import growth for these areas to be slowing as well. In fact, data from the World Trade Organization for Japan, France, Italy, Sweden, Spain, and the United Kingdom seem to show a recent slowdown in imported goods for these countries as well.

If this lack of demand growth by a number of industrialized countries continues, it will tend to seriously slow export growth for developing countries.

Where Does Demand for Imports Come From?

Many of the goods and services we import have an adverse impact on US wages. For example, if we import clothing, toys, and furniture, these imports directly remove US jobs making similar goods here. Similarly, programming jobs and call center jobs outsourced to lower cost nations reduce the number of jobs available in the US. When US oil prices rose in the 1970s, we started importing compact cars from Japan. Substituting Japanese-made cars for American-made cars also led to a loss of US jobs.

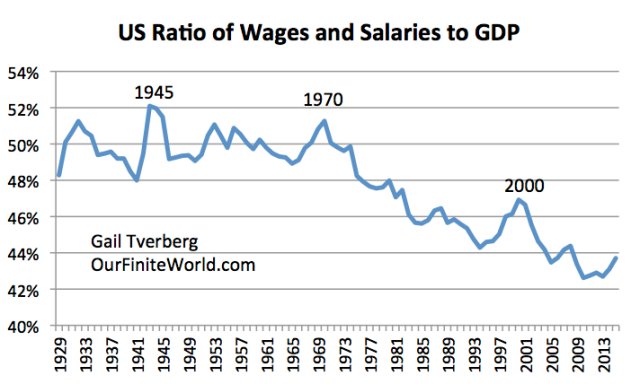

Even if a job isn’t directly lost, the competition with low wage nations tends to hold down wages. Over time, US wages have tended to fall as a percentage of GDP.

Figure 3. Ratio of US Wages and Salaries to GDP, based on information of the US Bureau of Economic Analysis.

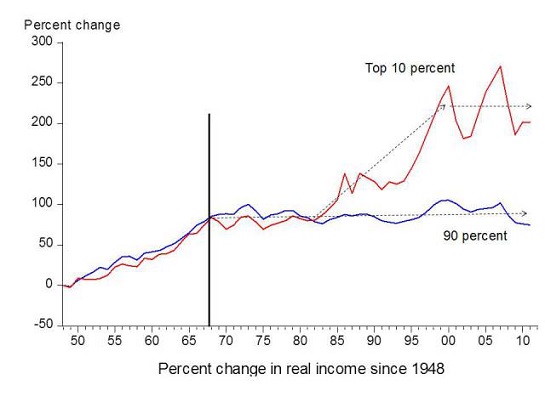

Another phenomenon that has tended to occur is greater disparity of wages. Partly this disparity represents wage pressure on individuals doing jobs that could easily be outsourced to a lower-wage country. Also, executive salaries tend to rise, as companies become more international in scope. As a result, earnings for the top 10% have tended to increase since 1981, while wages for the bottom 90% have stagnated.

Figure 4. Chart by economist Emmanuel Saez based on an analysis of IRS data,published in Forbes. (“Real income” is inflation-adjusted income.)

If wages of most workers are lagging behind, how is it possible to afford increased imports? I would argue that what has happened in practice is greater and greater use of debt. If wages of American workers had been rising rapidly, perhaps these higher wages could have enabled workers to afford the increased quantity of imported goods. With wages lagging behind, growing debt has been used as a way of affording imported goods and services.

Inasmuch as the US dollar was the world’s reserve currency, this increase in debt did not have a seriously adverse impact on the economy. In fact, back when oilprices were higher than they are today, petrodollar recycling helped maintain demand for US Treasuries as the US borrowed increasing amounts of money to purchase oil and other goods. This process helped keep borrowing costs low for the US.

Figure 5. US Increase in Debt as Ratio to GDP and US imports as Ratio to GDP.Both from FRED data: TSMDO and IMPGS.

The problem, however, is that at some point it becomes impossible to raise the debt level further. The ratio of debt to GDP becomes unmanageable. Consumers, because their wages have been held down by competition with wages around the world, cannot afford to keep adding more debt. Businesses find that slow wage growth in the US holds down demand. Because of this slow growth in the demand, businesses don’t need much additional debt to expand their businesses either.

Commodity Prices Are Extremely Sensitive to Lack of Demand

Commodities, by their nature, are things we use a lot of. It is usually difficult to store very much of these commodities. As a result, it is easy for supply and demand to get out of balance. Because of this, prices swing widely.

Demand is really a measure of affordability. If wages are lagging behind, then an increase in debt (for example, to buy a new house or a new car) can substitute for a lack of savings from wages. Unfortunately, such increases in debt have not been happening recently. We saw in Figure 5, above, that recent growth in US debt is lagging behind. If very many countries find themselves with wages rising slowly, and debt is not rising much either, then it is easy for commodity demand to fall behind supply. In such a case, prices of commodities will tend to fall behind the cost of production–exactly the problem the world has been experiencing recently. The problem started as early as 2012, but has been especially bad in the past year.

The way the governments of several countries have tried to fix stagnating economic growth is through a program called Quantitative Easing (QE). This program produces very low interest rates. Unfortunately, QE doesn’t really work as intended for commodities. QE tends to increase the supply of commodities, but it does notincrease the demand for commodities.

The reason QE increases the supply of commodities is because yield-starved investors are willing to pour large amounts of capital into projects, in the hope that commodity prices will rise high enough that investments will be profitable–in other words, that investments in shares of stock will be profitable and also that debt can be repaid with interest. A major example of this push for production after QE started in 2008 is the rapid growth in US “liquids” production, thanks in large part to extraction from shale formations.

Figure 6. US oil and other liquids production, based on EIA data. (Available data is through November, but amount shown is estimate of full year.)

As we saw in Figure 5, the ultra-low interest rates have not been successful in encouraging new debt in general. These low rates also haven’t been successful in increasing US capital expenditures (Figure 7). In fact, even with all of the recent shale investment, capital investment remains low relative to what we would expect based on past investment patterns.

Figure 7. US Fixed Investment (Factories, Equipment, Schools, Roads) Excluding Consumer Durables Ratio to GDP, based on US Bureau of Economic Analysis data.

Instead, the low wages that result from globalization, without huge increases in debt, make it difficult to keep commodity prices up high enough. Workers, with low wages, delay starting their own households, so they have no need for a separate apartment or house. They may also be able to share a vehicle with other family members. Because of the mismatch between supply and demand, commodity prices of many kinds have been falling. Oil prices, shown on Figure 9, have been down, but prices for coal, natural gas, and LNG are also down. Oil supply is up a little on a world basis, but not by an amount that would have been difficult to absorb in the 1960s and 1970s, when prices were much lower.

Figure 9. World oil production and price. Production is based on BP, plus author’s estimate for 2016. Historical oil prices are calculated based on a higher than usual recent inflation rate, assuming Shadowstats’ view of inflation is correct.

Developing Countries Are Often Commodity Exporters

Developing countries can be greatly affected if commodity prices are low, because they are often commodity exporters. One problem is obviously the cutback in wages, if it becomes necessary to reduce commodity production. A second problem relates to the tax revenue that these exports generate. Without this revenue, it is often necessary to cut back funding for programs such as building roads and schools. This leads to even more job loss elsewhere in the economy. The combination of wage loss and tax loss may make it difficult to repay loans.

Obviously, if low commodity prices persist, this is another limit to globalization.

Conclusion

We have identified two different limits to globalization. One of them has to do with limits on the amount of goods and services that developed countries can absorb before those imports unduly disrupt local economies, either through job loss, or through more need for debt than the developed economies can handle. The other occurs because of the sensitivity of many developing nations to low commodity prices, because they are exporters of these commodities.

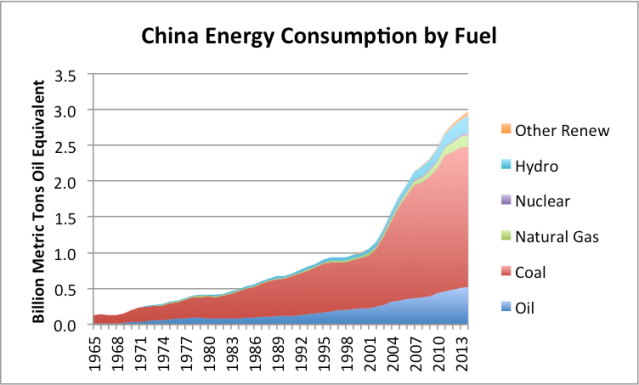

Of course, there are other issues as well. China has discovered that if its coal is burned in great quantity, it is very polluting and a problem for this reason. China has begun to reduce its coal consumption, partly because of pollution issues.

Figure 10. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.

There are many other limiting factors. Fresh water is a major problem, throughout much of the developing world. Adding more people and more industry makes the situation worse.

One problem with globalization is a long-term tendency to move manufacturing production to countries with ever-lower standards in many ways: ever-lower pollution controls, ever-lower safety standards for workers, and ever-lower wages and benefits for workers. This means that the world becomes an ever-worse place to work and live, and the workers in the system become less and less able to afford the output of the system. The lack of buyers for the output of the system makes it increasingly difficult to keep prices of commodities high enough to support their continued production.

The logical end point, even beyond globalization, is for automation and robots to perform nearly all production. Of course, if that happens, there will be no one to buy the output of the system. Won’t that be a problem?

Adequate wages are critical to making any system work. As the system has tended increasingly toward globalization, politicians have tended to focus more and more on the needs of businesses and governments, and less on the needs of workers. At some point, the lack of buyers for the output of the system will tend to bring the whole system down.

Thus, at some point, the trend toward globalization and automation must stop. We need buyers for the output from the system, and this is precisely the opposite of the direction in which the system is trending. If a way is not found to fix the system, it will ultimately collapse. At a minimum, the trend toward increasing imports will end–if it hasn’t already.

No comments:

Post a Comment